Key Takeaways

- 01Calculating overhead costs accurately and reducing the ones that you can do without will help you increase revenue and reduce cash flow problems

- 02Not all overhead costs can be removed - some are necessary to run your business

- 03Overhead costs are categorized into three types: fixed, variable, and semi-variable

- 04The overhead percentage rate = total overhead cost / total sales × 100

- 05Reducing overhead costs boosts profitability and prevents critical cash flow issues

Desired to earn a high profit, streamlining all your business processes? Obviously yes, we all wish to make good money but do we all succeed in the same way? No the one who abruptly levies the cost and doesn't know how to manage it may face adverse conditions. According to the Bureau of Labor Statistics, that due to high overhead costs and critical cash flow problems, on an average 30-40% of small business owners fail in their intal years. Here we have a comprehensive guide for you where you can know how to calculate overhead cost accurately. See, you will never be able to eliminate the overhead costs, but you can surely cut the unnecessary running expense of your business and can get a good deal of profit. When you know which expense to cut and which to levy you will save money and as they say, "A penny saved is a penny earned." So, without further ado, let's get started!

What Are Overhead Costs?

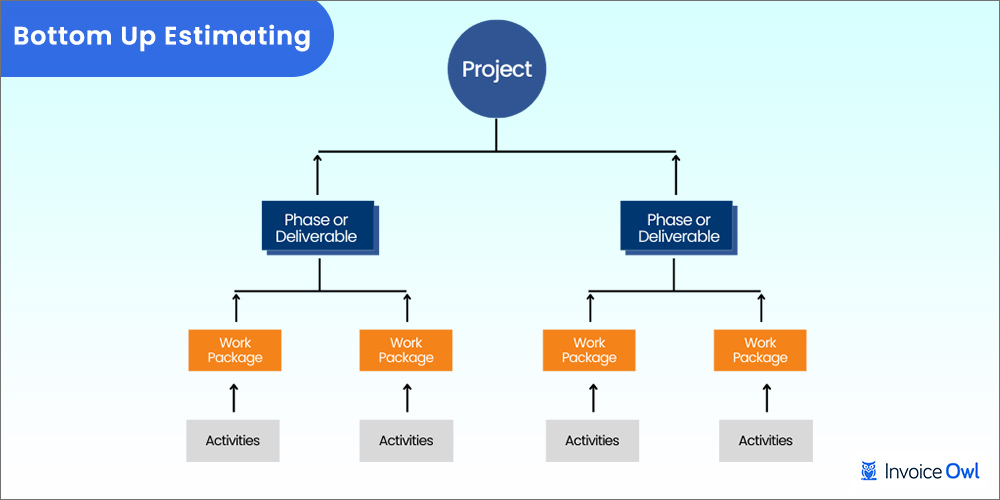

Overhead costs, also known as recurring expenses, keep your business running but do not add to revenue. These expenses are frequently referred to as indirect costs because they are not part of business operations that generate revenue and boost net profit. Watch this: Overhead costs are categorized into three types: fixed overhead costs, variable overhead costs, and semi-variable overhead costs.

1. Fixed overhead costs

Fixed overhead expenses remain constant every month. Here are some examples:

- Payments for rent or mortgage

- utility bills

- Taxes on real estate

- Insurance

2. Variable overhead costs

Business operations influence variable overhead costs. These types of overhead costs rise in accordance with increased business operations. Variable overhead expenses include the following:

- Shipping

- Materials

- Advertising

- Maintenance of office equipment

3. Semi-variable overhead costs

Semi-variable overhead costs vary significantly from month to month based on usage. These are some examples of overhead costs:

- Utility bills

- Salaries (including overtime)

- Business vehicle usage

- Maintenance and repairs of tools and equipment

When calculating overhead costs, these categories become less significant. However, understanding the differences is critical to the functioning of your organization.

Importance of overhead costs

Based on your business operations, overhead expenses make up a big amount of dollars bills that you spend every month. Understanding and managing them properly might play a crucial part and make a difference in your company's profit and loss.

Now that you know what overhead costs are and why they are significant, let's move on to understanding how to calculate and reduce them.

How to Calculate Overhead Cost?

To determine your overhead costs, follow the steps discussed below:

Review last year's financial statements

For parallel allocation of costs every year, the fastest way of categorizing the expenses into direct costs or indirect costs is to peep into the last year's financials. Take a look at those financials, or you can even see what IRS categorizes as expenses, and you can do accordingly. From the balance sheet and income statements, you will get the actual idea of monthly as well as annual indirect expenses. However, considering the monthly component will be useful as you need to allocate indirect expenses on a monthly basis. For example, insurance, gas bills, and electricity bills are mostly months.

List all the expenses and check for any amendments

After getting a clear idea, make a detailed list of indirect business expenses such as rent, utilities, taxes, office equipment, etc. These expenses are your overhead costs. Overhead costs do not include direct costs associated with the production of goods, such as labor costs and costs for raw materials. Remember that some things cannot be assigned to a specific category when categorizing direct and overhead costs. Some business expenses can be considered overhead costs for others, but they are direct costs for your company.

Sum up all the expenses

Add all the monthly overhead costs to find the total overhead costs. This is the amount of money required to run your business every month.

Calculate overhead costs

Now, after identifying the total overhead costs, it's time to determine the overhead rate. Since the overhead costs are not directly proportional to the sales revenue you generate, it becomes difficult to calculate the monthly overhead cost. However, when you calculate the proportion of actual overhead costs compared to monthly sales, you will get the idea.

Overhead Percentage Rate = Total overhead cost for the period / Total Sales for the period × 100

Suppose that your monthly overhead expense is $50,000 and your monthly sales revenue amounts to $100,000. Then your overhead rate will be:

Overhead Percentage Rate = $50,000 × 100 / $100,000 = 50%

Why Are Reducing Overhead Costs Important?

As Mark Twain quotes, "Too much of anything is bad '', so as our monthly overhead costs in the business. It is a fact that overhead costs will never contribute to generating monthly sales, and that is the reason they are also familiarised as indirect costs that don't add value to sales. However, spending them appropriately will let you save money and ultimately raise your profit margins.

When you cannot remove the indirect costs, you can surely cut the non-essential indirect expenses by following certain techniques.

Ways to Reduce Overhead Costs

1. Get an employee

By utilizing the expert knowledge of the accountant hired, you will enhance your accuracy levels and prevent unnecessary financial mistakes in the future.

2. Have a Deep Dive into your Overhead Costs

Reviewing the overhead costs at regular time intervals is a must. By this, you will be able to categorize the relevant indirect expenses and the irrelevant ones. For example, you Having such identification is necessary so that you can get to know which needs to be eliminated from the business reducing the total overhead cost.

3. Trim the Staff Count

Downsizing is often a preferred alternative, particularly if you've discovered that you can lower the number of employees without affecting productivity or efficiency.

4. Outsource Few Duties

It is not always important to find everything in-house. Specific responsibilities can be outsourced to help you replace staff shortages without needing to pay full-time compensation. It also means you'll save money on office supplies and other overhead costs.

5. Look for System Upgradation

Instead of buying the pricy software or the latest system models, try purchasing the license for only those employees who needs them.

6. Go Green

If you're not careful, your utility expenses can quickly add up.

Going for more sustainable alternatives such as LED bulbs and energy-saving power outlets may have a higher initial cost, but they will result in cheaper utility bills in the long run.

7. Go Paperless

Stop bearing the cost of printing, papers and inks. Instead, start adopting digital methods and resist bearing such additional unnecessary overhead costs.

Willing to Create Accurate Cost Invoices/Estimates?

Ever thought of going completely paperless? InvoiceOwl helps you create unique invoices and estimates swiftly, saving you time and overhead costs.

Start Your FREE TrialFrequently Asked Questions

The percentage of indirect costs that are allocated to goods and services is known as the overhead absorption rate. Overhead absorption is not required by the internal management but for external financial reporting. Overhead is assigned to a product or service based on direct material hours, direct labor cost, machine hours, etc. The formula to calculate the overhead absorption rate is: Overhead / Direct labor hours × 100

Those costs which are not directly related to the production activity and do not contribute to the revenue-generating activities are known as overhead costs. Examples of overhead costs are utilities payable, rent payable, insurance payable, office supplies, and salaries payable to office staff.

The ideal overhead percentage rate varies from industry to industry depending on various factors, such as the industry you are operating in, the size of your company, and the type of business you run. For restaurants, the overhead percentage should be 35% of sales; for retailers, overhead ratios are typically between 20-25%, whereas, for professionals, they may be as high as 50% of sales.

Follow these steps to determine the overhead rate per employee:

- Calculate the labor cost, which includes not only the hourly pay but also the medical benefits, paid holidays, retirement, and pension benefits

- Calculate the overall business overheads

- Subtract the overhead costs from the billable hours. For instance, if your company employs five technicians, the overhead charges are split among them

- Adding direct or overhead costs and labor costs to billable hours yields the net cost of that employee per hour

By reducing the percentage of expenses, a company can acquire a competitive advantage by raising the profit margin or selling its products by pricing them more competitively.

Scale Your Business with InvoiceOwl!

Now that you have gone through the conclusive guide on how to calculate overhead costs accurately, we hope that the scalability of your business will be on top after following the complete process as well as tracking your monthly overhead costs data. But as we've mentioned earlier, overhead costs cannot be eradicated fully. Some of them are necessary to run a business, such as a software solution. Software like InvoiceOwl can streamline several of your work processes with automation, help you save time and money, and increase revenue as well. So what are you waiting for? Go for our [FREE trial period today](https://app.invoiceowl.com/register?u_referrer &u_medium=B_Start_FREE_Trial_1 "FREE trial period today") and experience the benefits we offer to our clients!