Key Takeaways

- 01Rent receipts serve as official proof of payment for both landlords and tenants

- 02Essential details include tenant/landlord info, payment amount, rental period, and payment method

- 03Digital receipts are gaining popularity for convenience, accessibility, and environmental benefits

- 04Rent receipts are critical for tax documentation and legal protection during disputes

- 05Automated receipt tools save time and prevent errors in rent payment tracking

Are you a landlord seeking ways to streamline your rent payment tracking? Or a tenant wanting proper proof of payment for your records? Either way, knowing how to write a rent receipt ensures smooth financial transactions.

Other than providing financial transactions, rent receipts also streamline record-keeping and prevent disputes. We understand what rent receipts are, but how to make sure your rent receipts contain all the right details?

To help you with that, we bring you a detailed guide on writing rent receipts. This blog focuses on various topics like the importance of rent receipts for tenants and landlords, the steps to create a rent receipt, and mistakes to avoid.

Let's start with the basics.

Table of Content

- What is a Rent Receipt?

- How to Fill Out a Rent Receipt?

- 5 Tips to Generate Rent Receipts Easily

- Importance of Rent Receipts

- How to Maintain Rent Payments Record?

- How to Send a Rent Receipt?

- Common Mistakes to Avoid When Writing a Rent Receipt

- Safeguard Your Financial Transactions with Professional Rent Receipts

- FAQs

What is a Rent Receipt?

A rent receipt is an official document provided by landlords or property managers to tenants upon receiving a rent payment. It serves as proof of the amount paid and records details such as the rental period, the amount received, and information about both the landlord and the tenant.

A rent receipt, also known as a rental fee invoice comes in handy to claim essential tax benefits like House Rent Allowance (HRA).

Rent payments can be received in different ways:

- Cash payment

- Check payment

- Credit card payment

- Electronic fund transfer

Understanding about a rent receipt is essential, but knowing how to prepare one is equally important. Next are the steps to create a detailed and professional rent receipt that accurately records payments and benefits both parties.

When is a rent receipt necessary?

Rent receipts are important in various situations like,

How to Fill Out a Rent Receipt?

There are 5 important steps to prepare a rent receipt effectively. Thus, follow the mentioned steps to ensure clarity, compliance, and proper record-keeping:

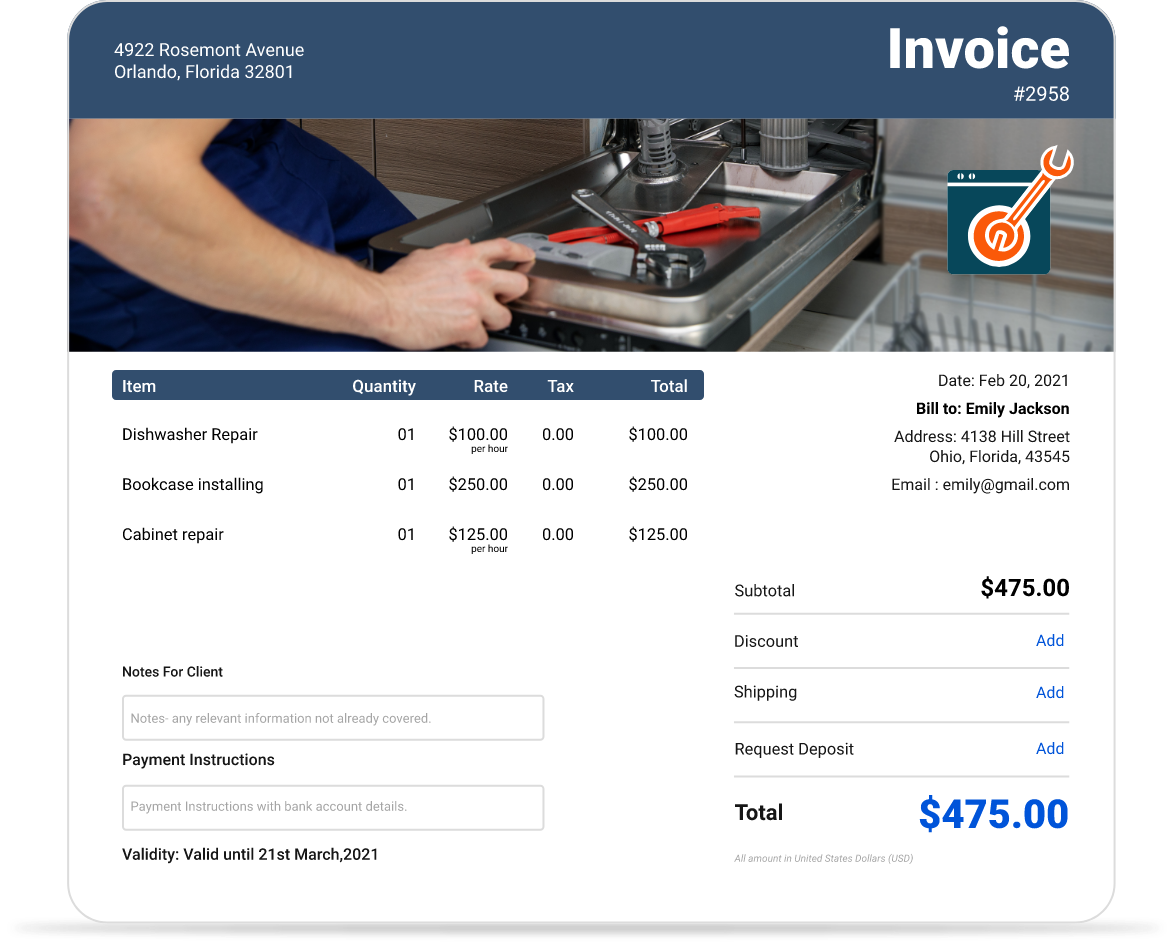

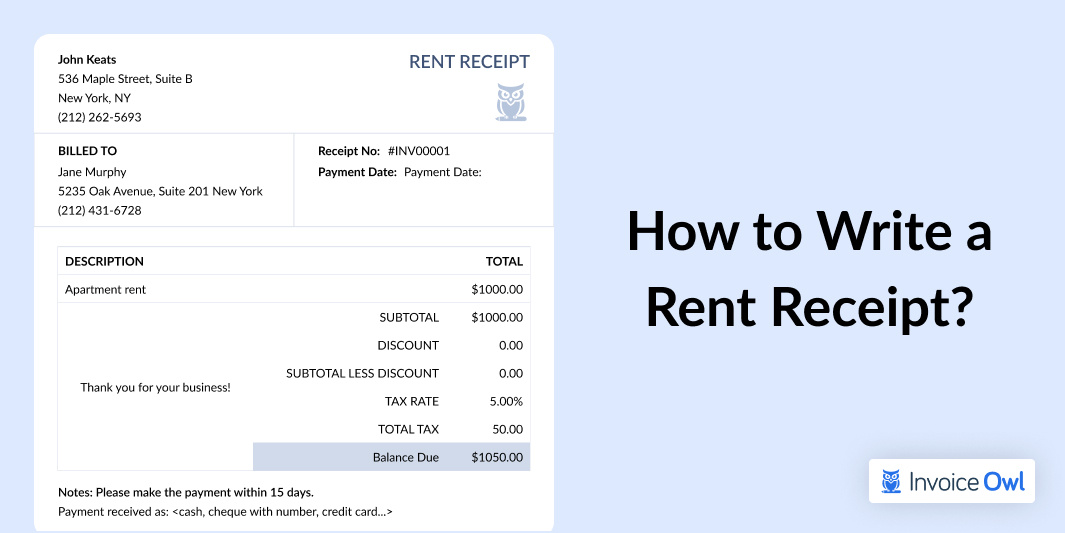

Step 1: Include basic information

Add the date of receipt, tenant's name, rental property address, and the amount received. In the U.S., the typical rent receipt format comprises property address, especially if the landlord manages multiple properties or if the tenant pays rent for a shared space.

Step 2: Specify rent payment details

Ensure to mention the amount paid along with the payment method (cash, check, or bank transfer). Also, add the rental period the payment covers, such as "Rent for March 2025", and a receipt number or unique identifier for each transaction.

Step 3: Include the landlord's information

Provide the landlord's name, property name, and contact details, and e-sign it to make the receipt legible. In some US states, such as New York and Massachusetts, landlords are legally required to issue rent receipts with this information.

Step 4: Add additional information

If required, you can also include additional fees like late fees, maintenance charges, or utility payments in the receipt template. For security deposit deductions, provide an itemized statement with reasons and supporting documentation (repair receipts). Many states like Florida and Texas require this statement within 30 days of move-out.

Step 5: Create rental receipt copies

Last but not least, give the original receipt to your tenant and keep a copy of the rent receipt for your records. In recent years, digital receipts have gained popularity due to their ease of use, quick accessibility, and environmental benefits. Consider using digital formats like PDFs. For professional and convenient options, consider using a rental invoice template to streamline the process.

5 Tips to Generate Rent Receipts Easily

Want to create the perfect rent receipt?

Follow these 5 tips to create a professional rent receipt that will make you stand out from the rest.

1. Use the free rent receipt template

Save your precious time by making use of customized receipt templates available on Google Docs for invoicing platforms like InvoiceOwl. These pre-made templates ensure that all the important details like the tenant name, date, and payment method are included in the rent receipt.

Save your precious time by making use of customized receipt templates available on Google Docs for invoicing platforms like InvoiceOwl. These pre-made templates ensure that all the important details are included automatically.

2. Add signatures

Irrespective of issuing a physical or a digital receipt, make sure to add tenant's signature along with the landlord's signature, respectively. A signature is essential to validate the transaction's authority and offer legal protection for both parties.

3. Automate receipt creation

With receipt generator tools, you can generate receipts automatically without any hassle. It is one of the best ways to prevent any errors and save your time that you could invest in another important activity.

4. Issue receipts promptly

As soon as the payment is made, ensure to issue the rent receipt on time without any delay. It will represent your organization to be professional and also help maintain accurate and updated financial record for both parties.

5. Adopt digital receipts

Opt for software or any digital tool for creating and record-keeping. One of the best things about digital receipts is that they can be easily shared, stored, and tracked. This trend is growing rapidly in the United States as it offers convenience and aligns with sustainable practices.

Importance of Rent Receipts

Here are some of the most important reasons for creating a rent receipt for both the property manager (landlords) and the tenants, as follow:

Benefits for tenants

Proof of payment: A rent receipt acts as the sole proof that the tenant has made the payment based on the agreed rent amount. This basically offers peace of mind to both the landlord and the tenants. This acts as a certain kind of protection from potential disputes regarding the payments during cash payments. With the rise of digital payments and e-receipts, issuing rent receipts promptly is a standard practice.

Legal protection and tax documentation: Rent receipts are critical for adhering to both legal and tax purposes. This document acts as evidence to sort various disputes like late payments and evictions. Additionally, it offers transparency to both tenants and landlords. They also come in handy for tax filings where self-employed tenants can claim deductions for home office use, whereas landlords can document rental income and expense deductions.

Benefits for landlords

- Maintaining accurate records: Rent receipts are important for maintaining accurate and organized records for accounting purposes. In the U.S., rent receipts come in handy for tracking income and expenses. Additionally, they also support compliance during IRS audits or state-specific record-keeping regulations.

- Avoiding disputes and compliance benefits: Rent receipts, as discussed earlier, act as proof of payments. This ensure transparency for government programs like Section 8, to streamline audits. Property owners get benefits from insurance or loan applications by showcasing consistent income and accurate records.

How to Maintain Rent Payments Record?

Maintaining rent payment records is essential for landlords and tenants to avoid any potential discrepancies and ensure transparency. Here are some effective ways to keep track of rent payments:

Use rent receipts

Ensure to offer and keep copies of rent receipts for every payment made. A rent receipt can be created both physically and digitally and serve as payment proof for both parties.

Maintain a spreadsheet

Create a proper spreadsheet for tracking monthly rent payments. While creating this spreadsheet, make sure to add different columns for payment date, amount paid, payment method, and any outstanding balances. For organized records, make an invoice in Google Sheets and manage it online.

Utilize property management software

Opt for property management software that can automate the process of collecting rent and maintaining records. These software are capable of generating reports, tracking due dates, and issuing rent receipts.

Store receipts in cloud storage

Always store your rent receipts and payment confirmations in cloud platforms like Google Drive or Dropbox. With a backup, you can get easy access to your important documents, safe storage, and quick retrieval whenever needed for legal documentation.

Cross-check with bank statements

Verify the rent payments by correlating them with the bank records to avoid potential discrepancies. Make sure that the payments have been cleared and are similar to what was decided in the lease.

How to Send a Rent Receipt?

To send a rent receipt, there are several factors depending on the payment method used and the preferences of both parties:

Rent Receipt Delivery Methods

| Method | Best For | Details |

|---|---|---|

| Physical copy | Cash payments | Write a receipt immediately to the tenant |

| Online payments | Send a digital copy with a clear subject line like 'Rent Receipt - [Month/Year]' | |

| Property management software | Automated systems | Software that automatically generates and sends receipts after payments |

| Online payment portals | Digital payments | Use portals such as Paypal, Venmo, Zelle, and RentPayment, which track payments and issue receipts automatically |

Common Mistakes to Avoid When Writing a Rent Receipt

While preparing your rent receipts, ensure you focus on what to include in a rent receipt to maintain accuracy, professionalism, and clear communication. Avoiding common mistakes is super important, as those can bring unnecessary problems.

Some of the common errors to avoid are elaborated below:

Incomplete information: Avoid missing important information like tenant and landlord's name, rental period, payment amount, and property address. Adding all these important information will make your rent receipt a valid one.

Incorrect dates or missing signatures: Ensure that the payment date and both parties' signatures are added to maintain the authenticity of the receipt and avoid potential disputes.

Unstructured format: A standardized format can enhance your readability and also be helpful for legal and tax purposes. Add important fields like payment method, outstanding dues, and reference numbers.

Not specifying payment methods: Always ensure to mention the exact mode of payment like cash, check, or bank transfer. It offers better clarity to both the parties involved along with accurate record-keeping.

Safeguard Your Financial Transactions with Professional Rent Receipts

Writing a rent receipt is important for both the tenant and property manager, as it ensures transparency and helps maintain accurate financial records.

Have you ever found yourself worried about missing information or a misunderstanding over rent payments? A well-prepared rent receipt with all the essential details can prevent these issues from the start.

Whether you are a landlord safeguarding your income or a tenant protecting your rights, issuing or requesting a rent payment receipt is pertinent. For a streamlined and hassle-free way to create, send, and store rent receipts, consider using InvoiceOwl. The platform simplifies the invoicing process with customizable templates, automated reminders, and easy client management features.

Want to Know How Digital Rent Receipts Can Transform Your Business?

Improve the efficiency of your rental transactions with professional, automated rent receipts. Say goodbye to manual paperwork and hello to streamlined record-keeping.

Try It Now!Frequently Asked Questions

Yes, rent payment receipts can be automated. With the help of an online rent payment system, tenants can pay their rent to the landlords without any hassle. It offers various benefits like improved cashflow, and enhanced security, and saves your precious time.

Yes, rent receipts can be used for additional payments to offer proof of payments received from the tenant. You can also add the security deposit that is refundable and not recorded as rent.

A rent receipt may become invalid under certain conditions. In the United States, a receipt is considered invalid without a transaction date, details of the amount received, and the vendor name.

Yes, you need to submit rent receipts for tax filing. If you are renting a property out, it is important to report your rental income on your tax return every year. A rental receipt is one of the best documents to record each transaction between the landlord and the tenant. As a landlord, you must ensure to keep a record of IRS Form Schedule E.

Yes, it is important to give receipts for all payments, specifically if the tenant is making any payment for the property owned by the landlord. This could consist of various things like tenant rent payments, security deposits, late payments, and partial payments. While entering into a lease agreement with the tenant, ensure that receipts as the most vital part of the overall process.

Yes, rent receipts can be used for rent control or subsidy programs. They are essential for tenants participating in rent control or housing subsidy programs like Section 8. These rent receipts confirm that the tenants are paying their rent and also help to ensure compliance with program guidelines.

Rent receipts are required by law in some U.S. states. However, the requirement for issuing rent receipts might differ from state to state across the United States. In states like New York, landlords need to provide a rent receipt if the tenant requests it or if the payment is made in cash. In several states across the US, it is not essential to issue a receipt unless mentioned in the lease agreement. Irrespective of the state law, issuing rent receipts is one of the best practices for record-keeping and transparency.

The major difference between a rent receipt and a lease agreement is that a rent receipt records the individual rental payment. On the other hand, a lease agreement covers the broader terms of tenancy like duration, rent amount, and rules & policies.