After giving your best in winning a bid to deliver the contract work, invoicing correctly is crucial as well. Your invoice should consist of every detail of the work you've completed. However, inaccurate or incorrect invoices can result in delayed payments for approximately 73% of businesses.

So, let's go through a step-by-step process on how to invoice as a contractor in . This guide will help you generate accurate invoices that not only match your client's expectations but also ensure prompt payments for your hard-earned work.

What You'll Learn

- 01Essential components every contractor invoice must include

- 02Step-by-step process to create professional invoices

- 03Common invoicing mistakes and how to avoid them

- 04Best tools and software for efficient contractor invoicing

- 05Payment terms and strategies to get paid faster

Introduction to Contractor Invoicing

Before learning how to write a contractor invoice you need to understand what is invoicing for a contractor and how to bill as a contractor.

What is invoicing for contractors?

Invoicing for contractors is the process that a contractor is owed money for the service performed. Understanding invoicing for contractors is the simplest thing. It's nothing but a systematic approach to bill clients for the services rendered. It involves providing a detailed breakdown of the work performed, specifying costs, and setting clear payment terms.

Efficient contractor invoicing not only ensures accurate compensation for services but also fosters transparent communication between contractors and clients, contributing to a smooth and professional business transaction.

How to bill as a contractor?

Billing for a contractor is an essential part of managing your business. The process determines getting paid for your work. To invoice as a contractor and ensure timely payment for your services, it's crucial to employ a strategic approach. From setting clear payment terms to utilizing professional invoicing templates and tools, this guide will walk you through the essential steps of effective billing in the contracting world.

Then it will be just a matter of a few tips:

- Get those standardized formats downloaded

- Enter the client name

- Provide a brief description of the services charged

- Specify the final amount

However, it's not so.

There is no one-size-fits-all solution. Each contractor has different billing requirements, ways, and methods to charge. So, they need to create personalized invoices that best fit their requirements and help them get paid promptly.

To help you get a better understanding, let's take two examples.

In some projects, contractors are required to get charged half of their total fees at the inception of the project and the other half at the delivery stage. On the contrary, in some projects, they are supposed to get paid at a mutually agreed timeline.

Apart from this, there are several ways to levy charges. Some of them charge on a flat rate basis, some on an hourly basis while others use the percentage rate based on project completion. Here is a comparison guide for you between a flat rate pricing model and an hourly rate model.

Though contracting requirements vary from project to project, there are some common points that are must-haves while billing. Whether you are creating handwritten invoices or trying a free contractor invoice template, above mentioned are some of the essential points that you cannot afford to skip when including in your invoice.

Establish payment terms and billing methods with your client before starting any project. This ensures clarity and prevents disputes when it's time to invoice.

Steps to Create an Invoice

To write a contractor invoice that is both professional and ensures prompt payment, meticulous attention to detail is key. Tailoring the invoice to include comprehensive project specifics, transparent cost breakdowns, and clear payment terms not only reflects your professionalism but also establishes a solid foundation for seamless financial transactions with your clients.

Step 1: Label the document as an invoice

The first thing to do while creating an invoice is to identify the document as an invoice. It should either be written clearly on the top of the document or you may use a large bold font to highlight it as an invoice. Doing this will reflect the purpose of the document and the expected payment to be made within.

Step 2: Include essential business information

Your business details are the foundational element in an invoice. Including the company name, company logo, phone number, and email address will help your clients to easily contact you. This will allow you to reinforce professionalism and brand identity while facilitating clear communication with your clients.

Step 3: Add the client's contact details

Moving further, add your client details in the contractor invoice. This can include the client's name, company name (if applicable), client's contact details, and email address. Including these details is significant for maintaining transparency between both parties. This practice will further ensure that invoices reach the intended recipient in the right department.

Step 4: Assign an invoice number

Invoices, if not managed sequentially, can lead to potential confusion when referring to them in the future. Hence, it is important to assign an invoice number for easy recognition. This consistent numbering pattern will help you and your client stay organized. It will also help both parties to easily track the invoices without any confusion or dispute over specific transactions.

Step 5: Mention invoice date and due date

Clear and explicit timelines are another important factor in the invoicing process. Mentioning the date when the invoice was generated, along with the due date for making payment, is essential. This not only establishes the payment expectations from the client but also helps contractors manage cash flow, ensuring timely payment.

Step 6: Provide details of the services provided

Create a comprehensive list of all the services provided, a brief description of each of them, quantities, and the rates charged. Applicable tax rates or discounts, if any should also be entered. The objective here should be to provide clarity and transparency to the client about what they are getting billed for.

Step 7: Calculate and state the total amount due

Naturally, the next step is pretty obvious: to sum up the cost of all the services rendered, and accurately state the figure on the invoice. If there are any applicable, make sure that they are itemized separately for transparency. The total amount is the ultimate purpose for which the invoice is made. Hence, it should be precisely stated.

Step 8: Specify payment terms

Any additional payment information or notes that you require your clients to know should be added here. This can include any rules of engagement for settling the invoice, accepted payment method, payment frequency, or any late fees or penalties. By clearly defining contractor payment terms, the chance of delayed or incorrect payments is minimized.

Define your business information clearly on every invoice, including address, TIN, and contact number. This establishes credibility and provides clients with essential details for payment or inquiries.

6 Common Invoicing Mistakes and How to Avoid Them

Now that you are aware of how to invoice as a contractor, let's discuss a few common contractor invoicing mistakes that you should avoid.

Mistake 1: Inconsistent invoice formatting

Follow a consistent invoicing format to enhance the professional reputation before your clients. A unified, polished look of contractor invoices will reflect your attention to details and dedication towards enhancing client relationship.

Mistake 2: Delayed invoicing

Delay in sending invoices, lead to unnecessary payment delays and unwanted cash flow issues. Sending invoices at an agreed time interval or project milestones ensures prompt payment from the clients.

Mistake 3: Not tracking billable hours

Right from the first task you initiate to the day you deliver the project work completion papers, tracking the hours is essential. If you forget to keep track of your billable hours, you will not be able to charge accurately. However, to streamline manual tracking, investing in an ideal invoicing software having automated time-tracking tools is a wise decision.

Mistake 4: Chase behind late payment

While it's good to get humble and polite with your clients for maintaining long term healthy relationship, it's equally important to take action when necessary. Timely following up on overdue invoices is essential to maintain financial stability and ensure that you get compensated fairly for the services provided.

Mistake 5: Clearly convey your payment terms

There is no space for guesswork. Don't leave it up to your client on what and how much you should get paid. To avoid any potential disputes with clients and for smooth payment processing, it is essential to clearly convey the payment terms.

Mistake 6: Acceptance of all payment methods

To ensure a streamlined payment process, catering to the client's client's preferred method is important. You need to allow them to pay in whichever form they want to. It can be through credit cards, bank transfers, digital wallets, etc. Offering such flexibilities will result in expedited payment and convenient settlement of invoices.

Not tracking billable hours can lead to undercharging clients and revenue loss. Use automated time-tracking tools to ensure accurate billing for every hour worked.

Tools and Resources for Efficient Invoicing

Invoicing clients for performed services is one of the main aspects of working as an independent contractor. Each independent contractor may have slightly different ways of billing clients for their services.

However, here are the two general ways with which you can generate accurate hassle-free contracting invoices covering all the crucial invoice details specified above:

Explore free contractor invoice templates:

There are multiple customizable free contracting invoice templates offered by InvoiceOwl. You can simply go through their range of invoicing templates, readily available in different file formats. What you have to do is:

- Select the template format that best suits you.

- Next, just fill in the details in the required fields. It can include business and client details, services provided, the amount charged, and many other details.

- You can even modify the template color to match your brand.

- Once all the personalization is done, save the template by labeling it as an invoice.

- After saving, send it to your client via email or you can even take the print of it.

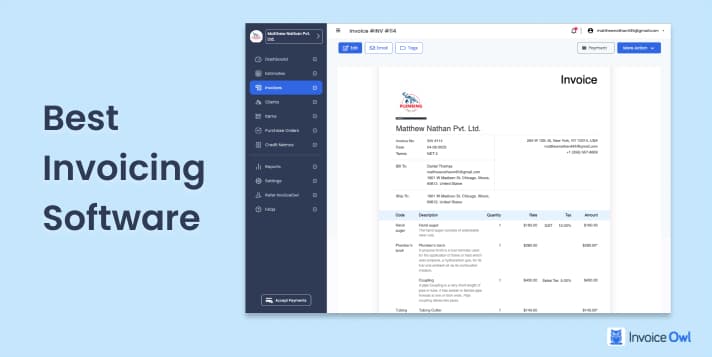

Discover efficient invoicing software: Benefits of using InvoiceOwl

To permanently streamline your billing process, integrating advanced invoicing software like InvoiceOwl is essential. Gone are the days of spending crucial working hours generating professional invoices and chasing payments. Now with advancements in automation, manual tasks can be easily done with the software.

Have a look at the ways in which InvoiceOwl proves advantageous to streamline the billing processes:

Comparing best invoicing software tools for contractors

Best Invoicing Software Comparison

| Tool | Best for | Top feature |

|---|---|---|

| InvoiceOwl | Small businesses and freelancers | E-sign & multi-company management |

| FreshBooks | Solopreneurs and medium-sized businesses | Time tracking & expense management |

| Zoho Invoice | Growing businesses | Seamless integration with Zoho apps |

| QuickBooks | Accounting-focused needs | Robust financial reporting |

| Wave | Startups and small businesses | Free invoicing and receipt scanning |

Ready to Streamline Your Contractor Invoicing?

Join thousands of contractors using InvoiceOwl to create professional invoices and get paid faster. Start your free trial today.

Try Free for 3 DaysFrequently Asked Questions

The effective strategies for managing late payments is to implement automated reminders for upcoming and past-due invoices. This creates a quick reminder and prompts clients to pay on time. Furthermore, establishing clear policies regarding late fees and communicating these terms upfront helps them get paid on time.

To ensure invoices are compliant with U.S. tax laws is by including accurate tax details, such as sales tax or VAT (if applicable), specifically based on the state of operation. Also, as a contractor, you should include your Employer Identification Number (EIN) or Social Security Number.

The difference between an invoice and a receipt is that an invoice requests payment from a buyer, detailing services or products provided, the amount due, and payment terms. On the other hand, a receipt, issued after payment, serves as proof of payment completion. While invoices initiate the billing process, receipts confirm transactions for record-keeping and tax purposes.

Conclusion

After going through this detailed guide on invoicing effectively as a contractor, you might have got completed understanding. All you now need is an efficient invoicing tool to send invoices and get paid promptly. Integrate InvoiceOwl today as an optimal invoicing solution. It will help you create personalized invoices, track them, request and accept payment

Not just this you will also be able to align your invoicing and accounting operations by easily syncing your InvoiceOwl account with QuickBooks Online. When everything is getting you under one single account, why resist trying for free? start your FREE trial period today and experience streamlined invoicing like never before.

![Construction Invoice Factoring [All-in-One Guide]](/images/2022/06/construction-invoice-factoring.jpg)