Most businesses rely on invoice payment to meet costs and keep a constant cash flow. However, late payments remain a widespread challenge, with around 57% of invoices being paid past their due date.

This issue constantly disrupts cash flow and hampers efficiency, leaving many organizations—whether large corporations, small businesses, or microenterprises—managing to secure payments on time.

Thus, it is important to get invoices paid faster after a project is completed. For solopreneurs, it often gets challenging to follow up on invoices, but the good news is that if you use the following 9 suggestions, you probably won't have to!

Key Strategies for Faster Payments

- 01Use clear and detailed invoices with professional formatting to eliminate confusion

- 02Automate invoicing processes and send timely payment reminders

- 03Offer multiple payment methods including digital wallets and direct payment links

- 04Set shorter payment terms (7-14 days) to create urgency

- 05Provide incentives for early payments and maintain positive client communication

- 06Handle delayed payments strategically with well-timed reminders and flexible payment plans

Table of Content

- Understanding the Importance of Timely Payments

- Essential Strategies to Accelerate Invoice Payments

- Utilizing Advanced Payment Options

- Enhancing Client Relations

- Handling delayed payments effectively

- Troubleshooting Common Payment Issues

- Conclusion

- Frequently Asked Questions

Understanding the Importance of Timely Payments

For maintaining the financial stability of small businesses, it is important to ensure timely payment. As discussed earlier, late payments harm your cash flow and make it difficult to cover expenses like employees' salaries, rent, and inventory costs.

Delayed payments can also hurt vendor relationships and pose limits to investing in growth opportunities. To avoid such critical instances, always make sure timely payments, which results in building trust, sustaining operations, and achieving long-term success.

Essential Strategies to Accelerate Invoice Payments

For a healthy cash flow, it is essential to get paid on time. Here are some top strategies to follow for quicker invoice payments and reduced delays:

You'll be getting paid more quickly if you follow these referred strategies. Scroll below to learn other important practices, if you have clients who don't pay their invoices on time.

Streamline invoice generation and delivery

Efficient invoice generation and delivery play an essential role in quickening the process of payment. Using automation software results in fewer manual errors and ensures timely invoice delivery. Ensure to send invoices quickly after the completion of a sale or a service and make use of professional invoice designs.

- Request prepayment or deposits

Asking for prepayments or deposits helps you get partial funds upfront, reducing financial risk and ensuring client commitment.

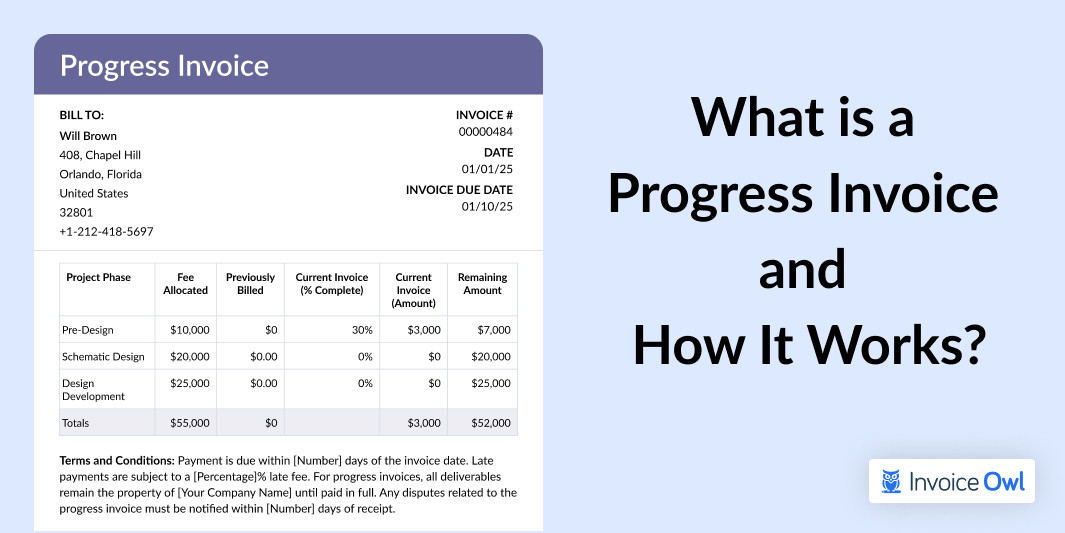

- Deliver user-friendly invoices

Make sure your invoices are easy to understand for your clients. Mention important details like the total amount, payment due date, and accepted payment methods, such as Apple Pay or Google Pay.

Defining clear payment processes

A streamlined payment process ensures that customers understand their responsibilities and reduce delays. A clear payment expectation results in improved cash flow and averts potential disputes.

- Establish upfront payment terms

Ensure clear payment terms from the initial stage to help the customers understand the when and how of payments. Here is a table comparing different payment terms to help businesses decide which one is best for them.

Payment Terms Comparison

| Payment Term | Description | Pros | Cons |

|---|---|---|---|

| Net 30 | Payment is due within 30 days of invoice date | Flexible for clients, industry standard | Delays cash flow for small businesses |

| Net 15 | Payment is due within 15 days of the invoice date | Faster cash flow, balanced timeframe | May be challenging for some clients |

| Immediate payment | Payment is required at the time of purchase or service | Instant cash flow, eliminates delays | Less flexibility, not ideal for B2B |

| Partial upfront | Percentage of payment required before work begins | Reduces risk, and ensures client commitment | Might deter new clients hesitant to prepay |

- Encourage direct invoice payments

Make payment processes effortless by enabling the client to pay the invoices directly. With direct payment options, you can save your time spent on the process of receiving payments.

- Using direct payment links

Adding direct payment links enables the customer to pay invoices within a single click. This approach offers an effortless payment experience and also saves you time.

Utilizing Advanced Payment Options

As a small business owner, using advanced payment options is always helpful during transactions and also improves the payment experience for customers. Thus, adopt modern tools to streamline the overall payment process and reduce delays.

Accept multiple payment methods

Providing various payment methods enables the client to choose the most convenient method for them. You must offer payment methods like credit and debit cards, digital wallets like PayPal or, google pay, bank transfers, and mobile payment solutions. This flexibility helps you cater to a wider range of customers and ease the process of settling invoices quickly.

- Set up automatic transactions

Payment automation eliminates the scenarios of missed deadlines and late payments. This saves the valuable time of both clients and businesses.

Maintaining a positive relationship with clients when their payment is past due will help you avoid sabotaging your chances of getting future work with the company. Based on this sentiment, the next segment guides you to know the necessary elements to apply for strong client relations.

Enhancing Client Relations

We're all prone to forgetting stuff and procrastinating occasionally, which jeopardizes client relationships. Maintaining strong client relationships in business is important for ensuring timely payments.

Here are some strategies to encourage cooperation while building trust and loyalty.

Offer incentives for prompt payments

Provide incentives to your customers like early payment discounts and loyalty rewards to encourage clients to pay invoices on time. These offers motivate clients to prioritize your invoices and pay them on time.

Maintain positive client communication

Ensure to have clear and professional communication with your client. Provide timely updates regarding the invoice status, payment reminders, and follow-up on remaining payments.

Provide flexible payment options

Offer various payment methods like credit cards, digital wallets, or installment plans. This payment flexibility enables you to meet different client preferences.

Regularly review payment policies

Regularly review your payment terms and policies to ensure they are fair and competitive. Take feedback from your client and tweak your policies to meet their specific requirements.

Handling Delayed Payments Effectively

Payment delays can harm your cash flow and hinder business growth. To address this issue, organizations must opt for strategic approaches to ensure timely payment while maintaining positive client relationships.

Sending strategic payment reminders

One of the best ways to get paid on time is to send a polite and timely reminder. Additionally, you can also use automated tools and offer various payment options to ensure timely payment without harming your professional relationship.

One of the best ways to improve your payment rates is to have a well-timed reminder system. The best suggested timelines for sending a reminder are before the due date, on the due date, 1 week after the due date, and 2-4 weeks after the due date.

Taking action on late payments

If reminders don't work for you, apply these proactive measures to recover overdue payments efficiently. Here are some strategies to handle late payment as follows:

Offer flexible payment plans:

- Pros: Supports partial payments and lessens the financial strain on customers.

- Cons: Lengthens the payment timeline and delays full recovery.

Apply late payment penalties:

- Pros: Creates a sense of urgency and eliminates future delays.

- Cons: If not communicated upfront, it might harm client relationships.

Send demand letters:

- Pros: Supports partial payments and lessens the financial strain on customers.

- Cons: Lengthens the payment timeline and delays full recovery.

Take legal action:

- Pros: Ensures compliance and recovery in extreme cases.

- Cons: Time-consuming and expensive, meant for significant debts.

Troubleshooting Common Payment Issues

Delayed or unprocessed payments can affect your cash flow and also come up with operational challenges. Unraveling the main cause and implementing an impactful solution is essential to solve these issues quickly.

What to do if payments are still not processed

If payments are still not processed after several reminders, then you must take some steps to address the issue.

- Confirm payment information: Verify the important invoice details like payment methods and bank account information.

- Contact the client: Get in touch with the client to ask if there are any challenges faced in payment.

- Offer alternative solutions: Offer flexible payment options in case the client is facing any financial issues.

- Escalate as needed: After following all these steps, if still the invoices are unpaid, consider sending a demand letter to the client.

Get Paid 10x Faster with InvoiceOwl

InvoiceOwl helps you create easily understandable invoices and automates payment reminders to make sure you get paid promptly.

Start Your FREE TrialConclusion

Don't hesitate to contact a client if their invoice is overdue. To ensure your clients pay early invoices, you must diligently pursue unpaid debts.

With InvoiceOwl, you can accept payments online and simplify payment collection. In hectic schedules, small business owners must execute various administrative responsibilities, including collecting money once invoices are sent.

With the help of estimates and invoicing software like InvoiceOwl, business owners can easily manage all their invoicing needs in one app, including the capability to collect payments.

Get a FREE trial today to test it out for yourself.

Frequently Asked Questions

Yes, it's completely fine if customers pay online. Probably the largest incentive to go digital is how simple it is to execute financial transactions. You won't need to carry large amounts of cash, use plastic cards, or stand in line to use an ATM. Additionally, it is a simpler and safer way to spend money when traveling.

Seven days before the due date, send reminders of the payment. When the invoice is due, follow up once more. Add extra payment reminders for each day passed in a single batch (7 days, 30 days, 60 days, 90 days). On-demand and 120 days after the deadline, a final email or letter.

Yes, you should take strict action against unpaid invoices. You can write a letter warning the client that you would charge them late payment interest and compensation if they don't pay within x days (don't give them too much time; five days is fine after all this time). Include a clause that the interest will keep accumulating until the full amount is paid.

InvoiceOwl is an invoicing software that can help you streamline your financial activities. By automating the process of human data reconciliation and client follow-up, invoicing software keeps your firm operating efficiently.

To speed up your invoicing process, use professional invoicing software that automates tasks such as invoice creation, client information management, and payment tracking. Tools like InvoiceOwl allow you to create and send invoices quickly by utilizing customizable templates, automating recurring invoices, and integrating with accounting platforms for seamless workflow.

Requesting immediate payment on an invoice requires to add clearly the payment terms. Thus, use "Due Upon Receipt" or "Pay Immediately" within your invoice to set expectations upfront. Moreover, you can include payment links directly on the invoice for instant processing.