![How to Keep Track of Business Finances? - [5 Best Ways]](/images/2021/07/how-to-keep-track-of-business-finances.jpg)

Key Takeaways

- 01Separating personal and business bank accounts is the foundation of proper financial tracking

- 02Digital receipt storage and organization saves time during tax season and prevents loss of important records

- 03Spreadsheets and accounting software automate tracking and reduce manual data entry errors

- 04Regular expense tracking helps identify spending patterns and improve profitability

- 05Digital invoicing streamlines payment tracking and reduces the risk of unpaid invoices

Losing track of business finances? It can lead to non-compliance.

Did you know? Non-compliance to rules and regulations results in high financial losses for businesses all over the globe.

Keeping track of the finances of your business is not just required by the law, but it also helps grow the business.

Therefore, to avoid lawsuits and scale new heights for your business simultaneously, we have brought you five of the best invoicing tips on how to keep track of business finances.

Because without a clear purpose in mind, even the important processes feel unnecessary.

So, without any further ado, let's get started by discussing the 5 ways to keep track of finances.

Table of Content

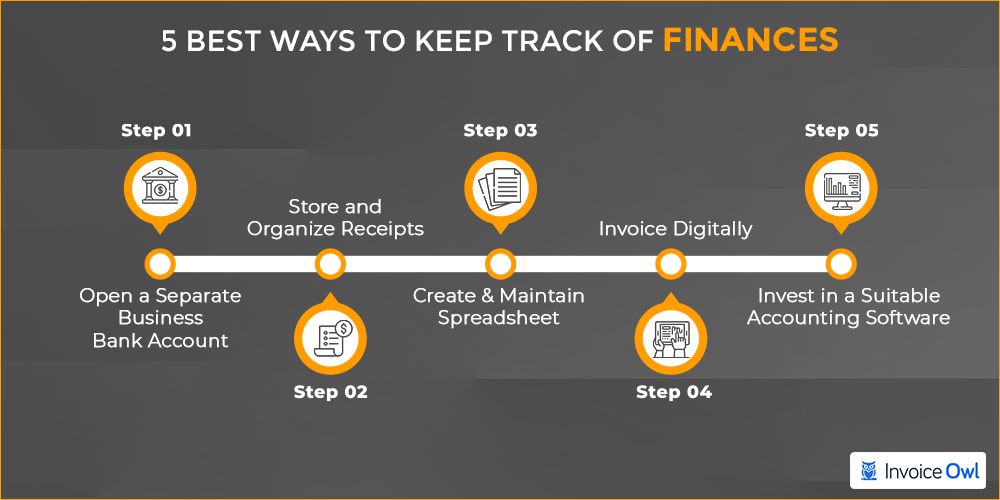

5 Best Ways to Keep Track of Finances

Keeping track of finances is where you need smart work more than hard work. Keeping track of finances can be made a lot easier than it sounds only if done smartly. And here are the five best ways to do that.

These methods disintegrate the task into smaller chunks that are easy to include in your daily routine and make a huge effect at the end of the financial year.

So, let's begin with them one by one.

Open a Separate Business Bank Account

Opening a separate business bank account is the first thing you should do to track your finances. Separating business accounts from personal bank accounts is the easiest method to keep things categorized. Once you separate a bank account from a business account, it saves you more time from segregating business purchases and personal ones.

Despite being so crucial and simple, many small business owners take this step for granted and continue mixing up their business accounts. If you don't want to go through heaps of bank statements at tax time, consider using dedicated business bank accounts.

Other than that, it helps to keep your personal expenses personal from your savings account. After all, your business partner does not need to know how much you spend or unnecessary costs incurred on your suits.

Store and Organize Receipts

The record of receipts of your business expenses and purchases is as important as the bank statement. Thus, you need to store and organize all your receipts mindfully.

Nowadays, technology has innovated how growing businesses use to store and scan receipts. Paper receipts are a thing of the past. Once their business grows, almost all business owners across the world prefer to store receipts digitally and use accrual accounting.

Paper receipts are hard to store and manage, but they also have limited details. It is hard to pick one from all the crumpled receipts and tell whether you met a client or your date over that coffee. But, if you store your business receipts digitally, you can even mention the purpose and write a few remarks about the business transactions too.

Create & Maintain Spreadsheet

If you are a new business owner just starting out, you might not be able to affordable small business invoicing software. This does not mean you have no options left. You can simply create a spreadsheet with Microsoft Excel or Google Sheets. This helps you track your finances to every single penny.

Maintaining a spreadsheet helps you note every business expense and record income with personalized details. You may add columns such as date, description, amount, category, vendor/client, purpose, and remarks.

Moreover, if you want to keep a detailed track, you can create and maintain separate spreadsheets to manage expenses and income. This gives you the total income and total expense figures quickly.

Invoice Digitally

When you are the sole proprietor of your business, your hands are full of several tasks at one time. And we all know you have the maximum room for mistakes when you have to focus on many important things simultaneously. Thus to avoid errors in important procedures, you should automate as many things in a limited time.

And one of the most tedious tasks that require utmost precision is invoicing. Therefore, invoicing is the process you should automate and digitalize ASAP. Digital invoicing has multiple advantages, which include tracking all the paid and unpaid payments.

Moreover, it gives you all the data for credit card payments, debit card payments, or online payments in one place. And to make things even effortless, download one of the most popular invoicing software —InvoiceOwl.

Invest in a Suitable Accounting Software

Investing in a suitable accounting system helps you track the financial status of your business expense on the go. You just have to easily connect the accounting software with your business account and it will automatically create and maintain all the accrual accounting and other important records.

This way you do not have to spend hours doing the mundane data entry, hire an accountant or professional bookkeeper for that matter. Most accounting software provides you with expense reports on all your payments and taxable income in less than a minute.

Moreover, with the right accounting software, tracking your small business expenses on a regular basis is as simple as a few taps on your smartphone. You can download the accounting software/mobile app and now you can track business expenses and income whenever and wherever you want.

See, all you need is a smart way for tracking your expenses and income.

But, expense tracking and expense controlling are totally different. The only similarity is that both are equally important for growing small businesses.

Now that you know the ways, let's dive deep into the importance of tracking business expenses and income.

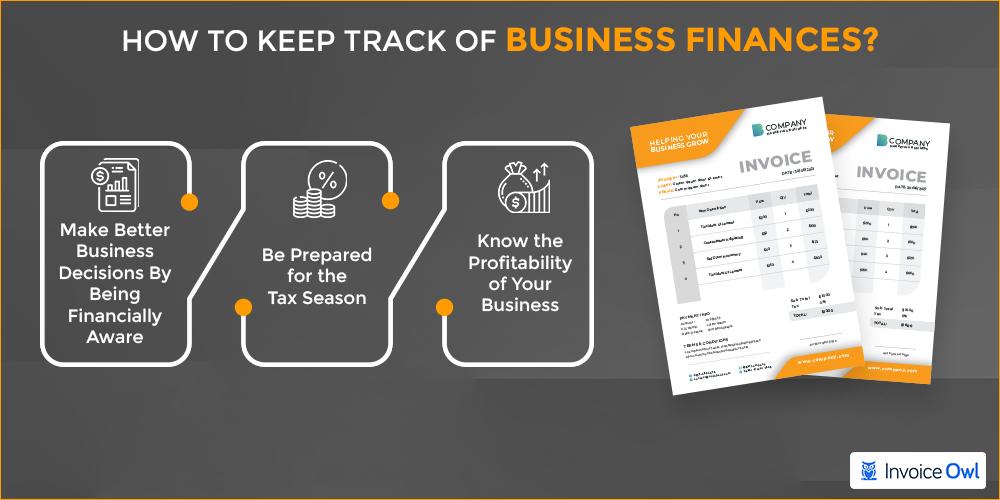

Importance of Tracking Business Expenses and Income

Keeping a note of business expenses and income is one of the most crucial parts of running a successful business. We can list out numerous direct and indirect reasons for tracking personal and business accounts and income, and it would take another blog to mention every one of them. It will also help you to know how to keep track of business expenses.

So, let's discuss a few major reasons that affect your business directly and the importance of keeping track of finances in the business.

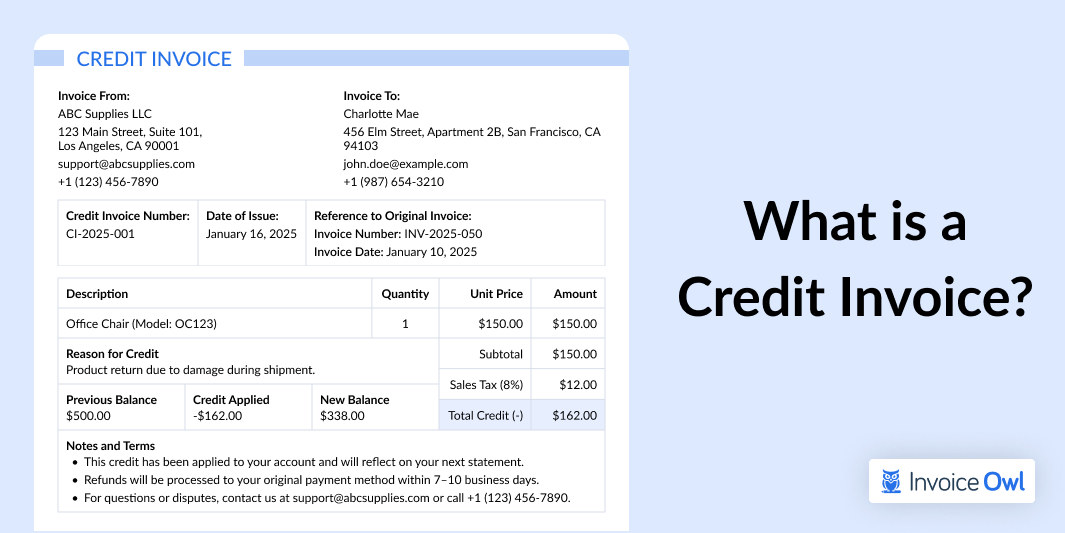

Make Better Business Decisions By Being Financially Aware

To make business expense decisions, such as closing deals, setting charges, and investment-related decisions, you need to be aware of your business's financial conditions. And small business expenses & income tracking make you totally aware of the financial statements.

And not only the present scenario, but it helps see the future of your business too. If you know the business income and expense graph for the past few years, you can plan for future goals and strategies.

These business decisions in your business plan can either make or break your business. Therefore, they better be precisely calculated as per the business needs.

Review your financial reports monthly to spot trends early. This allows you to adjust your strategy before small issues become major problems.

Be Prepared for the Tax Season

Tax time is a huge headache if you are not well-prepared. You might get muddled with all the overwhelming data and end up making mistakes in paying the tax and paying the sales tax. And if you are a wise businessperson, you know how detrimental these mistakes can be for your finances of business and reputation as well.

Therefore, tracking your business expenses and income tracking can make the mammoth task a lot more simplified.

Moreover, when you know the financial information of your business inside out, you can even save money in tax by getting some of the money back.

Know the Profitability of Your Business

Every business expense goes through ups and downs. If you want more ups than downs, you should know what is working for your business. The best way to figure out what is working in favor of your profit and what is not, you must track expenses and income.

Tracking expenses and income lets you know where you can minimize the expense and from where you can get more income. And the simple difference between income and expenses gives you the profit you make. So, if you want to increase your profit margin, know your expenses and income. In short, you need to be ready to deal with strong expense management.

Thus, every business consultant emphasizes tracking business expenses and income.

Wait, we are not over yet! Let's discuss another most used method on how to keep track of business expenses.

Joint Expense Tracking

As we mentioned earlier, it is a different method of keeping track of business expenses. It is the best way to keep track of business expenses when you are running a large business with multiple partners.

Managing small finance is challenging, now imagine managing the finances of your team or multiple partners on your own? It becomes even more difficult. But no worries, as we have joint expense tracking tools.

The joint expense tracking tool allows you to track the business expense of your partner or group. It assists you to split finance into individuals and provides a joint spreadsheet that helps you to manage and organize finance wisely.

Every partner should have a dedicated and individual positive balance in their account.

It will save your time by summing up the total amount faster and streamline the cash flow of your business.

Business Expense Tracker

In the end, every business owner wants to save money and business expenses, don't we?

No one wants to pay for the unnecessary expenses and thus, a business expense tracker comes to the rescue. It helps businesses to save money and restrict their irrelevant business expenses. The business expense tracker also assists you to organize balance.

By adopting a business expense tracker, you can save money and time; what else a business would need?

Now, last but not the least, let's have a quick look at how you can control your business finance.

How to Control Finance in Business?

We will talk about sure-shot tricks to control finance in business. These tricks are evergreen and can be applied to any sort of business.

So, let's get started.

Plan and Fix a Budget

No matter if you are a small business owner or CEO of a huge corporation. You can not afford to run a business without planning and fixing a budget. A well-planned budget keeps your business-related expenses in control and stops you from making any impulsive business expenses.

Track and Review Expenses

The first step is simply tracking your expenses regularly and reviewing them gives you insight into spending patterns and spots where you could have spent less than you did. This study contributes a lot to the business's success.

Other than that, you need to pay attention to the invoice checking process to avoid fraud and wrong payments.

Maintain Good Business Credit

The various offers and plans on the business credit card are tempting to most small business owners, but you have to maintain good business credit by paying the credits as soon as possible. And only take loans when it's essential.

Implement Good Billing Practices

Whenever you pay bills, make sure to use the debit card even if the vendors accept credit card payments. Good practices like these help you control the expenses by making you continually reassess the balance in your business account.

And that's a wrap from our side. But hold on, we have another efficient way for your business, what's that? Keep reading!

Manage Your Business Finance like a Pro

InvoiceOwl helps you generate professional invoices and estimates, track payments, and manage your finances all in one place. Say goodbye to financial chaos and hello to streamlined business operations.

Start Your FREE TrialFrequently Asked Questions

Proper tracking of profit and loss in your business requires regular tracking of business expenses like vehicle-related expenses and taxable income. And to determine the profit/loss, you simply have to find the difference between both. That is:

- Total income - Total Expense = Profit

- Total Expense - Total income = Loss

Recording and monitoring the business expenses, such as business-related purchases, tax deductions, travel expenses, and even entertainment expenses is known as expense tracking. This is done by tracking invoices and receipts for business-related expenses.

Income tracking is done by monitoring all the amounts credited to your business account. These credits are generally from transactions, such as client payments, and tax deductions, to prepare tax returns, and investment interest incomes. And referring to the bank statement is the simplest method to maintain track of income.

Here are a few effective accounting tips for small businesses:

- Stay on top of the accounts receivable process

- Keep a Close Eye on Cash Flow

- Register Expense Receipts

- Log Cash Expenses

- Keep personal and business finances separate

- Create Financial Statements

Related Resources

Conclusion

Hurray!

We hope this blog has cleared your doubts about keeping a track of business finances. We learned about tracking finances with their importance. And we also talked about the practical ways to control your business expenses. This knowledge will help your small business grow exponentially.

And if you want to automate creating, sending, and checking double-entry bookkeeping all your business invoices professionally, adopt InvoiceOwl. InvoiceOwl helps you get paid quickly, keeps track of all the paid and unpaid payments, and generates sales reports.

So, what are you waiting for? Start tracking the financial situation of your business sign up now!