Key Takeaways

- 01A credit memo journal entry requires debiting sales returns and crediting accounts receivable

- 02Different scenarios require different journal entries - overstatements, discounts, and goods returns

- 03Proper credit memo tracking prevents accounting errors and maintains accurate financial statements

- 04Excessive credit memos can signal quality issues or fraudulent bookkeeping activity

- 05Free templates and automation tools simplify credit memo management and reduce errors

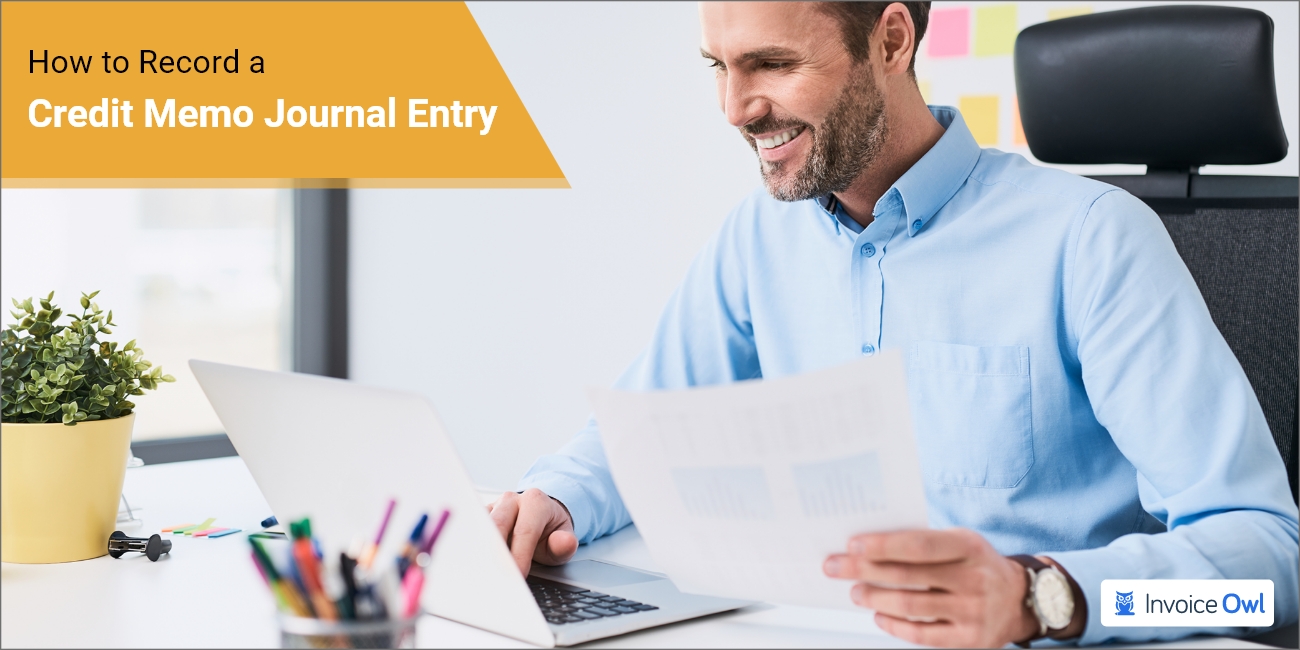

A credit memorandum, aka credit memo, is an articulated form indicating an amount the contractor owes to the client. Recording a credit memo's journal entry is a must for an income statement or net sales revenue.

Not everyone knows how to record an accounting entry, which is why we have written this article. It helps record a certain transaction to maintain the financial statements. Plus, we have also shared how to make an entry if you are a client in the case of the credit memo issue.

So let's know both the seller and the buyer side.

Table of Content

- What is a Credit Memo?

- When Credit Memos are Issued?

- Why Do Businesses Use Credit Memos?

- Basic Credit Memo Accounting Entry

- Credit Memo Journal Entries for Certain Transactions

- Free Credit Memo Templates

- How to Handle Credit Memos?

- Why Credit Memo Journal Entries are Important?

- 10 Best Tips to Avoid Credit Memo Accounting Errors

- FAQs

- Conclusion

What is a Credit Memo?

A credit memo (or credit memorandum) is a financial document issued by the seller to the buyer, indicating a reduction or refund in the amount owed by the buyer. It is typically used as a correctional document to reduce the amount owed due to errors, price adjustments, or returns in sales transactions.

When Credit Memos are Issued?

Contractors, individuals, or small business owners issue credit memos to customers under different scenarios. Have a look:

- When a customer feels that services rendered are not up to the expectations

- Contractors not meeting deadlines

- Prices charged are higher than the market rate

Why Do Businesses Use Credit Memos?

Businesses use credit memos for the following reasons:

- To record returns or refunds of goods/services rendered to customers

- To rectify the pricing errors or overcharges on the previously issued invoices

- To compensate customers for faulty, damaged, or incomplete orders

- To maintain accurate accounts receivable records

- To levy discounts or allowances once an invoice has been sent

- To offset future invoices instead of issuing refunds

- To facilitate the reconciliation of accounts between buyers and sellers

- To assure transparent communication about transaction adjustments, fostering trust among customers.

- To ensure transparency in transactions and build customer goodwill

Basic Credit Memo Accounting Entry

To record a credit memo journal entry, debit your sales returns, and allowances account and credit your accounts receivable account.

Here is a visual representation to clearly understand the accounting entry:

Basic Credit Memo Journal Entry

| Entry | Debit | Credit |

|---|---|---|

| Sales Return & Allowance | XXX | - |

| Accounts Receivable | - | XXX |

This entry reflects the reduction in your receivables and your sales revenue.

Credit Memo Journal Entries for Certain Transactions

Businesses have several transactions, out of which, sales returns are one of them, which happens due to several reasons. Recording transactions for financial records is a must not only for future reference but also for taxation purposes.

So here are the three main reasons for sales return and issuing a credit memo.

1. Overstated amount in the original invoice

If the contractor mistakenly charges a higher price than what is fixed, it can issue a credit memo stating overstatement as a reason. Now the entry would be:

| Entry | Debit | Credit |

|---|---|---|

| Sales Revenue | XXX | - |

| Accounts Receivables | - | XXX |

Here, the sales revenue account has been debited, and the accounts receivable have been credited with the difference amount.

Contractor A sold goods or services at $500 to company B, which actually costs $300. When found by Company A, they issued a credit memo stating the reason as overstatement. In this case, company A owes $200 to company B.

For recording this transaction, they have made the necessary entries:

Entry: Sales Return debited $200, Accounts Receivable credited $200

2. Discount applied

Another reason for issuing a credit memo and recording entries could be a discount applied or allowed or forgot to apply in the original invoice.

The entry for such would be:

| Entry | Debit | Credit |

|---|---|---|

| Discount Allowed | XXX | - |

| Accounts Receivable | - | XXX |

An invoice of $1000 has been generated by Company A and payment has been made by Company B. Due to good relations between both parties, company A decided to offer 10% discount to Company B.

In the above case, the entry would be: Discount Allowed debited $100, Accounts Receivable credited $100

3. Goods return

Lastly, when the buyer receives damaged goods, incomplete orders, or the goods don't match the buyer's expectations.

| Entry | Debit | Credit |

|---|---|---|

| Sales Returns | XXX | - |

| Accounts Receivable | - | XXX |

Company A sells goods worth $1000 to Company B and an invoice has been generated. After a week, the goods were returned by Company B stating they were damaged for which Company A issued a credit memo.

The entry for this transaction is: Sales Revenue debited $1000, Accounts Receivable credited $1000

That's how you will record journal entries for credit memos. Adding entries in your books of accounts will help you know your right sales and revenue. If you still have any questions, you can go through the next section.

Free Credit Memo Templates

There is no more manual processing of individual credit memos and refunds. InvoiceOwl's freely available credit memo templates, part of our robust invoice and estimate app, allow you to easily edit and tailor credit memos to match your brand identity. These industry-specific templates are available in different file formats like Microsoft Word, Microsoft Excel, and Adobe PDF.

So, without any further ado, quickly make things right with our free printable credit memo template. It swiftly turns apologies into action.

Do not limit yourself to credit memos, explore our free invoice template and estimate template galleries as well.

How to Handle Credit Memos?

To handle credit memos, you need to be precise. This is because credit memos are an important accounting tool for correcting invoices, processing returns/refunds, and adjusting customer accounts. However, there are different types of credit memos available, and issuing the right one is important.

There are several scenarios where credit memos come into play, each requiring a specific approach. Let's have a look:

When you are the customer

If you are a customer availing services from a contractor, and you immediately inform them to stop offering services, you would be entitled to receive the amount that you already paid for.

The supplier is no longer your creditor, rather, you are his/her creditor. You can always ask for payment or goods or services.

When you are a customer of the goods or services and credit memos are issued, make necessary accounting entries in your books.

Customer Journal Entry

| Entry | Debit | Credit |

|---|---|---|

| Creditor's A/C | XXX | - |

| Purchase Return A/C | - | XXX |

When you are the contractor

When you prepare a credit memo for goods return or stopping the services, the accounting entry would be:

Contractor Journal Entry

| Entry | Debit | Credit |

|---|---|---|

| Sales Returns A/C | XXX | - |

| Accounts Receivable A/C | - | XXX |

Here, the buyer's accounts receivable account is credited and the sales returns account is debited when the buyer returns the goods.

Review all the outstanding credit memorandums at the end of the month. Make sure you apply for credits as the buyer makes another purchase or demands a refund. This habit makes your general ledger look cleaner and better.

Now that you know how to make accounting entries in different scenarios, let's also look at the benefits of recording entries.

Why Credit Memo Journal Entries Are Important?

Credit memos are issued only when the product is returned due to being damaged or faulty. Or when there is an intimation from the customer's end about not wanting to continue services.

The scenarios could be either the services/goods are not up to the mark, manufactured or packed properly, or there can be chances that your shippers mishandle them.

Another alarming situation could be when the number of credit memorandums is issued way higher than the average. In this case, the bookkeeping department might be committing some fraud.

Apart from this, the higher the credit memos issued, the lesser the actual sales. It also means the business is financially unstable. It can affect you when applying for loans or credit extensions from your suppliers. Another dent to your goodwill is big sharks may show less or no interest in your company.

Make sure you scrutinize your income statement and balance sheet to ensure everything is clear and transparent.

Since it is important to maintain the balance sheet and financial statements, you must automate your accounting software. Automating efficiently manages your general ledger.

Plus, automation eliminates manual work and bookkeepers, eventually removing the frauds that might be committed by manpower. Another benefit of Automating is it ensures a proper application of credit memos.

In a nutshell, these are the main benefits or importance of maintaining credit memo journal entries:

- Maintaining Sound Business Health

- Eliminating Malicious Activities

- High Chances of Loans & Credit Extension from Banks

Without beating around the bush, let's quickly know the entries to record in the books of accounts.

10 Best Tips to Avoid Credit Memo Accounting Errors

Create Professional Credit Memos Online Easily

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers, and contractors create credit memos on the go and keep on top of your finances.

Get Started for FreeFrequently Asked Questions

As a seller, you must credit the receivables, while as a buyer, you need to debit the payable account.

A credit memo is an invoice indicating a negative amount that is yet to be received from a supplier, which depicts credit. So basically, a credit memo is a credit.

A credit memo indicates that a supplier is obliged to pay a specific amount against the return of the goods. It depends on the buyer whether he/she wants a full refund or another order.

No, credit memo and invoice are different. The requirement to issue a credit memo comes into the picture when the already generated invoice goes wrong. It means when the goods are purchased, payment is made, and then the buyer returns the goods.

To track credit memos, various accounting and invoicing software solutions are available in the market. They have built-in credit memo tracking, ensuring linked memos, accurate records, and easy auditing. Also, businesses can maintain digital or physical logs detailing memo purpose, amount, associated invoice, and date of issuance.

A credit memo depicts a credit on the buyer's account. When the invoice goes wrong and needs to be written off, you issue a credit memo. It means you have to credit your customer's account.

No, you cannot reuse a credit memo. Plus, you cannot void the credit memo.

Related Resources

Conclusion

Any transaction that happens in the business should have accounting as well as financial records. A credit memo is one of the transactions that take place post-sales when the customer sends back the goods, mentioning a reason for return. The memo issued indicates the buyer's outstanding balance, dates, sales price, and customer details.

If you want to quickly create a credit note, you can use credit memo/note software and create unlimited credit memorandums.