Key Takeaways

- 01Independent contractors control their own work schedule and handle their own taxes, unlike W-2 employees

- 02Collect a W-9 form from all contractors before starting work to ensure IRS compliance

- 03Issue 1099-NEC forms to contractors who earn $600 or more during the tax year

- 04Payment methods include direct deposit, checks, wire transfers, online payment solutions, and accounting software

- 0586.5 million people are projected to work as freelancers in the U.S. by 2027

Lots of startup businesses are taking advantage of the gig economy and are hiring global talent or independent contractors to lower running costs.

Statista projects that by 2027, 86.5 million people will be into freelancing or independent work in the United States. The global freelance platforms market size is projected to reach a CAGR of 15.3% during 2021-2026.

Hence, business owners find hiring remote team members a lot more cost-effective and, in most cases, more rewarding.

However, when it comes to process payments, it indeed differs from the regular payment to the employees. Thus, we are here with a comprehensive guide to answer your query on, how to pay independent subcontractors.

Let's dive in.

Table of Content

- How Does Paying Subcontractors Differ From Paying Employees?

- How to Identify a 1099 Worker?

- How to Pay Independent Contractors

- Considerations When Deciding How to Pay Contractors

- What are the Contract Types for Independent Subcontractors?

- 5 Best Ways to Pay Independent Subcontractors

- FAQs

- Ending Note

How Does Paying Subcontractors Differ From Paying Employees?

There are several ways wherein the payment to subcontractors differs from paying to employees, like

- Unlike traditional full-time employees, subcontractors decide which projects to take up and determine their own remuneration, payment terms, and in some cases, their working hours as well.

- They usually don't depend on the client to provide their work tools or other social amenities, which in most cases creates a payment disparity between contractors and full-time employees.

- The independent subcontractors have nothing to do with the provisions of withholding taxes. They are responsible for paying their own taxes.

Even though subcontractors are usually responsible for their own taxes, you're required to withhold 24% of your contractor's payment (known as backup withholding taxes) if they refuse a legitimate request to fill out a W-9 form or provide an invalid social security number.

Businesses are obligated by the IRS to obtain a completed W-9 Form when they pay contractors $600 or more during the year and failure to comply results in heavy fines.

For most independent subcontractors, their contract agreement may not include the following employee benefits as in the salary of a full-time employee:

- Health benefits or medical insurance

- Wages paid during sick leaves or vacations

- Pay unemployment taxes or social security taxes

- Workers' compensation insurance

- Unemployment/disability allowance

- Worktools provided or fully-equipped workspace

How to Identify a 1099 Worker?

Before processing the payments to an independent contractor or a 1099 worker, it is very much significant to classify workers. This will ensure whether they fall under the category of independent contractors or not.

For this, IRS (Internal Revenue Service) has issued the list of the following areas to determine whether or not someone is an independent contractor:

IRS Worker Classification Criteria

| Factor | What to Examine |

|---|---|

| Behavior | Check whether the company controls or possesses the right to control how the worker gets their jobs done. |

| Finances | Keep an eye on workers' finances, and know how they are paid and who provides the necessary work tools and supplies. |

| Relationship type | Consider the companies' relationship with the worker in the areas like employee benefits, written contracts, and ongoing work. |

If a worker controls all three points mentioned above, it means that they fall under the category of an independent worker.

However, if you still cannot decide on the class of a worker, you can submit Form SS-8 to the IRS. The IRS will review your submitted form and will respond with an official classification.

The response from the IRS for the worker classification may take up to 1 year. So, the applicant must wait on an average a year before receiving the determination from IRS.

How to Pay Independent Contractors

Discuss Payment Terms

Once you have decided to hire a contractor for a particular role, the first thing to do is to educate yourself on the current market rates. Based on your research, you should arrive at an appropriate payment process that is accurate and cost-effective.

To ensure you get the best fit for the role, write a job description that clearly itemizes the job's requirements, roles, and responsibilities. When you've found the best independent contractor for the job, discuss the engagement requirements to ensure you both are on the same page about modes of payment, pay rates, and payment terms.

It's also important to inform independent contractors of your preferred payment method to avoid misunderstandings down the road.

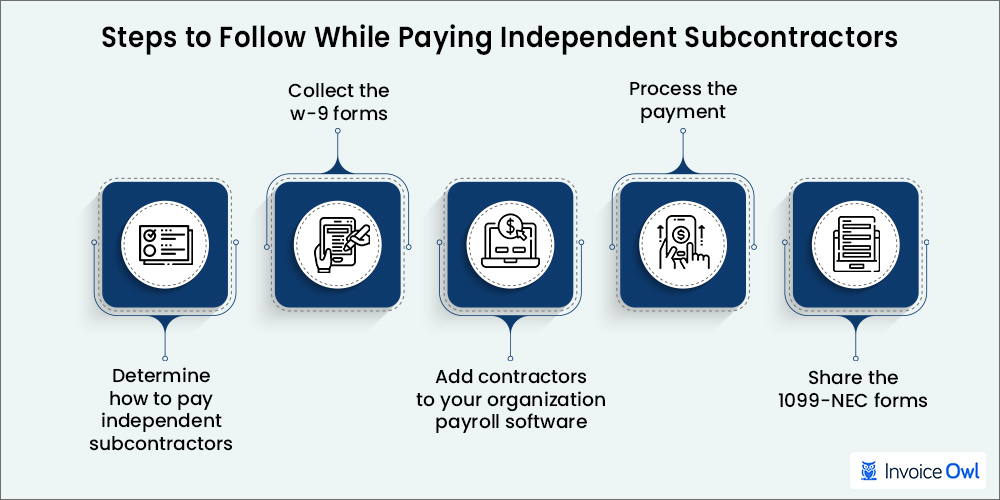

Collect the W-9 Forms

After reaching on the construction contract agreement and deciding on the most appropriate method to pay contractors, it's time to collect the contractor's details through a W-9 form before you assign any task to them. Ask the independent contractors to fill out the W-9 form.

This federal tax form is an IRS document that requires personally identifiable information like the full name, address, taxpayer identification number, or social security number, which businesses use to report the payments they make to independent contractors, freelancers, or consultants.

Bid farewell to the cluttered client information – Try InvoiceOwl today and save all your client data in one place.

Add Contractors to Your Payroll Software

When you have collated all the required information, you can proceed to include the independent contractor in your organization's payroll system. Collating all the details in the payroll platforms well in advance helps you make rapid, error-free payments.

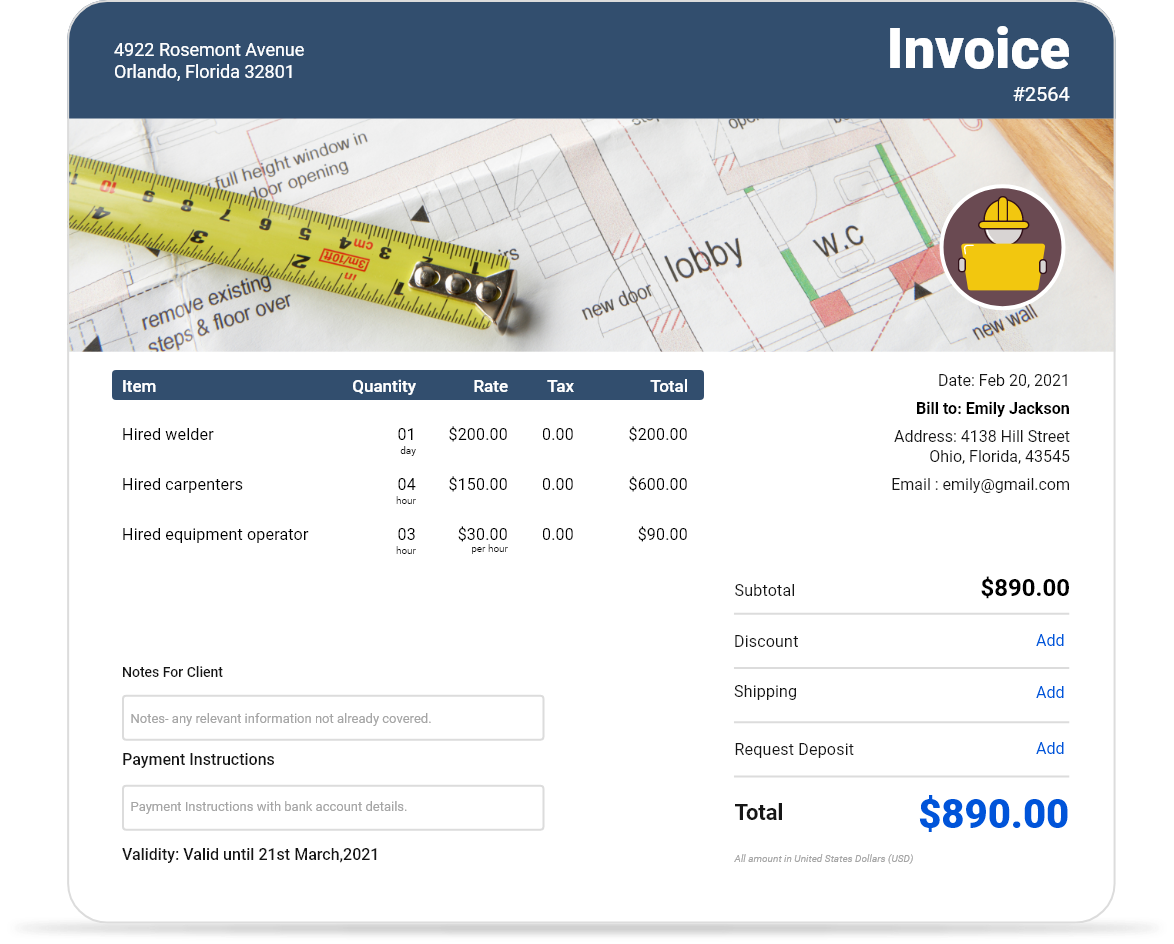

Process the Payment

Once you have all the details in your organization system, pay independent contractors as per the agreed payment terms including additional fees like overtime where applicable. Various modes of payment processing are described below.

Share the 1099-NEC Forms

While approaching year-end, set aside time to prepare the 1099-NEC forms. The 1099-NEC form helps you report the payments you made to independent contractors to the IRS in the financial year and is required for every contractor you have paid more than $600 a year.

You should keep a copy of the 1099-NEC forms for your business books as you share copies with the contractors, the IRS, and the state tax authority. Doing so ensures your books are accurate and helps contractors pay their federal income tax correctly.

Considerations When Deciding How to Pay Contractors

Before finalizing an ideal payment option to pay independent subcontractors:

Let's look at a few common methods for paying independent subcontractors.

What are the Contract Types for Independent Subcontractors?

How you pay independent contractors largely depends on their preferences. However, here are the most common types of remuneration provisions for contractor payments:

1. Hourly rates

Many independent subcontractors prefer to bill clients by the hour. And to accurately charge their hourly rate, contractors often log their working hours with a time-tracking solution or fill in the timesheet provided by their clients. Billing clients by the hour is often common for professionals like coaches, service workers, caregivers, landscapes, content editors, copywriters, and business advisors.

2. Fees per project

A lot of independent subcontractors may charge a flat fee for projects. In some cases, they require an advance before commencing a project and the rest after the project completion. You can also agree to pay the compensation at predetermined project milestones.

Such type of pay is suitable for self-employed professionals, such as general contractors, artists, designers, software/web/app developers, and event planners.

3. Commission-based payment

In payments based on commissions, an independent subcontractor is compensated on the basis of their performance. The commission can be a predetermined amount or percentage of the total revenue or sales.

While this is not a suitable payment method for all projects, commission-based remuneration is ideal for any independent contractor in real estate, sales, recruitment, staffing, and marketing.

4. Retainer fees

For an independent contractor, consistent cash flow is of utmost importance. That's the reason why many prefer to work with organizations on a retainer. Also, many organizations nowadays would agree that a retainer fee is the best way to pay independent contractors.

Retainers are usually fixed routine payments for a monthly, quarterly, or 6-month period. Retainers work best for independent contractors working as business strategists, marketing professionals, visual/graphic designers, lawyers, and tech executives.

Here's a five-step guide to help you hire and set up payments for any independent contractor while ensuring you remain tax compliant.

5 Best Ways to Pay Independent Subcontractors

Payments to independent subcontractors should be prompt and efficient to keep them motivated. At the same time, it's crucial that the payment process is cost-effective and in line with your organization's policies.

1. Payment through direct deposit

Direct deposit payments are one of the most common and fastest payment methods while paying independent subcontractors. Under this method of payment, money gets deposited into a contractor's bank account electronically through ACH networks.

The essential details that you will need to pay the independent subcontractor through the direct deposit mode are

- contractor's bank account number,

- routing number,

- account type (checking or savings account),

- and transaction type (one-time, recurring).

To send out payment through direct deposits, all you need is the account details of the recipient (as mentioned above) and they should receive payments within 1-2 business days. To set up a direct deposit payment mode for 1099 workers, you'll need authorization for making payment this way. Some banks also offer same-day deposit services which would certainly delight the subcontractor. If you work with contractors often—either on a retainer basis or use software to automate your recurring payments—direct deposits can be your go-to time-saving payment option.

2. Payment by check

Payment via check was once popular. However, if we talk about today's businesses, they are dealing with multiple contractors at one time. Due to this, they find payments via check a time-consuming and less secure option. Why time-consuming? Here is the answer:

- First, a check is to be written.

- After writing the check, it has to be mailed to the recipient.

- Once the mailing is done, the recipient has to deposit it into their bank account.

- It can take up to 2-5 additional business days for the check to clear and the funds to be made available in the contractor's account.

After considering the above process, payment through checks can be avoided for the business entity having multiple contractors to deal with. However, payments through checks are also relatively cheaper and simpler than signing up for payment transfer services or installing a software system. If you plan to work with an independent contractor on a single project, checks can be a decent payment option. And nowadays, businesses leverage online checks as many payroll systems enable the printing and approval of checks through their system.

If you're paying through checks, you'll need a system for keeping track of 1099 worker and payment information including:

- Name and address of the worker

- Date of payment

- Pay rate

- No of hours worked

- Total owed to worker

3. Payment via wire transfers

A wire transfer is one of the fastest ways to pay your subcontractor in the digital age. While domestic money transfers take about 24 hours or less to get processed, international transfers may take a bit longer, depending on the payment medium.

For most wire transfer transactions, both the sender and receiver are charged a fee, which could be a flat rate or a percentage of the amount sent. This can be quite expensive for both small businesses and subcontractors, especially for routine milestone payments. Hence, wire transfer payment is suitable for large or time-sensitive payments.

The information that you will need to supply while undergoing the domestic as well as international wire transfer is mentioned below:

For domestic wire transfer:

- the recipient's name,

- address,

- bank account number,

- ABA number (routing number).

ABA number is a 9-digit routing code used for financial transactions in the United States, such as direct deposits, wire transfers, and check processing. It is also known as a routing transit number (RTN).

The ABA number helps that the funds are routed to the correct bank and the payment is processed correctly.

While transferring the international wire transfer:

- the recipient's name,

- address,

- banks SWIFT BIC,

- bank account number,

- plus the International Payments System Routing Code.

4. Payment via online payment solutions

Many online payment platforms like PayPal, Wise, and Payoneer have made it convenient to transfer funds securely and directly to independent subcontractors in a matter of minutes.

With Wise (formerly TransferWise), you can send payments directly to a contractor's bank account with your linked debit card, credit card, or bank account. To pay contractors via most online payment systems, they must provide their full name as it appears on their bank account, bank account number, and account routing number. Most digital payment solutions also charge a processing fee for their services and it's important to learn about their rates before getting on board.

5. Payment through the in-house accounting system

Many independent contractors prefer this payment method to others as it helps them sort out their finances as they tend to work with multiple clients. InvoiceOwl for example, helps contractors automate many invoice and payment related-processes.

Just reading the mentioned points above is not enough - Start Your FREE Trial Today with InvoiceOwl & grab fruitful results through personalized invoices and prompt payments.

Streamline Your Contractor Payment Process Today

InvoiceOwl helps you create professional invoices, track payments, and manage contractor relationships effortlessly. Get paid faster and stay organized.

Start Your FREE TrialFrequently Asked Questions

An independent subcontractor is a self-employed professional who offers their services and gets paid for the same. They have complete control over their work schedule, methods of performing the work, and the necessary work supplies or tools they use to complete their projects. Such contractors work on a contract basis, rather than as a full-time employee.

Usually, the payment made to independent contractors can be in various ways. For instance, on a retainer basis, per hour, or per project.

The payment options can vary depending on the terms with independent contractors. Payment through direct deposit, checks, wire transfer, and online payment systems are mostly done.

When the independent contractor earns more than $600 in a calendar year, the company must issue a 1099 IRS form. The form should be submitted to the IRS for the purpose of reporting their income.

The steps involved in making a payment to the independent subcontractor are:

- Ask for the tax information via (W-9 form)

- Determine the amount due for the services rendered

- Issuance of 1099 form (if the contractor earns more than $600 per year)

- Make payment through agreed mode.

These are three factors that are determined by the IRS to classify a worker as an employee or an independent contractor:

- Behaviour

- Financial control

- Relationship of the parties

Ending Note

To establish a pleasant working relationship with independent subcontractors, it is essential to pay them fair and on time. Since there are several ways to pay independent contractors, it may get difficult to choose the right one. However, with this guide, you will surely get a boost in making wise decisions.

And to add worth to your decision, InvoiceOwl helps you smoothen your payment processes. From creating customized estimates and invoices to getting real-time updates, generating sales reports, tracking invoices, and ultimately getting paid faster, everything is possible.