Handling different invoices can be exhausting for businesses that are providing recurring payment options. A consolidated invoice can simplify this issue by combining all the charges in one easy-to-manage bill to save time and reduce mistakes. This approach smoothens the cash influx and improves the customer experience. In this article, we will discover how consolidated invoices can boost your business.

What You'll Learn

- 01What a consolidated invoice is and how it simplifies billing processes

- 02Step-by-step guide to creating effective consolidated invoices

- 03Key benefits of consolidated billing for business efficiency

- 04Common challenges with manual invoice processing and how to overcome them

- 05Top 5 tools to generate consolidated invoices seamlessly

What is a Consolidated Invoice?

A consolidated invoice is the process of combining different invoices into a single one. This helps in tracking revenue conveniently and handling expenses wisely. By consolidating multiple sums of money in a single invoice, you can achieve the following:

- Free up additional resources for the company's other operations.

- Limit additional costs to a minimum by tracking individual payments.

- Save time utilized on data entry and reconciliation.

Once the supplier sends an invoice to the customer for the goods/services they purchased, the client approves it. Furthermore, it is added to the consolidated invoice system. Once approved, the invoice is added to the other pending bills from different vendors or suppliers.

How to Create a Consolidated Invoice?

Invoice consolidation needs smooth preparation behind the scenes. Once the preparation is done, you can start entering the data in a single invoice. It is always better to consolidate information and create an invoice. Let us take a look at the steps necessary to do it.

Step 1 – Decide the billing cycle

The first step to creating a consolidated invoice is to determine the billing cycle. Some companies lean towards a monthly payment, others like a quarterly payment, and some even claim yearly. The duration of billing must be determined by how often your customers need to receive an invoice.

Common options include:

- Monthly: Suitable for regular, recurring transactions.

- Quarterly: Works well for less frequent but significant payments.

- Yearly: Preferred for long-term agreements or contracts.

It also helps in understanding how often each client needs to receive an invoice. Furthermore, there also needs to be a system that sends invoices to their designated destinations at scheduled times.

Step 2 – Store the detailed records

While creating multiple invoices you need to keep a record of all the payments received. This helps in strengthening the accuracy of the records. It also offers additional security if any errors show up after the payment has been made. Make sure to document every transaction separately and add the following information:

Step 3 – Create your consolidated invoice

By combining the scheduled billing time and detailed payment records, you can next work on your consolidated invoice. This invoice will showcase all purchases made by a client or supplier over time. Such an invoice can help track the record of the purchases made between both parties. Make sure to include the following information:

- Tax rates

- Quantities bought/sold

- Item names

- Unit prices

Create your own custom consolidated invoice that not only covers all the categories but also is simple to understand. Use invoice generation tools to streamline this process and ensure accuracy.

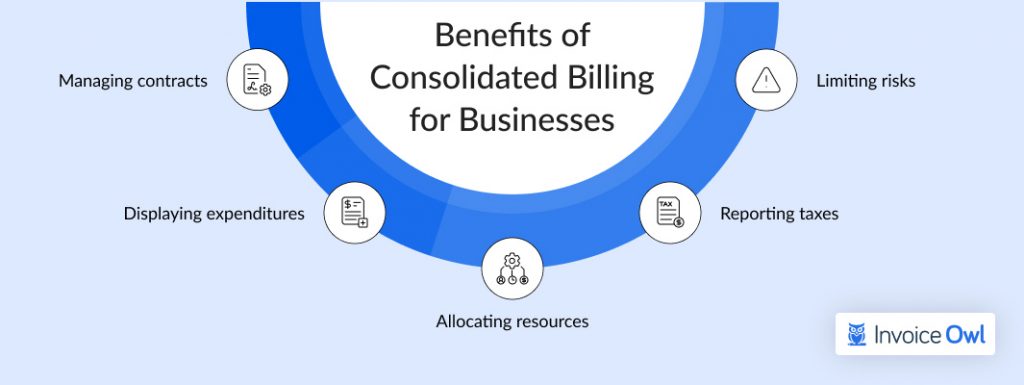

Benefits of Consolidated Billing for Businesses

Now that you understand how to build a consolidated invoice, let us see some benefits for corporations.

Managing contracts

Consolidated billing is bound by a single service agreement which removes the requirement to monitor different contracts of varying terms and conditions. This eliminates the overhead expenses of managing contracts and the probability of legal issues.

Displaying expenditures

Implementing consolidated billing provides a holistic breakdown of the prices of all services. This helps in easily assessing patterns and recognizing areas for streamlining.

Allocating resources

Creating consolidated invoices can help businesses save financial and labor resources and allocate them to more important company sectors.

Reporting taxes

Tax reporting is simplified due to consolidated billing, as it enlists all service-related taxes in a single document. This also simplifies tax calculations, making them more precise.

Limiting risks

A single invoice guarantees businesses' payments, eliminating late fees and service disagreements. This also assesses the business's creditworthiness and bolsters its reputation with vendors.

Manual Invoice Processing Challenges Faced by Businesses

Managing funds can be quite difficult during invoice processing. Buyers have more flexibility due to net terms agreements. These agreements extend the time for vendors from delivery to repayment, carry default risks, and make cash flow calculation planning more difficult. Let us take a look at some challenges businesses face with manual invoice processing.

Late payments

Insufficient invoice validation is one of the major reasons why payments get delayed. If an organization manages hundreds of vendors, managing multiple invoices for every vendor can be difficult to track. Hence, submitting paper invoices is one of the most complicated ways of assessing funds.

Duplicate invoices

Duplicate invoices need to be well-researched, refunded from the supplier, and removed from the general ledger (GL) system from both sides. This could pour hours and days of your time and effort wasted in making corrections.

Analyzing backlogs

Manual invoice processing generally entails heaps of paperwork that never decreases in size. The finance department finds it exhausting to assess all the invoices, which can increase errors and eliminate benefits like early payment discounts. Also, keeping up with Generally Accepted Accounting Principles (GAAP) is important in the U.S.

Multiple invoices

For an organization having multiple business units in different locations, vendors send an invoice for each transaction. Hence, this kind of invoicing makes it difficult to monitor each transaction in all the locations of an organization.

Additional challenges

There are some potential challenges, too, that we can't overlook. To get a more comprehensive understanding of the difficulties businesses face with manual invoice processing, here are some points listed below:

Manual invoice processing can expose your business to serious risks including lack of real-time visibility, compliance issues, and increased fraud vulnerability. Automating your invoicing process helps mitigate these risks.

- Lack of real-time visibility

As there are no tools to provide real-time data on pending payments, this creates blind spots and poor business decision-making.

- Compliance issues

Businesses across the U.S. can face severe penalties or audits due to missing tax deadlines and miscalculating taxes.

- Risk of fraud

There are more chances that manual processes are easily prone to duplicate invoices and inflated amounts.

Ready to Streamline Your Invoicing?

Build your own consolidated invoice easily with InvoiceOwl. Create custom invoices that are simple to understand and cover all necessary categories.

Start Your FREE Trial5 Tools to Generate Consolidated Invoices Seamlessly

Since consolidated invoices facilitate invoice processing by miles for an organization, it is important to know about the tools that simplify them. Let us take a look at a few.

1. InvoiceOwl

InvoiceOwl is a free invoice generation tool that not only generates invoices but also generates estimates, designs e-signs, and offers real-time notifications to track the progress of invoices and estimates.

Besides this, it also provides affordable pricing options with a freemium version for small and medium-sized businesses. Besides these benefits, it also provides other features for its audience.

2. Tide

Tide is a financial platform developed for startups and small businesses. This platform not only provides billing consolidation but also provides a bank account, accounting software integration, and invoice tracking capabilities. The user can easily organize his/her consolidated billing by certain categories to track their finances.

3. QuickBooks

QuickBooks is a reliable accounting app that is utilized for billing and accounting. This app's invoice consolidation tool can keep the user's invoice entries streamlined and simple for both a self-employed freelancer and a small business owner.

Besides invoicing, it offers features like bill management, which helps track billing dates, run reports, and organize taxes. Let us take a look at some additional features:

4. Invoiced

Although the rest of the items on this list are all-in-one tools, Invoiced offers only invoice generation capabilities in its platform. It provides a complicated set of tools that contains in-built templates that allow invoice customization as required.

Users can consolidate multiple invoices in a single user-friendly format to align with their requirements. It also supports subscription billing, offering customers complete control of their own renewal and payment schedules. You can also convert estimates into invoices with a few clicks.

5. Zoho Invoice

Zoho Invoice was created as an add-on to the Zoho accounting software, which stands alone as a useful invoice consolidation tool. Users can build custom invoices with their business' brand and logo, utilize invoice automation processes, and consolidate different bills into one. One of the best features of Zoho Invoice is to convert estimates into invoices monitoring a project from start to finish. To process payment, there are multiple payment gateways available in Zoho Invoice.

Frequently Asked Questions

A consolidated invoice can simplify the billing process of the client. It reduces confusion and facilitates invoice monitoring and tracking of their clients. Instead of receiving different invoices, the client gets only a single one accommodating the expenses of all the other services provided by the business.

A consolidated receivable is combined with other receivables offered by the business. Such a combination helps the company to decrease the number of different accounts that it needs to manage to only a certain amount.

Consolidated invoices help reduce administrative tasks, decrease errors, and simplify complex processes. It also helps in improving cash flow management, reduces payment processing fees, and error handling costs, and increases resource allocation.

Yes, they can be used for cross-state transactions, however, the invoice must align with the sales tax regulations of both the seller's and buyer's states. Make sure that the invoice reflects the correct tax rate based on the "destination-based" or "origin-based" sales tax rule, based on the states involved.

Stay Organized Through A Consolidated Invoice

Now that you understand how a consolidated invoice can make things simple, make sure to implement them in one of your projects. You don't always need a separate invoice for payment processing. This type of invoice can make your business more seamless than ever, and the accounts department can leverage these invoices.

InvoiceOwl offers multiple consolidated invoice templates that allow users to combine long sheets of calculation to their advantage. Besides this, InvoiceOwl can also focus on other things like estimates that can further be converted into invoices.