Key Takeaways

- 01A valid receipt must include transaction date, business info, itemized prices, taxes, and payment method

- 02Businesses must retain receipts for 3-7 years for IRS compliance and audit purposes

- 03Digital and paper receipts are equally valid under U.S. tax regulations

- 04Professional receipts build customer trust and streamline returns, exchanges, and record-keeping

- 05Using automated receipt systems reduces errors and simplifies financial management

Are you facing issues with managing customer payments or tracking business sales?

If, yes then you must start writing a receipt.

With a professional-looking receipt, you can streamline the entire business process. Maintaining a clear transaction record that benefits both you and your clients.

In this blog, we'll guide how to write a receipt and make it precise, professional, and effective for your business.

Let's start.

Table of Content

- What is a Receipt?

- What are the Differences Between Sales Receipts and Invoices?

- Step-by-Step Receipt Writing Guide

- What is the Importance of a Receipt?

- Enhance Your Business with Organized and Accurate Receipts

- FAQs

What is a Receipt?

A receipt is a printed document that serves as proof that goods or services have been exchanged for payment.

This business transaction record is also known as proof of purchase. The customer can use it to showcase the amount paid for a product or service. The receipt includes other details like the date and time of the transaction and payment method.

Generally, it is not required federally to issue a receipt for products or services in the United States. However, businesses need to keep records of all transactions for state sales tax purposes and financial reporting.

Now that you know what a receipt is, let's understand the ways to make a receipt valid.

What makes a valid receipt?

To make a valid receipt, you need to add the essential details that verify a transaction and also ensure transparency. A valid receipt comprises the date and time of purchase, business information (company name, address, phone number), customer information (customer's name and contact details), a list of items or services purchased, itemized prices, applicable taxes, the total amount paid, and payment method.

Legal requirements for business receipts

Businesses must follow the legal requirements for content of receipt and retention. The receipt should have all the accurate information related to costs, taxes, and fees to comply with sales tax laws. Organizations must retain their receipts for 3 to 7 years for tax auditing purposes.

Additionally, business owners should add the business's tax identification number (TIN) to ensure proper tax reporting. Following these legal regulations confirms the transparency and compliance with legal standards.

Receipts must include accurate cost information, taxes, and fees to comply with sales tax laws. Keep your receipts organized and accessible for potential IRS audits.

Industry-specific requirements

Industry-Specific Receipt Requirements

| Industry | Requirement | Additional Notes |

|---|---|---|

| Healthcare | Must retain patient billing and transaction records for 6 years under HIPAA. | Digital storage must comply with HIPAA security standards to protect patient privacy. |

| Construction | Keep invoices, receipts, and contracts for 7 years to comply with IRS and state regulations. | Digital records improve project tracking and simplify audits; some contracts may need longer retention. |

| Retail & E-commerce | Sales records must be retained for at least 3 years for IRS and compliance purposes. | Credit card data storage must follow PCI-DSS standards if kept digitally. |

| Financial services | Maintain transaction records and receipts for 7 years due to SEC and FINRA regulations. | Digital storage must include secure encryption and quick access for audits. |

| Government contractors | Must keep records for 3-10 years depending on contract specifications and federal regulations. | Follow FAR guidelines and secure data storage for easy access during potential reviews or audits. |

| Legal services | Store client and financial records for 7-10 years based on state requirements and ABA guidelines. | Digital copies should be secured and encrypted to maintain client confidentiality. |

Now that you have a clear understanding of the different aspects of payment receipt, it is time to clear up any confusion you might have between sales receipts and invoices! Although they might seem similar, they actually serve different purposes in a business transaction. Understanding these differences will help you use the right document at the right time!

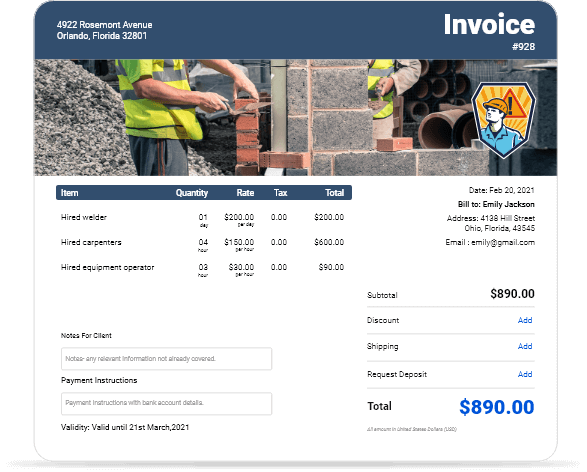

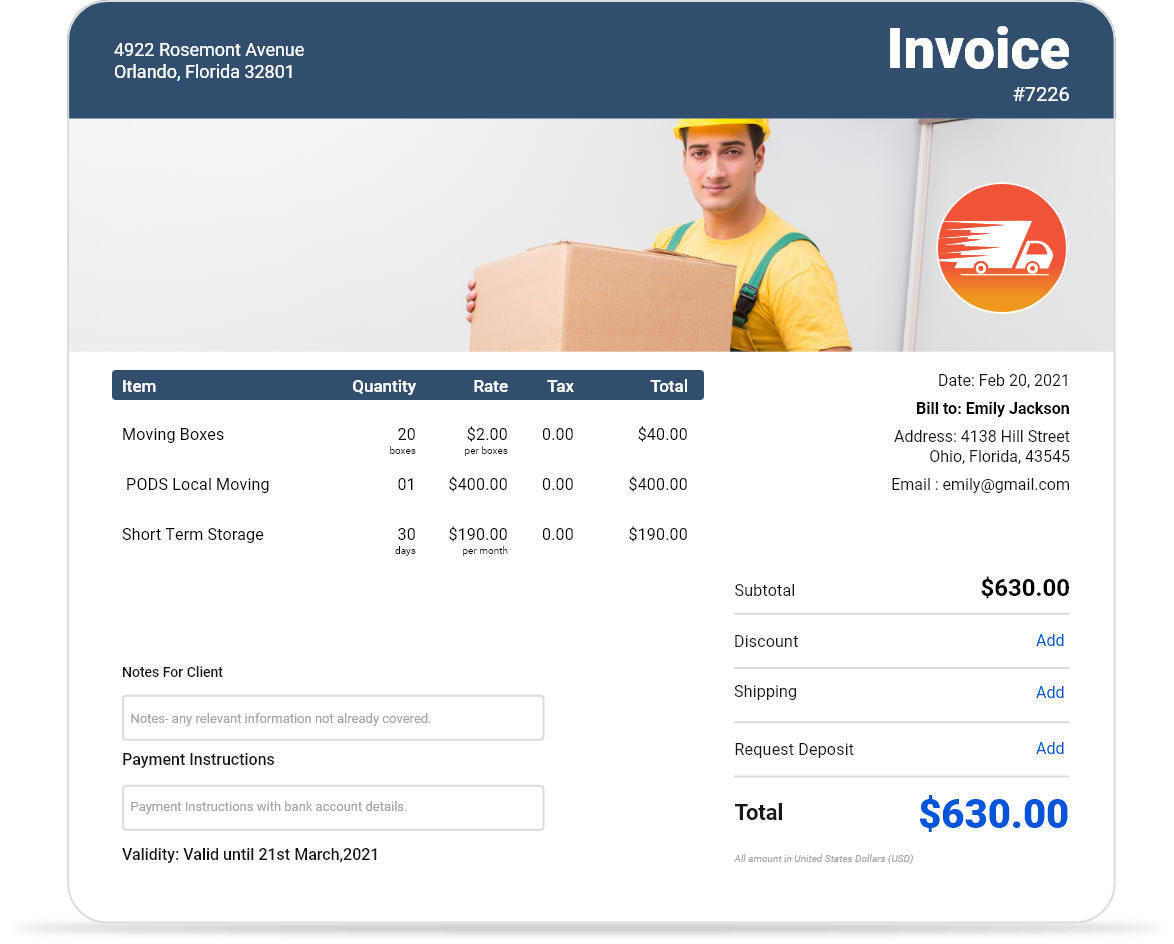

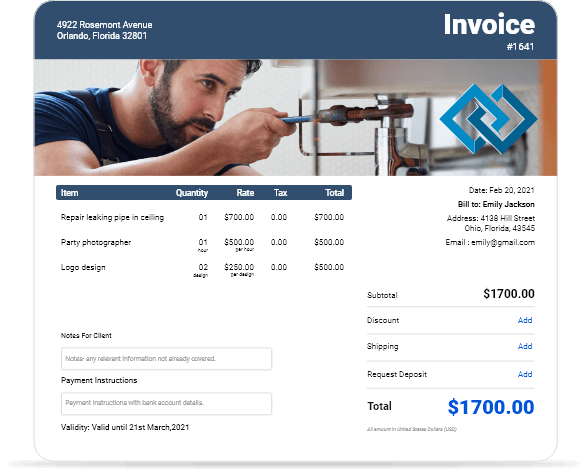

What are the Differences Between Sales Receipts and Invoices?

Here are the key differences between sales receipts and invoices:

Sales Receipt vs Invoice Comparison

| Feature | Sales Receipt | Invoice |

|---|---|---|

| Purpose | Confirms payment has been made | Requests payment for goods or services |

| Issued when | After payment is received | Before payment is made |

| Key information | Date, amount paid, method of payment, transaction details | Date, amount due, payment terms, itemized services |

| Payment status | Payment has been completed | Payment is still pending |

| Customer obligation | None, since payment is already settled | The customer is expected to make a payment |

| Use case | Used for immediate purchases or services | Used for deferred payments or credit terms |

| Common users | Retail businesses, service providers (instant payment) | Freelancers, contractors, and businesses with terms |

| Legal requirement | Required for record-keeping and returns | Required for requesting and tracking payments |

Now that you have understood the major differences between sale receipts and invoices. You should also have a look at invoice vs receipt to know the differences between a general receipt and an invoice for a better understanding of both concepts.

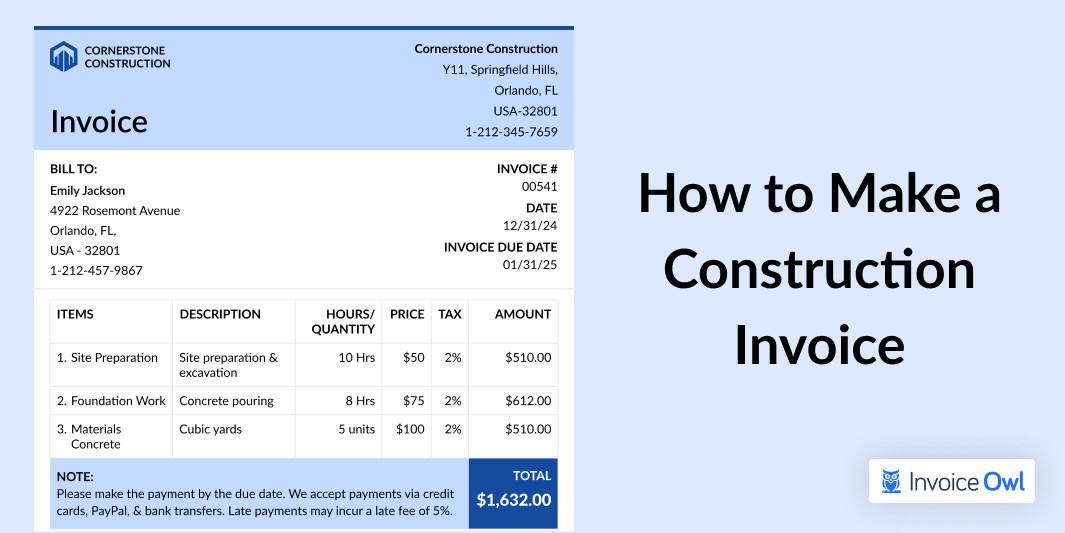

Step-by-Step Receipt Writing Guide

A well-prepared receipt helps to maintain the accuracy of financial records and compliance with legal standards.

Follow these 8 important steps to create clear and professional receipts that build trust and simplify accounting.

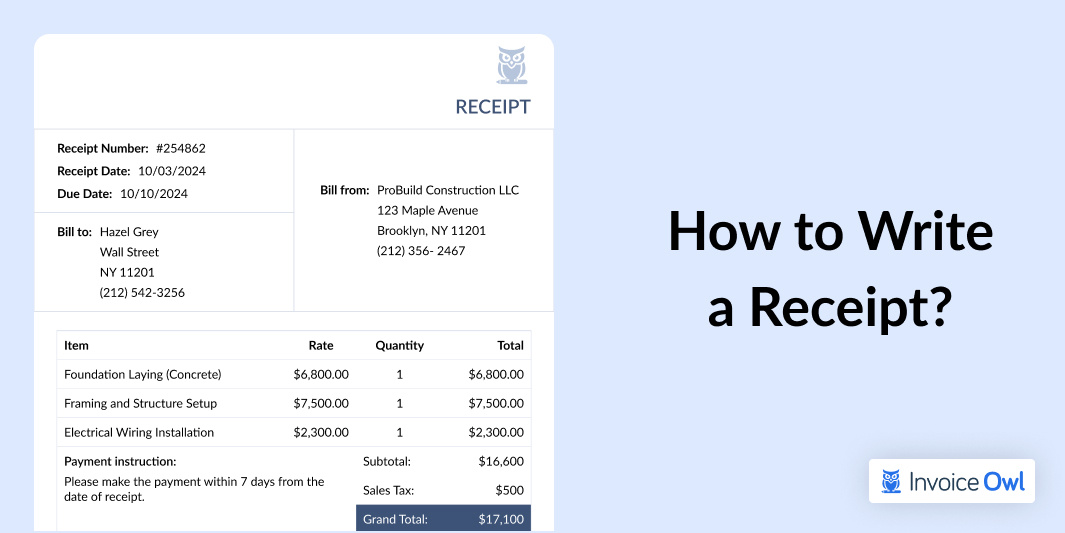

Step 1: Download a receipt template

Start by searching for free receipt-generating tool available for creating professional-looking receipts. Use them and download the most suitable receipt for your business. After downloading the receipt, fill in the important details, like your organization's name and additional information.

Best practices:

- Choose a template that enables you to make customized fields for adding industry-specific information.

- Make use of a consistent layout to maintain professionalism in your receipts.

Common mistakes to avoid:

- Avoid the usage of complex templates that make it difficult to read the receipt.

- Avoid using templates that don't have important fields like payment details or company information.

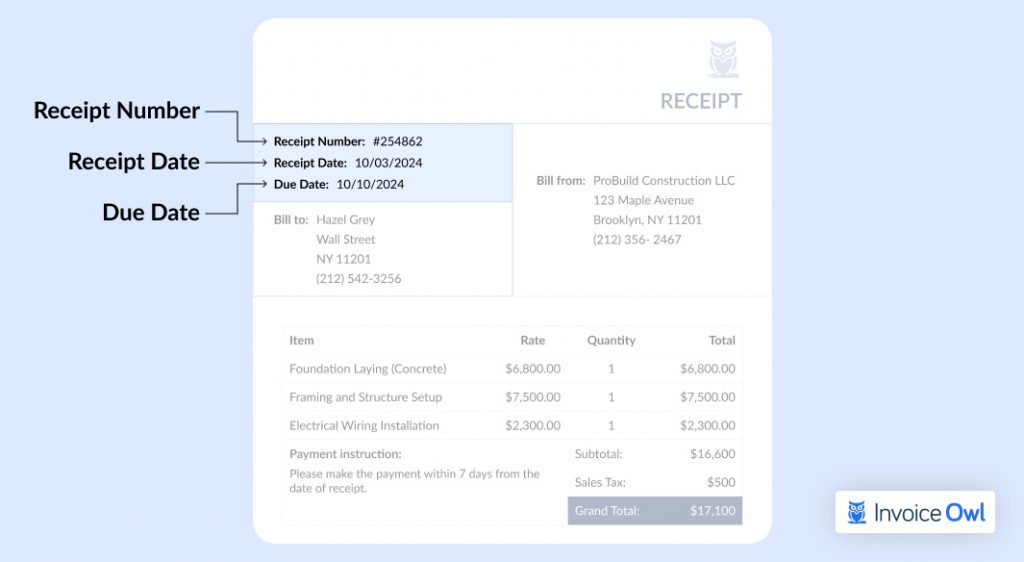

Step 2: Write the receipt number and date

Ensure to write the full date when the sale was made. Also, add the receipt number to track the sales throughout the day. Remember to start the receipt number with 001 and then keep adding the number for each receipt.

Best practices:

- Add a numbering system that makes it easy to track and refer.

- Make use of automated systems to reduce any potential errors.

Common mistakes to avoid:

- Avoid using inconsistent numbering as it can lead to confusion.

- Don't forget to add the date as it is essential for record accuracy and tax compliance.

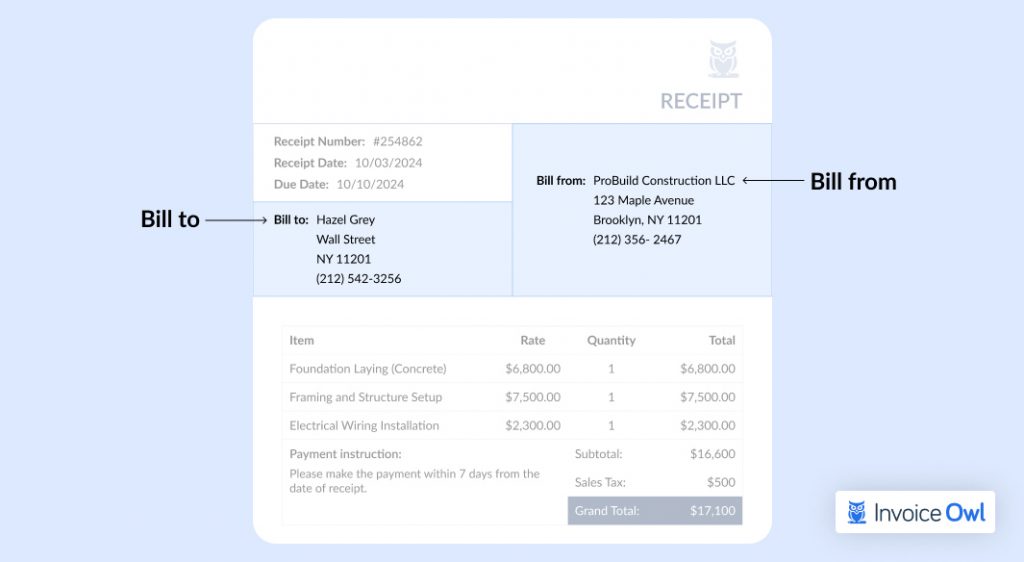

Step 3: Add organization name and contact details

Add the organization's name, contact details, and the address. Besides this, you can also add other important details like social media accounts, websites, and working hours. This information will act as legal proof that your company made the sale and allow customers to contact you if needed. In a situation where you don't have a company, you can write your name instead.

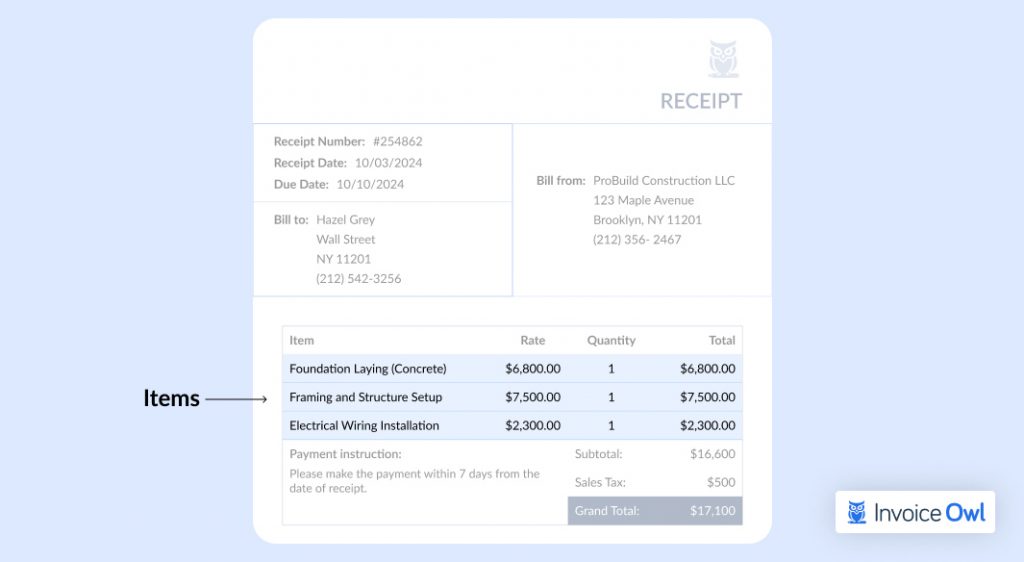

Step 4: Add the items purchased and their cost

Ensure to add the purchased items on the left side of the receipt template and the costs associated to them on the right side. After selling more than one time, make a proper list of the items and the costs in a row.

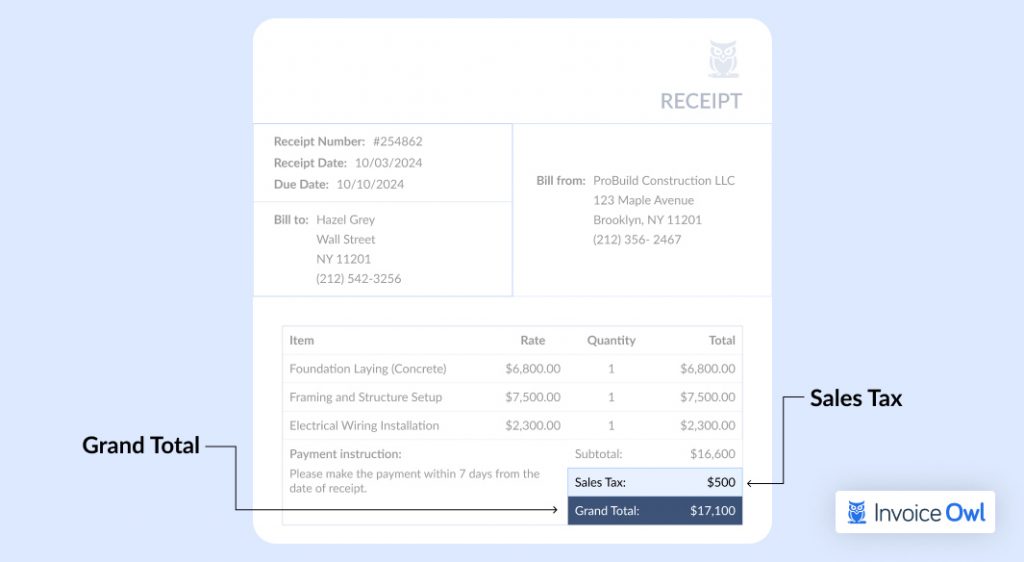

Example: Foundation Laying (Concrete)……….$6,800.00 Framing and Structure Setup…………$7,500.00 Electrical Wiring Installation………….$2,300.00

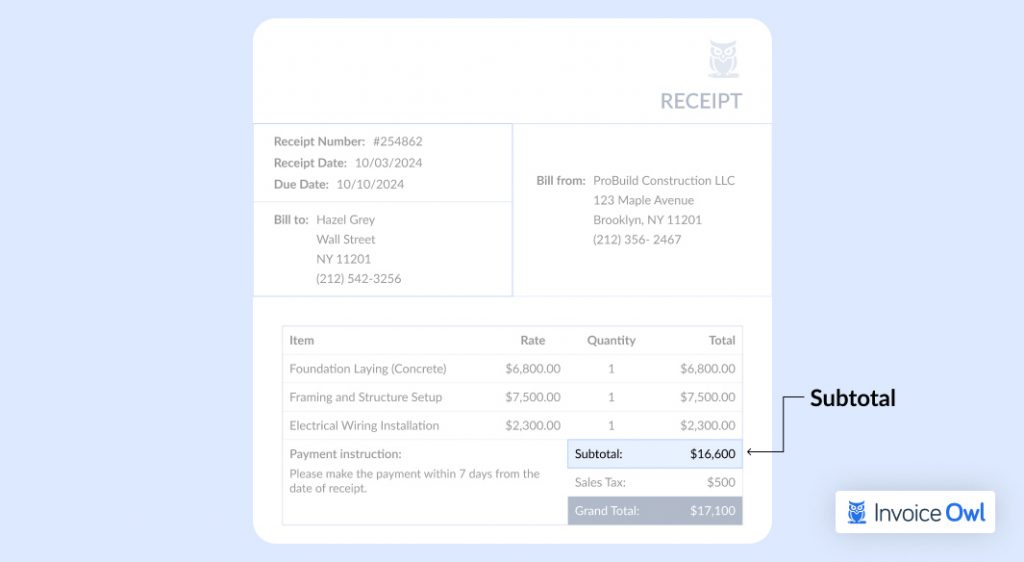

Step 5: Add the subtotal below all of the items

The term Subtotal refers to the price of all the products before adding the taxes and additional fees. Make sure to add the cost of each item sold by you and mention the total amount of the items.

Example: Foundation Laying (Concrete)……….$6,800.00 Framing and Structure Setup…………$7,500.00 Electrical Wiring Installation…………$2,300.00 Subtotal……………………………….$16,600

Step 6: Add taxes and other charges

Now it is time to add the sales tax or any additional charges on the receipt's left side and add the prices on the receipt's right side. Once done, add other applicable fees to the subtotal and get the final amount to be paid by the customer.

Example: Sub total…………..$16,600 Sales Tax………….$500 Grand Total….........$17,100

Step 7: Mention the payment method

Offer various payment methods like cash, check, or credit card. Handover the original receipt to the customer via mail and have an extra copy of the receipt for your records.

Step 8: Use a POS system for receipt management

With the help of a POS system, you can track your business expenses, sales, and receipts and process payments like credit cards, and checks. This system is capable of generating a receipt automatically for the customer at the point of sale and adding that sale to your main database. Ensure to try different POS systems and then pick the one that suits your specific business needs.

In the U.S., both digital and paper receipts are accepted for IRS compliance, as they are both clear and legible. Business owners should store these receipts for at least 3 to 7 years, depending on the expense type. Last, but not least, ensure to follow proper security measures like encryption and backups to avoid any data loss.

What is the Importance of a Receipt?

Receipts are essential for accurate record-keeping and financial planning, ensuring compliance with state-specific regulations.

Here, we are going to discuss the top 5 significances in detail:

1. Returns and exchanges

With the help of receipts, it becomes easier to issue returns or exchanges. It acts as a clear record of the product purchased and accounts for the same. They ease the process of returns for the stores and refunds or replacements for the customers.

2. Track sales

Sales receipts come in handy to track the products or services that are mostly purchased by your customers. With this information, you can customize your services to meet the specific requirements of your targeted customers.

3. Tax compliance

Receipts are important for both individuals and businesses in the tax season. It enables to ensure that all the transactions are accounted for properly in the financial statements. With the help of accurate receipts, you can easily handle sales tax calculations and ensure compliance with IRS regulations.

4. Budgeting and accounting

With the help of receipts, you can manage your finances by tracking your spending. Receipts act as legal records for reconciling bank accounts, tracking cash flow, and aligning expenses with budgets. They are extremely important for maintaining accurate and updated financial statements.

5. Customer satisfaction

A professional receipt adds to the transparency of the transaction, which leads to building customer trust. It showcases the authenticity of business operations and the values it brings out for customers. A cash receipt provides detailed and complete documentation of their purchase.

Create Professional Receipts in Minutes

Stop wasting time with manual receipt creation. InvoiceOwl helps you generate accurate, professional receipts that build customer trust and simplify your record-keeping.

Start Your FREE TrialEnhance Your Business with Organized and Accurate Receipts

Writing receipts is one of the most important steps to maintaining accurate financial records for both individuals and businesses. A professional-looking receipt ensures transparency and also acts as proof of transaction in future business operations.

No matter, if you are a freelancer or a small business owner like a contractor, electrician, or plumber, having a detailed receipt will help in building trust with the clients. Additionally, it also helps track transactions and organize overall financial records.

Several tools like Google Docs, Google Sheets, and receipt software like InvoiceOwl are available for creating professional receipts. Additionally, InvoiceOwl enables businesses to go 100% paperless and automates invoice and estimate generation. Last but not least, these invoicing tools will boost your business's operations and improve your financial management.

Frequently Asked Questions on How to Write a Receipt

Various tools like InvoiceOwl and QuickBooks are available to create perfect professional digital receipts. These tools can be of great help for creating receipts along with tracking sales, managing payments, and integrating with different accounting software.

Yes, the hand-written receipts are valid in the US. However, opting for digital receipts will reduce paper clutter and simplify your record-keeping process. A digital receipt can be stored easily and used for taxation purposes without any hassle. Last but not least, it has a lesser impact on the environment.

The most common US payment methods are cash, debit/credit cards, checks, and electronic payments like PayPal or Stripe, and ACH transfers. Always remember to specify the payment methods used for every transaction in the receipt.

As per the guidelines from the IRS, businesses should safeguard their receipts and records for at least three to seven years to support income and expense reports in case of an audit.

Yes, most of the US-based businesses are opting for digital receipts sent via mail or just app-based solutions. When compared to hand-written receipts, digital receipts are legally acceptable and convenient for both organizations and customers.

Yes, if applicable the receipts must list the sales tax separately or maybe add it to the statement that states prices are tax-inclusive.

Suppose, a customer loses the receipt, you can offer a duplicate receipt as long as you have the transaction record. Ensure to mention clearly - "Duplicate Receipt" to avoid confusion.

![Cash Receipts: The Complete Guide [With Examples & Templates]](/images/2022/09/what-is-a-cash-receipt.jpg)