Key Takeaways

- 01Receipt templates streamline the receipt creation process and save valuable time

- 02Digital receipts are more environmentally friendly and cost-effective than paper receipts

- 03The IRS requires receipts to be accurate, easy to store, maintain, and retrieve

- 04A good receipt template should support multiple payment methods and be user-friendly

- 05Online receipt tools allow easy sharing with accountants and centralized storage

Are you tired of creating sales receipts repeatedly and spending too much time on them? So can you do about it, since it is essential to any business? This is where the receipt template comes in! IRS states that receipts should be easy to store, accurate, reprint, maintain, and retrieve. For businesses, a receipt template is a helping hand. If you choose the right receipt template, you won't have to spend much time on it. Basically, you need to select the receipt templates and edit it according to your needs and requirements, and then it is ready to be sent to your customers. As a business owner or someone in management, you will know how important it is to streamline the receipt generation process so that your organization understands what is coming in and what is going out. In this article will cover everything about payment receipt templates and show how to choose the right one.

Table of Content

- What is a Receipt Template?

- Why Use a Receipt Template?

- How Can I Issue a Receipt?

- How to Pick the Best Free Receipt Template

- What are Some Examples of Receipts Templates?

- Benefits of Receipt Templates for Customers

- FAQs

- Conclusion

What is a Receipt Template?

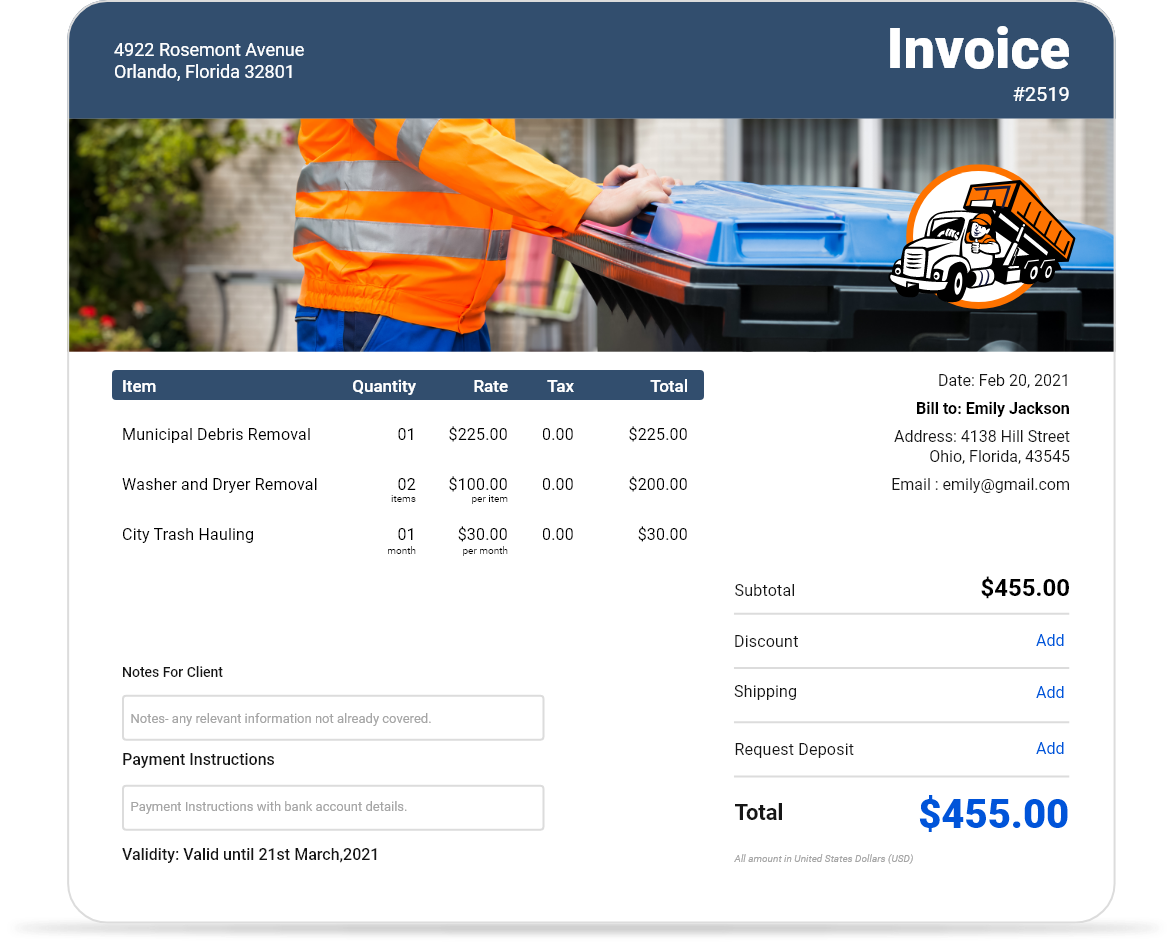

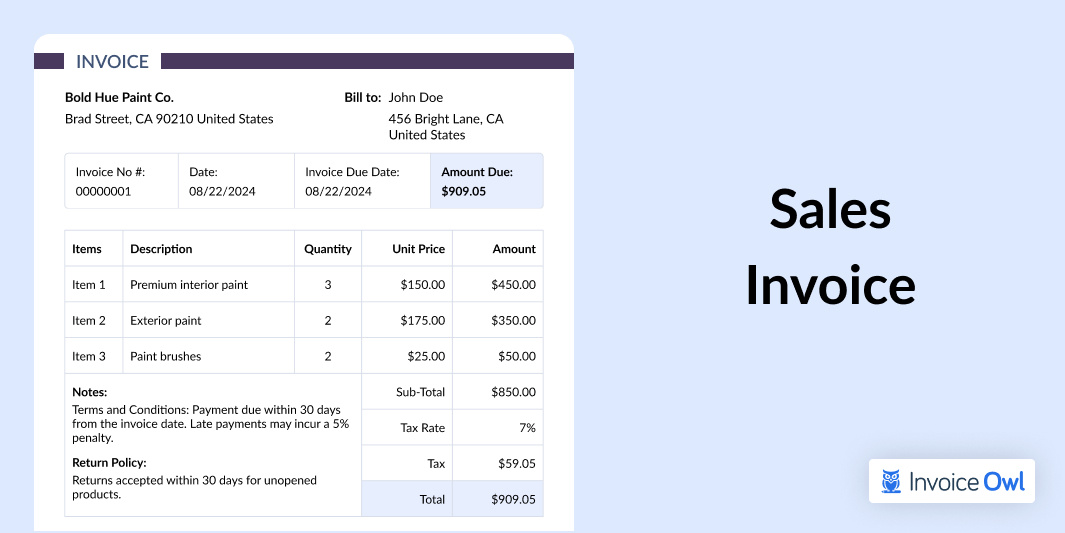

The sales receipt is a piece of paper that vendors and service providers must provide to their customers as evidence of payment. More likely than not, every single day you get service receipts from several different stores. There is no doubt that professional receipts are an essential part of the paper trail, which must be maintained for business-to-business (B2B) transactions. Using a receipt template, you can create cash receipts that fit the needs of your business or individual transactions by customizing the receipt template to fit your needs. Depending on how the payment is made, receipts can take a variety of forms, including emails or printed receipts. It is also possible to send a personalized PDF receipt. Less common are receipts in a proprietary format like Microsoft Word. It is common for receipt templates to include basic fields that can be used to collect essential information about these transactions, such as the receipt number, date, subtotal, sales tax, unit price, details about the company, information about the sale, etc. Using a receipt template offers many benefits, including cutting down on the time you need to manually calculate things like value-added tax, so you can save time by not having to do so.

Every receipt template should include basic fields like receipt number, date, subtotal, sales tax, unit price, company details, and sale information to ensure proper documentation and compliance.

Why Use a Receipt Template?

Here are some pointers that turn you to use receipt template:

- As a business owner, you should use receipt templates to create receipts that simplify accounting, save time, and encourage growth.

- To simplify the process of filling out customer receipts, a receipts template is a great way to reduce the time you spend working on it because all the structure and recurring content have already been done for you.

- Templates can standardize your receipts and assist your accounting team when filing their taxes. It is required by the United States Internal Revenue Service (IRS) that you provide documentation of certain expenses, and businesses are advised to retain all gross receipts and receipts related to certain expenses.

- Accurate records such as cash register tapes, deposits on cash and credit sales, receipt books, petty cash slips, and invoices are included in this section. Online service receipt templates make it easier for distributed accounting teams to coordinate and get their numbers right, like between offices.

Receipt templates in Microsoft Word and Google Docs can be great, but they are hard to manage on a large scale. The InvoiceOwl will help you regain control of your bookkeeping by automating workflows and helping you choose the receipt maker template that helps you generate receipts easier.

How Can I Issue a Receipt?

Receipts can be issued in a variety of ways. There are two types of receipts: paper and electronic. Typed or handwritten, it can be either way.

Electronically

Many small cash registers come with a built-in printer that prints receipts. Additionally, they have software that allows you to program all the tax rates and codes into the register, allowing the system to do all the calculations for you.

There is also the option of sending receipts digitally using a free online receipt maker, which has been becoming increasingly popular over the past few years as a method of issuing a receipt. In this method, following the creation of the receipt, the receipt will be emailed directly to the customer's inbox. Using an online tool such as InvoiceOwl, you can use a customized receipt template to create delivery receipts online according to your needs. Get started today!

Digital receipts are becoming increasingly popular as they can be emailed directly to customers' inboxes, providing instant delivery and easy record-keeping for both businesses and customers.

Paper

It is just as acceptable to write a receipt by hand if you need software to provide a digital receipt. Stationery offers a book for sale that usually include two copies of each receipt (one for your records, one for the customer). Another option is to download a receipt template or create a new one based on an existing one, for example, using Microsoft Word.

How to Pick the Best Free Receipt Template

What goes on receipts, and why they're essential? Now that you know why receipts are necessary, how do you choose the best free receipt template? If you want the best payment receipts for your business, you should invest in software like InvoiceOwl. It helps you streamline the finances of your business. Now it is time to understand how you can choose the free receipt template for your business.

Receipt Scanner

A busy business with multiple daily transactions can make keeping track of paper receipts a nightmare. The receipt scanner will simplify the process by digitizing everything and storing it on your dashboard. As a result, you'll have all your receipts in one place when you need them, so you can recall them immediately when needed, send them to your accountant when tax time arrives, and keep them all together for tax purposes. This method works for any business, large or small.

Easily Share with Accountants

It is essential to quickly and easily share the cash receipt directly with your accounting team when you create them. So you should choose the receipt maker template, which you can easily share with your accounting and finance team. Ideally, you can do it with suitable templates without worrying about losing any, printing them and sending them manually, or worrying about duplicate copies. There are several benefits to using software, such as sharing receipts directly with accountants in one go. With this tool, you can simplify your finances, stay organized, and minimize the likelihood of missing out on deductions.

A User-Friendly Interface

Another great factor when choosing the receipt template is considering its user interface. Your receipt template must be user-friendly and easily customized to suit your company's needs. Any information pertinent to the transaction, such as your company logo, business, and customer information, should be added without navigating multiple screens. Software solution templates are straightforward to use since their intuitive dashboard is user-friendly.

Multiple Payment Methods

Refraining from limiting yourself to just a few payment methods regarding your product or service is essential. Even though creating a cash payments receipt template is possible, you should display credit card details, debit card, or check templates. In addition to being very popular for small and large businesses, mobile wallets are also very popular with consumers. With the right payment methods, you can increase sales and make your business more appealing to customers.

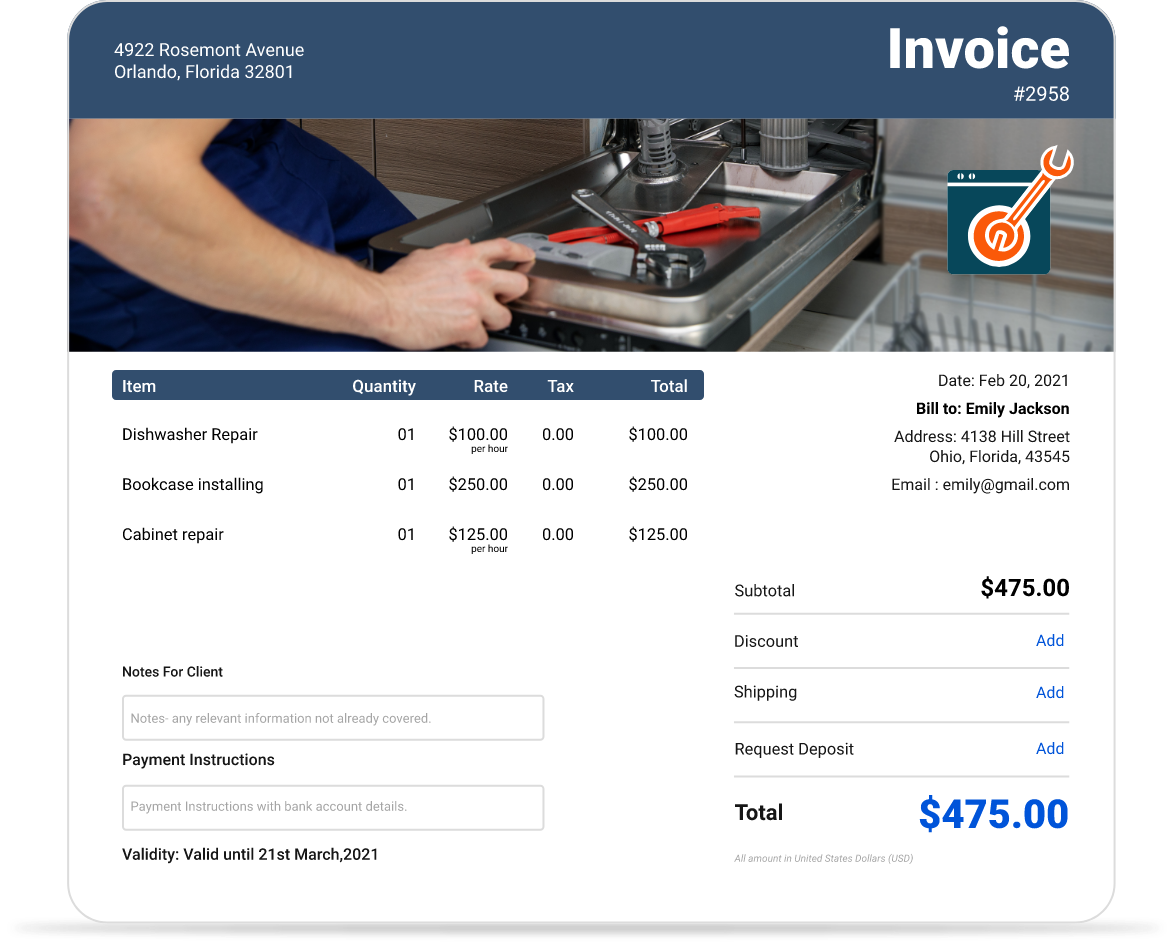

What are Some Examples of Receipt Templates?

There are many receipts and different kinds of free receipt templates that come in various designs. If you need to become more familiar with how they work, we will demonstrate some of the most common receipt templates you will likely encounter in your daily business life.

Cash receipt template

It is a fundamental type of receipt to issue a cash receipt. The printed acknowledgment shows the amount of cash received – or its equivalent – during a transaction, which is just a printed confirmation of the payment. It is generally the case that two copies of the sales contract are issued at the point of sale, including one copy for the customer and one for the vendor or seller.

It is typically a type of template where you can fill in the information about the product or service you have sold, the price you charged for it, and any taxes that have been paid. The credit card transaction form will also usually allow you to include information about the company that paid for the transaction – such as the name and address – and the date and time it was paid for.

Bills of lading templates

This is a legal document that the carrier issues to the shipping company to confirm the contents of a shipment. This document specifies how much, what type, and where the goods will be transported. Bills of lading can also serve as contracts between shippers and carriers rather than traditional cash receipts. Whether the document is legally valid depends on whether all three parties involved in the transaction have signed it, namely the shipper, the recipient, and the carrier. The fields on a bill of lading template typically include information about the recipient, the parcel details, a shipping tracking number, as well as the identifiers of the delivery company. In addition, there should also be an area for you to make notes and a place to write any special instructions about the delivery. You should also include a clause about liability and a place to sign for all parties involved.

Gross receipt templates

Gross receipts are forms that are usually used by tax authorities for tax purposes. In this report, you'll be able to see all the income and payments you've received for your business – as well as the sources and amounts of each income and payment. Documentation supporting your claim includes receipts, cash register tapes, and information on your deposits in cash registers. Typically, state tax authorities will provide business owners with their own templates for calculating their gross receipts each month or quarter.

Rent receipt template

In a lease settlement, the landlord or property rental company provides tenants with a rent receipt as proof the rent has been paid. Tenants and landlords receive rent receipts proving that services were rendered and fully paid for. Depending on the complexity and amount of information included, rent receipt templates differ. In these cases, the landlord's and tenant's names and addresses are essential, as well as a description of what is owed and what is paid, dates when it was issued and when it was paid, and the type of payment.

Benefits of Receipt Templates For Customers

Paper and ink used for printing receipts aren't environmentally friendly. As a result, switching from cash payment to receipts payment will benefit your customers in many ways. When you go digital, you are going green at the same time. In fact, as of 2022 some medical research suggests the ink used in many receipt printers is highly toxic, and even brief touches may cause medical issues if repeated many times. Digital receipts also offer several other benefits when you decide to use them in your business. Customer receipt templates offer a number of benefits.

Medical research suggests that the ink used in many receipt printers can be highly toxic, and repeated exposure may cause health issues. Going digital not only helps the environment but also protects both you and your customers from potential health risks.

1. Time-saving solutions and easy access

Digital receipts are easier to access than hard copies. Online receipts can be retrieved with a click of a button because they are stored on a cloud and can be retrieved anytime you want. By storing the receipts digitally, you can optimize your workflow since you won't have to spend hours looking through stacks of paper to find the receipt you're looking for because you will save time.

2. Online receipt can save you time and money in the long run

If you own a small business, you should prioritize saving money. Hard copies of documents have many hidden costs, like ink and paper. As a result of using digital receipts, you will be able to save a lot of money as you will eliminate the need to purchase paper, ink, and printing equipment.

3. A quick and easy way to capture receipts

To operate some printing machines, you may need to plug them into an electrical outlet. A battery-powered receipt printer is also an option, but be aware that the battery may only last for a while. A digital platform allows you to create a receipt from anywhere on the go with just a few clicks. A device and a connection to the Internet are all you need to create and send receipts. For small merchants who attend outdoor events frequently, digital receipts are a good option.

4. Cut storage and clutter costs

Receipts printed on paper create a lot of clutter. To keep all their receipts in order, some businesses buy archive boxes. Utilizing digital receipts can help you save space and clutter. Your office won't be filled with large boxes or an extensive paper trail.

5. Enhanced customer satisfaction

Digitized receipts are also convenient for customers as they can organize and store them safely. As tax season approaches, online receipts may help alleviate stress. There are also those people who are concerned about the environment and appreciate it when corporations do everything they can to limit their paper usage.

Ready to Simplify Your Receipt Management?

Stop wasting time creating receipts manually. InvoiceOwl's professional receipt templates help you create, send, and track receipts in seconds.

Start Your FREE TrialFrequently Asked Questions

Starting with a template is the best, but you can find several free receipt generators and templates online. Each receipt you issue should include the following information, no matter how you make it:

- Purchase date, time, and number

- A receipt number or an invoice number

- Total price and number of items purchased

- Identify the business from which the items have been purchased and its location

- Taxes imposed

- Payment methods

- Return policies

- The receipt should be printed or sent to the customer as a digital file, and a confirmation of receipt should be obtained

You can customize receipts and invoice sheets using Microsoft Word's templates – over 100 online invoice templates are available. Be mindful that this can be a fairly manual process in Word, so make sure you store all of your digital receipts logically and in an organized manner. There are also several free receipt templates available in Microsoft Excel, but they could be more apparent. In addition, since each team member must update and share the documents manually, adoption is delayed. Live receipt templates keep your team informed at all times. By using an online platform you can track all your receipts coming in and going out, giving you a real-time view of your expenses and income as they are accrued.

Certainly, InvoiceOwl offers easy-to-use templates for creating receipts that you can easily customize. Businesses and institutions can download the receipts directly to their devices in just a few minutes, enabling them to complete the sales process quickly. With the help of free receipt templates, users can send different receipts to their customers to receive payment from them.

Digital receipts are receipts that your merchant e-mails to you or sends directly to your phone. Electronic receipts are sometimes also called e-receipts, in short. In this way, they serve as proof of payment and as a paper trail without requiring physical records.

Conclusion

It is necessary to have a good receipt template to make the process of making a receipt easier, as well as to give the customer a better sense of the price of the receipt.