Key Takeaways

- 01Sales receipts serve as proof of completed transactions and must be issued after full payment is received

- 02All receipts should include essential information like item details, quantities, prices, taxes, and payment method

- 03There are multiple types of sales receipts including cash register, handwritten, digital, and specialized receipts for different industries

- 04Sales receipts differ from invoices - receipts confirm payment received while invoices request payment

- 05Proper receipt management is crucial for bookkeeping, tax preparation, legal compliance, and inventory management

Sales receipts are a necessary and everyday part of business operations. In fact, they are so prevalent that if you work in retail, you might take their presence in your business for granted.

However, paying considerable attention to your receipts when running a company is crucial. The details they contain, how they are generated and issued, can all impact your accounting and finance.

Therefore, you should always give customers a receipt after they purchase products or services from your business.

Sales receipts come in various forms, and your business will use the appropriate ones applicable to the specific sale. People keep their receipts for various purposes, such as tax preparation, employer reimbursement, and personal bookkeeping.

The customer's sales receipt serves as their documentation of the transaction, including what was purchased and the total amount paid.

Let's dive deeper and understand what is a sales receipt, its many types, and the many advantages it can offer.

Table of Content

- Definition and Overview of Sales Receipts

- Why Sales Receipts Are Important

- Fundamentals of Sales Receipts

- Different Types of Sales Receipts

- Sales Receipts vs. Invoices

- Why Issue Sales Receipts

- Specialized Receipt Types

- Summary and Final Thoughts

- Frequently Asked Questions

Definition and Overview of Sales Receipts

A sales receipt serves as proof of the products or services a company has provided. They are only provided to clients once the receiver has received the goods or services.

Additionally, payment for the goods or services must be made in full prior to delivery in order to receive a sales receipt. Business owners may choose to offer partial receipts to customers who are paying for a product or service in installments.

Partial receipts enable both the client and the company to keep a record of the amount that is still owed. The balance will often be shown on these receipts after payment has been received.

Receipts are typically used as proof that a company has provided clients with goods or services. In this way, it is clear that the product or service has been received without any doubt or dispute.

Why Sales Receipts Are Important

Sales receipts show how much money your company has generated over time. They are essential for business accounting needs because they record sales as well as taxes paid.

All small businesses require an effective receipt management system. This makes it possible to create receipts efficiently, which is essential for accurate record-keeping.

Additionally, maintaining client satisfaction can be impacted by poor sales receipts. It can be difficult to tell what customers have actually received if erroneous receipts are issued to them.

Fundamentals of Sales Receipts

All receipts have a similar appearance. They also include standard information regarding the completed transaction. Typically, the following details are mentioned:

In addition to these, certain receipts will provide extra information. Along with the details mentioned above, CRA-compliant receipts also include the following:

- The name of the business

- The time, date, and location where the sale was completed

- The seller's GST/HST registration number

- Contact details of the company, including a contact number, email address, and website URL

- The name of the salesperson who processed the transaction or the registered station number where the transaction was processed

In addition, some businesses will adopt a sales receipt template that is unique to their company. A longer sales receipt document can be printed when offering services that necessitate more accurate documentation.

Companies like repair shops frequently use handwritten receipts to list the services rendered on vehicles. After the document is printed, it can be manually filled out with service details, parts used, and labor costs.

Different Types of Sales Receipts

You can create a variety of receipt kinds as long as they include the fundamental details mentioned above.

Although there is no universal format for receipts, certain industries frequently create a form that becomes the de facto norm. Here are a few typical choices:

Traditional Cash Register Receipts

The most frequent use of this popular receipt style is in retail transactions with customers. Cash register receipts are typically used in gas stations, grocery stores, and specialty stores with set locations. For businesses with high-volume transactions, the automatic printing and speedy tear-off functionalities of the receipt are helpful.

Handwritten Receipts

These are popular for providing personalized service and making spontaneous sales. For instance, a landlord may prefer handwritten receipts to confirm a renter has paid rent. A book of carbons could also be used by business owners operating out of temporary and makeshift booths, such as those at trade shows or conventions. These can also be used by contractors who seek out new clients on the job, like a roofing or landscaping specialist who pays home visits to prospective clients.

Invoices

These are fairly common records for B2B sales. Some buyers of goods and businesses that pay for services request receiving invoices in a specific format based on their organizational bookkeeping. Although they are frequently printed and sent, invoices are increasingly being generated and delivered online.

Packing Slip

Companies that ship goods to customers instead of making in-person sales use packing slips. The packing slip includes a list of every item that is shipped to the customer, along with the price and the company's contact details. Additionally, a return label might be included, depending on the business, and the slip is bundled with the delivery.

Digital Sales Receipts

Nowadays, receipts aren't exclusively handed out on paper. More and more companies are providing customers with digital sales receipts. In larger chain stores, customers can select the type of receipt they want to get after making a payment with a debit or credit card. Your company must keep up with the latest technological advancements in receipts.

The primary difference between paper sales receipts and digital sales receipts is the amount of information they contain. Since digital sales receipt has no physical limits, the information on them can be far more comprehensive.

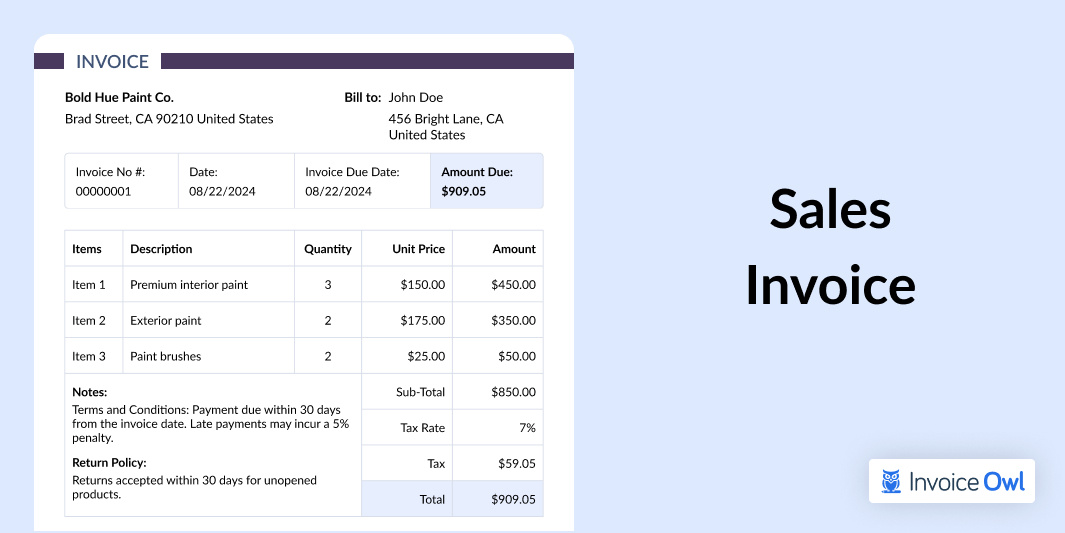

Sales Receipts vs. Invoices

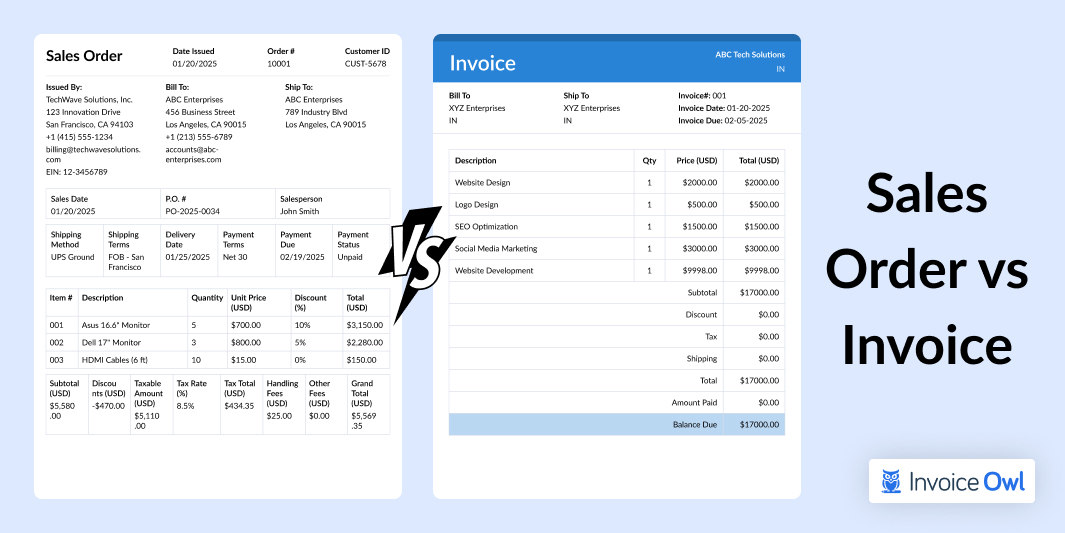

Sales receipts and invoices are pretty similar. They both record a sale and include a lot of the same information. Two factors that set a sales receipt and invoice apart are when they are issued and how you use them in your accounting.

Sales Receipts vs. Invoices Comparison

| Aspect | Sales Receipt | Invoice |

|---|---|---|

| Purpose | Proof of completed transaction | Request for payment |

| When Issued | After payment is received in full | Before payment is made |

| Industry Usage | Common in retail sector | Common in service sector |

| Accounting Function | Documents completed sale | Tracks pending transactions |

| Payment Status | Payment completed | Payment pending |

Usually, a sales receipt serves as proof of a successful transaction. It is issued after a payment has been received in full. On the other hand, invoices just document a part of a transaction. They are typically issued before payment and are used to keep track of sales.

The service sector uses invoices more frequently than the retail sector. Occasionally, retail establishments will send invoices to clients with credit accounts so they can receive the merchandise first and pay later.

Why Issue Sales Receipts

The issue of sales receipts is important, as it's critical to have a written record of all company transactions, regardless of whether you send out sales receipts or invoices. The following are some of the major benefits of issuing sales receipts or invoices:

Bookkeeping and Reporting

Because they can generate a written record of every sale, invoices and receipts serve as the bedrock of your accounting system. Copies of all sales receipts, whether printed on paper or provided electronically, should be kept in a file system. You can ditch the paper and pen and subscribe to cost-effective and reliable accounting software or invoicing software such as InvoiceOwl to generate multiple, errorless invoices with complete automation.

Tax Preparation

Because they give a comprehensive written account of your earnings, sales receipts are also essential for preparing your tax returns. You should also save your receipts for business expenses.

Legal Compliance and Protection

You might need to review sales receipts in addition to filing tax returns if a lawsuit is made against your company. The date you rendered services and the timeframe for any job completed are both shown on sales receipts. On the other hand, invoices are incredibly useful since they include payment terms, which is handy for tracking down late payments.

Inventory Management Advantages

Finally, issuing receipts and keeping them on hand can help with inventory management. Receipts can be used to keep track of transaction data, so you can determine what products are being sold and when. This aids in estimating the demand for products and future projections.

Whatever format you use for your sales receipts, be sure it is appropriate for simple recordkeeping. Issuing invoices and receipts is a simple process, thanks to online filing systems and accounting software. If you save them online, you may also access the information whenever you need it for your financial statements.

Specialized Receipt Types

Specialized receipts are customized to meet specific documentation requirements for various industries and transactions. Here's a detailed explanation of 5 types of specialized receipts:

1. Retail receipts

These receipts are the most common ones and are issued at the point of sale. They are issued to itemize the products, quantities, prices, taxes, and final total to confirm the purchase of a product. In the U.S., they often include item details such as name, description, and SKU or barcode.

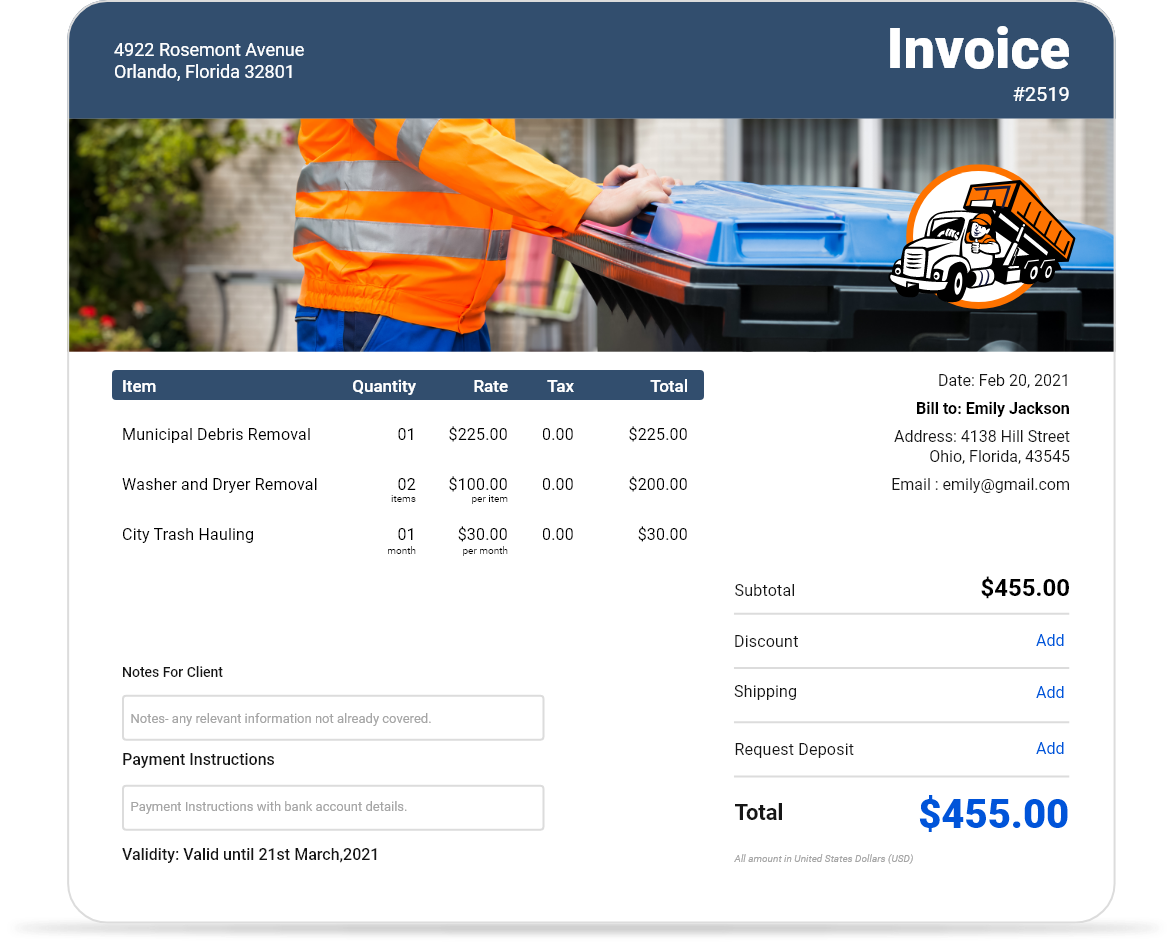

2. Service receipts

Professional service providers generally use these receipts for repairs and consultations. Commonly issued by professionals like mechanics, consultants, and contractors They list the labor costs, hours worked, and material charges to offer a breakdown of fees to the clients.

3. Online purchase receipts

These receipts are used in eCommerce transactions to list item purchases, shipping costs, taxes, tracking details, and payment confirmations. These receipts are tailored for online shoppers and include itemized purchase details, like products purchased, unit prices, and totals.

4. Donation receipts

Non-profit organizations issue these receipts to the donors. They specify the donation amount, date, and purpose while also serving as proof for tax deduction claims. U.S.-based 501(c)(3) organizations mostly issue these receipts, which meet IRS requirements for tax-deductible donations.

5. Rental receipts

These receipts are commonly used in real estate or equipment leasing. They consist of the rental period and property address to offer clarity to both parties. These receipts are crucial for landlords and tenants to maintain transparency and legal compliance.

Summary and Final Thoughts

Sales receipts assist you, as a small business owner, in maintaining precise financial records. Therefore, an efficient receipt management system is essential to accomplish this.

A more advanced solution is to keep digital copies of your business transactions on your point-of-sale device's database. When it is time to settle the financial books, you can use the stored data to fill out a spreadsheet.

However, you do not have to wait until the end of the day to calculate sales. You can do that instantly with a cloud-based tool even as your sales representatives are still at work.

Along with that, you can also generate invoices with an invoice generation software and create receipts with a electronic receipt maker software. This is your sign to go digital and ditch paper and pen.

Get Your Receipt Generator on a Single Click

InvoiceOwl has an in-built receipt generator for you. Start creating and sending it to your customers today with our automated platform.

Start Your FREE TrialFrequently Asked Questions

The amount of money collected during a business transaction involving the exchange of cash or cash equivalents is acknowledged in writing on a cash receipt. The vendor gives the client the original copy of the cash receipt; the seller retains the second duplicate for recordkeeping purposes.

The primary distinction between an invoice and a sales receipt is that an invoice is sent before a company has received money from a customer, but a receipt is issued after a customer has paid.

Yes, invoices act as a receipt once they are paid. This document confirms both the payment and transaction details for record keeping.

No, pack slips serve as a reference, not as a formal receipt unless additional payment details are added. This document includes detailed shipped items but lacks payment confirmation.

Digital receipts provide documentation, reduce paper waste, and integrate seamlessly with different financial software for better tracking.