Creating an invoice for hours worked can seem simple—until you sit down to do it.

You're faced with the challenge of knowing what information to include and how to ensure timely payments.

With the rise of remote work and freelancing, hourly invoices have become significant for professionals across industries. Today's clients expect more than a simple breakdown—they want transparency and accuracy.

This is where understanding the process of hourly invoices comes into the picture.

What You'll Learn

- 01How to generate a professional hourly invoice in 5 easy steps

- 02Why hourly invoices are critical for small businesses and freelancers

- 03Best practices for tracking time and ensuring timely payments

- 04How to customize free invoice templates for your business needs

- 05Tips for enhancing security and professionalism with e-signatures

Introduction to Hourly Invoices

Charging for hours worked is often more complicated than a single lump sum payment. It requires meticulous tracking, clear communication of your rate, and a transparent breakdown of services provided.

In this guide, we'll walk you through the process of creating an invoice for hourly work that not only reflects the time you've put in but also makes sure you're compensated fairly and on time.

How to Generate an Hourly Invoice

Generating an hourly invoice involves a structured approach. Professionals, including freelancers and contractors, need a quick way to bill their clients based on the hours worked.

Let's check out how you can generate invoices for hours worked in 5 easy steps.

Understanding the basics of hourly invoicing

Before diving into the steps, it's important for U.S. businesses and professionals to understand the essentials of hourly invoicing to ensure compliance with industry standards.

Download a ready-made template instead of starting from scratch. This saves time and ensures you don't miss critical invoice elements.

Step 1: Download the invoice template

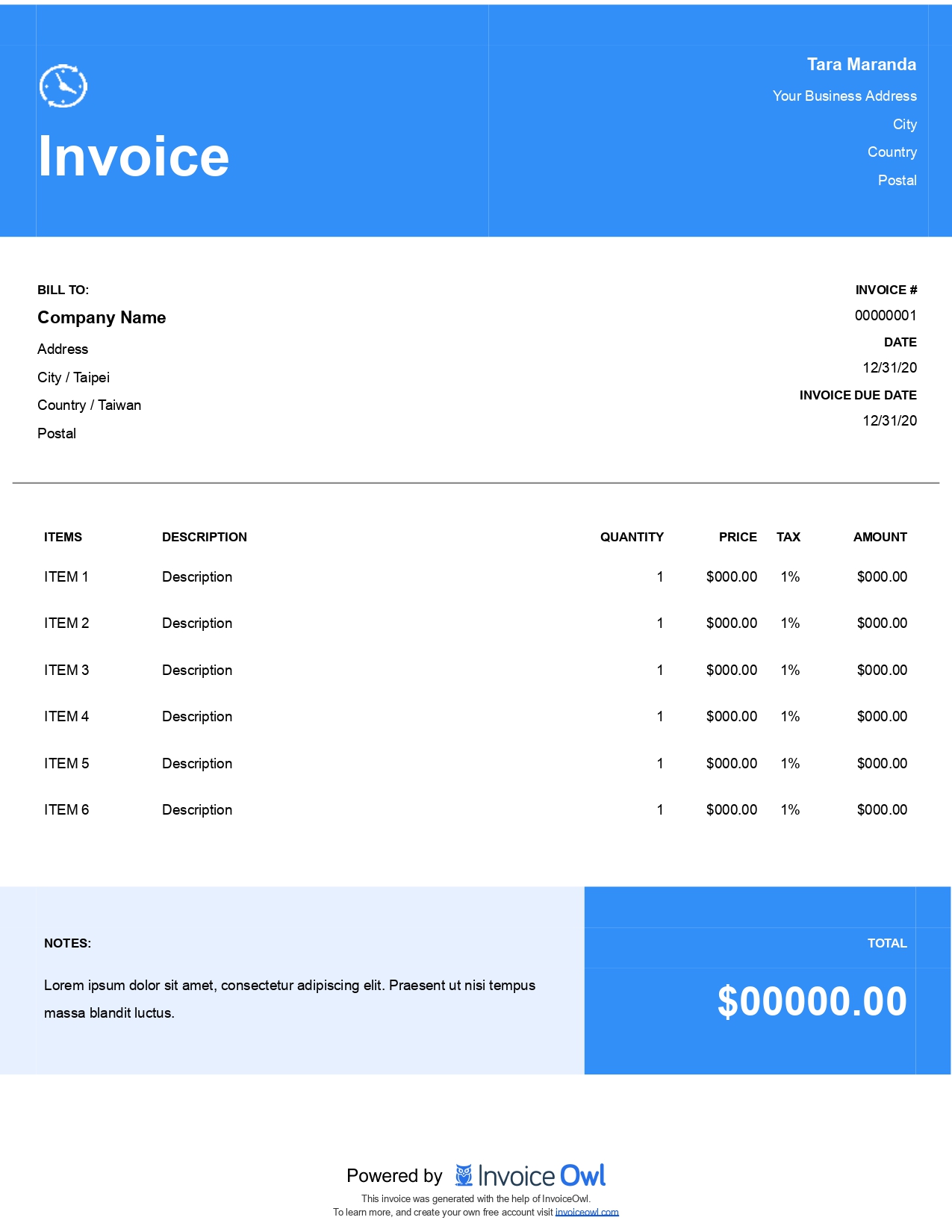

Instead of generating an invoice from scratch, you can download the free invoice template for hourly rate on InvoiceOwl, and customize accordingly. You can tailor the template to your brand and add details such as:

Step 2: Add business & client details

Make sure to include both your details and your client's information at the top of the invoice. These details need to typically include:

- Your business name and logo

- Address and contact information, like email and phone number

- Client's name and address

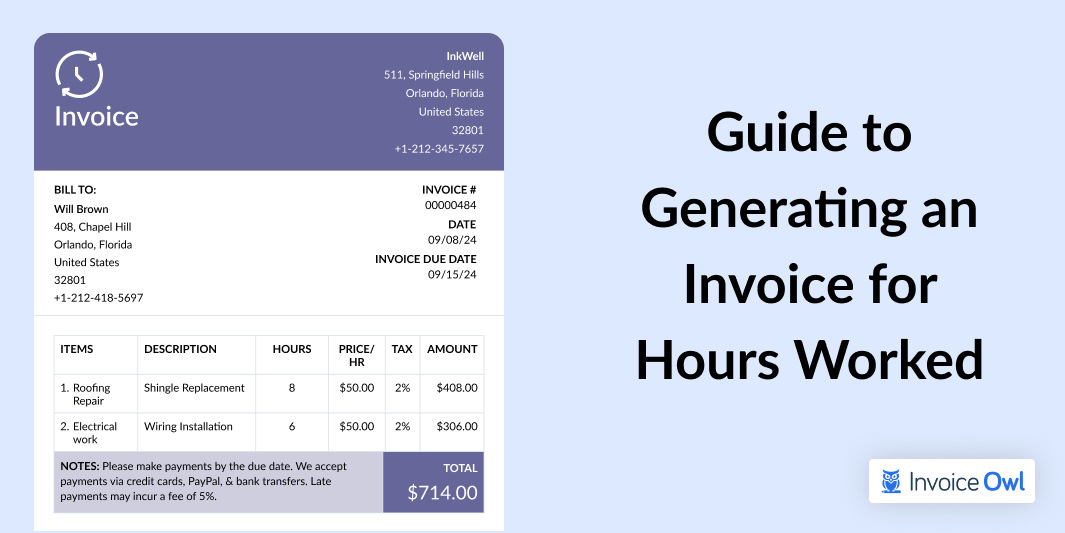

Step 3: List services provided with detailed time entries

In the invoice templates, you'll find a section to add the list of services. Break down the services, and specify the tasks or projects completed and the date or period when the work was done. The listing needs to include:

- Task description: A clear explanation of the work done (e.g., "Wiring installation" or "Cabinet building").

- Hours worked: The exact number of hours spent on each task.

- Hourly rate: The rate you charge per hour.

- Total: Multiply the hours worked by your hourly rate for each task.

Step 4: Calculate the total amount due

Add the services to get the total for the hourly invoice. If applicable, add:

- Taxes: Depending on local laws or the agreement with the client.

- Discounts: If any discounts apply.

- Additional fees: For example, late fees or rush charges.

Make sure to double-check your math so there are no discrepancies in the invoice.

Step 5: Add payment terms

Clearly outline the payment terms, such as:

- Payment due date: The last acceptable date when the amount is due.

- Payment methods: List accepted payment methods, such as bank transfer, credit card, and PayPal.

- Late fees: Mention any late fees that will apply if the payment is not received by the due date.

Create an invoice for hours worked in a jiffy with customizable templates!

Importance of an Hourly Invoice for Small Businesses

An hourly invoice is important for small businesses as it ensures to get fairly for every hour. It can offer distinct advantages over charging a flat fee.

Furthermore, well-structured hourly invoice templates help you stay organized and safeguard your business interests. Here is why hourly work invoices matter:

Transparency

While billing, transparency is essential to ensure timely payments without unnecessary disputes. An hourly invoice shows a detailed breakdown of the services performed and the time spent on each task. This level of transparency builds trust and assures clients of the final amount.

In the United States, industries across consulting and legal services—where hourly billing is common, transparent invoices help avoid misunderstandings.

Financial tracking

An hourly invoice helps you track how much time you spend on each project. This information is valuable for budgeting and improving time management. It provides an accurate financial record that complies with U.S. tax regulations, ensuring your documentation is complete for IRS reporting. You can easily gauge if you're getting paid according to the industry standards.

Timely payment

An hourly invoice reduces the chance of payment disputes as you clearly outline the hours worked, costs, and payment terms. It reduces the chances of doubts, and clients are more likely to pay on time and in full, helping your business maintain a healthy cash flow.

Legal protection

A detailed invoice can be legitimate evidence of the work you've completed and the rates you've charged in case of a legal dispute. In the U.S., having a clear and itemized invoice is critical for documenting hours worked, the services rendered, and the payment terms agreed upon by both parties. This detailed record can be invaluable in protecting your business from claims of non-performance or overcharging.

How to Use the Free Hourly Invoice Templates: Download the Free Template

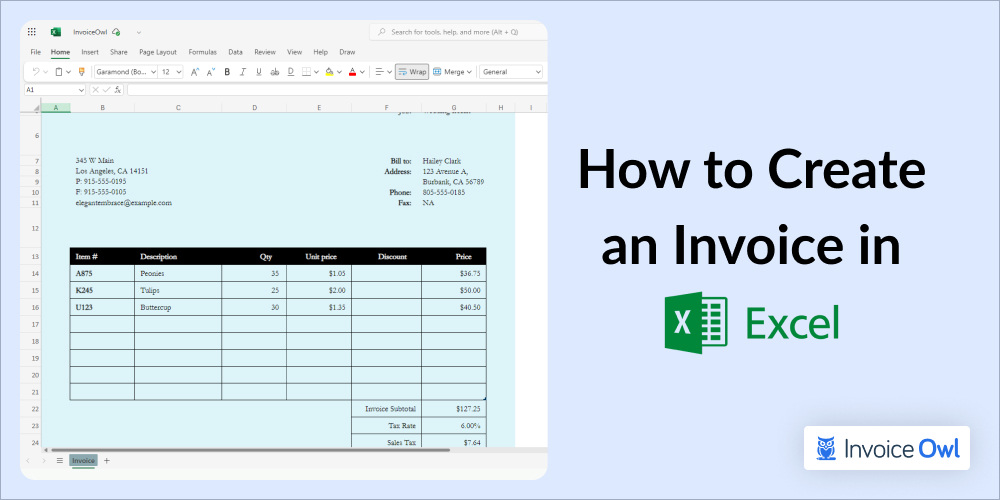

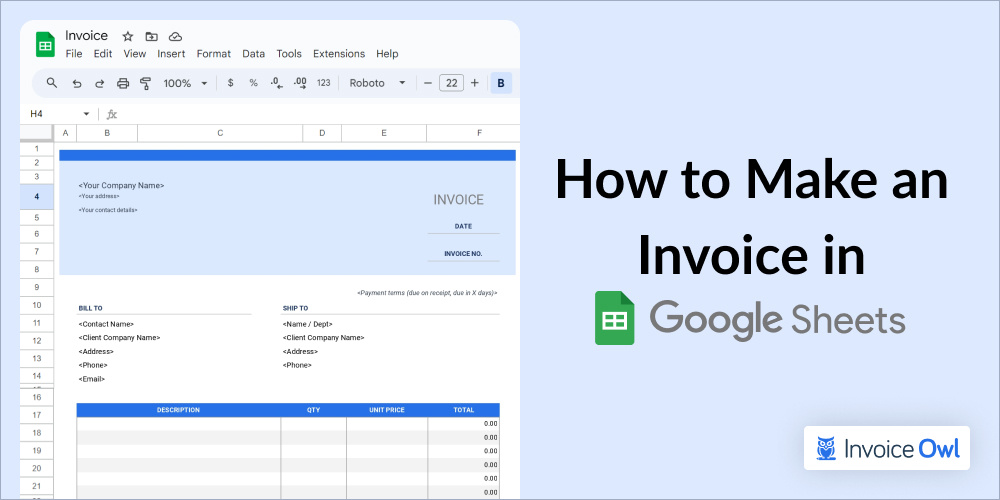

Here are the free invoice templates to charge your clients on an hourly basis. Download these hourly invoice templates in Word, Excel, PDF, and Google Docs formats.

Available formats overview

This free invoice template is available in formats like Google Docs, Google Sheets, MS Word, MS Excel, and PDF as well.

5 Pro Tips for Sending Professional Hourly Invoices

Here are 5 tips to send professional invoices for hours worked to boost customer satisfaction and loyalty to new heights:

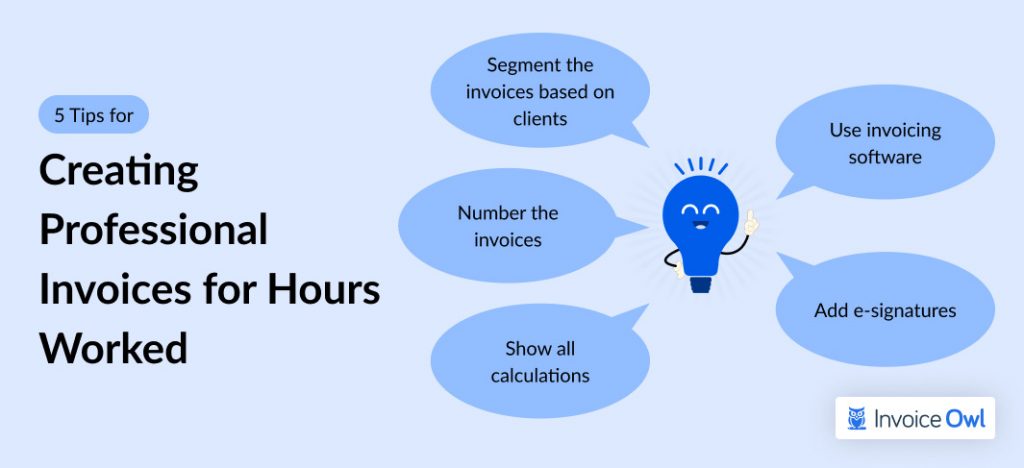

Client-specific customizations

Organizing your invoices by client helps you keep track of each client's payment history. This helps you personalize the invoice and chase late payments from certain buyers. It is useful for tax purposes too.

Add invoice number

Add the unique, date-wise invoice number for a systematic approach to billing. For example, for a client like ABC Corporation, an invoice sent in March 2025 might be numbered ABC-2025-03-005. This practice helps both you and tax authorities audit invoices, while also enhancing the professional image of your brand.

Show all calculations

Just mentioning the grand total is not enough. You need to show a breakdown of all calculations, including any taxes added and discounts subtracted. This transparency ensures that clients understand the exact charges.

Integrating with invoicing software

Invoice templates are great if you want to send an invoice one time. But if you want to automate the process and reduce the burden of administrative tasks, using invoice software is the way to do so. It also includes additional features such as managing multi-company accounts under the same platform, generating estimates, and invoice tracking through real-time notifications.

Enhancing security with E-signatures

Using an invoice automation tool, you can add e-signatures to expedite your invoicing process. You can sign digitally on the InvoiceOwl app itself and make invoice generation completely paperless. This helps you save time and the hassle of sharing invoices with the clients.

Ready to Streamline Your Hourly Invoicing?

Join 100,000+ contractors using InvoiceOwl to create professional hourly invoices and get paid faster.

Try Free for 3 DaysGenerate Professional Invoices with InvoiceOwl Features

By following these steps for generating hourly invoices and using hourly invoice templates, you can ensure that the invoices are clear, professional, and easy to share. Getting your invoices right is essential to maintaining strong client relationships and ensuring timely payments.

For a more streamlined process, consider using invoicing software like InvoiceOwl. It not only helps you create polished, professional invoices but also simplifies tracking hours, calculating totals, and setting payment terms. Try the tool for free to experience the ease of invoice automation and quick payment receivables using InvoiceOwl.

Frequently Asked Questions

You can track hours for invoicing using time-tracking tools that log the time spent on each task in real time. Some invoice processing tools have built-in timers that track the time and ensure you charge for the exact hours worked.

You can set clear payment terms to ensure timely payment for an hourly invoice. Add the due date, the accepted payment methods, and send the invoice promptly after the work is completed. You can also send friendly reminders before and after the due date if payment hasn't been made.

Yes, there is a recommended format for hourly invoices. You can use a structured invoice template on InvoiceOwl with sections for your details, client information, a list of services, hours worked, and payment terms. Many invoicing platforms like InvoiceOwl offer customizable templates designed for hourly billing.

You need to avoid including sensitive personal information such as a client's Social Security Number or any unnecessary details that could violate data protection laws like GDPR (General Data Protection Rules) or CCPA (California Consumer Privacy Act). Stick to business-related information, like names, addresses, and payment terms, and always ensure that client data is securely handled.

Word

Word Excel

Excel PDF

PDF Docs

Docs