Invoices are more than bills. They are essential documents for business transactions. The invoice format simplifies the payment process and also aids accountants, vendors, and clients in navigating essential information, ensuring accurate financial record-keeping.

However, understanding invoices can be tricky.

What You'll Learn

- 01Understanding what an invoice is and why it matters for your business

- 02Decoding essential invoice components including header, transaction, and payment details

- 03The 5 most important things to check when reading an invoice

- 04Practical tips to verify invoice accuracy and avoid common mistakes

- 05Tools and resources to streamline your invoicing process

Understanding Invoice Essentials

Ever received an invoice and felt completely lost? Fear not, you're not alone!

This comprehensive guide is for you. Herein, we'll equip you with the knowledge and techniques to read invoices with confidence and proficiency. You'll learn to identify and interpret every element of an invoice.

What is an invoice?

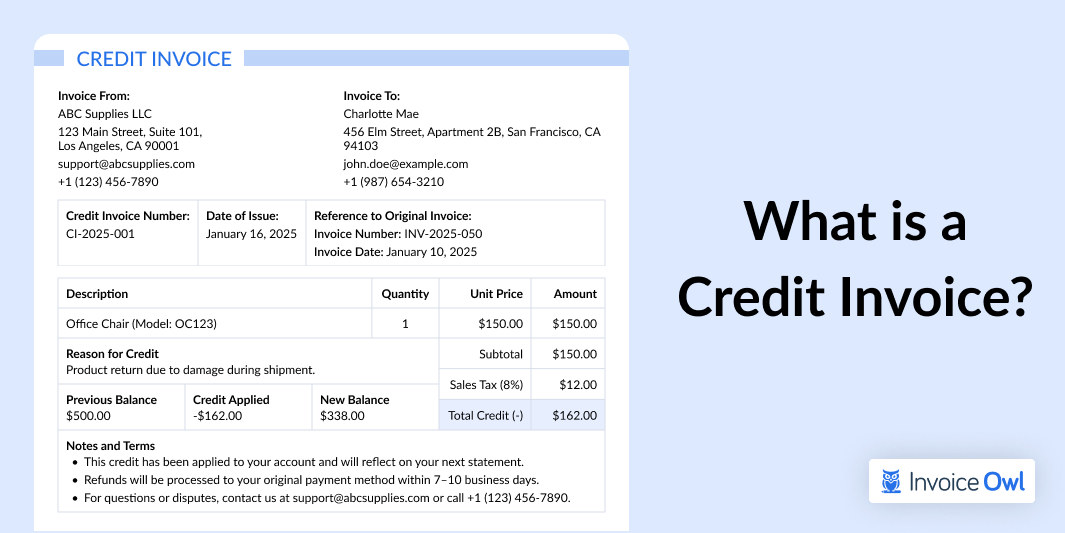

An invoice is a type of billing document that outlines the details of a transaction between a buyer and a seller. It includes information about the services, the total cost, business contact information, payment terms, and due dates. The invoice acts as an official request for payment and proof of the transaction.

Why do invoices matter?

Invoices are important as they're critical for financial transparency and legal compliance. They help businesses track payments, manage cash flows, and maintain accurate records for audits and taxes. They also ensure clarity for buyers and clients on what they're paying for and serve as evidence of the purchase.

Decoding the Invoice Components

Before delving into the process of reading an invoice, it is crucial to familiarize yourself with the fundamental invoicing terms to set the stage for understanding this crucial financial document.

Here are essential invoicing elements for your understanding:

1. Header information

2. Transaction details

- Description of goods/services: Make sure you provide a clear and concise breakdown of the goods or services provided.

- Quantity: Also, it is equally important to list the number of units provided or hours worked.

- Unit price: Enter the price per unit of each product or service.

- Total cost for each line item: Multiply the listed quantity with cost per quantity.

3. Payment details

- Subtotal: Add or sum up all the mentioned line item totals and then you will get the total cost before taxes.

- Taxes or discounts: It should include the applicable sales tax or VAT (if any), with a clear breakdown of the tax rate(s) applied.

- Total amount due: The final amount which the customer owes adding the subtotal and the applicable taxes or discounts (if any).

- Due date: Last date by which the payment is expected, if not additional interest or late payment fees will be levied.

- Preferred payment method: Clearly specify your business's preferred payment method on the invoice to avoid any last minute confusion at the time of receiving payment.

4. Optional components

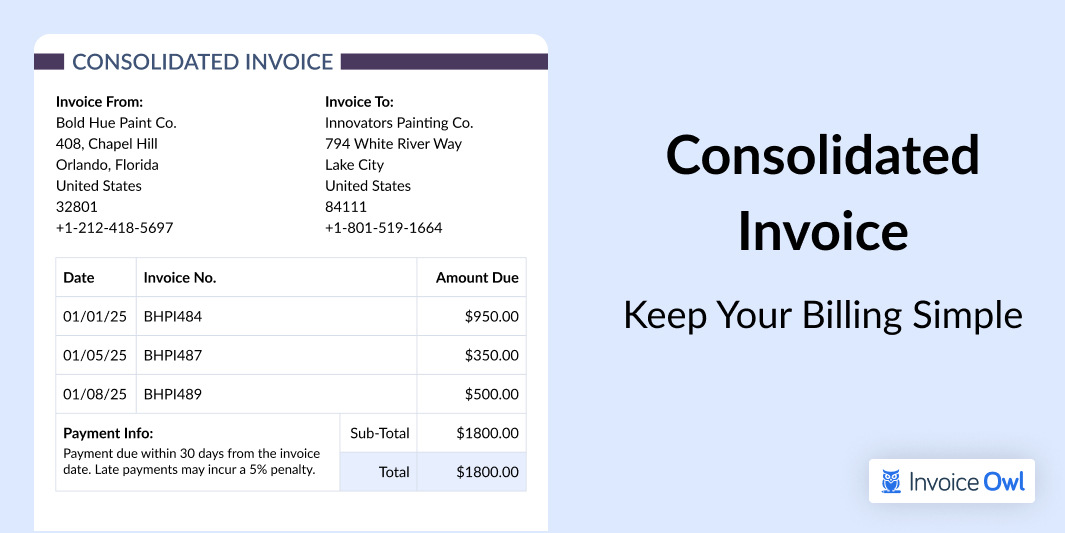

- Payment terms: The payment terms may specify accepted payment methods (e.g., credit card, bank transfer) and any potential conditions.

- Net 30: It lays out the expectations like "Net 30" meaning the invoice must be paid within 30 days of the invoice date.

- Additional notes: Any additional information relevant to the invoice, that requires the user's attention or special instructions.

Experience the Power of Effortless Invoicing

Tailored invoices, accurate payment tracking, online payment acceptance, deep business insights, and much more are just at your fingertips.

Start Your FREE TrialHow to Read an Invoice (5 Most Important Things to Check)

To read an invoice minutely, check these 5 important things:

- The supplier's contact information

- Purchase order number explained

- Invoice number and its significance

- Description and pricing breakdown

- Payment terms and conditions

1. The Supplier's contact information

The supplier's contact information includes the correct supplier's name, company name, address, email address, phone number, and details of the accounting department. These should have all the details in clear fonts.

Importance of accurate supplier details

Cross-checking supplier contact information helps you avoid confusion or miscommunication. Incorrect information can delay the resolution of issues, and in case any information is missing, you might even get a late payment.

Always verify supplier contact details against your records before processing payment. This helps prevent fraud and ensures you're paying the right party.

2. Purchase order number explained

When a customer or a company receives an invoice with a purchase order number, it means the customer or company has already approved the amount they will pay.

When the right department in charge of payment sees the purchase order number, their team detaches the original purchase order and compares the details to ensure it tallies with that on the invoice.

Not all companies use a purchase order number; they only need it when making large and expensive orders. A company may set a rule that all orders above $5,000 will have an approved P.O. number in advance.

Linking to transactions

Matching the PO number with your records ensures the goods or services listed were authorized and delivered. This surety prevents billing discrepancies.

3. Invoice number and its significance

Companies use an invoice number for reference purposes, sometimes for pending payment. The supplier is responsible for assigning a unique number to the invoice.

When the supplier of goods gets paid for the invoices, he can refer to the number of an invoice and keep a record of the payment, after which the transaction becomes closed.

A supplier who works for the same customer will need to assign the invoice number to help follow up on paid and unpaid invoices. He also needs to keep all the information along with the usage summary, handy.

Tracking and audit purposes

An invoice number will assist both the supplier and the customer. Once the customer makes a payment, he can close the purchase order, which means the order is generated and the transaction is done. It helps businesses track payments and identify pending invoices quickly.

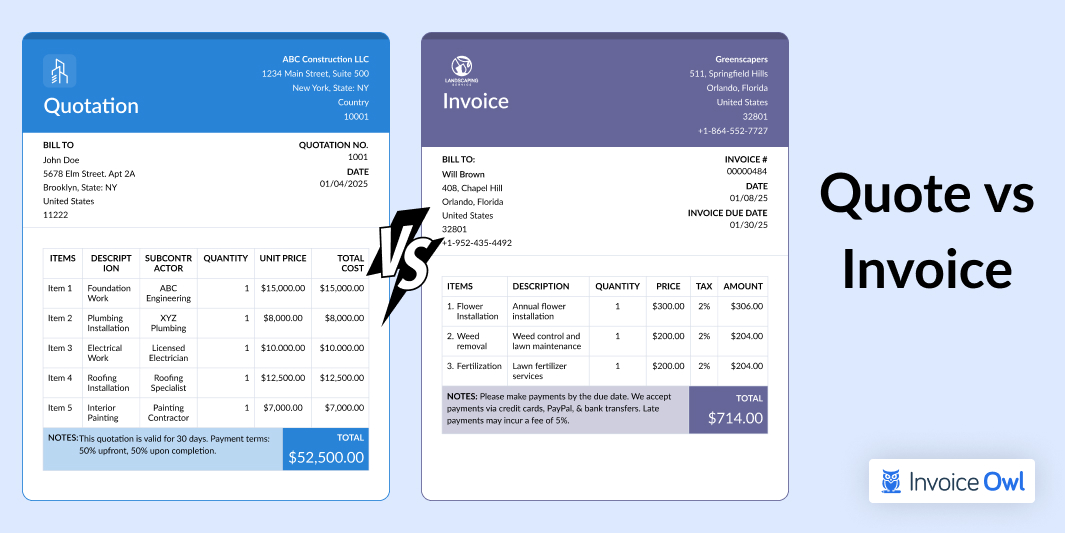

4. Description and pricing breakdown

This aspect clarifies the customer on the services or products that have been discussed when negotiating the charge summary and agreed price. The information should be kept from that of the purchase order.

An alteration on the invoice total doesn't necessarily mean the payment cannot be approved. If customers change their minds halfway through the business, their accounting department will notice the purchase order change. If the difference is not much, the customer has already approved and signed the invoices before sending them to the accountant.

An explanation for every cost you're requesting in the invoice is also necessary. Assuming a customer wants to know how much he spent on a particular service after a long time. He can trace back the invoice and see how you have explained the cost. You have to detail your invoice to the customer, so he doesn't encounter much stress finding the invoice.

Ensuring transparency

Check for clear itemization and if each line item matches what was agreed upon. This avoids misunderstandings relating to the overall amount.

5. Payment terms and conditions

Payment terms are there for notifying you as the supplier is expecting your payment. Sometimes you find phrases like "net 60 days" or "payable upon receipt."

Some payment terms can be confusing, especially when the customer has his own payment time, and does not agree with that of the supplier.

Jack is the owner of a landscaping company in Florida. He sends an invoice to a large car dealership being the first of his invoice as the business owner and adds a payment term of "net 30 days" to the invoice.

This term might differ from the agreement with the dealer, who regularly pays the invoice every 60 days. Jack is unaware of his customer's payment terms and calls the company after his payment date is due.

The supplier of services and the customer working for the first time should always reach a payment agreement. If Jack were aware of his car dealership payment terms, he'd have demanded an upfront payment of maybe 35% of the total amount before he started the job.

Understanding due dates and late fees

Payment terms inform the customer of what preferred payment method the service supplier accepts. Review the due dates carefully to avoid late fees.

Practical Invoice Reading Tips

Reading and deciphering invoices might seem straightforward. But it's easy to miss small errors or inconsistencies that can ultimately lead to payment delays and impact the cash flow. The following tips will help you verify invoices with confidence.

Tips to check invoice accuracy

Tools and resources to assist

The right tools and resources can significantly reduce your burden for creating and receiving invoices. Here are some of the tools and resources you should consider for the invoicing process:

- Invoice scanning app

- Accounting tool

- Invoice automation tool

- Expense tracking apps

Recommended software for invoicing

Here are the top invoicing tools that you can consider:

- InvoiceOwl

- Zoho Invoices

- Square Invoices

- Invoice2go

- HoneBook

Get Rid of Invoicing Hassles in Just a Click

InvoiceOwl's feature-rich invoicing software helps you create professional invoices, track payments effortlessly, and get paid faster with ease.

Get Started for FreeCommon Mistakes and How to Avoid Them

For invoicing to be a quick and seamless procedure, you need to pay heed to the mistakes that can hamper the process. It's essential to be on the lookout for the top mistakes that businesses usually make.

Recognizing errors on invoices

Don't confuse "invoice date" with "due date." Ensure you understand the deadline for making the payment to avoid late fees.

- Be aware of any applicable sales tax or VAT on the invoice and factor it into your payment calculations.

- Read the fine print to identify any potential additional fees not explicitly mentioned in the line items, such as processing charges.

- Verify that the seller's contact details on the invoice are accurate in case you need to reach out for clarification.

- Don't hesitate to question the seller if you find any errors or inconsistencies on the invoice. It's better to address them promptly than face potential issues later.

Frequently Asked Questions

If you spot an error, the first thing to do is reach out to the supplier right away. Ask them politely and point out the mistake. Provide supporting documents like a purchase order to back your claim. Most businesses will be open to resolving errors to maintain good customer relationships.

Yes, you can dispute the invoice if the invoice contains discrepancies, incorrect charges, or unauthorized items. Contact the issuer, explain the issue clearly, and request a revised invoice.

The invoice date is when the invoice was created and issued, while the due date is the deadline by which payment must be received. Understanding this distinction is crucial to avoid late payment fees.

An invoice number is a unique identifier that helps both suppliers and customers track payments, reference specific transactions, and maintain organized financial records for auditing purposes.

If your company requires PO numbers for all purchases, contact the supplier and request a revised invoice with the correct PO number. This ensures proper tracking and approval of the transaction.

Double-check all details including contact information, itemized descriptions, quantities, unit prices, tax calculations, and payment terms. Consider using automated invoicing software to reduce manual errors.