Key Takeaways

- 01Credit memos document positive balances when customers have overpaid or returns occur

- 02Invoices request payment for goods or services provided to customers

- 03Both documents are legally binding and essential for accurate bookkeeping

- 04Credit memos are issued after payment adjustments, while invoices request payment

- 05Understanding when to use each document prevents accounting errors and maintains professionalism

Accounting is a broad field and it's okay if you don't know everything. Especially if you are just starting your business. And not only you but 60% of business owners like you are not confident about their accounting knowledge.

And that is mostly because it is quite a steep learning curve for small business owners and especially for contractors. Therefore, we should take one step at a time. And today, it is credit memo vs invoice. Let's learn the difference, the similarity, and how to use both for the most effective accounting process without investing in accounting software.

Table of Content

- Understanding Credit Memos and Invoices

- When and How to Use Each Document

- Key Differences and Similarities Between Credit Memo and Invoices

- Conclusion

- FAQ

So, if you want to differentiate any two things, you must learn both of them inside out separately. Hence, let's learn what a credit memo and an invoice are, individually.

Understanding Credit Memos and Invoices

Before we begin with our guide, let's break down the idea of credit memos and invoices followed by the key components of both.

What is a credit memo?

The term credit memo is the abbreviated form of the credit memorandum. It is also known as a credit note.

The textbook definition of the credit memo is an accounting document that is issued by the seller to the customer to notify them of their positive balance in the account.

In simpler words, whenever the customer has paid more than the worth of services or goods he/she got, the company issues a credit note to reflect the same.

A customer of yours hired you for renovating his bathroom. You had an agreement on the estimated price of $10,000, which he had paid you in advance. Now, for some reason, the project got completed for just $9000.

So, you will have to create a credit memo to acknowledge the extra $1000 of positive balance he has.

Now, you must be thinking what are those scenarios that create a need for issuing credit memos, right?

So, let's discuss when you need to issue credit memos.

When to issue credit memos

Your accounts payable department needs to create credit memos in many situations. So, you must know when to issue credit memos.

- When your customer returns goods or disagrees to avail your services, and demands a refund.

- When the prices drop and the customer has paid advance payments.

- When you want to settle pricing disputes.

- When the scope of the service gets modified resulting in reduced accounts receivable balances for you.

Basically, whenever the seller owes money back to the customer, the seller needs to create a credit memo. You can use a credit memo maker to quickly prepare credit memos.

But can't he/she just tell the customer about the same thing over a phone call? Umm no! And here's why.

What's the purpose of credit memos?

Well, that's right that the contractor can simply inform about the positive credit balance over a phone call but that's not the only purpose of a credit memo. So, let's know more about it.

Now, if you have understood the concept of credit memos, let's talk about the invoice.

What is an invoice?

An invoice is a legally binding accounting document that is issued by the seller to the customer for requesting the payments for the goods/services provided. While this is the primary purpose, it has multiple secondary purposes too, which we will discuss in this blog shortly.

An invoice helps the customers know how much they owe to the vendor, what they need to pay, when they are expected to pay, and how to pay the due.

Therefore, an invoice is mandatory to produce for every business transaction.

When to issue invoices

A contractor needs to create and send invoices at several instances during the time of the contract. This highly depends on the contract and the prior agreement between you and your client.

However, we will discuss the most common times to send invoices and you can choose the one which suits your business.

At the End of the Service

This is the most common scenario as the clients are more willing to pay the due after experiencing your services. Once the client is satisfied with the work, you have a greater chance of quick payment processing. And such a type of invoice is also known as a credit invoice.

In-between the Project

Mostly the gross amount of a contract is way too large to process in a single go and not every contractor can afford to invest such a large capital initially. Therefore, contractors issue interim invoices after every major event gets completed during the project to break down the total amount into smaller installments and manage their cash flow better.

Before the Service Starts

As discussed in the above point, the contractor has to invest huge amounts of capital at the beginning of a project. Thus, contractors issue an invoice before the service starts to request a partial payment or full payment as an advance payment depending upon the agreement.

In a nutshell, it is issued whenever the vendor wants to request money. Now, if you want to save time and get them approved quickly, make invoices online.

What's the purpose of invoices?

Creating an invoice is among the first things accountants need to learn because it has multiple purposes that can benefit the business and the client. So, let's learn a few of them.

- Bookkeeping: Invoices are recorded for bookkeeping and keeping track of business sales.

- Accounting records: Invoices help in recording your business transactions and managing the accounts tally.

- Legal purpose: As invoices are law binding, you are supposed to make professional invoices to avoid a lawsuit against your business.

- Managing Inventory: An invoice records the product/goods sold and thus, you exactly know how stocked your inventory is.

- Brand marketing: An invoice is a great place to market your brand. You can mention all your services, brand logo, and contact details. It helps a lot in boosting customer loyalty.

If you find your invoice process complex and tiresome, signup to InvoiceOwl and create professional-looking invoices now! Keep your invoicing process updated for better business management.

Now that we have discussed credit memos and invoices separately, let's compare them next to each other and know the difference.

When and How to Use Each Document

There is no denying the fact that both invoices and credit memos play a vital role in business accounting. However, they both serve a very different yet crucial role. As a result, it is very important to understand the implications of both documents to avoid misunderstandings and maintain accurate financial records for your business.

Credit memo usage guidelines

A credit memo is typically used in the following situations:

- Product returns: In case of a product return, the credit memo adjusts the reduced balance.

- Billing errors: A credit memo reduces the overall amount if a customer is overcharged.

- Discounts or allowances: This document also helps to promote exclusive discounts and promotions for qualified customers.

- Customer satisfaction: Credit memos also help businesses to resolve customer issues and compensate accordingly.

Step-by-step credit memo creation

Creating a credit memo accurately is essential for maintaining precise records. Here's a step-by-step guide:

Choose the right format

Always use a standard template or specialized software to create a professional credit memo.

Add key details

Carefully add important details like the name of your company, contact details, and the date.

Reference the original invoice

Maintain a clean audit trail by listing the related invoice number.

Specify the reason

Keep the reasons clear and concise for the credit such as returned goods or overcharge correction.

List adjusted amounts

Describe the adjusted amounts and any applicable taxes to be credited.

Communicate to the customer

Send the credit memo to the customer, either as a document or digital file, and confirm they understand the adjustment.

Invoice implementation best practices

Invoices are essential for requesting timely payments and clarifying the terms of a sale. Best practices for issuing invoices include:

- Timely delivery: To encourage prompt payment, send an invoice as soon as the product is shipped.

- Clear itemization: Avoid any confusion by clearly describing the product names, quantities, and prices.

- Set clear payment terms: If any, do not forget to mention due dates in the invoice. Also, mention any late fees so the clients know when and how to pay.

- Use consistent numbering: For easy reference and categorization, use the proper numbering style in every invoice.

- Maintain a professional tone: A professional, polite tone helps build trust and encourages positive client relationships.

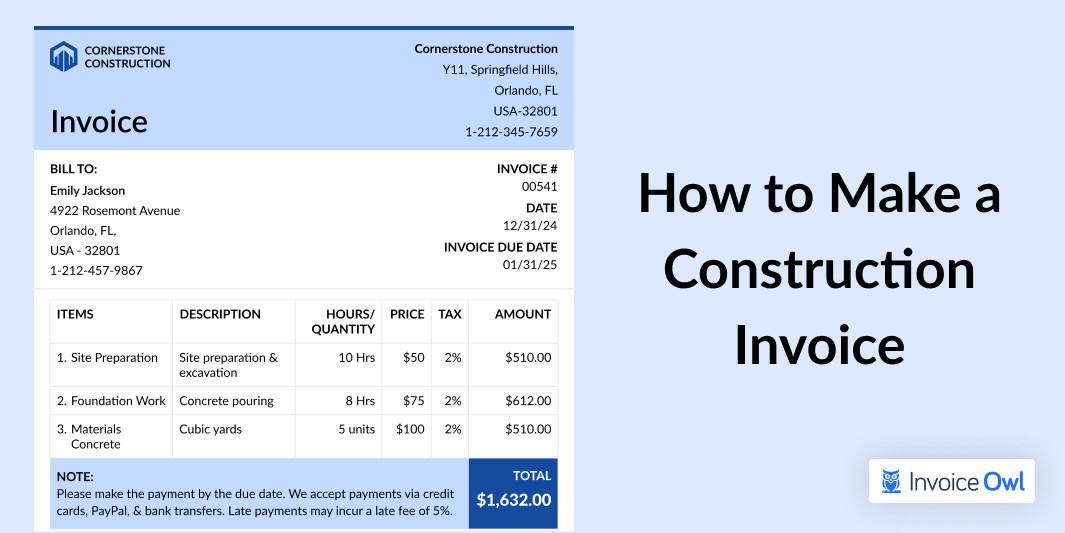

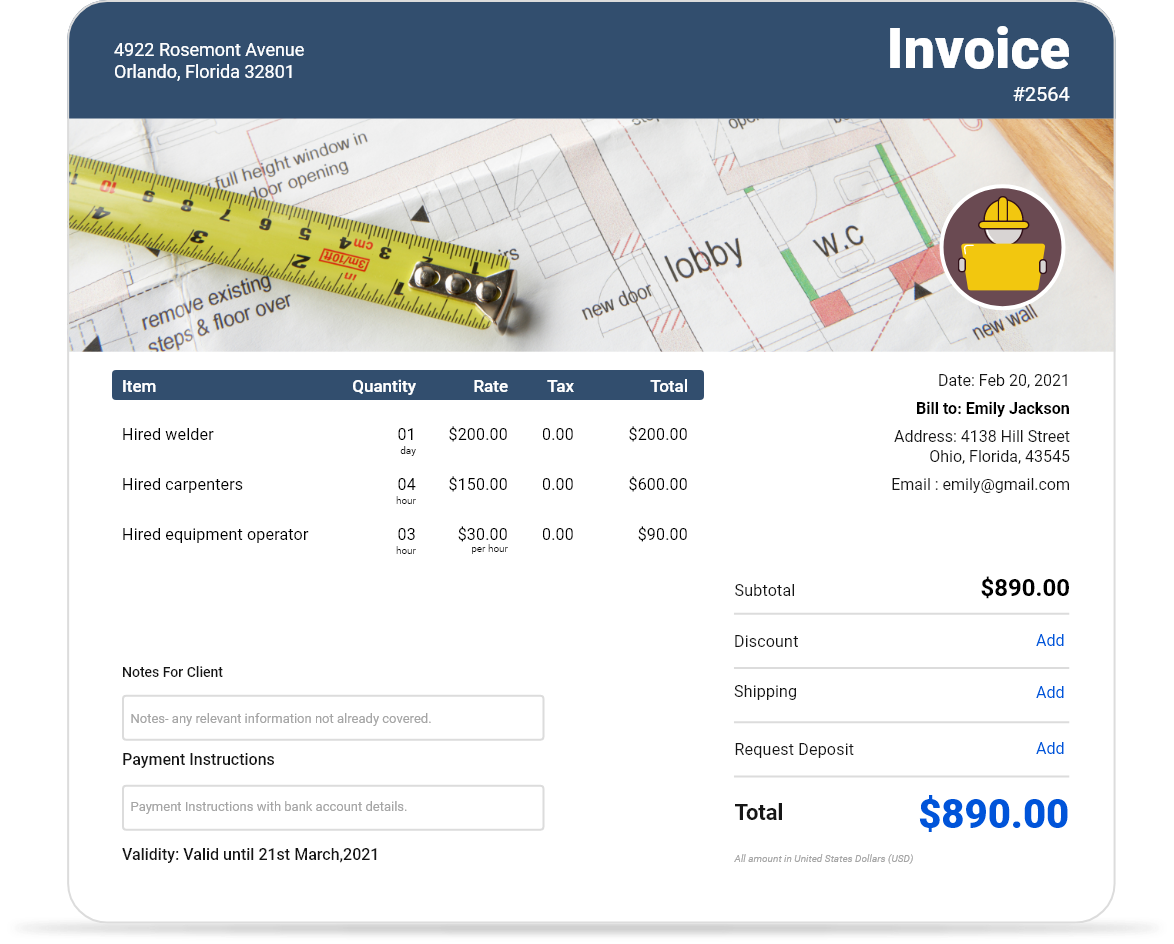

Creating professional invoices

A professional invoice improves payment speed and reinforces your brand's reliability. Here's how to create an effective one:

Key Differences and Similarities Between Credit Memo and Invoices

Let's explore the key differences and similarities between credit memos and invoices, two essential financial documents used in business transactions.

Format and content differences

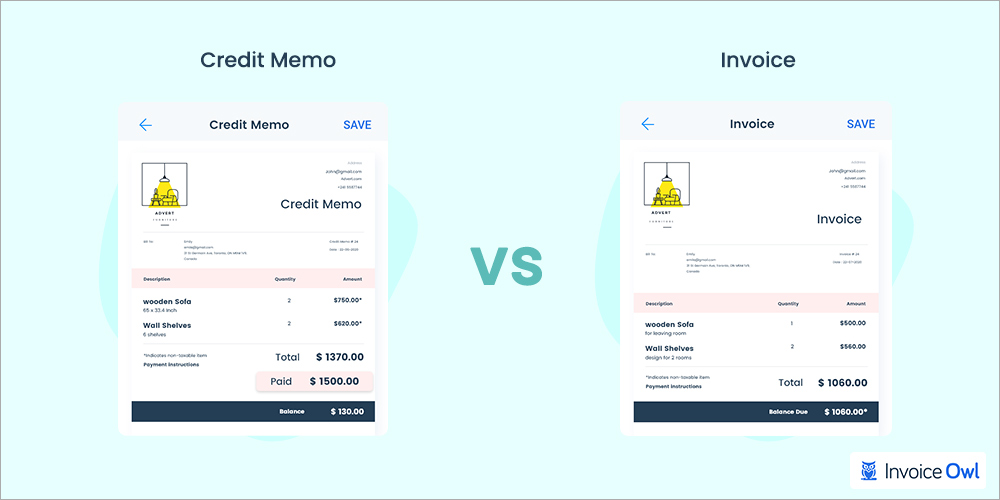

Credit Memo vs Invoice: Key Differences

| Criteria | Credit Memo | Invoice |

|---|---|---|

| What does it show? | A positive balance in the customer's account. | The amount a customer owes to the contractor. |

| When is it issued? | When customer demands a refund, rate changes, or scope changes. | When the contractor sells services/products. |

| At what time is it issued? | Mostly, after the customer has paid the amount. | Whenever the contractor wants to request a payment. |

| What does it include? | Customer's information, contractor's information, issuing date, credit memo number, original invoice reference number, item list with description, total positive balance | Customer's information, contractor's information, date of issue, invoice number, purchase order reference number, itemized list of products/services provided, total accounts payable |

| Who owes the total amount to whom? | The contractor owes the customer. | The customer owes the contractor. |

Document purpose comparison

Yes, they have quite a few differences.

But, both have similarities too. And that's why most contractors are confused between them.

So, let's talk about the similarities.

Similarities Between Credit Memos and Invoices

| Criteria | Credit Memo | Invoice |

|---|---|---|

| Who issues it? | Contractor | Contractor |

| Whom is the addressee? | Customer | Customer |

| Is it legally binding? | Yes | Yes |

| Which department handles it? | Accounts payable department | Accounts payable department |

Alright, we have discussed the differences and similarities between both accounting documents. Now, you can easily differentiate between the two and know what to issue and when to.

And just to make sure we cover all your doubts, we have answered the frequently asked questions to help you clarify your doubts if any.

Conclusion

Both the buyer and the seller must know the difference between a credit memo and an invoice. Especially contractors like you. Because you have to issue the appropriate documents at the appropriate time to be professional.

So in this blog, we talked about the differences and similarities between a credit note and an invoice.

If this is too overwhelming for you as a contractor, you must try InvoiceOwl —estimating and invoicing software for contractors. You get a free trial without any commitment. So, sign up to InvoiceOwl now to win more jobs and get paid faster.

Simplify Your Invoicing and Credit Memo Management

Stop struggling with accounting documents. InvoiceOwl helps you create professional invoices and credit memos in minutes, keeping your financial records accurate and organized.

Start Your FREE TrialFrequently Asked Questions

An invoice is the accounting document used for requesting payments. Whereas, a credit memo is the accounting document used for informing clients about the positive balance they have in the account.

No, a credit memo is not an invoice. A credit memo denotes a positive balance and an invoice denotes an outstanding balance.

A credit memo is a document that contractors have to issue whenever they owe money to a client. This includes various scenarios like a refund, rate fluctuation, change in scope, or deposit return.

A credit memo is used for notifying the client about his/her account balance left after the deduction of the invoice amount.