Key Takeaways

- 01A debit memo increases the amount a customer owes due to billing corrections or additional charges

- 02Debit memos are essential for correcting underbilling, billing for extra services, and adjusting prices post-sale

- 03Key elements include date of issuance, debit memo number, original invoice reference, and reason for the debit

- 04Unlike credit memos which reduce amounts owed, debit memos increase customer account balances

- 05Proper management includes accurate record-keeping, automated systems, and clear customer communication

Imagine completing a project for a client and sending an invoice, only to realize later that you forgot to include charges for additional materials or overtime. Resending the invoice isn't an option, so what should you do? The answer lies in issuing a debit memo.

A debit memo is a lifesaver. It allows you to adjust the original invoice without the hassle of reissuing it.

Eager to know how it works and what it comprises?

Let's get into the details and understand its role, best practices, types, and importance in financial transactions.

Table of Content

- What is a Debit Memo?

- What are the Key Elements of a Debit Memo?

- When are Debit Memos Issued?

- Prominent 3 Types of Debit Memos in Accounting

- Debit Memo Vs. Credit Memo - Understanding the Differences

- Top 5 Practices of Managing Debit Memoss

- Streamline Your Financial Management through Debit Memos

- FAQs

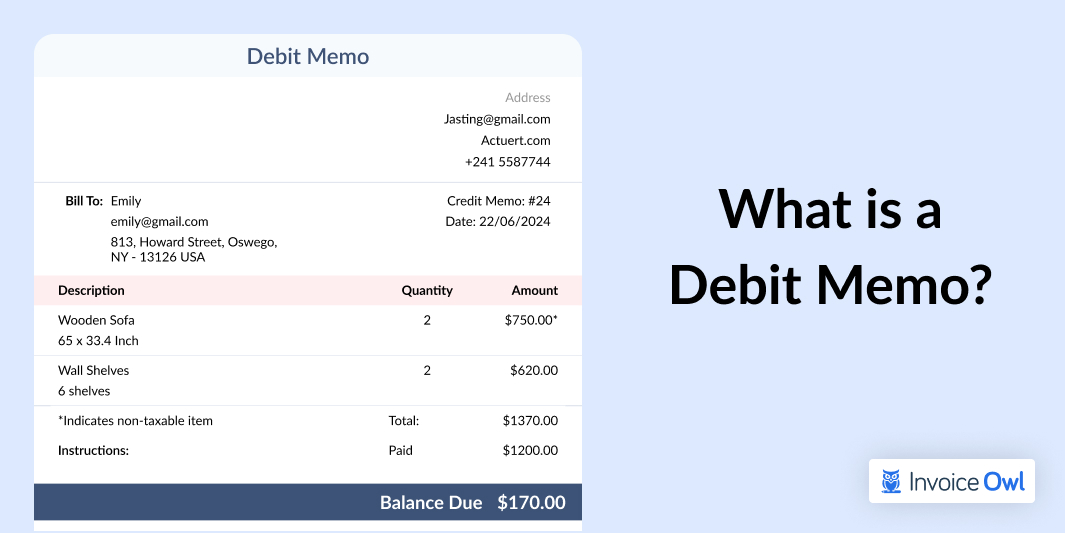

What is a Debit Memo?

A debit memo is a document issued by a seller to inform the buyer or customer that their account has been debited or increased by a specific amount due to additional charges. These memos are generally used in B2B transactions to communicate any adjustments, corrections, charges, or penalties related to a transaction between business partners.

- Documents transaction for accurate record-keeping

- Adjusts undercharges or omissions in original invoices

- Allows companies to promptly bill for any overlooked or miscalculated charges

- Tracks any outstanding debts and accounts for goods that buyers received on credit

Debit memos are a common phenomenon in the banking and finance sectors. When a bank charges a fee, it often issues a debit memo to the affected bank account.

In this case, the fees act as an adjustment rather than a specific bank transaction. This amount is debited from the customer's account and recorded as a debit memo. Additionally, debit memos can be used to correct inaccurate account balances.

Recommended: Difference between a debit note and a credit note

ABC Manufacturing Co. shipped a large order of industrial equipment to XYZ Corp. Due to a clerical error, the invoice sent to XYZ Corp was $5,000 less than the agreed-upon price. Upon discovering this mistake, ABC Manufacturing promptly issued a debit memo to XYZ Corp for the $5,000 difference.

ABC Manufacturing also informed XYZ Corp that their accounts payable balance would increase by $5,000 to rectify the billing error. This document ensured that both companies' financial records accurately reflected the true value of the transaction, maintaining the integrity of their business relationship and accounting practices.

Now that we understand what a debit memo is, it's important to understand the key components of a debit memo.

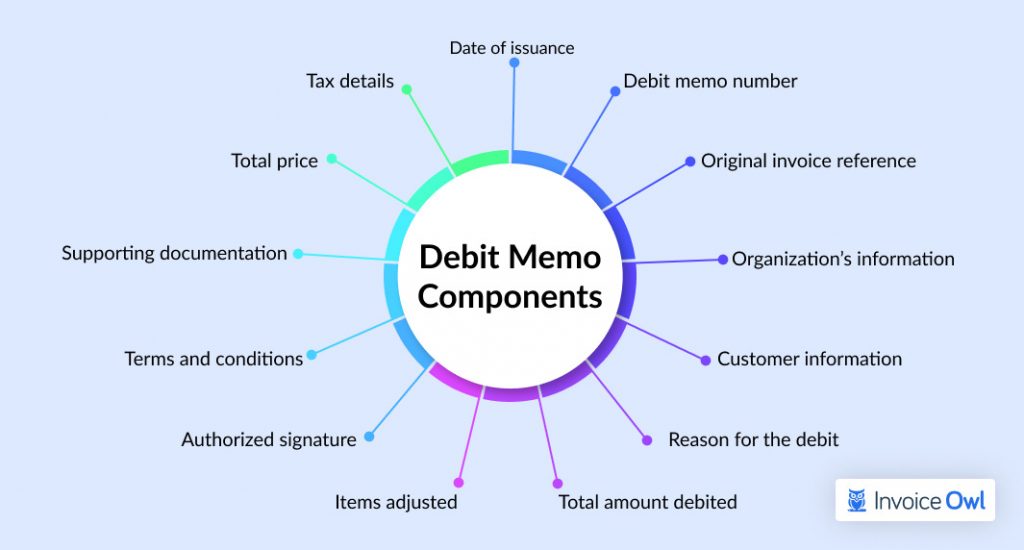

What are the Key Elements of a Debit Memo?

Here is a list of notable elements to include in every debit memo:

After understanding the essential components of a debit memo, let's see when businesses use them.

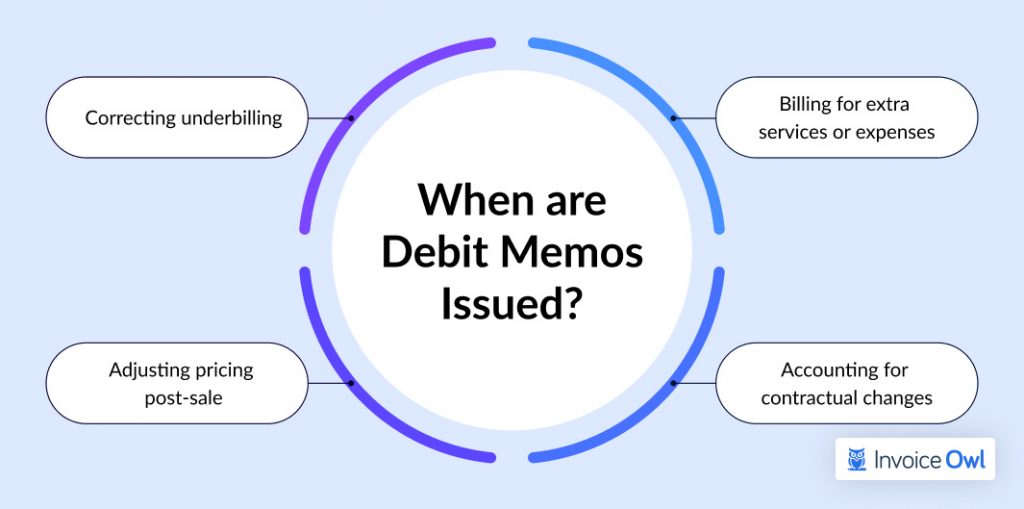

When are Debit Memos Issued?

Here are some primary reasons that prompt businesses to issue debit memos for adjusting financial accounts.

Correcting Underbilling

A debit memo is issued when businesses have underbilled a customer due to calculation errors, incorrect pricing, or oversight in billing for a part of the service. According to the research, 39% of invoices are paid late in the US due to invoicing errors. By raising a debit memo, you can politely inform your customers that they owe a little bit more.

Billing for Extra Services or Expenses

Sometimes an unexpected expense comes up after the initial billing. This might happen when a customer requests additional work or an unforeseen cost arises from your side. With a debit memo, you can add these additional charges to your customer's account while ensuring your financial statements are updated.

Adjusting Prices Post-Sale

When market conditions or costs necessitate an increase in pricing after an initial agreement, businesses use debit memos to formally notify clients of the adjusted, higher charges for goods or services.

Accounting for Contractual Changes

There are instances when businesses have contracts with clauses that require billing adjustments at a later date, like an increase in annual price. When these changes are applied, a debit note is used. It enables the customer or client to know about the new charges as per the contract.

After getting familiar with when businesses issue debit memos, let's understand the different types of debit memos.

Prominent 3 Types of Debit Memos in Accounting

Debit memos come in various forms, each serving a specific purpose in financial transactions and accounting.

Here are the top 3 types of debit memos listed below:

Debit memos on bank statements

In retail banking, a debit memorandum is provided to the account holder when a customer's account balance is reduced for reasons other than a cash withdrawal. Debit memos might result from various sources, such as bank service charges, returned check fines, and charges for printing additional checks.

A debit memo is marked with a minus sign next to the charge and is usually included with monthly bank statements sent to customers.

Internal offsets with debit memos

A debit memo can be created to offset a credit balance existing in a customer's account within the company. When customers pay more than the invoiced amount, the businesses can issue a debit memorandum to offset the credit and eliminate the positive balance.

When the credit balance seems to be large, an organization is more likely to refund the customer instead of issuing a debit memo. This approach is more customer-centric and helps maintain a positive relationship.

Debit memos for additional billing

Debit memos act as a correction tool in business-to-business transactions when a customer is inadvertently undercharged. This adjustment is meant to address billing errors by formally notifying the customer of an increase in their accounts payable.

Suppose a company fulfills the order but invoices the customer for a lower amount than agreed, they issue a debit memo. This document explains the outstanding balance, effectively rectifying the undercharge.

Now that you have an idea about the types of debit memos, let's understand the difference between a debit and a credit memo.

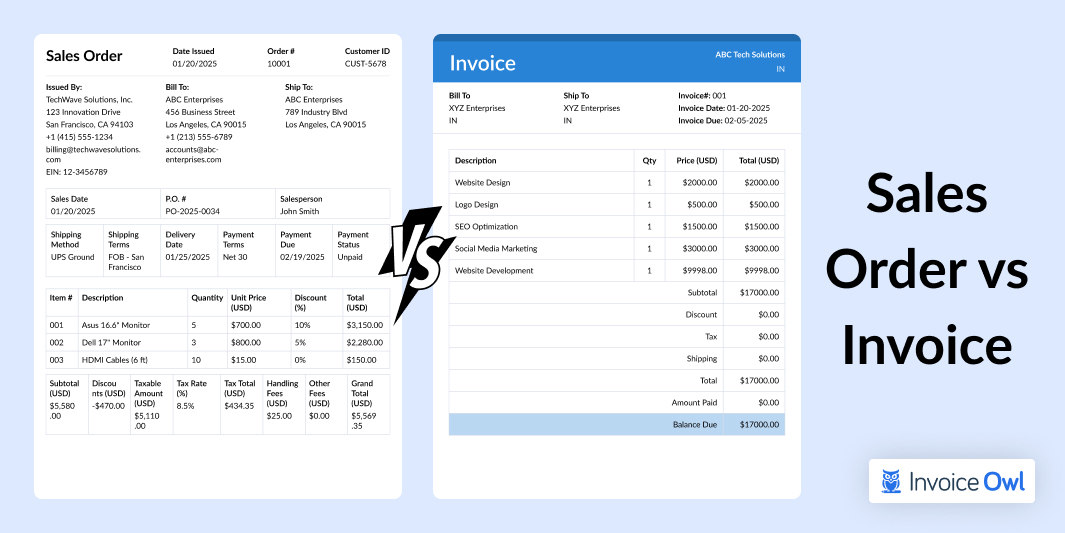

Debit Memo Vs. Credit Memo - Understanding the Differences

Both debit and credit memos serve different purposes in business accounting.

Have a look at the key differences between them for accurate financial record-keeping and effective communication with customers.

Debit Memo vs Credit Memo Comparison

| Aspects | Debit Memo | Credit Memo |

|---|---|---|

| Definition | A document issued to increase the amount a customer owes | A document issued to lessen the amount owed by a customer |

| Purpose | To notify debit adjustment made to customer's account due to billing errors or additional charges | To reduce the amount a buyer owes to the seller due to pricing errors and product returns |

| Effect on customer account | Increases the balance owed by the customer | Decreases the balance owed by the customer |

| Common reasons for issuance | Billing errors, bank fees, adjustments, and internal offsets | Price discrepancies, product returns, and post-price adjustments |

| Accounting impact | Increases accounts receivable or accounts payable | Decreases accounts receivable or accounts payable |

| Examples of usage | Late payment charges and correction of undercharges | Refunds for returned goods and correction of overcharges |

| Document details | Date issued, customer info, original invoice reference, the reason for debit, and the total amount debited | Date issued, customer info, original invoice reference, the reason for credit, and the total amount credited |

| Relation to invoice | Can be issued in conjunction with an existing invoice | Can be issued in conjunction with an existing invoice |

After understanding the differences between credit and debit memos, let's explore the best practices for managing debit memoranda effectively to ensure accuracy and efficiency in your financial processes.

Top 5 Practices of Managing Debit Memos

Effective management of debit memos is essential for maintaining financial records and healthy customer relationships across various business sectors, such as banking and finance, insurance, and utility companies.

Here are the top 5 practices:

Maintain accurate accounting records

A debit memo reflects an increase in revenue and accounts receivable. Accurate accounting entries ensure your financial statements and, thus, reflect your company's current financial situation. This is especially crucial in industries like retail, manufacturing, and federal contracting, where precise financial records are important to keep.

Automate integration with accounting systems

Efficient management of debit memos is important for flawless accounting. The implementation of automated systems offers various advantages, such as timely reminders to issue or process memos, flag any discrepancies, and provide a seamless reflection of these adjustments in your financial statements.

Implementing automated systems provides timely reminders to issue or process memos, flags discrepancies, and ensures seamless reflection of adjustments in your financial statements.

Ensure clear communication with customers

Always state a specific reason for issuing the debit memo, the impact it will have on the customer's account, and the actions they need to take. Clear communication helps avoid misunderstandings and builds trust between the seller and customers.

Provide employee training and education

Ensure that your staff is well-trained in handling debit memoranda. Provide clear guidelines as to when and how to issue these debit memos, along with proper training in communicating with customers. Proper employee training results in reduced errors and better efficiency.

Maintain proper legal documentation

Never forget to regularly review and audit the debit memo transactions. This helps to recognize any underlying errors, understand customer concerns, and ensure compliance with Generally Accepted Accounting Principles (GAAP) standards and accounting policies.

Streamline Your Financial Management through Debit Memos

A debit memo acts as a financial document meant for adjusting invoice amounts or correcting account balances. They play an important role in business financial management, by adjusting billing errors, additional services, or any contractual changes. Debit memos have a big role to play in banking and financial industries in terms of managing fees and correcting inaccurate account balances.

If you have a proper understanding of debit memos, you will be able to manage them efficiently. This will result in accurate financial records, streamlined financial transactions, and improved trust among businesses and customers. Handling debit memos by implementing the best practices leads to effective financial management and overall business success.

Stop Losing Money on Invoice Errors

Tired of billing mistakes and payment delays? InvoiceOwl helps you manage invoices, debit memos, and credit memos with precision and ease.

Start Your FREE TrialFrequently Asked Questions

The term force pay debit memo refers to a specific type of transaction that a financial institution like a bank uses to enforce payment before an account is debited. This kind of debit memo implies that a code on the accounting system is forcing a purchase to be cleared before taking further steps.

In compliance with Regulation E (Electronic Fund Transfers), which requires banks to obtain customer authorization for automatic debit transactions, Force Pay Debit Memos ensure that customers are notified and agree to the terms before processing the transaction.

No, a debit memo is meant to adjust the amount owed on an existing invoice. Whereas an invoice is a request made for payments of products or services provided. Creating invoices manually is a cumbersome task, but you can opt for invoice-generating software for all your invoicing template needs.

The key differences between a debit memo and a refund are:

- A debit memo increases the amount owed by a customer or reduces their account balance, while a refund returns money directly to the customer.

- Debit memos are recorded as increases in accounts payable or decreases in account balances, while refunds are recorded as cash outflows and reductions in revenue.

Yes, debit memos can be used in accounts receivable for increasing the amount a customer owes, whereas in accounts payable to record an increase in the amount owed to a supplier.

Yes, it is possible to dispute a debit memo. All you need to do is respond within 30 calendar days of receiving the memo. Under Regulation E by the Federal Reserve Board, consumers have the right to dispute incorrect electronic fund transfers, including debit memos. When you dispute it, you will have to address the issue raised in the first place and the reason behind considering it invalid.

Debit memos are issued to inform the customer about any deductions made from their accounts. Some of the most common reasons for issuing debit memos are bank fees, such as maintenance fees, overdraft fees, or wire transfer fees and other internal adjustments to rectify positive balances. These memos act as formal notifications for reducing the account balance for a particular reason rather than regular transactions.

A debit memo and a billing adjustment are similar but are not identical. A debit memo is a specific kind of billing adjustment that increases the amount a customer owes on an existing invoice. Every debit memo is a billing adjustment, but not all billing adjustments are debit memos. Billing adjustments can also include credits or various other modifications to the invoice.

When customers come across an incorrect debit memo, they should get in touch with the issuer to dispute the charges. They should provide a proper explanation that supports their claim and request a correction or reversal of the debit memo.