Key Takeaways

- 0129% of freelance invoices are paid late, primarily due to unclear payment terms

- 02Net 30 and Net 15 are the most common payment terms for freelancers

- 03Offering early payment discounts (like 4/15 Net 30) can improve cash flow significantly

- 04Clear payment methods (PayPal, EFT, direct deposit) should be specified on every invoice

- 05Late payment terms with penalties encourage clients to pay on time

- 06Advance payments protect freelancers against non-payment for new clients or large projects

You will be surprised to know that about 29% of freelance invoices are being paid late.

The primary reason for such late payments is that the clients are not able to find the best option to pay in the invoice.

So, you need to make your invoice terms and conditions such that it becomes easy for the clients to pay faster.

But, how is that possible?

For your convenience, we've highlighted different freelance invoice terms and conditions that will make it easy for the freelancers to include in the invoice.

Table of Content

- What are Invoice Payment Terms?

- Importance of Payment Terms

- Invoice Payment Terms Examples For Freelancing

- 13 Most Common Freelance Invoice Payment Terms and Conditions

- Payment Terms Challenges to Keep In Mind

- Get Access Invoiceowl Free Trial And Start Adding Invoice Terms And Conditions

- Conclusion

- FAQs

What are Invoice Payment Terms?

Invoice payments are payment instructions that you need to include in your freelance quotes, ongoing contracts, and even invoices. Moreover, it helps you to highlight the information on how and when a customer pays for your services.

Invoice payment terms give you an overview of:

- How will your customer pay you?

- When will your customer pay?

- Which method should your customer use in making payments?

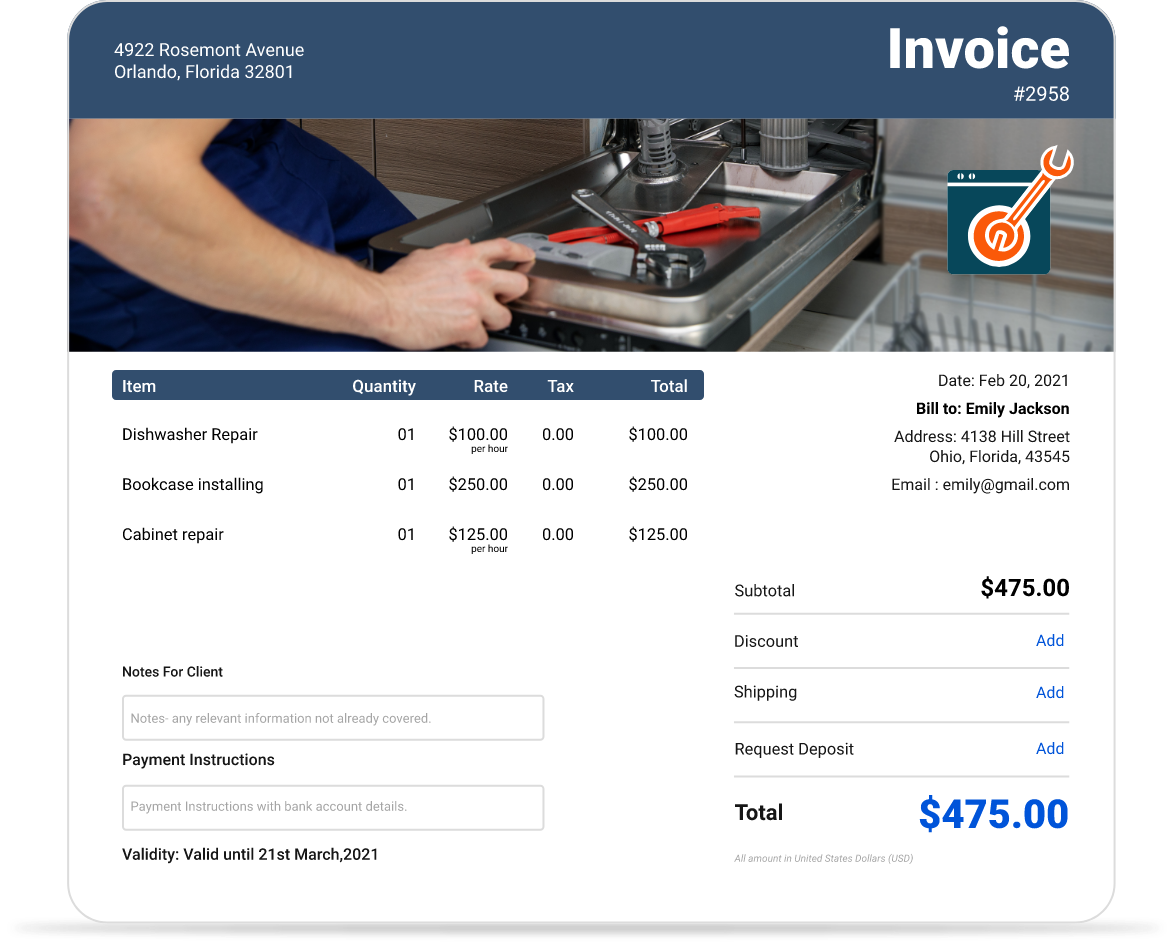

Try our free online invoice generator today!

Whether your business is in construction, landscaping, consulting, photography, auto repair, or the medical field, invoicing takes way too long. That's why we're here. InvoiceOwl makes your invoicing faster and simpler so you can get paid promptly and without the hassle.

Importance of Payment Terms

A swift cash flow keeps any business operative, and any delay in receivables may demand alterations, eventually leading to complications.

Big organizations still manages if there is delay in payments by their one of the parties, but it becomes a near to death situation for small businesses.

Growth and goodwill of the business depends on smooth cash flow. Even regular tax payment is also dependent on good cash flow. A professional-looking invoice is what you must look for to send to your clients.

Invoice with clear and precise payment terms and conditions get high-priority when it comes to closing one.

So, let's know how it works.

Invoice Payment Terms Examples For Freelancing

When it comes to freelancing business, you must know the payment terms and conditions. In some cases, you can ask for advances as a down payment and then continue with escrow-style payment method.

Besides, you can even offer Net 30, 60, and 90 to your clients depending on the relation. Make sure you are clear with your payment terms and conditions. You may even come into contact with some clients who will pay immediately upon receiving invoices, while there may also be some clients who keeps on delaying payments.

You have to make sure which invoice payment Terms and Conditions work for you better. Start with Net 30 or Net 15 for new clients, and adjust based on your cash flow needs and client relationships.

You have to make sure which invoice payment Terms and Conditions work for you better. So, let's see the differnet types of T&C's.

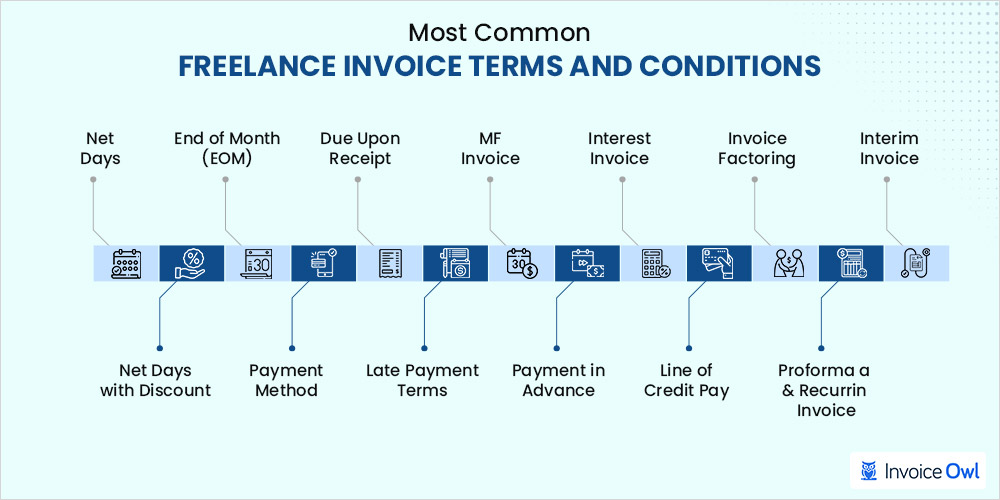

13 Most Common Freelance Invoice Payment Terms and Conditions

Let's explore different invoice payment terms and conditions that freelancers can include in the invoice.

1. Net days

Net days is one of the most common invoice payment terms. It specifies the number of days after the invoice date in which payment is expected.

In the accounts receivable process, the Net days' payment term is usually calculated by using the total amount receivables on the balance sheet.

Generally, there are five Net days options available that you can stipulate in your invoice to accept payments.

- Net 7

- Net 10

- Net 30

- Net 60

- Net 90

Net 7 means payment is due 7 days after the invoice date.

It depends on the freelancers or small business owners to decide the duration for making the payment. But, for freelancers, the best options are Net 30 or Net 15.

Net 30 provides the customers with the freedom to pay any time before the 30 days expires, but after that, the account is considered past due.

Let's say, you have created an invoice on August first and you're using Net 30.

Then, you must expect the payment before August 30.

What happens if you're not able to get payment before August 30? You have an option to provide a grace next pay period after your chosen due date has passed. You can also send a payment reminder notice to your clients too.

This can help maintain good relations with potentially problematic clients and get rid of other cash flow problems.

Often, there is a big misconception with this term.

Some say that days begin once the invoice is received. While others say that it's from the date when an invoice is issued.

To remove such misconception, consider the term "Days" and not "Net."

2. Net days with discount

Do you find it challenging for your clients to pay late?

You have an option where you can add a discount period to your Net days' term.

For example, for your Net 30 as a payment term, you could prompt payment discounts if paid within 15 days. So, it's the best way to offer an incentive for immediate payments to help with cash flow.

A 4% discount would be reflected in your payment terms as, "4/15 Net 30".

The first section is the discount and the time within which it can be claimed.

The second one denotes the full term deadline for punctual payment.

It depends on you to select the best discount to offer to your clients as per your Net days' term.

3. End of month (EOM)

As the name suggests, the invoice would be due at the end of the month it was generated, irrespective of the date.

Adopting this method brings assurance of a relatively predictable, large influx of funds at the end of each month.

The major downside is that whether your invoice is generated on the 1st or 15th, the due date remains the same.

This method works the best only if you commit to invoices every month.

4. Payment Method

Nowadays, many freelance payment methods are available for freelancers which allows them to accept payments and get paid faster.

By including the convenient payment method in your invoice, you can easily get the payment or during a specific period depending on the situation.

With the help of this payment term, you'll get assurance that how your clients are going to pay you, whether it may be:

- PayPal

- Cheque

- Online payment

- Electronic Funds Transfer (EFT)

- Direct deposit that goes straight into your bank account

5. Due upon receipt

Due upon receipt is one such payment term that helps you to get paid once you've sent an invoice to your client.

For larger projects, it may be required to pay a down payment to start your work. Whereas for small projects, your clients need to pay within 24 hours.

By sending invoices that are due upon receipt, you need to make sure that you're providing them with the most efficient way to prompt payments using options like PayPal or Stripe.

Generally, you'll need Due Upon Receipt invoices only when you are in desperate need of cash or awaiting payment for work to commence.

The best option is to include Net 15 or even Net 10 for Due Upon Receipt. It will give your clients more time to pay and is a better way to maintain good client relationships.

The major downside of this method is that it does not give your clients time to verify whether they have money in their account or not. In addition, it happens that clients sometimes refer to "Due Upon Receipt" as "Due whenever they can pay", as we are not specifying a payment deadline.

6. Late payment terms

To handle the full payments or by the due date, you need to include late payment terms in your invoice.

One of the easiest ways to handle such late payments is by adding monetary penalties to unpaid invoices. You can even include additional late fees and interest charges for non-payment or partial payments.

By providing such additional costs and higher bills, the clients will stay alert and they are more likely to pay on time.

On the other hand, if you are facing any challenge in creating or issuing invoices, you can end up with a payment receipt delay for that particular customer. So, it becomes essential to track everything electronically just to make sure that there are no payment delays and you can send invoices to the client faster.

7. MF invoice

Month Following (MF) Invoice is a way to include a steady payment date that avoids the potential for unreasonably short payment windows.

In simple words, this method allows you to specify a particular date for payment in the month following the month in which the invoice was generated.

For example, 16 MFI. It means that the 16th is the date of the current month in which the invoice is due.

This way, the customers will have 15 days to make a payment even if the customer's invoice was sent on the last day of the current month.

The downside to this payment term is that it can be overly generous for invoices generated at the beginning of the month, which can be problematic for your normal cash flow.

8. Payment in advance

The freelancers can use Payment in Advance (PIA) as a payment term to allow clients to make a payment ahead of schedule.

With the help of early payments, you can always include an early payment option with an attractive discount between 5% and 10%. And the good part is that it's payable when a job is completed.

Offering an early payment discount is an effective way to encourage the client to pay your invoice ahead of time. But, it's particularly useful for larger businesses, or if you're working for a client where your invoice might go unnoticed.

Nowadays, almost every freelancer asks for an advance payment or partial payment for their services, especially for a new client or a large project. It depends on the freelancer about how much money or down payment they need to charge from the client.

Advances protect freelancers against non-payments or partial upfront payments and can cover out-of-pocket expenses.

9. Interest invoice

An invoice that is sent to the customers who have not made a payment by providing an additional charge is an interest invoice.

This invoice includes the interest based on the period, month, or year of missed payment, and most importantly, the interest on such due payments.

How is the interest calculated?

Let's say, the invoice is for $2,000 and it's 25 days late. You are charging a 5% interest rate.

- First, you need to divide 25 by 365;

- Now, multiply that result by .05;

- Finally, multiply that amount by 2,000.

- So, the interest amount will be $6.84 for 25 days.

It's the best option for freelancers as they have the freedom to set their terms and interest.

10. Line of credit pay

With the help of this payment term, your clients will have to pay their bills over a specified period. It may be either monthly or quarterly.

In simple words, the client can purchase your services on credit.

As there are more risks involved, this payment term is usually used in many larger businesses.

11. Invoice factoring

Invoice factoring is a payment collection solution that makes a freelancer's life easy and so it is an important factor to consider in a freelance business plan!

A factoring company will pay you most of the invoiced amount immediately, then collect payment directly from your customers.

The working process is simple. You just need to submit your invoice to the invoice factoring company. Once you submit, 85% of the advance payment will be given to you by that company, and need to return back within a specific time.

Keep in mind that these companies will charge you a fee, so make sure that you read all of the fine print.

12. Proforma and recurring invoice

A proforma invoice is a final price that both you and the customer have agreed upon.

We can say that it's just similar to sending quotes and estimates to your clients.

Quote says "I hope we can work out a deal."

The Proforma invoice says "deal is done."

Recurring invoices are for ongoing services and the amount billed is the same each month.

To make it easy for you, you might be having a membership or subscription. Right? Then you must be familiar with recurring billing.

Recurring invoices guarantee cash flow for your business, makes forecasting a snap and saves you the time of having to invoice all of your clients each month.

13. Interim invoice

An invoice is issued to the customer before starting the project is an interim invoice.

For creating an interim invoice, the vendor first needs to draft an achievable cost for the entire project.

Interim invoices are always agreed upon by the seller and buyer from the start of the project and are often sent to the customer on a monthly, weekly, or quarterly basis.

In simple words, we can say that an interim invoice is a way to take a large project and break the payment down into multiple payments that correspond to the completion of a certain portion of the project.

You need to select a specific set of invoice payment terms and conditions that help you improve consistency, cash flow planning, and make sure that the customer doesn't get separate invoices with varying terms.

Payment Terms Challenges to Keep In Mind

When setting up payment terms and conditions, you are also required to prepare for some challenges. Let's have at look at it so that you know what should you be prepared with when setting up terms and conditions.

Security

With online payments, you cannot rely on all the payment gateways. A single loophole and all your hard-earned money would be vanish. Therefore, when you are receiving payments, you must ensure that the money is successfully credited to your account.

Tracking Invoices & Payments

Your business size or complexity would make it troublesome for you to allocate funds and resources. So, how will you do it appropriately? With an agile invoicing system that automates most of the unnecessary human-intervention processes. This would even include strict payment terms and workflows to accomplish the objectives.

Invoices Remain Unpaid

Small businesses suffer from unpaid invoices since that's their lifeline to run their business. For this late or no payment issue, you can add strict payment terms and guidelines to your invoices. Besides, you can even go through invoice factoring to make sure that you stay secured and protected from delayed payments.

Still, have any questions related to invoice payment terms?

Don't worry! The next section includes the frequently asked questions to resolve your queries.

Get Access Invoiceowl Free Trial And Start Adding Invoice Terms And Conditions

Creating invoices would be a lot easier and stress-free with InvoiceOwl. And adding terms/conditions is part of invoice preparation process. With these factors, there would be no slips through cracks.

Moreover, the software is not limited to creating invoices; several other benefits awaits for you to explore. From payment tracking to receiving and creating quotes to sending them right through anywhere is what you can expect from this software.

Conclusion

It's time to select the payment terms that suit best your business requirements.

It's not that important how you structure your payment terms, but you should always focus on how you get buy-in from your client immediately. And it's made possible if you send an invoice to the client and set the payment terms that help you get paid faster.

To create and send a professional invoice quickly, the best option is to adopt an online invoicing software solution. One such software solution is InvoiceOwl which allows you to save your time in making an invoicing process smoother.

Isn't it great? What are you waiting for? Sign Up Now for InvoiceOwl and create your first invoice with us.

Create Professional Invoices Online Easily and Keep On Top of Your Finances

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers, and contractors to create invoices on the go and get paid quicker!

Get Started for FREEFrequently Asked Questions

- Use a clear and concise language

- Make sure your information is well-structured and logical

- Try to limit the length of terms and conditions

- Make proper formatting by giving proper subheadings, numbered paragraphs, bold highlighting, and bullet points

- Invoice date

- An invoice number

- Client name and address

- A description of the goods/service provided

- Date of service offered

- The total amount of individual services

By having appropriate payment terms, you can easily maintain your cash flow and help you regulate purchasing of inputs to ensure you have provided the services to the clients.