What works for your business—a flat rate or an hourly rate?

Well, the answer depends on various things like your profession, project type, and client expectations. The choice between a flat rate and an hourly rate is important for freelancers, small businesses, and contractors as it shapes how will they communicate value, manage projects, and secure fair compensation.

A flat rate pricing simplifies the billing process with its fixed scope of work, while hourly rates provide flexibility for variable tasks. Picking the right pricing model ensures profitability and aligns with industry norms, whether you're in construction or consulting.

Before comparing which billing method is better for you, it is essential to have a clear concept of the individual payment methods.

Let's begin.

Key Takeaways

- 01Flat rate pricing offers predictable costs and simplified billing, ideal for projects with well-defined scope

- 02Hourly rate pricing provides flexibility for variable tasks and ensures fair compensation for time-intensive work

- 03Hybrid billing combines both models, offering cost certainty for standard tasks while charging hourly for complex work

- 04Industry standards and project complexity should guide your choice between flat rate and hourly pricing

- 05Using professional invoicing tools like InvoiceOwl simplifies managing both pricing models

What is Flat Rate Pricing?

The flat rate pricing structure refers to the fixed or flat fees for a specific product or service irrespective of the hours worked or additional project cost. The term flat rate is the fixed fee for products or services that covers all the costs and desired profit in the final price.

A flat-rate pay system is appropriate for projects that have pre-decided deliverables and a well-defined scope of work. This payment method is appealing to both the client and the businesses, as it is simple to understand.

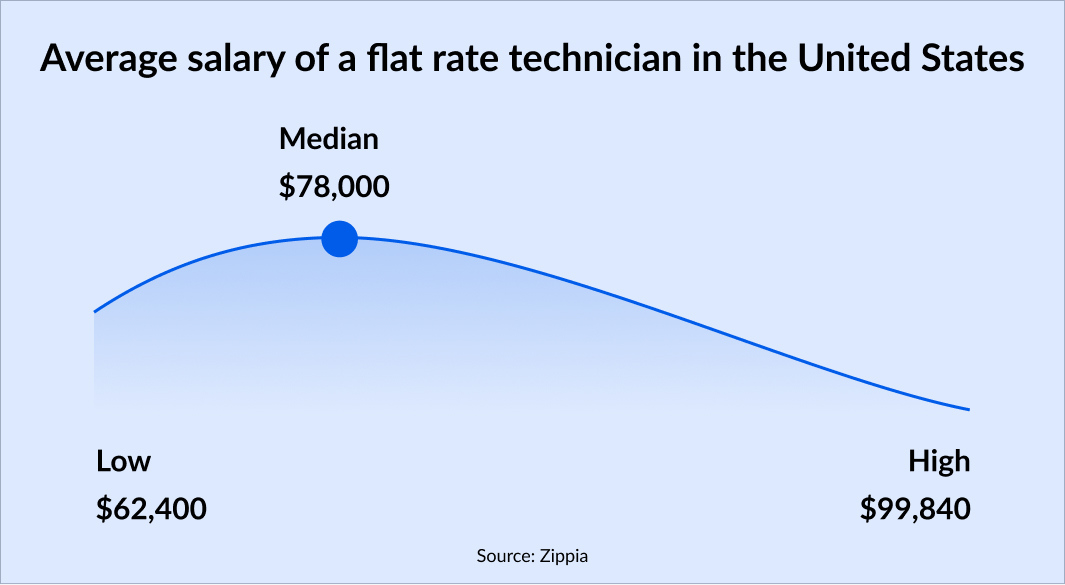

Once the pricing has been locked, you'll not have to worry about tracking time, maintaining documents, or providing any proof of the hours worked. This model is common in many industries, including freelance work, home improvement, and technical services. According to the research, flat-rate technicians—who often work on vehicles or appliances—earn an average annual salary of $78,000 in the USA.

Examples of flat rate pricing

An HVAC contractor offers to replace an entire HVAC system in a home for a fixed price of $15,000. This HVAC flat rate pricing includes labor, equipment, and the completion of specific tasks, such as removing the old system, installing a new furnace, and testing the system. The homeowner pays the agreed amount, regardless of how long it takes to complete the project.

Now that we have an idea about the concept of flat rate, it's important to understand the ways of calculating it.

Step-by-Step Guide to Calculating Flat Rate

Here's a step-by-step approach to calculating an appropriate flat rate for your service or business in the US:

Step 1: Calculate your time invested

Foremost, start by calculating the cost related to the time you will be spending on a particular project. Once done, estimate the amount of time a project will take to complete and then multiply it by your hourly rate.

Step 2: Determine material and other costs

Once you have calculated the time, move on to calculating the overall cost of all the materials required for completing the project. Ensure to add a small markup percentage as it will help you reap profits from the project.

Step 3: Calculate your final total

Last but not least, it is time to create a total of all the money spent on both labor and suppliers to acquire at flat rate pay. This total amount will act as the base rate for your comprehensive pricing structure. Well, it is also possible to add extra services offered or special projects to the total amount.

You can ask for more money if any work requires some special attention or an experienced person to perform that particular task. After the flat rate for each service is decided, you can advertise these rates on your organization's website or other promotional materials.

Now, let's understand another billing method that holds great importance for several businesses and that is hourly rate pay.

What is Hourly Rate Pricing?

The hourly rate refers to the price or payment charged, paid, or earned for each hour worked. An hourly rate pay system includes charging the customers for the specific hours needed to complete a project.

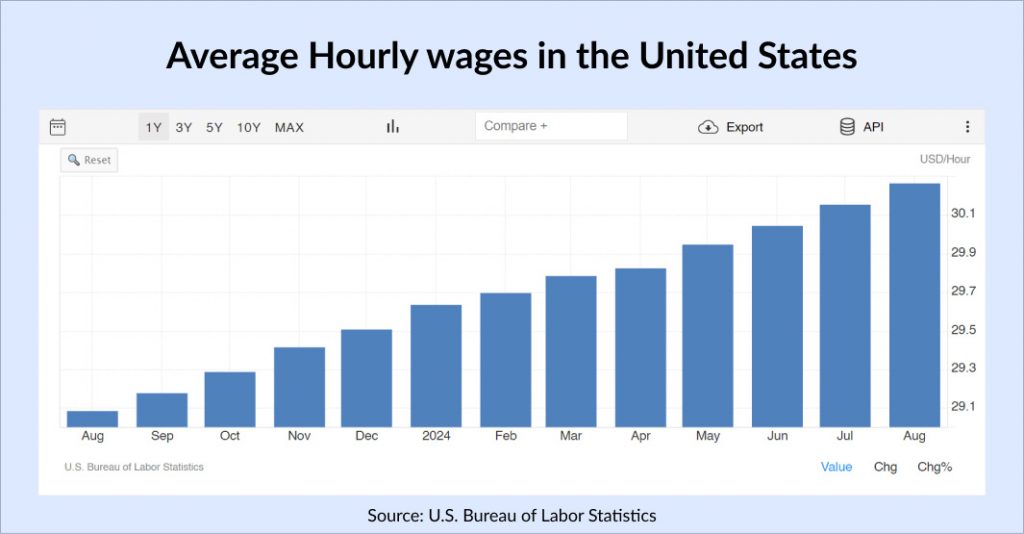

To adapt this payment model, you need to start by estimating the specific hours needed to complete a particular task and multiply the same by your hourly fee. The average hourly wage in the USA was $30.27 per hour, which provides a benchmark for setting competitive rates in the market. You can also opt for an hourly rate invoice template for accurate calculation of hourly fees.

Opting for an hourly rate pay system is feasible for long-term projects, which are more liable to change. It turns out to be the option if you are working for the client in-house. Hourly rates can be challenging to apply in remote working conditions. Anyway, it might become easier for you to account for changes in the project.

Examples of Hourly Rate Pricing

An HVAC contractor is hired to install a new heating system in a residential home. The contractor charges an HVAC hourly rate of $50 for their services. The installation, which includes removing the old system, installing the new unit, and performing necessary tests, is estimated to take around 20 hours.

The total cost would be calculated as:

- Hourly Rate: $50

- Estimated Time: 20 hours

- Total Cost: $50 x 20 hours = $1,000

If the job takes more or less time, the final price will adjust accordingly, ensuring the contractor is paid based on the exact hours worked.

Now that we have an idea about the concept of an hourly rate, it's important to understand the ways of calculating it.

Step-by-Step Guide to Calculating Hourly Rate

To calculate an hourly rate, follow these 3 steps:

Step 1: Setting your base rate

Initiate by starting with the agreed hourly rate pay system. Now, you must multiply the number of hours worked on a specific project. If your hourly rate is $100 and you worked 10 hours, the calculation would be $100 x 10 = $1000.

Step 2: Maintaining accurate time logs

To ensure proper billing, you need to have an accurate record of working hours. You can use time-tracking software or applications to calculate the exact hours on a particular project or task. This will help you avoid any potential disputes and ensure that you are paid accurately for the work done.

Step 3: Billing in time increments

There are certain professions like web designers or electricians need to break time down into smaller increments, such as 6- or 10-minute intervals. This ensures that every small task is accounted for, which makes the billing process more accurate.

Ready to Simplify Your Pricing Structure?

Choose InvoiceOwl to create clear, professional invoices, whether you charge a flat rate or an hourly rate. Start your free trial today.

Start Your FREE TrialAfter having an in-depth understanding of the billing methods, it is time to unravel the pros and cons of both billing methods.

Key Differences Between Flat Rate and Hourly Rate Pricing

Here is a detailed comparison of flat rate pricing and hourly rate pricing as stated below.

Comparison Table: Flat Rate vs Hourly Rate

| Aspect | Flat Rate Pricing | Hourly Rate Pricing |

|---|---|---|

| Suitability | Ideal for projects with a clear scope and defined deliverables | Best for tasks with uncertain time requirements or ongoing work |

| Predictability | Offers clients predictable costs regardless of the time taken | Costs may vary depending on the number of hours worked |

| Risk factor | Higher risk for the provider if the project takes longer than expected | Lower risk for the provider as compensation aligns with effort |

| Flexibility | Less flexible if project requirements change mid-way | Adaptable to changes in project scope or duration |

| Industries commonly used | Creative services, construction, and product-based businesses | IT consulting, maintenance services, and ongoing advisory roles |

| Payment process | A single payment or installment schedule is agreed upon beforehand | Payments are tracked and invoiced periodically based on hours logged |

Flat Pay Rate vs Hourly Pay Rate: Pros and Cons

Both flat and hourly rates each have their own pros and cons. It's for you to decide which is the most preferable for your billing process.

Advantages of flat rate pricing

The flat-rate pay system is power-packed with several advantages as listed below:

Drawbacks of flat rate pricing

- Difficulty in estimation: It is always easy to create estimates for projects with a well-defined scope. Without proper clarity, you will be confused regarding setting the price that has to be offered to the client.

- Poor work quality: To finish more projects quickly and increase their pay, employees might rush through their jobs and offer mediocre services. This approach could hamper your organization's credibility in the industry.

- Lesser flexibility: Opting for a flat rate price can hamper your ability to adapt to the changing project scope. In a larger project, you might feel that the amount of time and material you estimated is inaccurate. By the time you realize this, it's too late to ask for more.

Advantages of hourly pricing

Drawbacks of hourly pricing

- Rigorous bookkeeping: Business owners need to pay more attention to the number of hours they and their employees have worked on a project. The hourly billing method is all about working hours, so you must opt for software that can help you track time effortlessly.

- Reduced efficiency: Employees working on an hourly wage are considered to be less productive. If you observe as a business owner, you might come to know that your employees are not eager to complete work on decided time as they are being paid based on hours worked.

Best Practices for Selecting Pricing Models Across Professions

Pricing Model Recommendations by Profession

| Profession | Preferred Pricing Model | Best Practices |

|---|---|---|

| Contractors (Construction, Renovations) | Flat Rate | Clear project scope, well-defined deliverables, and predictable costs for clients. |

| Freelance Designers (Graphic, Web) | Flat Rate | Projects like logo design or website development have defined requirements, making flat rate suitable. |

| Consultants (Business, Management) | Hourly | Consulting work is often undefined and may involve various meetings, research, or analysis. |

| IT Professionals (Tech Support, Programming) | Hourly | Scope often varies based on troubleshooting or custom development, making hourly preferable. |

| Tutors / Trainers (Education, Fitness) | Hourly | Individual or group sessions are generally billed by the hour or session. |

| Home Services (Plumbing, Electrical) | Flat Rate | Repairs, installations, or renovations often have predictable costs. |

Quick Comparison: Key Factors

| Factors | Flat Rate Pay | Hourly Rate Pay |

|---|---|---|

| Charge determination | The charge is determined on the project. | The charge is determined on the basis of hours worked. |

| Amount changes Fixed | In the flat rate, the amount remains fixed. | In the hourly rate, the amount is uncertain as it will be decided later |

| Calculation Time | Shorter | Longer |

| Ideal Project | Ideal for small projects. | Ideal for long projects. |

| Accurate Estimation | With flat rate pay, you can provide nearly accurate estimates. | With hourly rate pay, you cannot provide accurate estimates. |

Factors to Consider When Choosing a Pricing Model

When selecting a pricing model, it's essential to balance your business goals with the needs of your clients, ensuring both profitability and a positive working relationship. Here are the following factors to look for:

1. Nature of the project

Assess the scope of the project and its complexity. The fixed deliverables and predictable timelines are suitable for fixed rates whereas ongoing tasks work better with hourly pricing.

2. Client preferences

It is important to understand your client's comfort level. Some clients might choose flat rates for cost certainty, while others prefer hourly billing for transparency and flexibility.

3. Your expertise and industry standards

Experienced professionals might ask for higher flat rates, while industries like consulting standardize their hourly rates for fair compensation.

4. Risk management

It is critical to consider the risk of unforeseen work. In flat rate, the risk is transferred to the providers, whereas hourly billing minimizes risk but may be disliked by cost-sensitive clients.

Consider using a hybrid billing approach to combine the best of both worlds. Charge a flat rate for standard tasks while billing hourly for complex or unexpected work.

Hybrid Billing as a Flexible Alternative

With hybrid billing, you can make the best use of both flat rate pay and hourly pay. This approach provides more flexibility allowing you to charge a specific amount for standard tasks and charge hourly for complicated tasks or work.

Hybrid billing helps the client to know the cost of the overall project beforehand, also ensuring fair compensation for the service provider when additional services are required. By choosing hybrid billing, you can meet the specific needs of every project while maintaining transparency and flexibility in your billing process.

Managing Multiple Pricing Models?

Choose InvoiceOwl to easily create, track, and send invoices for both flat-rate and hourly projects effortlessly.

Try InvoiceOwlFlat Rate vs Hourly: Making the Right Choice for Your Projects

Choosing between a flat rate and an hourly pay system depends on the nature of your work, client preferences, and the specific needs of your projects. Flat rates offer predictability, whereas hourly rates provide flexibility for time-intensive tasks.

Irrespective of the choice you make, InvoiceOwl can help you manage both these billing methods effortlessly. Our free invoice templates enable you to create professional invoices within a few clicks and help you stay organized and get paid faster. Once you have created the invoice, you can also print it and download it as a PDF, or send it directly to the client online.

Frequently Asked Questions

No, you don't need different invoice templates for flat rate vs. hourly rate pay systems. Both billing systems are different, and you must ensure that you showcase these differentiations. The main description is the only thing that creates the difference between both invoices.

Generally, the flat rate employees are paid as per the tasks completed, rather than the hours worked. During slow periods, the flat rate employees have fewer tasks, which might lead to reduced earnings as they are not paid for idle time.

The hourly rates are dependent on the hours spent on a particular task. So, you need to accurately represent the time spent on completing a specific project. However, there is no specific rule. Some freelancers opt for 10-minute increments, whereas others use 15-minute increments. You must specify the method prior to avoid any potential disputes.

The tax levied on a flat rate and hourly billing is the same when it comes to being added as a business income. But the main difference lies in tax filing, deductions, and compliance based on the bill structure.

If you are working as a freelancer or an independent contractor, then you will have to pay self-employment tax irrespective of your billing structure. As per the latest records, 15.3% of tax rates are implied on freelancers covering both Social Security and Medicare.

Before choosing a pricing model, you must consider your target audience, operational costs, desired profit margins, and market trends. Also, look out if the pricing model aligns with your business goals and offers competitive sustainability.

The implementation scenarios of the hybrid approach consist of subscription-based and usage-based pricing models. Consulting firms opt for combining the flat-rate and per-project pricing. Opting for this approach helps organizations boost their revenue and offer flexibility to the customers.

Yes, you can switch the pricing methods based on the project type. Suppose, you can use hourly pricing for ongoing work and flat rates for specific deliverables. Before doing this, always communicate with your client to avoid any confusion in the future.

Flat rate prices include taxes only when stated clearly. Before adding taxes to your invoice, clarify the same with your client to maintain transparency.

Flare rates are preferred by clients with fixed budgets or clear deliverables. Knowing the detailed flat rate pay meaning, can help many clients to choose it for cost certainty and to avoid unexpected expenses.

A flat rate is a better option for experienced professionals who prefer predictable earnings. The hourly pay system is more suitable for tasks with uncertain scope and long durations.