To establish a consistent and streamlined approach to accounts payable, it becomes of prime importance for customers like you to pay an invoice on time.

There exist many strategies that you can apply to make the payment for invoices you receive from the service provider. But, we've highlighted the best tips on how to pay an invoice on time.

Key Takeaways

- 01An invoice payment is a transaction made by a business to a vendor for goods or services received

- 02Elements like invoice date, due date, payment terms, outstanding balance, and remittance details must be included in the invoice

- 03Important to choose appropriate methods for getting timely payments and maintaining organized records

- 04Payment terms dictate when payments are due and may include options like 'Net 30' (payment due in 30 days) or 'Due upon receipt'

What is an Invoice Payment?

An invoice payment refers to those transactions that a business makes to the vendor to pay for goods or services provided. The invoice serves as a formal request for payment, detailing the amount due, the due date, and any applicable payment terms.

It is a key component of financial management. Ideally, an invoice is a type of document that holds crucial information about the transaction made, such as services or goods provided, due amount, terms of the payment, and much more.

What are payment terms?

Payment terms are varied instructions by vendors for the customers to follow. Most of the time such terms highlight the payment date with the instructions to pay for the goods or service provider.

The standard payment terms in the U.S. are mentioned below:

- Net 30: Payment is due within 30 days of the invoice date.

- Net 60: Payment is due within 60 days of the invoice date.

- Due upon receipt: Payment is expected immediately upon receiving the invoice.

These terms establish clear expectations, and thus, help both parties manage their cash flows and business operations effectively.

In the United States, some suppliers offer early payment discounts to encourage prompt payments. For example, a term like "2/10, Net 30" means a 2% discount is available if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days.

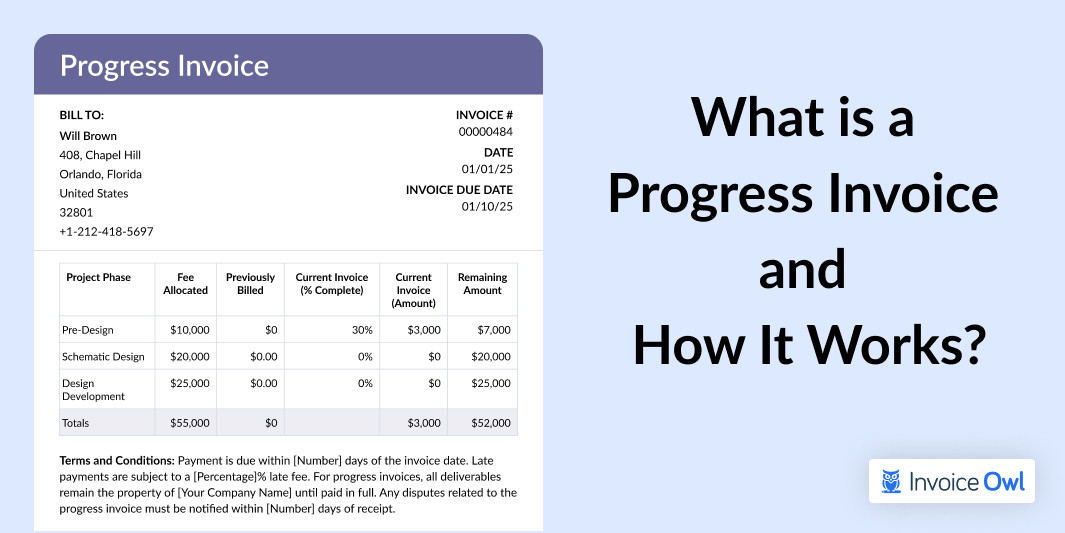

What Should Be on an Invoice?

Let's quickly hover through all the essential components that should be on an invoice.

Understanding these basics prepares users to handle invoice payments effectively, avoiding misunderstandings and ensuring a smooth process.

Step-by-Step Invoice Payment Process

The step-by-step invoice payment process is important because it ensures accuracy, timely payments, and smooth financial operations. Below is a step-by-step guide developed as per the U.S. market.

1. Invoice verification checklist

Before processing a payment, you need to ensure the invoice is accurate and complete by verifying the following details:

- Vendor's name, address, and contact details

- Invoice number and date

- Purchase order (PO)

- Goods/services

- Calculation, taxes & discounts

- Late fees and terms & conditions

2. Payment timeline planning

Developing a payment schedule is essential to align payment schedules with your cash flow to ensure funds are available, and thus, consider the following components:

- Due dates

- Early payment discounts

- Cash flow

- Approval processes

3. Choose your payment method

Based on your purchase your invoice will highlight the payment methods according to the company's terms. A vendor can choose from any payment method like cash, credit, check or card. It is a good practice to be well-versed with available options so that when the time comes there are no unfortunate delays.

4. Add the invoice to your payment schedule

You need to track the due dates for all the invoices you receive to manage your cash flow. To make this simpler, try using a spreadsheet or a cloud-based accounting software for keeping track of upcoming payments. Depending on how many invoices you get and the payment timelines, you may process your invoices and payments weekly or monthly.

Invoice Payment Methods

Selecting the appropriate payment method depends on various factors. Below is a comparison table highlighting the pros and cons of various payment methods:

Payment Methods Comparison

| Payment Method | Pros | Cons | Best For |

|---|---|---|---|

| Credit Card Payments | Quick processing, Enhanced fraud protection | Possible transaction fees, Interest charges if not paid promptly | Smaller transactions, Vendors that accept cards |

| Bank Transfers | Direct transfer to vendor, Secure and traceable | May incur bank fees, Processing times may vary | Larger payments, Direct vendor preferences |

| Digital Payment Platforms | Convenient and fast, Often lower fees, Integration with accounting software | Both parties need accounts, Security concerns if not managed properly | Small to medium payments, Quick and efficient transactions |

5 Essential Tips for Timely Invoice Payments

To ensure prompt and on-time payments of your invoices, there are certain tips and tricks to follow. Consider going through them and ensure that your invoices are getting paid faster:

1. Verify the invoices you receive

The first step that you need to take is reviewing all the invoices that you receive from the service providers and it's just to maintain accuracy.

You need to check whether all the goods and services are billed accurately and received from service providers.

But, how to maintain accuracy?

It is done by reviewing:

- Orders that you received;

- Received orders to check whether it is aligned correctly as per your order;

- The cost mentioned in the invoice matched perfectly with your initial agreement with the service provider.

For more information, we highly recommend you read our blog on how to verify your invoices.

2. Never miss your payment due date

The invoices that you receive from your vendor must specify the payment due date. Tracking all due dates for your invoices is key to properly managing your expenses.

The service providers will include any late charges. So, if you are not paying on time, then you need to be ready to pay a late charge.

Record the due dates of all your invoices in your calendar or software to remind you to pay them on time.

On a spreadsheet or online accounting software, add a schedule for all upcoming payments and all other payment confirmation details along with the contact information.

When you create a payment schedule, double-check your added bank account or credit card details for smooth bank transfer.

Your invoice payment may be scheduled on a weekly or monthly basis. It depends on how many invoices you have to pay.

3. Keep records of payment confirmation

After paying an invoice for your firm, ensure that every proof of payment or confirmation of payment is kept.

Payment details such as a number assigned to you after making an online credit card or debit card payment must be available with you for future purposes.

It is important to have payment records because your vendor may get confused about whether you have paid or not.

4. Pay the invoice in the pre-decided currency

Most often, you will be dealing with local vendors. So it's a given that you need to pay with the local currency such as the US dollar.

However, the issue can arise when you are dealing with an overseas business like Canada, Europe, or UK. So make sure that you have agreed upon the currency like Canadian Dollar, Euro, or Pound, in which you need to pay for received goods/services.

Then, as you schedule your payment, set the agreed-upon currency for paying the invoice.

5. Seek discounts

When you purchase from some vendors, they may indicate some dates when you pay via invoice and receive a certain discount.

This means that making early payments gives you a discount. If this is the case with your vendors, make sure to plan before receiving the invoice, so you get to pay the discounted price.

Common Invoice Payment Challenges and Solutions

This table outlines typical challenges businesses face with invoice payments across various industries, along with practical solutions to streamline the payment process.

Industry-Specific Payment Challenges

| Industry Sector | Challenge | Solution |

|---|---|---|

| Retail | The high volume of invoices leads to tracking errors and missed payments | Implement automated invoicing software to track and manage invoice schedules efficiently |

| Manufacturing | Errors in invoice details due to varying product specifications | Use a standardized checklist to verify invoice accuracy before processing payments |

| Healthcare | Delayed payments due to complex insurance reimbursement processes | Coordinate with insurance providers for real-time updates and streamline billing cycles |

| Real Estate | Large invoices with extended payment terms, leading to cash flow issues | Negotiate shorter payment terms with clients or set up partial payment options |

| Construction | Payment delays from clients awaiting project completion milestones | Use milestone-based invoicing, enabling partial payments as project stages are completed |

| Consulting | Unpaid or late invoices due to unclear service descriptions | Ensure detailed service descriptions on invoices and use digital tracking for timely follow-up |

| Education | Fluctuating cash flow due to seasonal payment schedules | Offer flexible payment plans for students or clients, with automated reminders for deadlines |

| Logistics | Complex billing structures due to variable shipping costs and surcharges | Consolidate billing periods and use itemized invoices for transparent breakdowns |

| Finance | High sensitivity to errors leading to disputes or regulatory penalties | Adopt double-checking processes and compliance software for precise and compliant invoicing |

| Hospitality | Inconsistent payment schedules, leading to reconciliation issues | Standardize payment due dates and set up automated reminders to ensure timely payment |

These solutions, tailored to specific industry challenges, help address common payment issues, minimize delays, and maintain strong vendor-client relationships.

Invoice Payment Tools and Resources

Selecting the right invoice payment tool is crucial for efficient financial management. Below is a comparison of prominent payment solutions:

Payment Solution Comparison

| Payment Solution | Features | Best For |

|---|---|---|

| InvoiceOwl | Create and send professional estimates and invoices, QuickBooks Sync, e-Signature | Contractors, freelancers, and small business owners seeking a comprehensive invoicing and payment solution. Perfect for those businesses who value user-friendly platforms and require professional-grade features without the complexity |

| Stripe | Advanced fraud detection, Developer-friendly APIs | Businesses requiring flexible, scalable payment processing with global reach. Ideal for businesses with a tech-savvy team or unique requirements |

| Square | Integrated POS system, Inventory management | Retailers and small businesses needing an all-in-one payment and sales solution. Excellent for brick-and-mortar stores with occasional online transactions |

| PayPal | Widely accepted online payments, Invoicing capabilities, Buyer and seller protection | E-commerce businesses and freelancers looking for a trusted, global payment platform. A go-to solution for those seeking reliability, trust, and a global payment network that integrates seamlessly with various platforms |

Upgrade to Smarter Invoice Management!

Start your FREE trial with InvoiceOwl and experience the ease of tracking, paying, and managing invoices like a pro.

Start Your FREE TrialConclusion

For records purposes, it is easy to change or lose paper invoices.

Going paperless is a good idea for small businesses and vendors. If you know that your vendor uses online invoicing software, always request digital invoices and online payment methods.

With online invoicing, you as the business owner can receive an invoice through email and document them in your cloud storage.

Frequently Asked Questions

To easily record invoices in your system, it will be useful to have basic knowledge of accounting. But no worries. We have already written a beginner-friendly guide for recording invoices. Check it out.

Whether the issue is from your side or the vendor's side, it is better to keep him updated on all the invoice payments. Then try to tackle it as soon as possible. However, the best practice is always to schedule the invoice payment at least 2-3 days before its due date to avoid such situations.

Ideally, the time to pay an invoice varies according to the payment terms stated by the vendor. In the U.S., businesses often see terms like "Net 30" or "Net 15," meaning payment is due within 30 or 15 days of the invoice date. Sticking to these terms helps maintain strong relationships with vendors and avoids late fees.

To ensure an invoice is accurate, you need to start by reviewing all key details. The important elements are the date, amount, and payment terms. Cross-check all the listed goods or services with what was actually received. Then, verify that taxes and totals are correctly calculated. Finally, add the vendor's contact and payment information to prevent potential errors, overpayments, or delays.

The best way to plan your invoice payment timelines is by arranging invoices to pay by the due date. This helps to prioritize those with the shortest terms. Additionally, setting reminders through calendar alerts or software can help you avoid missing deadlines, and if you anticipate a delay, communicating with vendors to discuss alternate payment options.

Selecting the right payment method depends on the nature of the transaction, the vendor's preference, and your cash flow needs. Common options include bank transfers (ACH), which are affordable and quick for large sums, and credit cards, which are convenient but may incur processing fees.