Key Takeaways

- 01A debit note is a formal document used to request adjustments for billing errors, returned goods, or damaged products

- 02Buyers issue debit notes to reduce amounts owed, while sellers may issue them to increase billing amounts or remind customers of debt

- 03Debit notes differ from credit notes in purpose: debit notes reduce payables, credit notes reduce receivables

- 04Proper debit notes include invoice references, clear descriptions, quantities, amounts, and reasons for adjustment

- 05Timely issuance of debit notes maintains transparency, ensures regulatory compliance, and strengthens vendor relationships

For business owners, in particular, debit notes and credit notes are perceived as official accounting documents.

These notes, which stand alone from an invoice, let customers know how much they owe or, alternatively, how much credit is available to them from the business.

In addition, they are essential for tracking shipments, determining when payments are expected, and figuring out whether the account still has any available credit.

There are many different kinds of notes, but debit notes are one of the most important ones that businesses should be aware of.

Watch this:

This note is crucial for the company's buying and selling processes; thus, it must be collected and archived.

Continue reading to find out more about a debit note, including what it is, when it is issued, and how it differs from a credit note.

Table of Content

- Understanding Debit Notes

- When to Issue a Debit Note?

- Detailed Procedure of Issuing Debit Notes

- Alternate Forms of Debit Notes

- Comparing Debit and Credit Notes

- Conclusion and Next Steps

- Frequently Asked Questions

Understanding Debit Notes

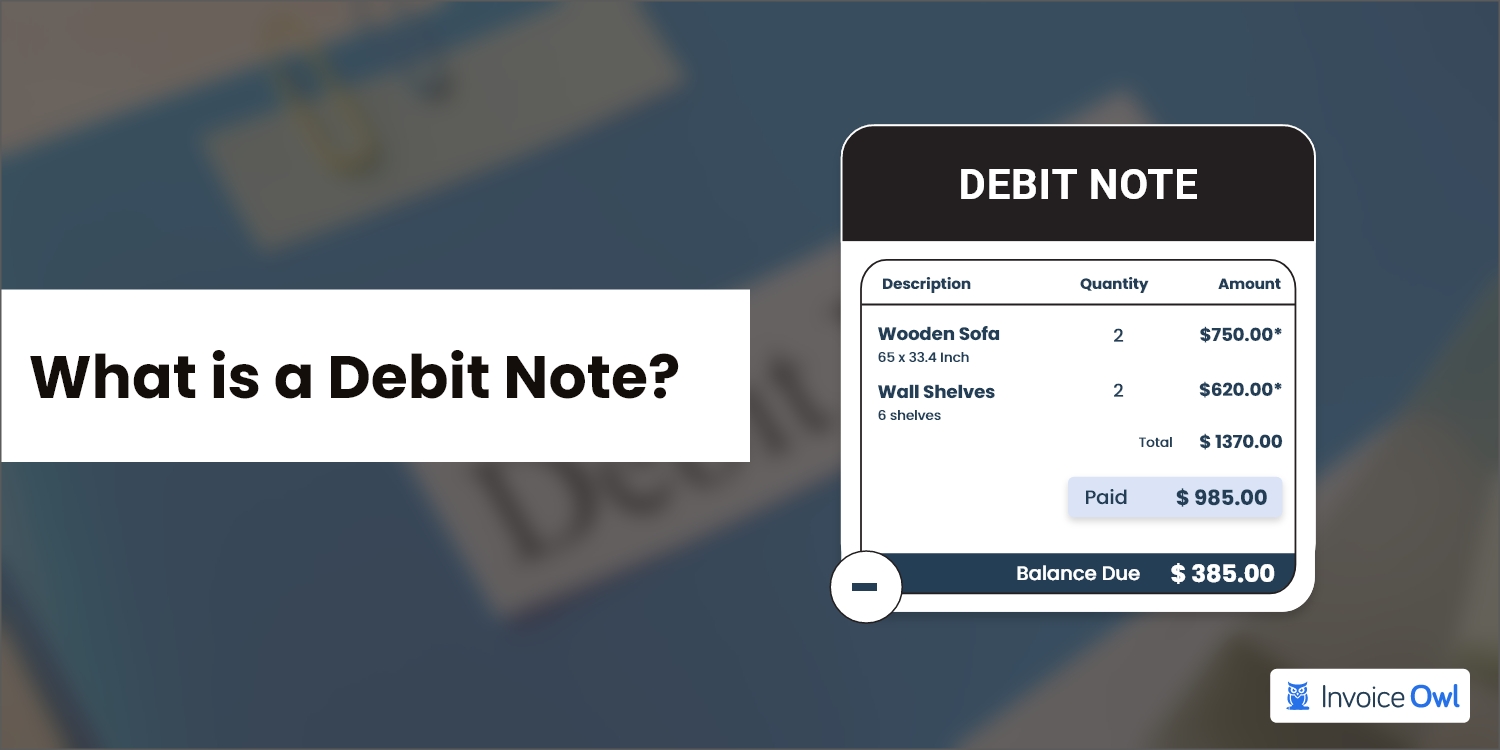

A debit note (sometimes known as a debit memo) is a document that a seller will give to a buyer to inform them of current debt obligations.

These notes are frequently used in business-to-business transactions, such as when one company provides another with goods or services before sending an official invoice. For documentation, the debit note "takes note" of the transaction.

These deals frequently entail a credit extension, in which the vendor sends a shipment of products to the buyer's business before the buyer has paid the purchase price. The note informs the purchaser that the vendor has debited money from their account.

Definition and basics

A debit note is a document issued by a buyer to a seller to communicate a reduction in the amount owed. Generally, this situation arises due to various issues like overbilling, returned goods, or damaged products. This document acts as a formal request for adjustment in the supplier's invoice. It also ensures that both parties have clear records of the corrections done.

The fundamental principles of a debit note consist of the buyer asking for a reduction in the amount owed to a supplier. Debit notes come in handy to maintain accurate financial records facilitate clear communication between buyer and seller, and ensure transparency in business transactions.

Importance of debit notes

Debit notes play an essential role in correcting financial discrepancies and maintaining clear communication between both parties.

Use cases of debit notes

Debit notes are essential tools for adjusting financial discrepancies and maintaining accurate records. Generally, they are used in the scenarios listed below:

- Returned goods: Issued by buyers to the suppliers for wrong or defective products

- Billing errors: Correcting overcharges or any discrepancies in invoices

- Service adjustments: Adjustment in charges for modified or canceled services

- Bulk orders: Correcting cost differences for changes in quantity

When to Issue a Debit Note?

A purchaser issues a debit note to initiate a purchase return for items bought on credit when:

- The vendor is negligent in failing to deliver the products or services on schedule.

- The seller delivered inferior quality goods that were defective, broken, or in the wrong size, shape, or quantity.

- There are higher taxes on certain goods and services.

- Calculation errors result in overbilling for goods or services.

- The buyer is no longer interested in making the purchase.

A seller may also issue a debit note in the following cases:

- In the event that the seller requests invoice revisions

- When a seller modifies (increases) the billing sum

- When the customer increases the order quantity

- In order to remind the purchaser of their existing debt obligations

Detailed Procedure of Issuing Debit Notes

Debit note issuance needs a structured approach to ensure compliance and accuracy. A well-prepared debit note supports transparent communication and avoids potential disputes. It plays an essential role in correcting transactions and addressing discrepancies.

Steps in issuing a debit note

Identify and validate the issue

Examine the issues like pricing discrepancies, defective goods, and overbilling. Collect all the supporting documents such as original invoices and purchase orders to validate the claim.

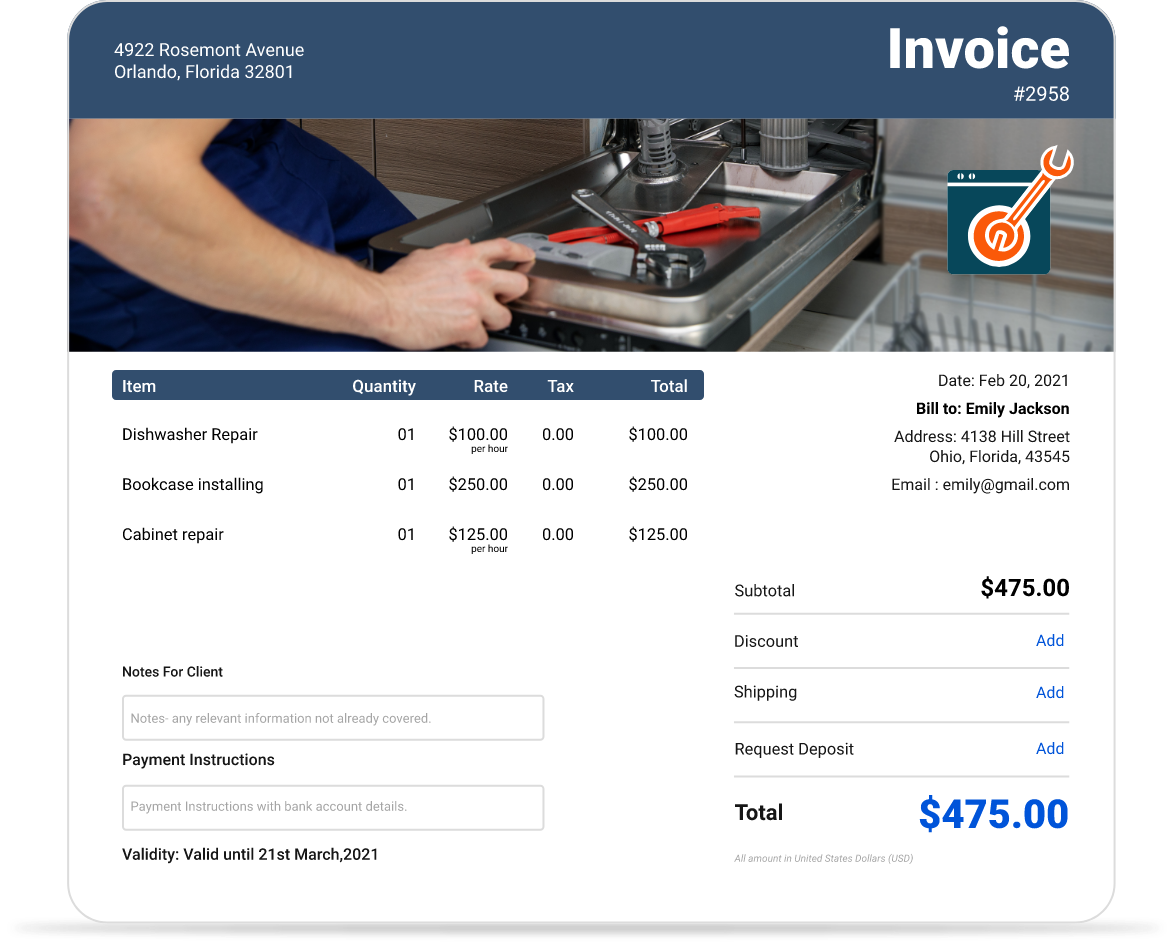

Draft the debit note

Add some important details like the invoice number, product or service description, quantity, and total amount. Make sure you comply with all the important tax and business regulations.

Send the debit note

Share the debit note with your client through email or any other channel. Additionally, request acknowledgment to confirm receipt.

Record and reconcile the adjustment

Keep your accounts updated to reflect the debit note changes, reducing the amount payable or the corresponding adjustment.

Key considerations in issuance

While creating a debit note, businesses must follow the best practices for legal compliance. With careful documentation, you can ensure effortless adjustments while building professional relationships.

Key Considerations for Debit Note Issuance

| Aspect | Key Details |

|---|---|

| Reason for issuance | Clearly identify the purpose, such as correcting errors, addressing defective goods, or pricing adjustments. Attach relevant documents for validation. |

| Clarity and transparency | Include precise details like invoice references, amounts, item descriptions, and adjustment reasons to avoid misunderstandings. |

| Regulatory compliance | Follow applicable tax laws and business standards to ensure the debit note meets legal requirements. |

| Timely issuance | Resolve discrepancies promptly to build trust and maintain professional relationships with clients. |

Alternate Forms of Debit Notes

Businesses sometimes use debit notes to bill for products that are not part of their core business. For instance, a business may issue a debit note for the rent if it sublets portions of its warehouse space.

Debit notes can also be used to fix invoice errors. For instance, if a client receives a lesser amount than what was charged on an invoice, a debit note could be issued to compensate for the difference.

Debit notes may be offered as shipping receipts with delivered items in addition to the letter format. Although the balance outstanding may be mentioned, payment is not expected until the buyer receives an official invoice.

This might give a buyer the option to return items without having to first make a payment if needed.

Some debit notes could be delivered in the format of informational postcards, which simply serve to remind the customer of the debt they have incurred.

This is beneficial in situations where the seller is unsure whether the initial invoice was acknowledged or reviewed. Additionally, the postcard might include details on how to pay the debt with relevant contact information.

Comparing Debit and Credit Notes

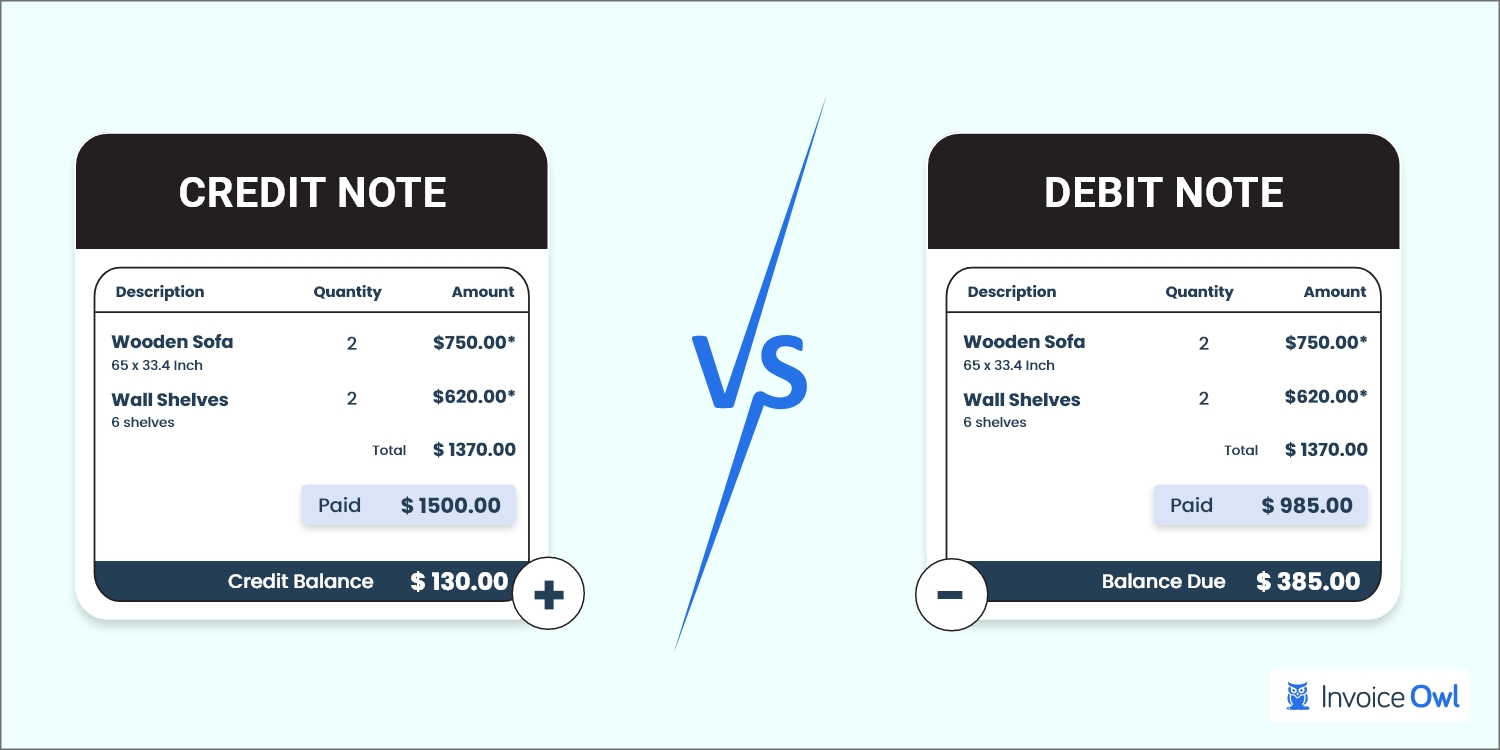

Debit and credit notes act as financial adjustments in business transactions while differ in their purpose and impact. This section showcases their differences to specify their respective roles, to ensure businesses use them effectively.

Differences explained

Here's a comparison between debit notes and credit notes:

Debit Note vs Credit Note Comparison

| Aspect | Debit Note | Credit Note |

|---|---|---|

| Definition | Issued by a buyer to inform the seller of a return or error requesting a reduction in the payable amount. | Issued by a seller to notify the buyer of a reduction in the amount owed. |

| Purpose | Indicates that the buyer's account has been debited (the amount payable has been reduced). | Indicates that the buyer's account is credited (refund or adjustment issued). |

| When issued | When goods are returned or a billing error favors the buyer. | When discounts, refunds, or billing errors favor the buyer. |

| Impact on accounts | Increases receivables or decreases payables for the issuer. | Decreases receivables or increases payables for the issuer. |

| Document content | Includes details of returned goods, amounts, and reasons for adjustment. | Includes reasons for credit, such as overpayment or discounts. |

Examples in practice

A contractor comes across inferior material delivered by a supplier for a residential project. To raise this issue, the contractor issues a debit note to specify the defective material, quantity, and cost reduction. The supplier acknowledges the adjustment by issuing a credit note to reflect the compensation.

A landscaping company overcharges a client for services offered due to a billing oversight. To rectify this error, they issue a credit note. This document enables the client to offset the amount in their next invoice.

Conclusion and Next Steps

We hope this blog provided you with appropriate insight on how debit notes work, on what grounds they can be issued, and how they differ from credit notes.

If you wish to easily create customized credit notes using credit note template and keep your customer accounts updated, then going digital and leveraging credit note management software is the key to achieving automation in your work processes.

It will help you impress your clients, work smarter, and get paid faster!

Create Professional Debit Notes in Minutes

Stop wasting time on manual paperwork. InvoiceOwl helps you create professional debit notes and credit notes with ease, keeping your accounts accurate and your clients satisfied.

Start Your FREE TrialFrequently Asked Questions

A debit note is a documented record issued by a purchaser to the seller in the event of a purchase return. Alternatively, sellers that want to correct an underestimated invoice will submit a memo to the purchasers. This note is sometimes also known as a debit memo.

A debit note is a declaration in writing of a purchase return delivered to the seller by the customer. The document also includes a list of justifications for returning.

On the other hand, an invoice is an itemized bill that a seller issue and sends to a buyer when a sales transaction is complete.

It is a notification sent by a seller to a buyer that credit has been applied to their account. These documents are sometimes known as credit memos. You may send a credit note if you need to cancel all or a portion of an invoice.

The common misunderstandings surrounding debit notes are being mistaken as invoices. But, in reality, they serve a different purpose like correcting errors or adjusting amounts in prior transactions. Another confusion is about it being only for the buyers, whereas suppliers can also use them to request payment corrections.

The most important advice for beginners using debit notes is to ensure that the debit note consists of clear references to the original invoice. Ensure proper documentation and issue the debit note promptly to avoid any potential disputes and streamline the process of account reconciliation.