![Cash Receipts: The Complete Guide [With Examples & Templates]](/images/2022/09/what-is-a-cash-receipt.jpg)

Key Takeaways

- 01Cash receipts are printed acknowledgments of cash received during business transactions, serving as proof of payment

- 02Essential components include transaction date, amount, description, payment method, and unique identification number

- 03Three main types exist: standard sales receipts, digital cash receipts, and miscellaneous cash receipts

- 04Proper cash receipt management ensures audit compliance, accurate accounting records, and legal protection

- 05Digital tools like InvoiceOwl can automate cash receipt tracking and reduce recording errors

Cash receipts are the sums of all the cash that you receive from your clients. These could be generated by sales or payment collections and raise the cash balance recorded on a company's balance sheet.

At times, understanding the concept of cash receipts can be tricky. People who work in professions that don't involve handling actual money will find this to be particularly true.

Watch this:

In this blog, we'll go into great detail on cash receipts. We will cover topics like the advantages of keeping cash receipts, the need for them, and how to record cash receipts.

Continue reading to find out more!

Table of Content

- Understanding Cash Receipts: Definition and Fundamentals

- Types of Cash Receipts and Their Applications

- Essential Components of a Cash Receipt

- Recording and Managing Cash Receipts

- Why Do You Need Cash Receipts

- Benefits and Importance of Cash Receipt Management

- When Do Cash Receipts Become Acceptable?

- Where Can You Find Cash Receipts on a Financial Statement

- How to Record Cash Receipts on Your Financial Summary?

- Final Words

- Frequently Asked Questions

Understanding Cash Receipts: Definition and Fundamentals

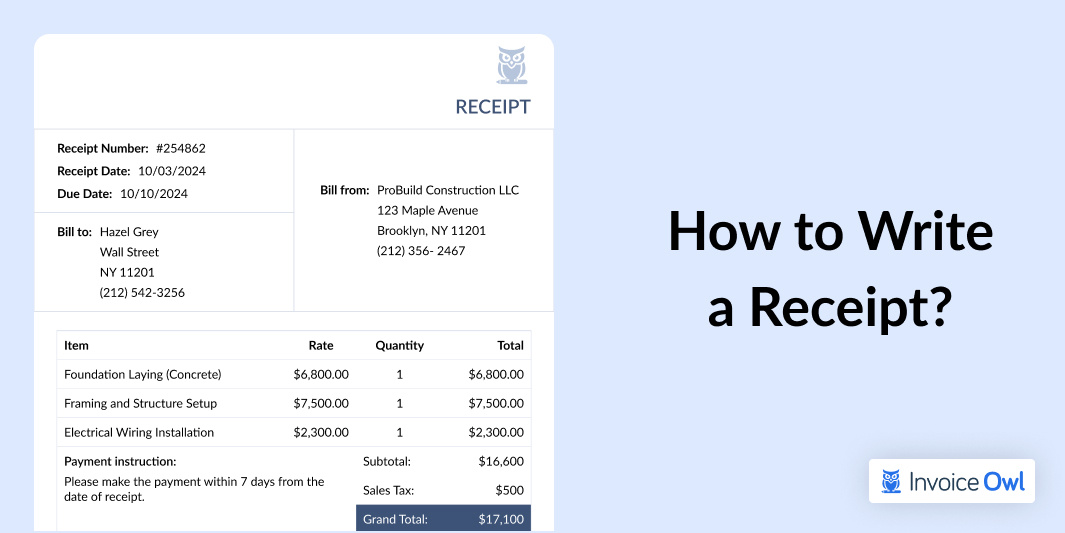

A printed acknowledgment of cash received during a business transaction that involves the transfer of money, or cash equivalent, is known as a cash receipt. The customer receives the original copy of this receipt, and the seller retains the other copy for record-keeping purposes.

Watch this:

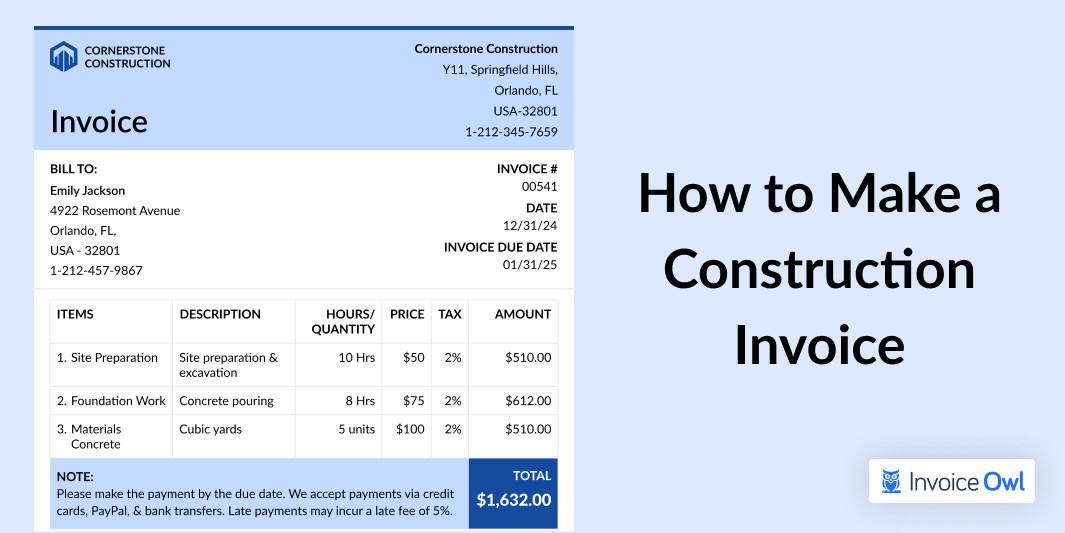

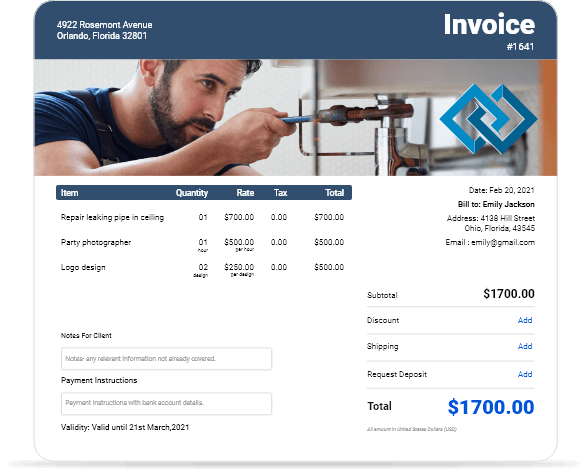

The printed cash receipt must have the following details in order to be considered a valid receipt:

- The date of the transaction

- The amount of the transaction

- Description of the product or service

- The total quantity sold

- The payor's name or company name

- Whether cash, cheque, or another payment method was used to complete the transaction

- The payor's signature

- An identification number

Types of Cash Receipts and Their Applications

Moving ahead, let's quickly go through different types of cash receipts and how they can help you streamline your business.

Standard Sales Receipts

The standard sales receipts are mostly used for in-person or retail transactions. Like any other receipt, these are the proof of transaction carried out between the seller and the customer. Such receipts hold crucial information about the transaction such as date, items bought, and total amount. Standard sales receipts are commonly used in retail stores as proof of payment and record-keeping of the transaction.

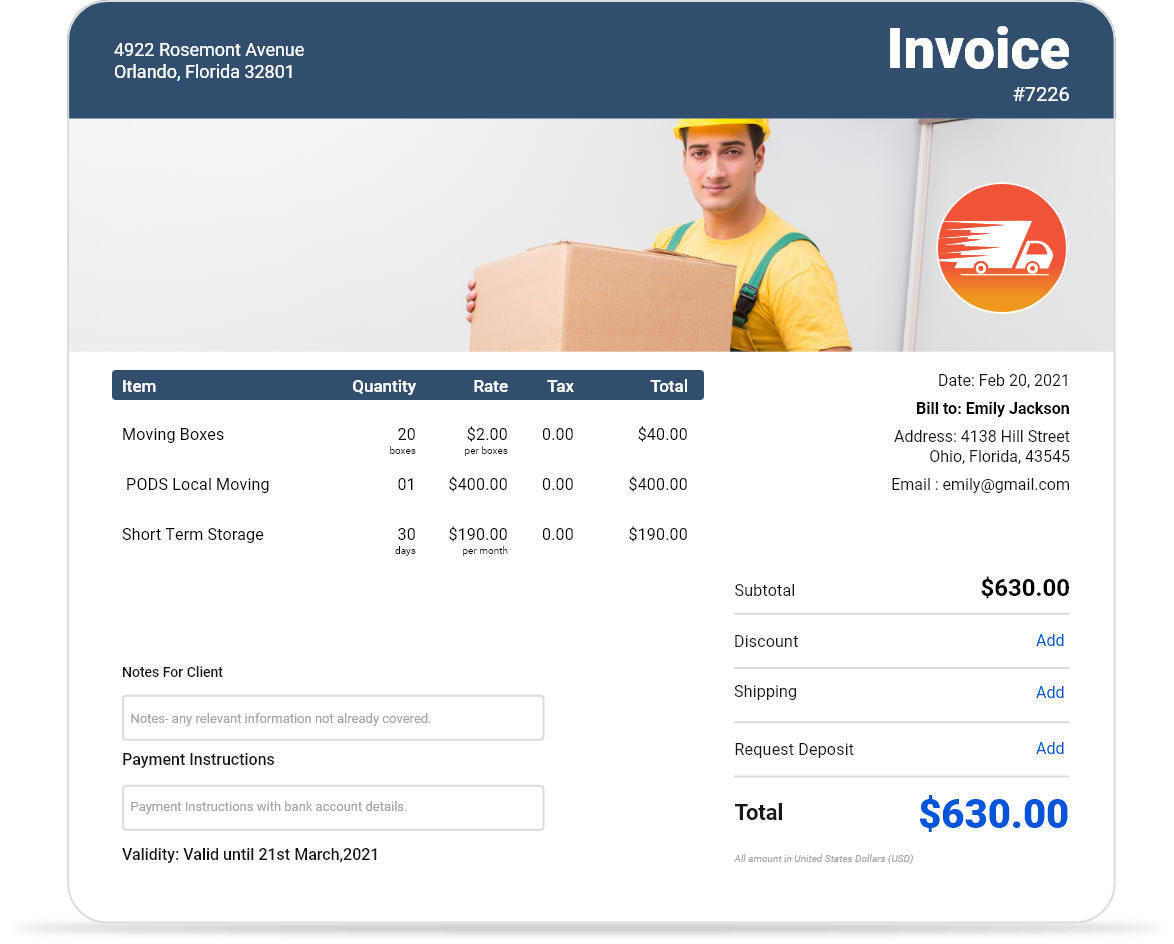

Digital Cash Receipts

Businesses operating online mostly use digital cash receipts as proof of payment. These receipts are usually sent via email or generated through online payment platforms. Simply put, digital cash receipts are paperless alternatives to standard receipts for every e-commerce and online retail store. What's more, they are also easier to track and organize, reducing the need for physical storage.

Miscellaneous Cash Receipts

These receipts highlight transactions that include post-purchase transactions like refunds, petty cash transactions, and other miscellaneous payments. Businesses use this method to keep a record of every transaction made even if its not related to sales. Miscellaneous receipts ensure accuracy in cash flow tracking for better financial management.

Essential Components of a Cash Receipt

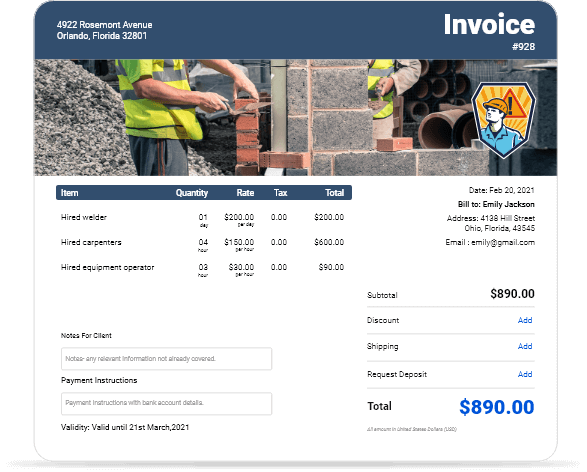

Cash receipts are composed of various essential components that must be accurately displayed in the invoice. Some of the prominent components are as follows:

By keeping these components in check, businesses can comply with legal compliance, accurate bookkeeping, and a clear record for future reference.

Recording and Managing Cash Receipts

Just making receipts is not enough for a smooth business operation. It is also essential to learn the correct way of record keeping and managing the entire flow of cash. Let's take a brief look at this idea:

Step-by-step recording process

The idea of record-keeping is pretty simple and straightforward. It helps to maintain clear and organized records, ensuring all incoming cash flows are accurately captured.

Simply follow the steps discussed below:

Step 1: Starting off, record the date of the transaction. Step 2: Mention the amount received and the medium of the transaction accurately. Step 3: Do not forget to add the payer information, such as name and address. Step 4: Keep a copy, whether digital or physical. Step 5: Regularly update the cash balance at the end of the day or after every transaction.

Digital tools and software solutions

This process can further be simplified with the help of advanced tools like InvoiceOwl, QuickBooks, and FreshBooks. These software solutions can automate entries, track transactions, and manage digital records.

With such tools at disposal, businesses can save time, reduce human error, and maintain up-to-date financial records for accurate cash flow analysis. Modern invoicing software can automatically generate receipts, sync with your accounting system, and provide real-time financial insights.

Common recording mistakes to avoid

To improve the application of cash receipts, there are a few common recording mistakes that can be avoided. Let's quickly read them all:

- Update the record cash immediately, as delaying the process can lead to errors.

- Carefully enter the details, like transaction dates and the name of the customer.

- Remember to classify the miscellaneous cash receipts to avoid distortion of financial records.

- Always back the digital recipes to minimize the risk of data loss.

Avoiding these common mistakes can help maintain accurate records, ensuring smoother cash flow management and financial reporting.

Why Do You Need Cash Receipts

When any of the following payment options are used, you must generate a cash receipt:

- Cash

- Cheque

- Using store credit for purchases

When you generate a cash receipt and receive one of the abovementioned types of payment, you credit the sales on the profit and loss statement and debit the cash account in the cash receipts journal.

In accounting for cash receipts, the seller's original cash receipt, whether it be printed or digital, is referred to as a source document. Source documents are proof that a business transaction was done and payment was received. It should be retained in order to support your financial accounts and for use in income tax reporting.

The easiest and safest place to save source documents today is online. If you use accounting or bookkeeping software, it is convenient to save one copy of the sale. As a backup, another copy should be uploaded to cloud storage.

Benefits and Importance of Cash Receipt Management

Although setting up and keeping track of cash receipts takes some effort, the returns are rewarding. Using a free online receipt generator software to keep track of cash receipts has the following significant benefits:

1. The provision of proof in the event of an audit

You will be thankful that you kept good records if you ever find yourself the target of an Internal Revenue audit. In such a situation, you can be asked to provide proof that your taxes are accurate, such as purchase receipts.

2. Proof of sale

The fact that you have proof of a transaction is the primary benefit of recording cash receipts. A history of previous cash transactions may come in handy if there is a dispute with a customer or the customer asks for a refund.

3. Reliable accounting records

You can run a successful business and make appropriate business decisions by keeping accurate financial records. They play a crucial role since they are required by law to generate an accurate tax return.

If you don't have cash receipts, you run the risk of underreporting sales, which would result in lower taxes and would get you into trouble with the law. Alternately, you risk the consequences of underreporting expenses, which might lead to overpaying taxes and putting you in hot water with the government.

When Do Cash Receipts Become Acceptable?

When a seller receives cash or cash equivalent from an external source, such as a bank, client, or investor, a cash receipt is created using a free receipt template.

Since they can be turned into cash anytime, liquid assets are listed on a company's balance sheet.

Cash is typically acknowledged when money is obtained from a client to reduce the unpaid balance of accounts receivable created when the credit sale transaction occurred.

As a result, it can be viewed as a sum of money that raises the balance of cash and cash equivalent balance on the company's balance sheet.

Where Can You Find Cash Receipts on a Financial Statement

On a financial summary, cash receipts are shown as an addition to the cash account or some other asset account. This is determined by the type of sale.

When a company offers services and receives payment in the form of cash, the amount is added to the company's accounts receivable.

If you sell goods manufactured by your manufacturing division, this will have an impact on inventories. This is in contrast to accounts receivable. In this case, you sold products that already existed.

In this scenario, a company can record the collection of cash payments as an increase to cash or some other asset account.

How to Record Cash Receipts on Your Financial Summary?

Implementing the following three steps will enable you to record cash receipts on your financial statements:

Step-1

Whenever you get paid for selling your goods or services, whether it's cash or a personal check, keep track of the entire amount. To do this, improve your cash balance by crediting cash and debiting accounts receivable.

Step-2

If you received payment for products that you manufactured but did not yet sell, record it as a rise in inventory (debit) rather than an increase in accounts payable (credit).

Depending on the kind of sale that was made, the credit would go to accounts receivable or cash, and the debit would go to inventories.

The increase in inventory brought on by production is reflected as a decrease in inventory after the sale has been made. Unlike an increase in cash, this is not recorded.

Step-3

Recording product returns on financial summary necessitate two things. Recording them simultaneously as reductions in both accounts receivable and inventory. They are recorded by crediting cash and debiting accounts payable.

Final Words

If you do not already create and store cash receipts now is a great time to start by using a free receipt maker tool.

If your business runs on a cash basis, you must keep track of cash receipts. They are essential for carrying out business processes.

Therefore, you should always create a digital cash receipt as soon as you receive one and save the original documents in a secure, accessible place.

Automate Your Cash Receipt Management

Stop struggling with manual accounting operations. InvoiceOwl streamlines your receipt tracking, automates entries, and keeps your financial records accurate in real-time.

Start Your FREE TrialFrequently Asked Questions

No matter the industry, all businesses need cash receipts. A business can more conveniently keep track of its revenue and costs by accurately recording cash deposits. Additionally, it shortens the time needed for a company to figure out how much revenue was generated from clients.

Your cash receipts should come in two copies—one for you and one for the client. The original copy will be kept in the company's records (the business). As proof of payment, the second copy is handed to the client.

If you are writing a cash receipt for a payment received in cash, make sure to include the following information: Date, Items purchased, Quantity of each item, Price of each item, Total cost, Type of payment, Amount of the payment, Your business name, and Contact information.

Cash that was not received throughout the normal course of business is subject to a miscellaneous cash receipt. Examples include money for additional capital investment, loan repayment profits, and refunds from the seller.

It could be challenging to establish an accurate balance sheet if you lose one or more cash sale transaction receipts since the cash account would be incorrect. An incorrect balance sheet might cause business expenses to be underestimated while profit and revenue are overstated. Due to possible overspending, inaccurate estimates of cash flow, and other complications, this could be financially detrimental to your company.