Key Takeaways

- 01Average contractor insurance costs $800-$900 annually for general liability

- 02Workers' compensation is the most expensive at $6,000-$7,000 per employee

- 03Insurance costs vary significantly by state, business size, and claim history

- 04Bundling policies can save you 10-25% on total insurance costs

- 05General liability and commercial auto insurance are high-priority must-haves

A contractor's job is unpredictable.

One minute, everything is running smoothly. And the next, you hear about an accident with your employee on the job site or an equipment failure that sets your project and finances back significantly.

In a way, there are situations that you don't see coming, which have irreparable consequences. But while the work may be out of your control at times, protecting your business from financial losses doesn't have to be.

That's where contractor insurance comes in. However, before buying, you need to have a detailed understanding of the contractor insurance cost, what it covers, and how to ensure you pay just the right amount.

What is Contractor Insurance?

Contractor insurance is a specialized type of business insurance designed to provide financial protection to contractors in the event of accidents or unforeseen incidents occurring during the course of their work.

Think about it—what would you do if something went wrong on the job?

Say your employees hurt themselves while plumbing, or there is flooding in client property as a result of your plumbing. Without proper insurance, you could be looking at thousands of dollars in out-of-pocket expenses.

Contractor insurance provides financial coverage for accidents, injuries, business property damage, equipment breakdowns, and other unexpected events that occur on a job site. Some of these insurance include general liability insurance, workers' compensation insurance, and commercial auto insurance.

Such insurance helps businesses avoid significant out-of-pocket expenses and stay financially stable when issues arise.

6 Types of Contractor Insurances

The type of coverage a contractor needs can vary based on the specific nature of the project, such as home remodeling, small office renovations, or retail space build-outs.

Here's a breakdown of the 6 different types of coverage available:

1. General Liability Insurance

The construction jobs and the other contractual projects come with a set of risks, most of which you cannot foresee but are hazardous regardless. General liability insurance protects contractors against third-party claims of bodily injury, property damage, or legal costs arising from job site accidents.

General liability insurance includes various versions of policies and pays for lawsuits related to copyright infringement and defamation.

Consider one of your contractors working on a home renovation project where you're using a bunch of equipment that is spread over the property. The client ends up tripping over an electrical cord resulting in a serious injury. The client sues for medical expenses and damages. General liability insurance would cover the legal fees and any settlement or judgment costs.

2. Workers' Compensation

Workers' compensation includes various benefits to your employees in case they encounter any accidents while on the job. Workers' compensation insurance is one of the insurance policies that provide financial support to workers who sustain physical harm or become unwell due to their professional responsibilities.

The coverage includes various benefits to aid your employees in recovering financially and physically, such as medical expenses, rehabilitation, and lost wages for employees injured. It's typically required by law if a contractor has employees.

A construction worker falls from a 10-foot-high scaffolding while installing roofing panels on a construction project and ends up with a fracture on his leg. The workers' compensation insurance would cover the employee's medical bills, rehabilitation costs, and part of their lost wages during recovery.

3. Inland Marine Insurance

While inland marine previously meant insurance coverage of ocean-bound materials and vessels, it has evolved to cover many types of property. This type of insurance is also known as "Tool & equipment insurance". Inland marine insurance protects tools, equipment, and materials while they are in transit or temporarily stored at different job sites.

This insurance is essential for contractors who move equipment from site to site frequently. Equipment insurance includes commodities such as forklifts, loaders, electric generators, hammers, drills, electric saws, and drywall.

Your expensive drilling equipment gets stolen from a truck while being transported to a new job site. Equipment insurance would cover the cost of replacing the stolen equipment.

4. Commercial Property Insurance

Commercial property insurance protects physical assets such as office buildings and warehouses from damage that results from fire, theft, vandalism, or natural disasters. The policy includes everything that ranges from real-estate investments and physical assets intending to safeguard entrepreneurs' belongings across industries.

The cost of property insurance fluctuates as it is based on numerous factors of a firm and the prevailing market conditions that are determined by external factors such as geographical location and economic cycles.

There is a small fire at your office due to an electrical issue and it did significant structural and smoke damage. Commercial property insurance costs would cover the cost of repairing the building and replacing damaged equipment inside.

5. Professional Liability Insurance

Such types of insurance are also known as errors and omissions, which are a type of insurance offering that provides coverage for businesses against errors resulting from their work.

Professional liability insurance protects against claims of negligence, faulty workmanship, or failure to meet contractual obligations. This is especially important for contractors offering design or consulting services where there is a higher margin of error or subjective disagreements.

A contractor is hired to install custom cabinetry, but the client claims the work was done incorrectly and does not meet the agreed-upon specifications. They file a lawsuit for damages. Professional liability insurance would cover the legal defense and any necessary settlements.

6. Commercial Auto Insurance

Commercial auto insurance is a type of business insurance that businesses buy to get claims for vehicles used by businesses. It helps policyholders avoid high vehicle repair costs, medical expenses, or lawsuits that are a direct result of an accident. The claims cover the costs for accidents, vehicle damage, and liability in case of injury or property damage to others.

Your vehicle that was carrying transport tools and materials is involved in an accident on the way to a job site. A commercial auto policy would cover the repair costs of the vehicle and medical expenses for any injuries caused by the accident.

How Much Does Contractor Insurance Cost?

The average contractor insurance cost is around $800-$900 annually. However, this cost can vary widely depending on the type of insurance, business size, location, industry risk level, and coverage limits.

The general contractor insurance cost differs based on which US state you belong to. For example, the insurance cost is higher in California than in Michigan. In California, the cost of a Contractor General Liability policy usually ranges from $796 to $1,230, depending on the business size, industry, and coverage limits.

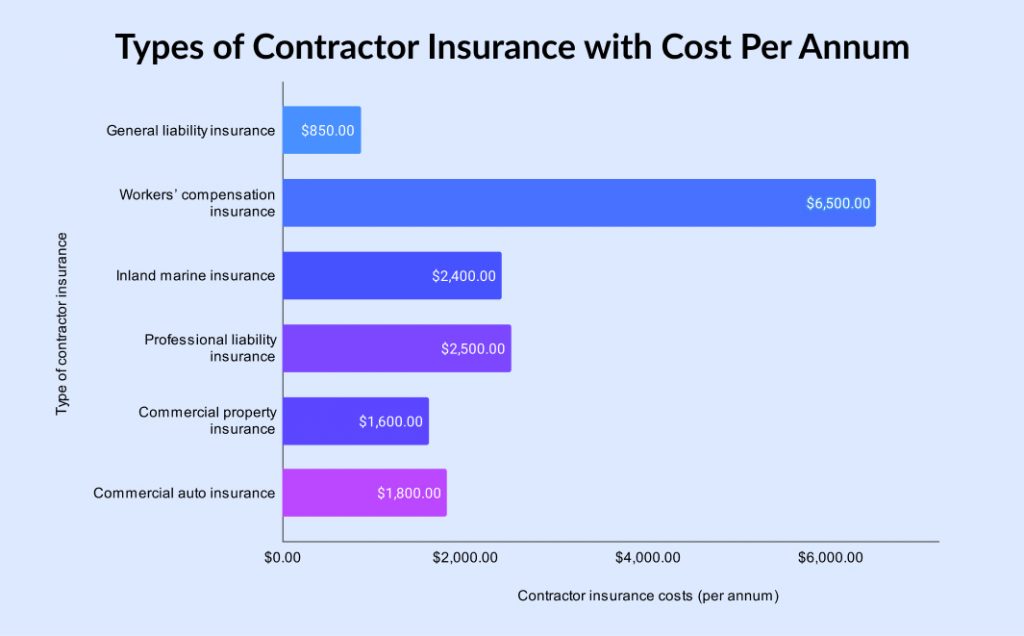

Let's check out the average costs of each type of construction insurance in detail:

Contractor Insurance Costs Breakdown

Annual costs and priority levels for each insurance type

| Type | Cost | Priority |

|---|---|---|

General Liability Insurance Essential for all contractors | $800-$900 | High |

Workers' Compensation Insurance Required by law in most states | $6,000-$7,000 per employee | High |

Inland Marine Insurance For equipment in transit | $1,800-$3,000 | Low |

Professional Liability Insurance For design/consulting services | $1,000-$3,000 | Medium |

Commercial Property Insurance For office/warehouse protection | $500-$3,000 | Medium |

Commercial Auto Insurance For business vehicles | $1,200-$3,000 | High |

Costs may vary based on location, business size, and claim history. Consider bundling policies for additional savings.

Contractors have the option of buying commercial umbrella insurance that helps boost the coverage limits of the insurance mentioned above. This policy is activated in case you reach your limit on an insurance claim and require additional coverage.

Key Factors that Affect Contractor Insurance Pricing

The key factors that affect contractor insurance pricing include various considerations. Knowing them helps you determine how much you ultimately need to pay.

- Business size: Usually, it is the size of your operations that decides the type of insurance you'll have to buy. If more commodities are at stake, the higher the claims needed to protect them in case of danger. For more details, refer to this contractor pricing guide to optimize profits.

- Number of employees: The number of employees can significantly impact your workers' compensation costs. The higher the number of employees, the higher the number of insurances you have to buy for each individual.

- Claim history: Your insurers will first check your claim history and prior business. If they find a history of claims or accidents, you'll probably face higher costs across all types of insurance.

- Location: Different states in the U.S. have different rates for premiums. States with a higher cost of living, like New York, have stricter regulations that often lead to higher premiums.

Who Needs Contractor Insurance?

Contractor insurance is for everyone who works in the construction and HVAC industries. All the individuals and entities listed below (but not limited to them) need construction insurance:

General Contractors

Considering the responsibility for the entire project, they face high exposure to risks such as job site accidents, faulty work, and property damage. Utilizing tools like a contractor invoice template can help them.

Specialty Trade Contractors

Specialty contractors such as electricians and plumbers deal with water damage and other accidents at home or facility.

Handyman Services

Handymen may face potential risks if they cause accidental property damage or if they are injured while on the job.

Landscapers

Landscapers deal with heavy machinery or hazardous tools that pose risks of equipment damage or personal injuries.

Construction Firms

Considering the scale of construction projects where the stakes are high, and a higher number of employees are injured, firms can frequently encounter project delays and worksite accidents.

4 Tips to Save on Contractor Insurance Costs

Insurance is a lot of money. You cannot escape it. You cannot avoid it. But at least you can take steps to save on the contractor insurance costs.

1. Compare Different Quotes

The final quote depends on various factors but even then insurance rates can vary significantly between providers. Once you create a quote, compare quotes from multiple insurers and check their price, coverage limits, and deductibles offered. That way, you can find a comprehensive policy and not one where you have to overspend.

2. Implement a Safety Program

The logic of insurance is simple. The higher the claims, the higher your rate. One of the ways to keep your claims low is by implementing safety programs that reduce the likelihood of accidents and claims.

With regular safety training, proper equipment maintenance, and strict job site protocols, you're advocating for job site safety and showing that you're a business that is committed to minimizing risks. Many insurers offer discounts for documented safety programs.

3. Bundle Up Different Insurance Policies

As a contractor, you may need multiple types of insurance. To reduce costs, look for insurers that offer package deals, combining policies into a single bundle.

Before choosing a policy, create a detailed project estimate using a contractor estimate template. This helps you understand your coverage needs better and makes it easier to select the right insurance package. This bundling approach, often referred to as a Business Owner's Policy (BOP), can lead to substantial savings.

4. Classify Your Workers

Not every employee in your business has a high-risk job. If you want to make money in your construction business, classify their work based on their level of risk so that you don't end up paying a high premium for a low-risk job. Review the employees' classifications regularly to ensure everyone is correctly categorized.

Where Can You Get a Quote for Contractor Insurance?

Various companies in the US provide contractor insurance. Some of them are listed below:

Improve the Financial Health of your Contracting Business—In More Ways Than One

While saving on contractor insurance is one of the ways to protect your bottom line, keeping track of your business finances is equally important. As a contracting business, managing your invoices efficiently can help you stay on top of payments and ensure that your business runs smoothly.

An invoice processing tool designed for contractors can streamline your invoicing process, reduce errors, and help you focus more on growing your business rather than getting bogged down in paperwork.

Streamline Your Contracting Business Today

Try InvoiceOwl free and see how easy it is to create professional invoices, track payments, and manage your finances—all in one place.

Start Your FREE TrialFrequently Asked Questions about Contractor Insurance Costs

You can revisit the contractor insurance policy whenever your contracting business undergoes a significant change, such as adding new employees or subcontractors, expanding your service offerings, moving to a new location, adding additional job sites, or simply adjusting your coverage to avoid being uninsured.

You can provide a Certificate of Insurance (COI) to potential clients to show you're insured. The certificate includes your coverage types, policy limits, and effective dates. It is a common and ideal practice for contractors to include COIs in proposals to build client trust and comply with contract requirements.

Look for an insurance company that has experience in the contracting industry, has a straightforward claim process, and good customer service. Compare the quotes, options, and reviews, and choose one that fits your goals and budgetary requirements.

Yes, there are special considerations for contractors working in high-risk areas across the United States. Contractors working in regions prone to hurricanes, earthquakes, or heavy snow landscape may face higher premiums or additional coverage requirements. You can check with your provider for additional policy endorsements or exclusions specific to these regions.

![Construction Invoice Factoring [All-in-One Guide]](/images/2022/06/construction-invoice-factoring.jpg)