Here, we'll look into the three distinct W's of the quoting process: what is a quote, when should you send a quote, why you need to send a quote, what is the invoice quote process, and why you need to pay the charges. If, for example, you have a faulty refrigerator and you make a call to a repair service or sales rep, then they will tell you how much you are spending to repair the refrigerator. You badly need to get the fridge working again, but it'll take time to process what the amount you're told to pay will cover. You need to inquire about the total service you are paying for, so you can request a quotation invoice for the service. Once the service provider gets the invoice request, they will inspect the work, give an estimation, quote, or invoice you are seeking, and break down the quote process to make you understand why you need to pay the charges.

You need to inquire about the total service you are paying for, so you can request a quotation for the service you're seeking.

What You'll Learn

- 01What a quote is and when to send one to customers

- 02The key differences between quotes and invoices

- 03Essential elements every quote and invoice should include

- 04How the invoice quote process works from start to finish

- 05Best practices for creating professional quotes and invoices

Table of Content

- What is a Quote?

- When Should You Send a Quote?

- Why Should You Send a Quote?

- What Should Your Quote Include?

- What are the Benefits of Providing a Quote?

- How to Request an Estimation/Quote?

- What is an invoice?

- Factors to Consider When Creating Invoices

- How Does the Invoice Process Work?

- Difference Between a Quote and an Invoice

What is a quote?

A quote is a watered-down analysis of different charges that add up to the total cost of a service or line item rendered. A quote cannot be altered once it has been agreed upon by the service provider and the customer.

When Should You Send a Quote?

A quote is usually sent upon request by the customer. When a customer calls to inquire about the service or line item you render and you are ready to take up the job, the next course of action is to send a quote for the project breakdown. You should issue a quote and ensure a formal agreement is reached between you as the service provider and the customer before you start work. To the customer's understanding, a quote is a documented record to look into as they browse other competitors to compare the differences in rates. When you email a quote and a formal agreement is reached, this shows that you are more professional on the business side than another vendor that sends a quotation over a text message with just the total amount. Your quote can easily be referenced compared to a text sent to notify a customer of the total amount to maintain the cash flow.

Why Should You Send a Quote?

A quote clarifies to the client what they are going to be spending on. It also helps to ask the service provider that every service you render in the course of executing the job is accounted for, including any purchase you make to complete the job. A quote also serves as legal proof of an agreement between both parties, the service provider and the recipient of the service or line item. With the quote, you can be sure that you'll get what you worked for after the whole job has been completed, based on the documented terms of the agreement. It can also be used in settling disputes between an employee and an employer, while the job is being executed.

What Should Your Quote Include?

Aside from the payment breakdown, there is vital information that should appear on the quote:

In addition, a detailed outline of the job should be stated in the quote. This outline includes hard costs; what is to be purchased for the job to complete. The quote will also contain every cost or labor input until the job is completed. If you wish to make your pricing look professional, you should read up on how to price your services, including other details that were discussed with the client during negotiations. Some quoting features or programs will help you custom quote templates just like a typical sample below. Just a few clicks of the invoicing software and you can send the full quote to your client via email. It will also help you maintain your business finances in just a few clicks. It can help you in order management, order fulfillment, and maintaining your sales team, finance team, and customer information at the same time by providing an outstanding browsing experience. Some website functionality also offers to make payments in dollar amounts or in other currencies. It also saves credit card, debit card, and bank information including advance payment terms for making invoice payments in one platform. For small business owners, the advantage of knowing how to write a correct quote that covers all expenses and services to be rendered is a great addition to your skills.

What are the Benefits of Providing a Quote?

Tips to Provide Quotes Following these tips when providing quotes helps you win more customers than before. So, want to try? Here is the list of types to follow:

Make the process transparent

Irrespective of your business type, maintaining transparency when it comes to quality service and pricing is of utmost crucial. Staying disciplined in maintaining transparency would help you win more jobs.

Transparency in pricing builds trust with customers and helps you win more jobs compared to competitors who aren't upfront about costs.

Never Undercut Your Costing

Always make sure that you list down all possible expenses so that you and your client can be on the same page. If at all any change comes up, you can create a change order and send it to your client. Moreover, you can even tailor-make your quote and send it to your customer.

Organize Estimating Through Software

Paperwork would be troublesome when it comes to preparing quotes. That's the reason, the software would be an escape. With software, you would be able to create unlimited estimates a day, and there would be no paper crumbles here and there.

How do I Request an Estimation or Quote?

A small business owner might request a quote in case they need to hire a specialist or a contractor or subcontractor for a job. For that, they need to send a "request for a quote" to not just one vendor but to multiple vendors, who can send them price quotes. A quote request should be clear and concise, and it should mention on what date the customer wants the quote. Customers need to include the quality of products they intend to opt for. For services, they need to specify which one they want to choose. Also, for the comparison, they can mention special requests they are interested in.

What is an invoice?

An invoice is a piece of documentation that is sent to the customer once all the work for which you are hired is completed. This document consists of the following information:

Wherever the work assigned is completed, you must send an invoice within 48 hours. The more time they get to pay, the quicker the payments are processed. Plus, your customers are also saved from unnecessary penalties that might make a bad impression in their minds. Penalties, interest, or late fees charged on overdue or unpaid invoices should be notified to your customers. There are chances when customers fail to pay on time, and these penalties help you recover your money. Make sure you include penalties under your payment terms. This helps your customers know the late fee charges they need to pay if failed to pay dues on time.

Factors to Consider When Creating Invoices

Make it Obvious

You should prepare an invoice in such a way that your customer knows that it comes from your business. Using software like InvoiceOwl helps you add your business logo to your estimate or invoice. A well-written invoice with proper spacing and text also wins the heart. Everyone likes well-organized invoices or estimates since it is easily readable and understandable.

Present a Professional Behavior

Not all customers will pay you on time, some might delay and a few might ghost you. In such a situation, you need to keep yourself calm and find a practical solution rather than panicking. Firstly, maintain or initiate a conversation with your client so that you stay in touch with them and get paid either fully or partially. Troubling your client with legal actions should be the last decision call.

When dealing with late payments, always maintain professional communication. Legal actions should be a last resort after attempting to resolve payment issues amicably.

Always Prefer Sending Digital Invoices

E-invoices should be sent to your clients instead of hard copies. One of the benefits of creating and sending digital invoices is you receive a notification whenever it is opened or processed. Another benefit is there is no chance of misplacement. Lastly, you have specific columns for every field, such as payment terms, due dates, discounts, rates, taxes, and notes.

Don't Restrict With Single Payment Method

Since you don't know which payment method your customer uses, you must offer them multiple payment options. Offering only one or two payment methods would have multiple negative effects; delay in payment and customers abandoning your brand. Credit cards, Apple pay, Debit cards, Stripe, and Paypal are some of the examples that you look for in the software.

Keep an Eye on Cash Flow

Having a sense of cash flow is important to run any business. Whenever you complete your job, make sure you send invoices to your clients. Having extra cash on hand is no bad deal since anytime any emergencies might crop up and you would need the money. Plus, this would also help in maintaining the financial health of your business.

Now that you know the factors, let's know the working process of invoices.

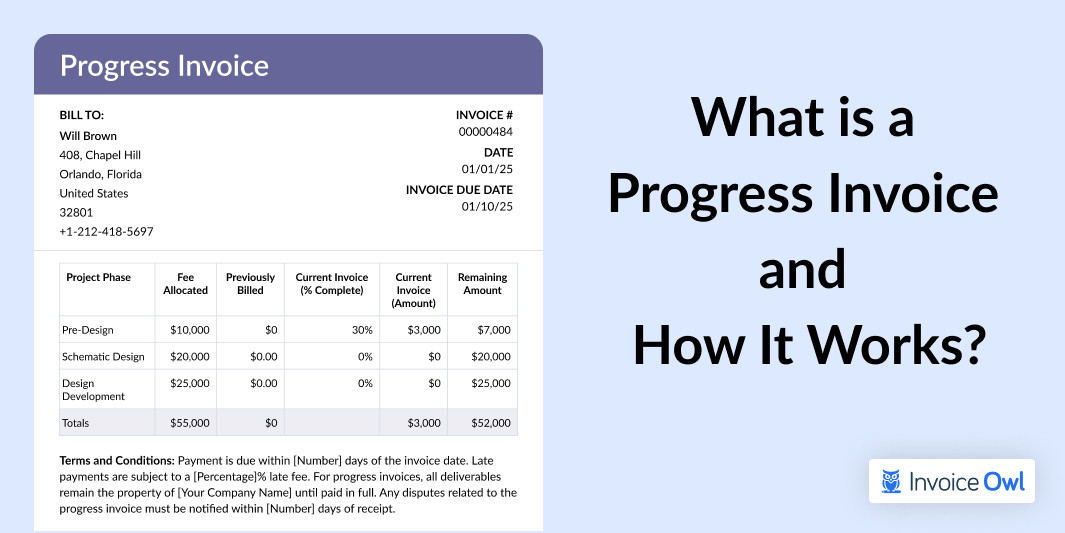

How Does the Invoice Process Work?

No matter you run a small business or MNC, the process of invoicing remains the same everywhere. Below is the smooth and swift invoicing process:

- A customer inquires about products or services

- You send an estimate or quote

- The customer approves the estimate/quote sent by you

- You start shipping products or offering services

- Initiate invoice with all details of parties involved, rate, and line items

- The invoice is sent to the customer

- Customers get time to verify invoices and pay on certain days (mentioned in the invoice)

- Customer makes full payments through convenient payment gateways

Create Professional Invoices Online Easily

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers and contractors to create invoices on-the-go and get paid quicker!

Start Your FREE TrialDifference Between a Quote and an Invoice

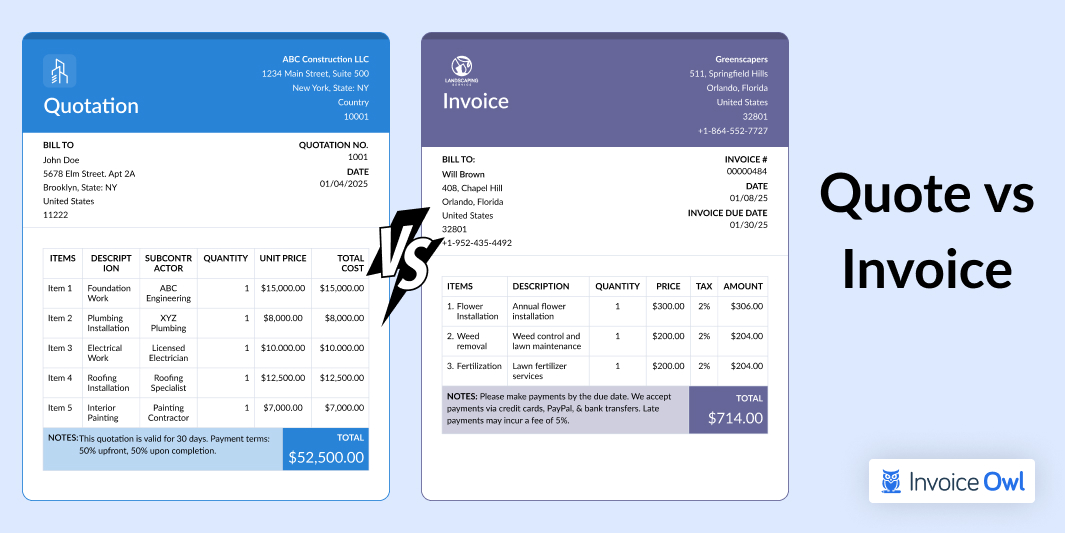

Many times, people are curious to know the difference between a quote and an invoice. So let's take a look at both of them to know them a little better, and get the best out of them.

A Quote

A quote is known as a formal estimation that shows the estimated amount for the proposed products or services. It can be verbal or written, may or may not be the same as the end product delivered. A quote lets customers know how much they will owe at the end of the projected work or services, and it also ensures they should expect the payable amount. Usually, a quote is valid for 30 days from the time it was issued, and it can be readjusted as per the client's requirement. For example, you have sent a quote to the client but the client wants to make changes in the services you have offered as per their budget and requirement. It will be possible with the estimations because it is not the final invoice. You can easily regenerate the new estimation as per the needs.

An Invoice

On the other hand, an invoice is a detailed document that includes a list of products or services that already have been delivered. Apart from that, the invoice also includes due dates, payment terms and conditions, taxes, and preferred payment methods. An invoice is also considered as a legal document from which the vendor can provide an invoice as proof for legal actions in case it is not paid on time or crossed all the notices. So, the invoice will be considered as the final document to get paid.

Frequently Asked Questions

A quote is an estimate sent before work begins to show the expected cost, while an invoice is sent after work is completed to request payment. Quotes can be adjusted based on customer needs, but invoices are final documents with set payment terms.

A quote is usually valid for 30 days from the time it was issued. However, this can be adjusted based on your business needs and agreement with the client. After 30 days, you may need to reassess pricing and send an updated quote.

Digital invoices are highly recommended. They provide benefits like instant delivery, read notifications, no chance of misplacement, and easier tracking of payment status. E-invoices also help you maintain organized records and faster processing.

Offer multiple payment options including credit cards, debit cards, ACH transfers, and digital payment platforms like PayPal, Stripe, or Apple Pay. Providing various payment methods reduces delays and makes it easier for customers to pay promptly.

You should send an invoice within 48 hours of completing the work. The quicker you send the invoice, the faster you'll likely receive payment. Prompt invoicing also demonstrates professionalism and helps maintain healthy cash flow.

Yes, quotes can be adjusted before work begins. If the customer requests changes to the scope of work or products/services, you can regenerate a new quote reflecting those modifications. However, once both parties agree and work starts, changes should be handled through change orders.