Key Takeaways

- 01FOB (Free on Board) determines when ownership and liability transfer from seller to buyer during shipping

- 02FOB Shipping Point transfers responsibility once goods leave the seller's warehouse, while FOB Destination transfers upon delivery

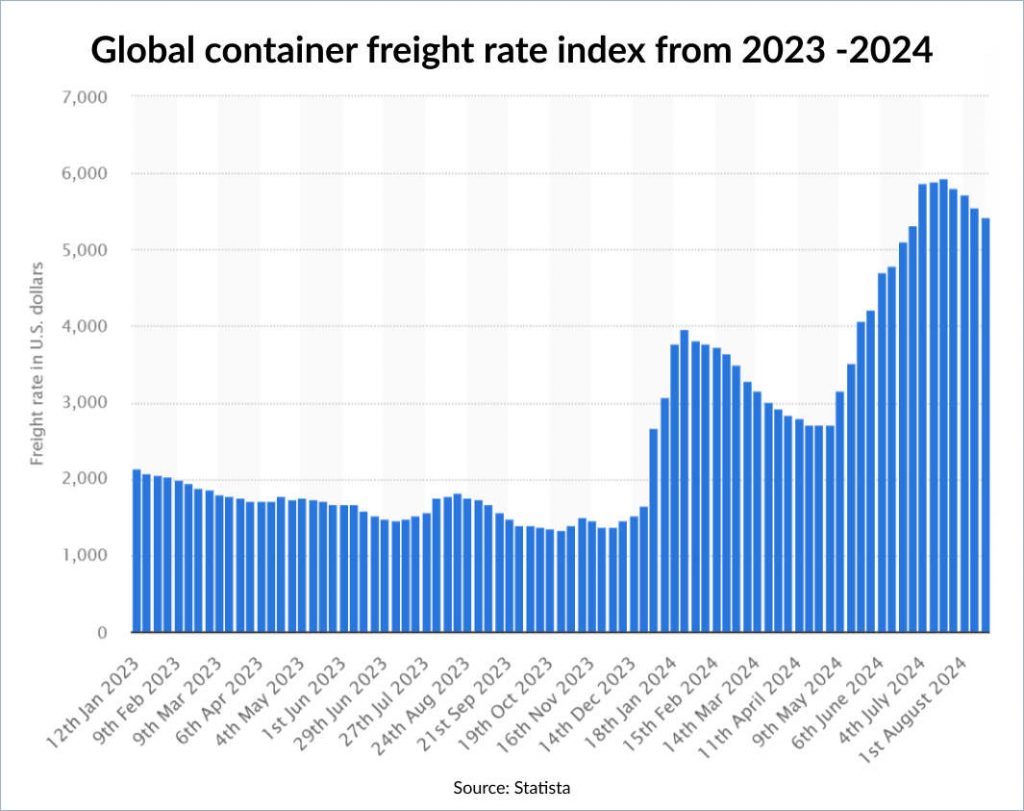

- 03Global container freight rates exceeded $5,900 in July 2024, making FOB terms crucial for cost management

- 04FOB terms directly impact accounting practices, insurance requirements, and sales tax calculations

- 05Understanding FOB vs CIF helps businesses choose the right shipping terms for their needs

Have you ever received an invoice with the term "FOB" and wondered what you're being charged for?

Is it related to shipping costs, ownership transfer, or liability during transit?

Understanding what FOB means on an invoice is important for both buyers and sellers to avoid unexpected charges and clarify shipping obligations.

For buyers, knowing FOB helps determine when responsibility for goods transfers. For sellers, it clarifies their risks after shipment.

Our blog will provide a detailed explanation of FOB, covering its significance, advantages, disadvantages, and key differences to ensure smoother transactions and protect your financial interests.

What Do You Mean by FOB?

Free on Board (FOB), also known as freight on board, is a shipping term used in both inland waterways and international overseas transport. It indicates the point in the supply chain when a buyer or seller becomes liable for the goods shipped.

This transportation term related to international commercial law has evolved as one of the most essential concepts for decoding reliability and ownership transfer.

FOB is found on the shipping document or transportation agreements indicating who is liable for the goods damaged or destroyed during the shipping process. The purchase order between buyers and sellers sets FOB agreements and helps determine ownership, risk, and transportation costs.

Mainly, there are two types of shipping terms related to FOB:

- FOB destination

- FOB shipping point

These two FOB types determine who is legally responsible for the transportation cost of the goods depending on where the goods originate from or the final shipping destination.

After getting a little bit of an understanding of FOB, let's move on to the concepts of FOB shipping point and FOB destination.

What is FOB Shipping Point?

FOB shipping point is a FOB term indicating sellers transferring the ownership of goods after the product has left the warehouse facility.

The seller records the sale for accounting purposes after the goods have been sent to the buyer. After doing so, the seller won't be responsible for any damage caused to the product. The buyer will be responsible for any damage or loss caused to the goods during the transit.

FOB terms significantly affect shipping costs, inventory, and insurance. Recently, global freight rates have risen sharply. Between 2023 and 2024, shipping costs increased dramatically, with container rates exceeding 5,900 U.S. dollars in July 2024.

Businesses need to monitor these trends closely to manage costs effectively.

What is FOB Destination?

FOB Destination is a shipping term where the transfer of ownership happens only when the goods reach the buyer's location, meaning the seller retains legal title until then. When compared to the FOB shipping point, the FOB destination offers more benefits to the buyer than the seller.

FOB destination protects the buyer from any unexpected losses that might occur during shipping. Similarly, the FOB shipping points benefit the seller. Suppose, the goods are shipped to Colorado, then it would be written as FOB Colorado in the invoice.

Now that you have understood the concepts of FOB Shipping Point and FOB Destination, it is time to look at the major differences between both concepts.

FOB Shipping Point vs FOB Destination

When it comes to FOB terms, understanding the distinction is important to know when you are liable to pay the transportation or shipping costs.

Here is the detailed table comparing FOB shipping point and FOB destination:

FOB Shipping Point vs FOB Destination

| Aspect | FOB Shipping Point | FOB Destination |

|---|---|---|

| Ownership Transfer | The buyer assumes ownership when goods leave the seller's premises. | The seller retains ownership until the goods reach the buyer's location. |

| Risk Transfer | The buyer takes on risk as soon as the goods leave the seller's facility. | The seller bears the risk until the goods arrive at the buyer's location. |

| Shipping Costs | The buyer has to pay the shipping costs. | The seller has to pay the shipping costs. |

| Insurance Responsibility | Buyer must arrange for insurance during transit. | The seller is responsible for insurance until delivery. |

| Freight Charges on Invoice | Freight charges are billed to the buyer. | Freight charges are absorbed by the seller. |

| Liability for Damage | Buyer assumes liability for any damage during transit. | Seller assumes liability for any damage during transit. |

| Seller's Control Over Goods | Once shipped, the seller no longer has control over the goods. | The seller has control of the goods until delivered to the buyer. |

| Common Use | Typically used when the buyer wants to control shipping and delivery logistics. | Typically used when the seller offers full-service delivery and wants to maintain responsibility until delivery. |

| Taxation Impact | Taxes may be calculated based on the shipping location. | Taxes may be calculated based on the destination location. |

| Delivery Timeline | The buyer is responsible for arranging and tracking the delivery. | The seller is responsible for ensuring goods reach their destination. |

What is the Significance of FOB for Small Business Accounting?

FOB plays an integral role in setting the important terms of shipping agreements for small business accounting. Free on board decides who among the buyer and seller will be liable to pay the shipping costs and who will take responsibility if the shipment is damaged, lost, or stolen.

In U.S. accounting, under FOB Shipping Point, the seller can record revenue once the goods leave their warehouse, following GAAP standards that recognize revenue when the performance obligation is fulfilled.

In the meantime, the buyer will record it in their accounting system, mentioning that the inventory has left the seller's premises and is on route. Performing this accounting entry will convey that the inventory has now become an asset in the buyer's accounting books even though the shipment hasn't yet arrived.

FOB Explained: Pros and Cons of FOB Origin and FOB Destination

Evaluating the advantages and disadvantages of FOB (Free on Board) is important for buyers and sellers to navigate shipping transactions effectively without any hassle.

Advantages of FOB origin

Low cost for sellers

In FOB origin, the seller saves a lot on shipping and insurance costs. Sellers are not responsible for goods once they are handed over to the carrier. This concept results in lesser expenses for the seller.

Flexible for buyers

With FOB origin, buyers can choose their preferred shipping method and carrier. This helps them negotiate for better shipping rates and opt for a quicker and more affordable transportation option.

Less seller liability

As soon as the goods are shipped, the buyer becomes responsible for the risk associated with the goods. The seller has nothing to do with the damages or losses during transit, resulting in a lower level of risk.

Disadvantages of FOB origin

- Increased risk for buyers: Once the goods are handed over to the shipping carrier, the buyer accepts all risks, which can lead to higher insurance costs, especially in the U.S. where shipping distances can be significant.

- Higher shipping costs for buyers: The buyer is solely responsible for arranging and paying transportation costs, which can result in higher expenses, especially when shipping agreements with carriers are unfavorable.

- Complexity for international buyers: International buyers are responsible for navigating import rules, regulations, and taxes. This added responsibility complicates the overall shipping process and also increases costs.

Advantages of FOB destination

Disadvantages of FOB destination

- Higher cost for sellers: Sellers are responsible for the overall cost and risk associated with shipping goods. This leads to deducted profit margins, especially for long-distance or international shipments. This shipping cost is then passed on to the buyer through higher product prices.

- Lack of control for buyers: Buyers hardly have any control over the shipping method or choice of carrier. Suppose a seller opts for less reliable transportation, the buyer may experience delays in receiving goods.

- Less transparency for buyers: Buyers often have less transparency during shipping under FOB Destination, but many U.S. businesses now require tracking updates from sellers to mitigate delays or uncertainties.

What is the difference between CIF and FOB?

According to the International Trade Administration, understanding international shipping terms like CIF (Cost, Insurance, and Freight) and FOB (Free on Board) is crucial for evaluating costs, insurance, and risk transfer between buyers and sellers.

Here is the detailed comparison:

CIF vs FOB Comparison

| Criteria | CIF (Cost, Insurance, and Freight) | FOB (Free on Board) |

|---|---|---|

| Definition | The seller is responsible for the cost, insurance, and freight of the goods until they reach the buyer's port. | The seller is not responsible for the goods until they reach the buyer's location. Once loaded in the shipping vessel, the liability is transferred to the buyer. |

| Responsibility for Costs | The seller covers transportation, insurance, and shipping charges until the goods reach the destination port. | The buyer is responsible for transport costs from the point the goods are on board the vessel. |

| Risk Transfer Point | Risk transfers from seller to buyer when the goods reach the destination port. | Risk transfers from seller to buyer once the goods are on board the ship at the point of origin. |

| Insurance | The seller is required to provide insurance for the shipment until it reaches the destination port. | Buyer must arrange for insurance after the goods are on board the vessel. |

| Control over Shipment | The seller has more control over shipping details, including insurance and transport arrangements. | The buyer has more control after the goods are on board the ship and must handle shipping from that point onward. |

| Ideal for | Beneficial for buyers who want less involvement in shipping logistics and prefer the seller to handle it. | Suitable for buyers who want more control over the shipping process and are experienced in managing transportation and insurance. |

| Shipping Documentation | The seller provides necessary documentation, including insurance certificates. | Buyer arranges for documentation and transportation beyond the point of loading. |

Ready to Take Control of Your Invoicing?

Use InvoiceOwl to create clear and concise invoices that highlight FOB terms, ensuring transparency and building trust with your clients.

Start Your FREE TrialRole of FOB in Streamlining Your Business Transactions

Understanding FOB terms on an invoice is crucial for U.S. buyers and sellers to negotiate better deals, reduce risks, and ensure smoother, more efficient transactions. Whether you're using FOB Origin or FOB Destination, if you know these terms, it will help you negotiate better deals and ensure a smoother transaction process.

If you are looking forward to streamlining your invoices, choose InvoiceOwl. It is one of the best invoicing software available in the market. InvoiceOwl offers customizable and professional invoices that reflect FOB terms, making your business dealings more transparent and efficient.

Last but not least, with easy-to-use and custom invoice templates, InvoiceOwl simplifies your invoicing process and enables you to focus on growing your business.

Frequently Asked Questions on What Does FOB Mean on an Invoice

The FOB shipping point has a great impact on goods ownership, as ownership transfers from the seller to the buyer once the goods have left the seller's shipping port. After this, the buyer is solely responsible for associated shipping costs and any damages caused to the goods during transit.

Here are the ways FOB terms can influence shipping expenses in the United States. In the FOB shipping point, the buyer has to pay shipping costs whereas in the FOB destination, the seller covers the shipping expenses until the goods reach the buyer's location.

No, FOB is not just used only for international shipping. In the US, FOB is also used in the domestic shipping contracts. They are specially used in freight and logistics to make clear decisions regarding the responsibility for goods during transport.

The roles of FOB in sales tax calculations differ based on the FOB terms. Talking about the FOB destination, here the seller might have to charge sales tax as the buyer's location. Whereas in the FOB shipping point, the tax burden might be shifted to the buyer's state.

The impact of FOB on insurance charges is dependent on the FOB term used. At the FOB shipping point, the buyer has to make arrangements for insurance coverage during transit. Whereas with FOB destination, the seller covers the overall insurance cost until the goods reach the buyer's location.

FOB pricing is the cost comprising transporting goods to the shipment port, insurance, freight transport, loading of goods to the shipping vessel, and unloading and transporting the goods from the arrival port to the final destination.

The liability to pay the freight costs for FOB origin depends on the term used. Suppose the term includes: "FOB Origin, freight collect," then the buyer will handle the freight charges. If the term includes: "FOB Origin, freight prepaid," then the buyer holds responsibility for the goods at the origin point, but it is the seller who pays the shipping cost.