Key Takeaways

- 0182% of small businesses fail due to poor cash flow management

- 02Maintaining a cash reserve of 3 months' expenses prevents cash shortages

- 03Shortening payment terms and offering early payment discounts accelerates receivables

- 04Categorizing payables into mandatory, essential, and flexible payments optimizes cash outflow

- 05Invoice factoring and financing provide advance payments on receivables when needed

- 06Leasing equipment instead of buying reduces immediate financial strain

Managing cash flow is essential, as it is the lifeblood of any small business. It is one of the ways to gauge how much money is coming in and leaving the doors of the business.

As per the research conducted by U.S. Bank and published on the SCORE/Counselors to America's Small Business website, cash flow problems are by far the most common cause of failure for small businesses. 82% of small businesses fail due to a lack of knowledge of cash flow and inadequate cash flow management skills.

Therefore, it is crucial for small business owners to comprehend ways and learn how to improve cash flow for small business.

The major reasons for cash flow issues will be discussed in this blog article, along with practical solutions for improving cash flow.

If this is something that interests you, keep reading to learn more.

Cash Flow: Definition

The net amount of cash and cash equivalents coming into and leaving a business is known as cash flow. Money spent symbolizes cash outflows, whereas money received indicates cash inflows.

The capacity of a business to generate positive cash flow during the regular course of its business activities determines its success.

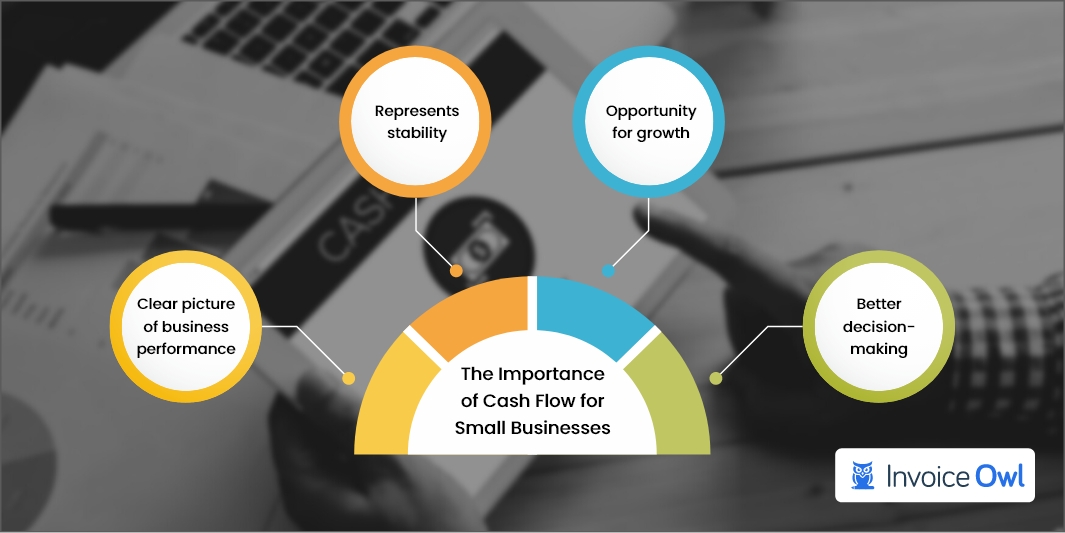

The Importance of Cash Flow for Small Businesses

Here are some essential pointers on why is cash flow important for small businesses:

- Clear picture of business performance: A cash flow statement provides a clear picture of the money that is really entering and leaving a business. It also determines if the amount of money earned exceeds the amount of money spent.

- Represents stability: A positive cash flow means a solid business structure. It enables you to make on-time payments to suppliers and fulfill other financial obligations. You will also be able to avoid penalties and fines for late payments which will portray a positive business image.

- Opportunity for growth: It becomes much easier to achieve growth and avoid high-interest loans if you have cash on hand to dedicate to development and expansion activities.

- Better decision-making: With an accurate cash flow statement in hand, you'll be able to make quick decisions and plan your future operations accordingly.

Common Cash Flow Problems Faced by Small Businesses

- An unrealistic cash flow forecast and a lack of cash reserves can result in the failure of your business due to negative cash flow

- Not preparing a proper cash flow budget will keep you from estimating the amount of money you anticipate spending and receiving over a specific time period

- Ignoring excessive overhead expenses can rapidly eat up your revenues

- Slow collection of receivables may hinder growth and prevent you from having the funds necessary to carry out regular business operations

- Setting low-profit margins can result in a never-ending battle with cash flows

- High-interest business credit cards and business loans may consume a significant portion of a company's cash flow

- Overinvesting in inventory and having sales that don't make up for the lost money can leave the businesses in a bind

- Not taking seasonal fluctuations in demand into consideration might negatively impact cash flow conditions

Ways to Improve Cash Flow for Small Businesses

1. Prepare for future cash requirements

You may make a projection for your business on the basis of past performance if you maintain accurate, timely, and appropriate financial records in accounting software. Business owners should be analyzing their business's cash flow on a regular basis.

Being upfront with your cash flow allows you to foresee the income you expect to have and aids in planning for difficult times or seasonal trends.

2. Maintain cash reserves

Keeping a cash reserve is the easiest approach to prevent running out of money. You won't run out of funds if you have three months' worth of expenses on hand for when an opportunity or unanticipated crisis comes. Be sure to manage your reserves in a systematic manner. Restock the reserve once you've used some of it.

To avoid running out of cash, you may also utilize a business credit card or get a line of credit.

Aim to maintain a cash reserve equal to 3 months' worth of operating expenses. This provides a financial cushion for unexpected crises or opportunities and helps maintain business continuity during slow periods.

3. Ramp up your receivables

You could manage your accounts receivable more actively by keeping track of unpaid bills and shortening the time it takes for payments to be received.

Encouraging clients to make early payments is one approach to achieving this. But how can you do so?

Let's see how.

4. Optimize your payables procedure

Improving your company's cash flow will depend on how well your accounts payable procedure is established and managed.

You are under no need to pay in full at once, and you really shouldn't. This is not to mean that you should let any payments fall behind. Rather, to make sure you have enough cash on hand, think about categorizing your invoices into three groups:

Category 1: Mandatory Payments

Payroll, taxes, and rent fall under the first category of obligations that must be met in order to maintain business operations. These should always be prioritized to avoid penalties and maintain operations.

Category 2: Essential Payments

When there are grace periods without penalties for utility and insurance payments, you could leverage that in your favor. Pay these on time but use the full grace period when needed.

Category 3: Flexible Payments

A lot of suppliers and vendors are open to negotiating a flexible payment schedule. Maintain open lines of contact, be truthful with them, and make your payments on schedule.

- Determine how late you may pay your vendors without incurring late penalties or jeopardizing your relationship

- Most suppliers will want a net 30 payment schedule, but when you establish a good rapport, they may be more willing to provide net 45 or net 60

- Search for lower interest rates when selecting checking, savings, and credit card accounts

- Consider making minimal payments on low-interest loans rather than paying them off immediately, as inflation can work in your favor

5. Better manage your inventories

- Check your inventory to have a clear picture of what products are lying in your stock.

- Analyze and identify those products in your inventory that are not doing well in the market. Such products can tie up a significant amount of cash and can result in negative cash flow.

- Get rid of what isn't selling rather than purchasing more of it, even if you have to sell it at a discounted price.

- To the extent it's feasible, locking in pricing in advance can help in inventory management. Even now, many small business owners buy in advance to prevent the impact of inflation.

- If you want to have more purchasing power, you have the option to join a purchasing group.

- You can even utilize shared warehouses to keep merchandise near international suppliers.

Products that aren't selling tie up significant cash and result in negative cash flow. It's better to sell slow-moving inventory at a discount to free up capital than to continue storing it.

6. Don't buy it, lease it

Although it is often less expensive in the long run, purchasing new equipment and upgrading obsolete technology might be expensive in the short term. Your immediate financial strain may be reduced by leasing equipment instead.

Equipment leases usually qualify for tax credits that reduce your tax liability, saving you the hassle of having to replace or try to sell out-of-date equipment that you've already bought. As a result, you'll have a more consistent, healthy cash flow and make fewer significant cash withdrawals from your bank.

7. Raising the prices

The idea of raising prices terrifies a lot of business owners. They are concerned that it will result in lower sales. To locate the sweet spot, though, pricing experimentation feels right. How high are buyers ready to pay? Without taking a chance, there is no way to find out.

Don't be afraid to experiment with pricing. Many business owners undervalue their services. Test different price points to find the optimal balance between profit margins and sales volume. You may be surprised at how much customers are willing to pay for quality work.

Stop Chasing Payments and Improve Your Cash Flow Today

Create invoices instantly, track payments in real-time, and get paid faster with InvoiceOwl's cloud-based invoicing software. Take control of your cash flow management.

Start Your FREE TrialFrequently Asked Questions

Here's how you can determine cash flow issues:

- A cash flow statement analysis might help you find issues with your cash flow

- Watch out for warning signs including a persistently negative cash flow, problems making bill payments on time, and difficulty attracting new clients

- Additionally, inefficient billing and invoicing procedures, a lack of cash reserves, and excessive expenditures are typical causes of cash flow issues

By streamlining the billing and invoicing process, invoicing may assist increase cash flow for small businesses by generating e-invoices quickly, making it simpler to track payments and take action on late payments.

Furthermore, certain invoicing software, like InvoiceOwl, enables small business owners to offer multiple online payment options to clients to get payments quickly.

Financial experts recommend maintaining a cash reserve equal to 3 months' worth of operating expenses. This provides a cushion for unexpected crises, seasonal fluctuations, or opportunities for growth without needing to secure high-interest loans.

Yes, offering early payment discounts (such as 2% off for payment within 10 days on net 30 terms) can significantly improve your cash flow. The small discount is often worth it to receive payments faster and reduce accounts receivable aging.

Leasing equipment can be better for cash flow management in the short term as it requires smaller, predictable monthly payments rather than large upfront capital expenditures. Leases also often qualify for tax deductions and eliminate the need to sell obsolete equipment later.

Poor cash flow management can lead to inability to pay suppliers on time, missed payroll, accumulation of high-interest debt, damaged business relationships, missed growth opportunities, and ultimately business failure. Studies show 82% of small businesses fail due to cash flow problems.