Key Takeaways

- 0145% of U.S. small business owners forego paychecks due to cash flow shortages

- 02Cash flow includes three types: operating, investing, and financing activities

- 03Free cash flow = Operating cash flow minus capital expenditures

- 04Regular cash flow monitoring helps ensure liquidity and enables better financial planning

- 05Positive cash flow indicates a healthy business with sufficient funds to meet obligations

Every small business owner knows that money can make or break their operations, yet cash flow remains a misunderstood topic for many. This lack of understanding leads many business owners to struggle to meet their financial obligations. Studies reveal that poor cash flow management is a leading cause of small business failure.

Did you know almost 45% of U.S. small business owners forego their paychecks due to cash flow shortages? To ensure your business isn't part of this statistic, learning how to calculate cash flow is of great importance.

In this blog, we will cover different concepts of cash flow, highlight its importance, and offer cash flow formulas and ways to calculate it.

Let's start.

Table of Content

- What is Cash Flow?

- Understanding Cash Flow: Key Types Explained

- Fundamental Cash Flow Concepts: Terminology Breakdown

- What are the Important Cash Flow Formulas You Must Know

- How Can You Calculate Cash Flow Using a Cash Flow Statement?

- What is Free Cash Flow?

- How to Calculate Operating Cash Flow?

- How to Calculate Cash Flow from Investing Activities?

- How to Calculate Cash Flow from Financing Activities?

- What is the Importance of Calculating Cash Flow?

- Master Cash Flow Calculations for Financial Success

- FAQs

What is Cash Flow?

Cash flow is the amount of money moving in and out of the organization for a particular period. Usually, organizations generate profit from sales as revenue or cash inflow and spend money on expenses or cash outflow.

- Net cash flow is obtained by subtracting total cash outflow from total cash inflow

- Cash flow is divided into three categories: cash flow from operations, investing, and financing

- A cash flow statement showcases its sources and use of cash for a specific period

- Income can be earned from various sources such as investment, interest, royalties, and licensing activities

The net cash flow is positive when the organization's cash flow exceeds its outflow and turns negative in the opposite situation. With the help of sales reporting software, public companies need to report their respective cash flows on their financial statements. This information on cash flow is greatly important for investors as it showcases the company's financial health.

Understanding Cash Flow: Key Types Explained

Cash flow is like the pulse of a business—it keeps everything moving and healthy. But before learning about cash flow formula, know the various types. Hence, to understand your organization's financial health, it's essential to delve into the key types of cash flow and what they signify.

Operating Cash Flow

Operating cash flow also known as net cash from operating activities, refers to the money involved with producing and selling goods from ordinary operations. It also ensures from the income statement that the organization has enough funds to pay bills and handle expenses.

Investing Cash Flow

Investing cash flow is all about reporting the amount of cash generated or spent from various investment-related activities at a specific time. Speculative assets and sales of securities or assets are considered to be investing activities.

Financing Cash Flow

The financing cash flow showcases the cash net flow used to fund the organization and its capital. Various transactions like paying dividends and equity issuance are considered to be financing activities. With financing cash flow, investors have a clear understanding of how much cash is required.

Fundamental Cash Flow Concepts: Terminology Breakdown

Here are some of the important cash flow statement terminologies as stated below:

- Operating activities: The money involved here is meant for day-to-day operations comprising, cash payments and other financial activities.

- Investing activities: This is related to the cash meant for business investment.

- Financing activities: This amount is generated through capital contributions and business loans.

What are the Important Cash Flow Formulas You Must Know

Here, we provide you with a list of some important cash flow formulas to ease the process of calculating cash flow for your organization.

Free Cash Flow: Free Cash Flow = Net Income + Depreciation/Amortization - Change in Working Capital - Capital Expenditure

Net Cash Flow: Net Cash Flow = Cash Receipts - Cash Payments

Discounted Cash Flow: Discounted Cash Flow = Σt=1n (Cash Flowt / (1 + r)t)

Levered Free Cash Flow: Levered Free Cash Flow = Net Income Before Interest, Taxes, Depreciation, Amortization - Change in Working Capital - Capital Expenditures - Mandatory Debt Payments

Operating Cash Flow: Operating Cash Flow = Operating Income + Depreciation - Taxes + Change in Working Capital

Cash Flow Forecast: Ending Cash = Beginning Cash + Projected Inflows - Projected Outflows

Unlevered Free Cash Flow: UCFC = EBITDA - Capital Expenditures - Working Capital - Taxes

How Can You Calculate Cash Flow Using a Cash Flow Statement?

With a cash flow statement, you get a better and complete overview of your company's cash inflows and outflows. It also helps you evaluate your business's financial health and operations efficiency.

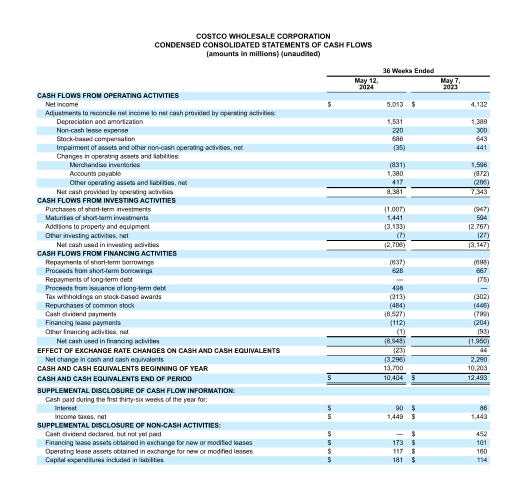

Here is Costco's cash flow statement for the fiscal year of May 12, 2024. All amounts are in millions of U.S. dollars.

This statement is important for assessing the financial health and the company's operational efficiency.

Cash flow statement formula:

Cash Flow = Cash from operating activities +(-) cash from investing activities +(-) cash from financing activities + beginning cash balance

Here is an example of how an organization's cash statement would look after using this formula:

- Operating activities = $30,000

- Investing activities = $5,000

- Financing activities = $5,000

- Beginning cash = $50,000

- Cash Flow = $30,000 +(-) $5,000 +(-) $5,000 + $50,000 = $70,000

What is Free Cash Flow?

Free Cash Flow (FCF) is a specific amount generated by businesses after accounting for operating expenses and capital expenditures. It is important for maintaining or expanding the operations of an organization.

This valuable metric showcases an organization's ability to generate surplus cash. This extra cash can be used for various purposes like reinvestment, debt repayment, or shareholder dividends. Having an optimized account payable process plays an essential role in managing cash outflows and striking the balance between cash retention and timely payments.

Unlike net income including non-cash items and accounting adjustments, free cash flow focuses on actual cash inflows and outflows. This makes it a perfect indicator of an organization's financial health and operational efficiency.

How to calculate free cash flow

It is very easy to calculate Free Cash Flow (FCF). All you need to do is subtract capital expenditures from operating cash flow.

Here's the free cash flow formula:

Free Cash Flow (FCF) = Operating cash flow - capital expenditures

Suppose a company reports $500,000 in operating cash flow and spends $150,000 on capital expenditures:

- FCF = $500,000 - $150,000 = $350,000

- The amount - $350,000 is available to reinvest, repay debts, and distribute to shareholders.

By calculating FCF regularly, you can assess your organization's financial health and make the right decisions relating to future investment and operations.

Now that you have an understanding of the cash flow basics, let's move on to three important cash flow statement bifurcations discussed below.

How to Calculate Operating Cash Flow?

The term operating Cash Flow (OCF) is meant to measure the money earned from an organization's primary business activities. The main focus of operating cash flow is on operations, rather than on financing or investing activities.

Here's the operating cash flow formula:

Operating Cash Flow (OCF) = Net income + non-cash expenses + changes in working capital

Suppose a company reports:

- Net Income: $200,000

- Depreciation: $50,000

- Increase in Accounts Receivable: $30,000

- Increase in Accounts Payable: $20,000

- OCF = $200,000 + $50,000 - $30,000 + $20,000 = $240,000

This means the company has $240,000 in cash generated from its core operations, which can be used for reinvestment, debt repayment, or other operational needs.

How to Calculate Cash Flow from Investing Activities?

The cash flow from investing activities showcases the cash spent or generated by the organization's investment-related transactions. This cash flow statement comprises the purchase and sale of long-term assets and investments in other businesses.

The formula for cash flow from investing activities:

Cash Flow from Investing Activities = Proceeds from the sale of investments - purchase of investments + proceeds from the sale of assets - purchase of assets

Suppose a company has the following data:

- Proceeds from selling investments: $150,000

- Purchases of new machinery: $100,000

- Proceeds from selling an old warehouse: $80,000

- Purchase of new property: $120,000

Cash Flow from Investing Activities = $150,000 - $100,000 + $80,000 - $120,000 = $10,000

This indicates a net positive cash flow of $10,000 from investing activities during the period.

How to Calculate Cash Flow from Financing Activities?

Cash flow from financing activities reflects the inflow and outflow of cash from a company's funding sources, such as issuing or repurchasing stock, borrowing, or repaying debt. This metric provides insights into how a business raises and uses funds to sustain operations and growth.

The formula for cash flow from financing activities:

Cash Flow from Financing Activities = Proceeds from issuance of debt or equity - repayments of debt - dividends paid

Assume a company has the following data:

- Proceeds from issuing new stock: $200,000

- Loan repayments: $50,000

- Dividends paid: $30,000

Cash flow from financing activities = $200,000 - $50,000 - $30,000 = $120,000

This shows a net positive cash flow of $120,000 from financing activities, indicating successful fundraising during the period.

What is the Importance of Calculating Cash Flow?

The fundamentals of how to calculate monthly cash flow isn't just estimating numbers—it's about knowing the rhythm of your business. However, learning the importance can change the entire dynamics of your business.

Here's why calculating cash flow is a cornerstone of smart financial management.

Ensures Liquidity

The cash flow calculation is important in helping businesses realize the available cash to cover day-to-day expenses, such as salaries, utilities, and rent. You must maintain a positive cash flow to ensure smooth operation without any disruptions.

Facilitates Financial Planning

Analysis of cash inflow and cash outflow helps organizations to create perfect financial forecasts. It is also one of the ways to improve cash flow, plan future investments, expand, and address potential shortfalls.

Evaluates Business Performance

Cash flow is an important criterion for assessing a company's financial health. If your business has a positive cash flow then it implies that the business is doing well.

Enhances Tax Planning

Accurate cash flow simplifies tax reporting and compliance. Additionally, they help in allocating the required funds to meet tax obligations without affecting operations.

Master Cash Flow Calculations for Financial Success

Cash flow is one of the most important aspects of any business, as it paints a clear picture of how the money comes in and goes out of business operations. Understanding ways to calculate cash flow comes in handy to ensure their financial health and make effective plans for the future.

Generally, there are two ways of calculating cash flows - direct and indirect methods. These cash flow methods empower organizations of various scales—small and medium-sized firms to enterprises to identify patterns, address inefficiencies, and optimize financial planning. You can make use of cash flow statements, estimating, and invoicing software to enhance these efforts. Prioritizing cash flow management, helps businesses to not only survive but also grow and lead towards long-term growth.

Take Control of Your Cash Flow Today

Stop worrying about cash flow gaps. InvoiceOwl automates invoicing, tracks payments, and helps you stay on top of your finances effortlessly.

Start Your FREE TrialFrequently Asked Questions on How to Calculate Cash Flow

The term cash flow shows the movement of money in and out of a business, whereas profit is the net income reported on an income statement. There can be situations where a business is experiencing negative cash flow due, but still be profitable.

Yes, a cash flow can be negative in circumstances where outflow exceeds the inflows. A negative cash flow showcases that the business is struggling to meet its obligations. However, it is not always a bad thing. For example, a negative cash flow from investing activities occurs when a company invests in growth opportunities.

Cash flow must be monitored regularly. Generally, on a monthly or quarterly basis. Regular calculations offer real-time insights into the business's financial health. Additionally, it helps to address potential issues quickly.

The major difference between cash flow and revenue is that cash flow focuses on the money moving in and out of the business, whereas revenue is the income a company earns on the sale of its products and services.

Price-to-cash-flow (P/CF) ratio is used for valuing stocks with a positive cash flow, which is not profitable due to large non-cash charges. The P/CF ratio compares a stock's price to its operating cash flow per share.

The formula to calculate cash flow to stockholders is: Cash flow to stockholders = Net income – dividends paid + increase in equity. Here, you will subtract the dividends paid from the net income and add any increase in equity.

The global cash flow formula is: Global cash flow = Net operating income + non-operating income – total debt. Global cash flow is meant to evaluate the capability of a borrower to produce sufficient cash flow to meet all debt obligations.