Key Takeaways

- 01A credit memo shows the positive balance or credit amount a buyer owes from the seller

- 02Credit memos differ from refunds - they represent store credit rather than cash back

- 03Essential elements include business details, unique memo number, itemized list, and tax calculations

- 04Common reasons for issuing include returns, wrong items received, or changes in payment terms

- 05Using credit memo software can save hours compared to manual creation

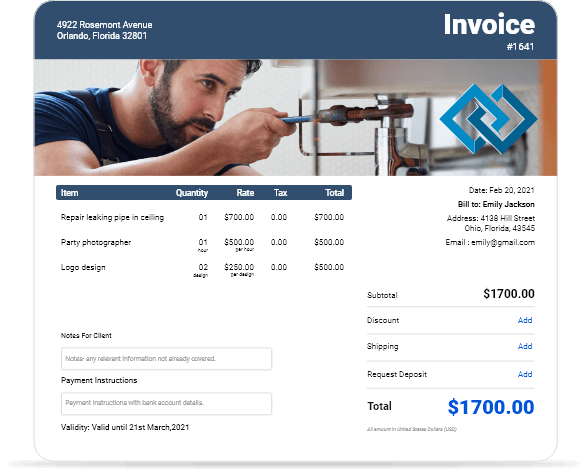

Being a contractor, managing a business account is a tough job. One mistake can cost you more than you expect and thus, the transactions need to be done carefully with attention and time. Another mistake several businesses have done is creating wrong credit memos. A credit memo is a document that helps in balancing various transactions. How? Let's find out in the blog what is credit memo and how to write a credit memo.

Table of Content

What is a Credit Memo?

A credit memo, also known as a credit memorandum or credit note is a document issued by the seller of the goods or services to show the positive balance in the account of the buyer. The amount can be accounts payable or customer owes; the reasons could be any, why? The reason for issuing credit notes is different for every business. For instance, several times changes in price are the reason for issuing. We will discuss different reasons briefly in this blog further.

Do not confuse a credit memo with a refund - in a refund you get the full amount back in cash. Also, the debit memo is different from a credit memo. The debit memo means the remaining amount a person has to pay with no deduction or discount.

Coming back to the credit memo definition; a credit memorandum is a piece of paper showing the credit amount or pending balance the buyer owes to the seller. It also helps in preparing journal entries for accounting purposes. Are you clear on the definition of a credit memo? Great, now let's discuss the method of how to prepare a credit memo.

How to Make a Credit Memo

Yes, the format is the same but there are two ways to credit memos: one is the manual traditional method, and the second is by adopting accounting software or credit memo template. Now, without wasting any time, let's go through the process of creating a credit memo.

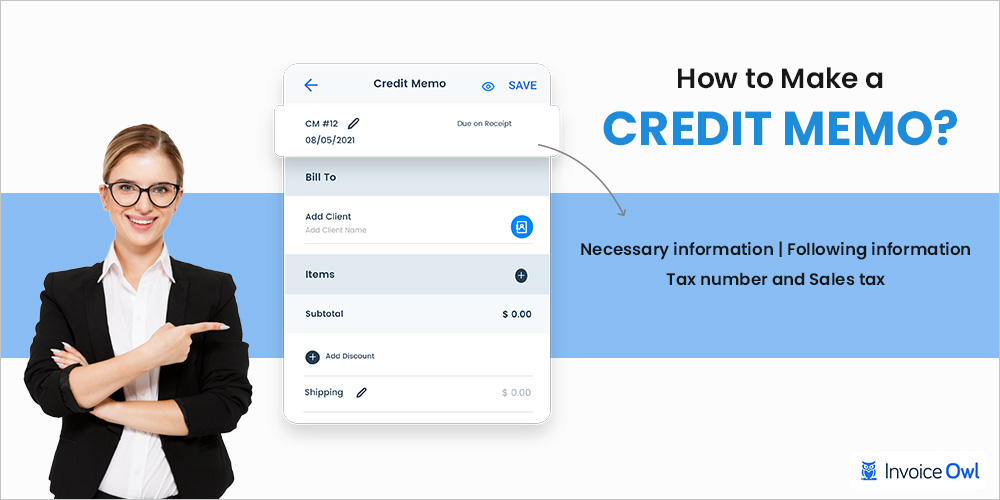

Necessary Information

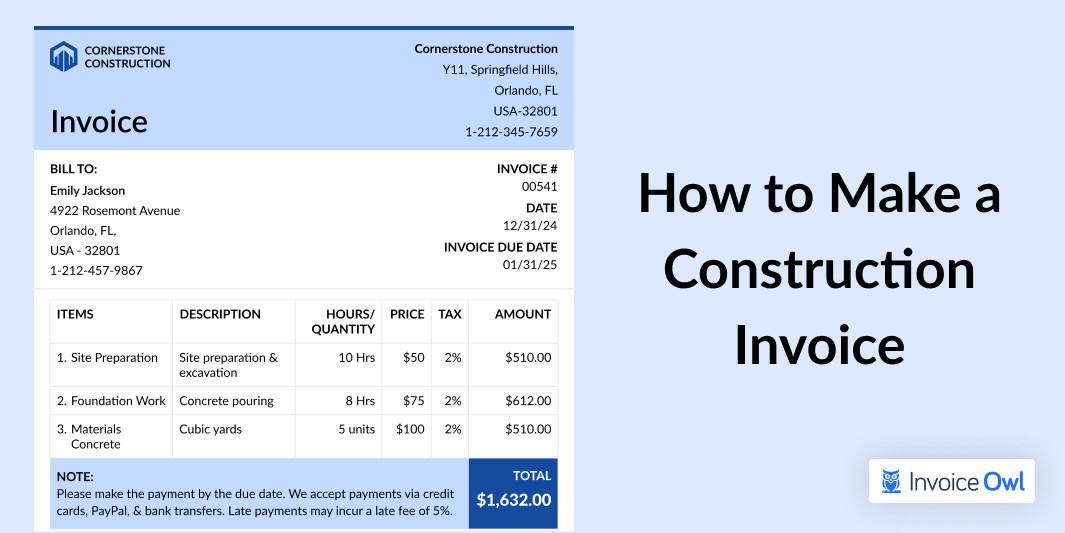

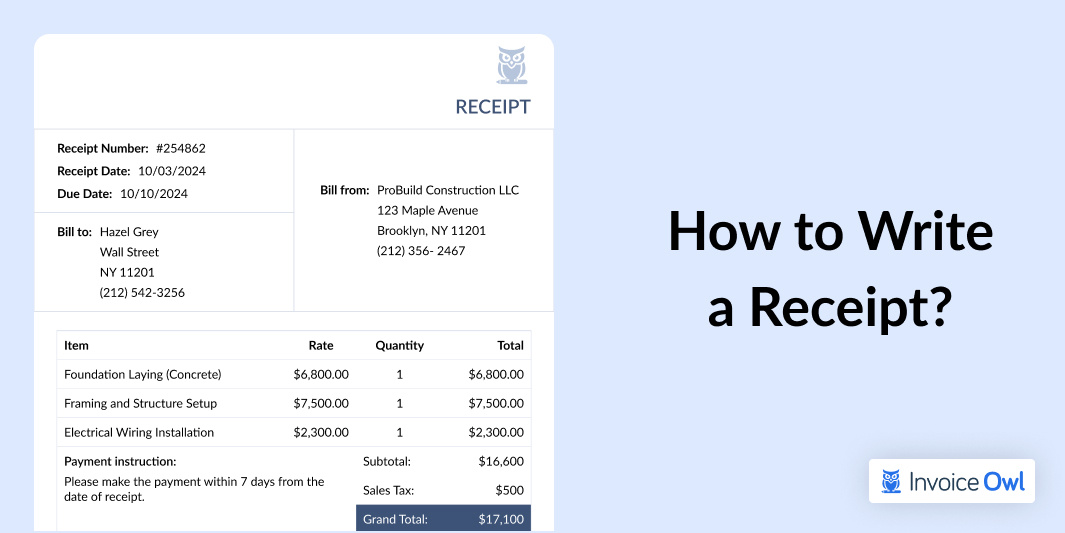

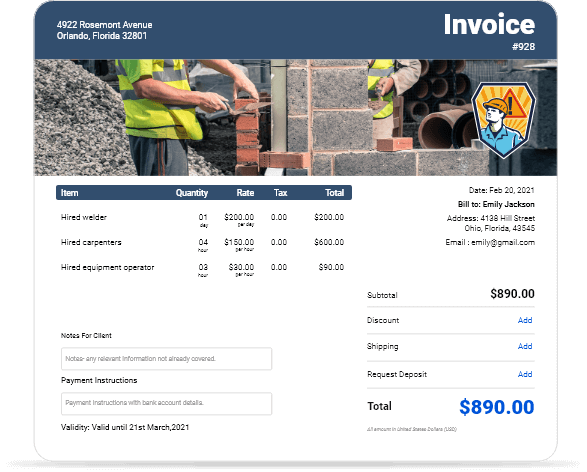

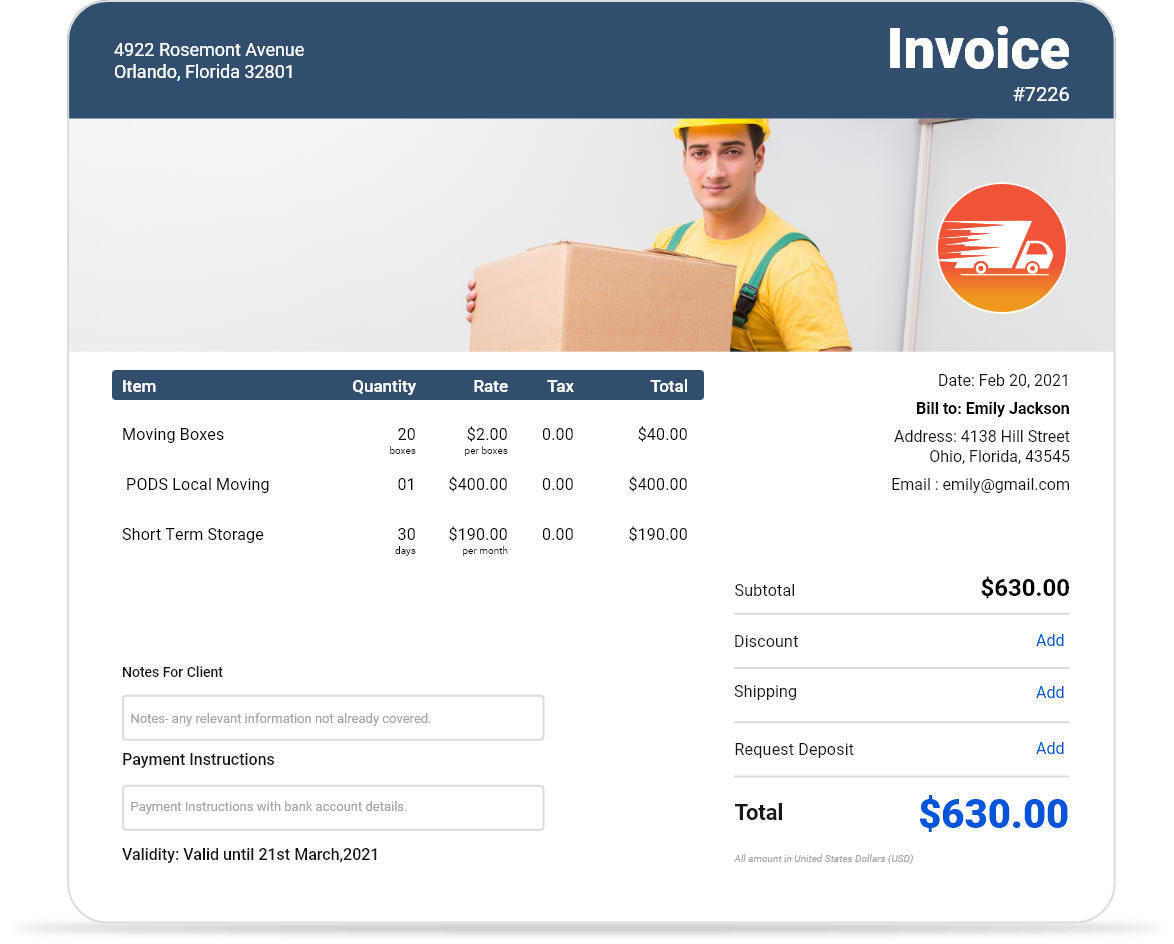

One missing piece of information messed up the entire connection, don't we all agree on that? Therefore it is essential to have the necessary information. Also, do you know a credit memo helps you to simplify calculations? Yes, a credit memo helps to simplify all calculations in the inventory by providing relevant information. While writing a credit memo your business name, email address and tax identification number come at the top of the memo. Other necessary information you need to include in your physical business address, phone number, purchase date, credit note number, and business website. Company details like logo and slogan can also be part of the credit note. If you are using software like InvoiceOwl to create personalized credit memos you just need to write a list of the necessary information. The code or number should be unique to identify different customers.

Following Information

Now you know what information to have, it is time to add information to that place. A credit memo is classified into five columns:

"The first column should be of quantity, second should be of memo number, third should be of describing item and reason, fourth should be the price of the item. In the fifth column, sum up the item's price by the quantity to calculate the line total."

The necessary information should be labeled properly with appropriate data. The five columns are the essential step to preparing a credit memo. Enter the reason for the credit and mode of payment as well to prevent confusion.

Tax Number and Sales Tax

You will require the original invoice number to indicate that the buyer or seller's accounts are receivable. Businesses calculate the sales tax for the remaining credited items. We hope now you know how to write a credit memo. Now, let's understand why businesses issue credit memorandums.

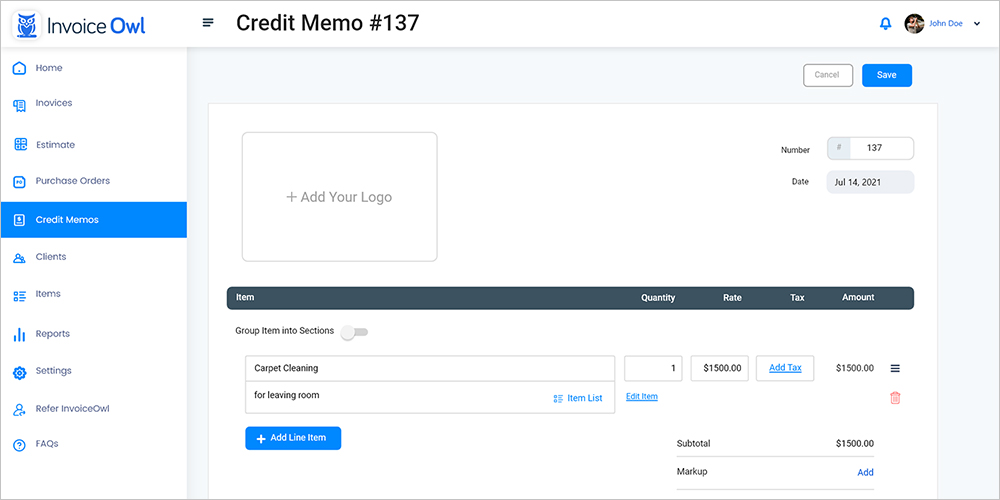

Using credit memo software like InvoiceOwl helps you to create and manage credit memos within a few clicks. With the automation process, you can save the time and money which you used to pay for creating manual credit notes.

Why do Businesses Issue Credit Memos?

We have discussed the meaning and how to make a credit memo, but why a credit memo is issued? Let's understand with following situations:

To issue a credit memo reasons might be different but a seller's credit memo is important for simple calculations and managing your business transactions.

Whether your business is in construction, landscaping, consulting, photography, auto repair, or the medical field, proper credit memo management is essential. InvoiceOwl makes your credit memo creation faster and simpler so you can maintain accurate records without the hassle.

Try Our Free Online Credit Memo Generator Today!

Stop wasting hours on manual credit memos. InvoiceOwl makes credit memo creation faster and simpler so you can get paid promptly and maintain accurate records.

Get Started NowFrequently Asked Questions

No, a credit memo is a document that shows the amount is due to a customer for an entire or partial refund. It represents store credit rather than cash back to the customer.

The following list should be included in a credit memo:

- Business name

- Purchase order number

- Shipping address

- Billing terms

- List of items

- Quantities

- Prices

A credit memo shows a positive balance or credit amount owed to the customer, while a debit memo indicates the remaining amount a person has to pay with no deduction or discount. They serve opposite purposes in accounting.

Yes, credit memo software like InvoiceOwl helps you to create and manage credit memos within a few clicks. With the automation process, you can save the time and money which you used to pay for creating manual credit notes.

Gross credit sales represent the total value before any adjustments, while net credit sales account for returns, allowances, and discounts. Credit memos help track these adjustments accurately.

Conclusion

Creating a credit manual takes hours and the result is not always accurate. But wait, are we not living in a technology era where one software can change the entire scenario? Yes, we do. Credit memo software like InvoiceOwl helps you to create and manage credit memos within a few clicks. With the automation process, you can save the time and money which you used to pay for creating manual credit notes. So, why not Try a FREE trial and see what the buzz is all about?