Imagine yourself sorting out endless stacks of paper invoices, manually entering data, and juggling complex approval workflows. Of course, the process is time-consuming and stressful—leading to delayed payments.

In fact, research shows that 59% of U.S. businesses still attribute poor cash flow and representing capabilities to outdated methods.

While businesses understand the need for the invoice automation process, many of them need help in implementing it successfully.

The following guide will give a complete walk-through of the invoice automation process, the reasons for automation, and tips for getting the process right. Let's dive in.

What You'll Learn

- 01How to analyze your current invoicing methods and identify bottlenecks

- 02A 4-step process to successfully automate invoice workflows

- 03Key benefits of automation including cost savings and fraud prevention

- 04Management tips to optimize your automated invoicing system

- 05Essential criteria for choosing the right invoice automation software

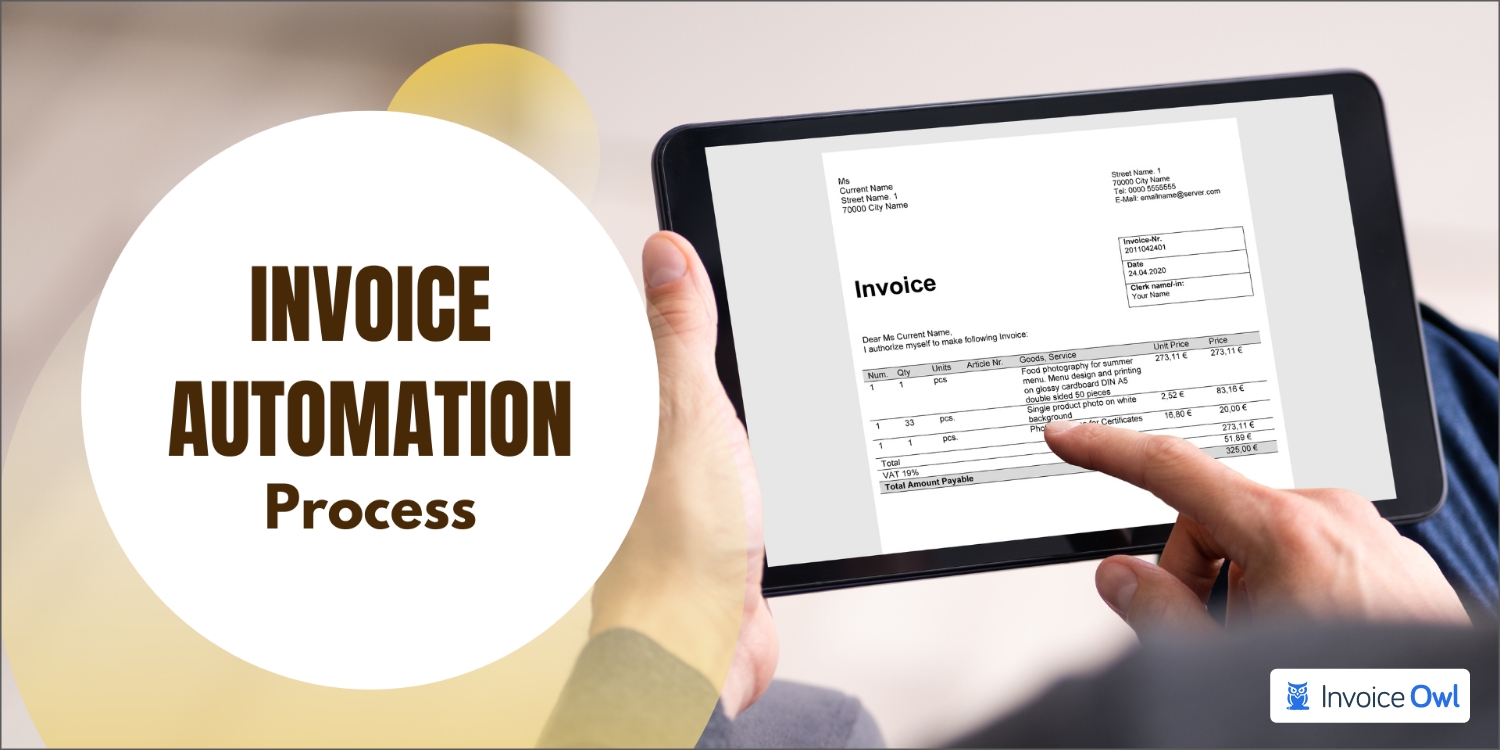

What is Automated Invoice Processing?

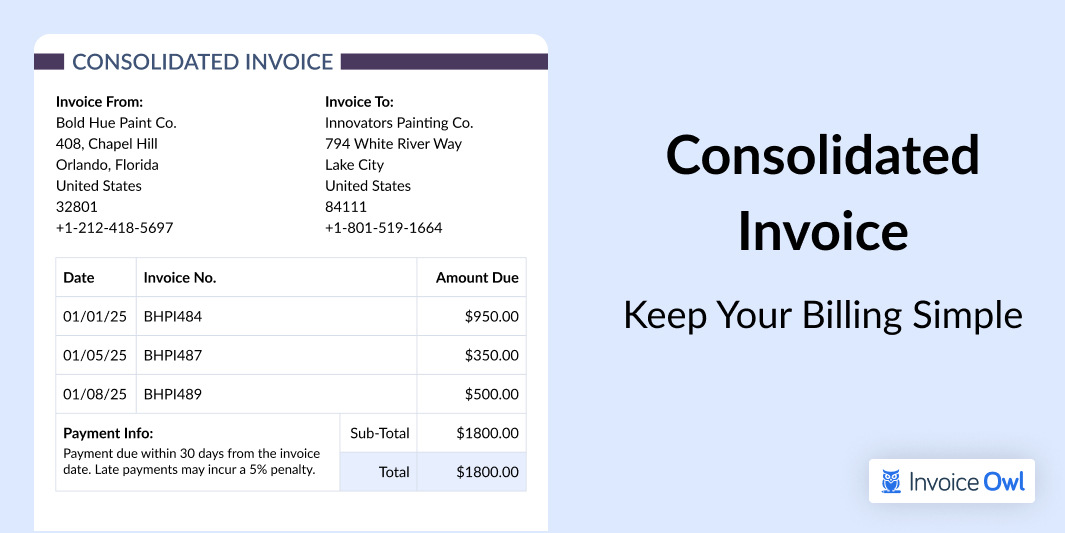

Automated invoice processing refers to the use of software to complete invoice process tasks. In order to streamline a series of steps of generating, sending, receiving, validating, approving, and storing invoices, invoice automation is pertinent. With the right software, businesses can significantly reduce manual tasks and improve efficiency.

There's no doubt that dealing with invoices is stressful, and you are certainly not the only one experiencing this. How can you keep your invoices organized and avoid costly errors? Is it possible to gain greater visibility across all aspects of accounts payable? The answer is to implement an invoice automation process.

This article outlines a step-by-step process and the reasons why automated invoice processing is required.

Step-by-Step Invoice Automation Process

With the advancement of technology, the invoice processing method has undergone a number of phases over the years. Listed below are four steps that can be followed to automate the invoice processing workflow.

Now let's begin.

Step 1: Analyze current invoicing methods

Having a clear understanding of how invoices are flowing through your organization is essential. For example, where is the invoice received, how is it transported to accounts payable (AP), how is it validated, and how long does it usually take to process the invoice? How should an invoice be processed?

A key to reducing delays and bottlenecks is to identify bottlenecks and delays, as well as the costs associated with them when they occur. When reviewing your current procedures, you are likely to find opportunities for improvement.

You can check your invoice processes using invoicing tools like InvoiceOwl, QuickBooks, Zoho Invoice, Xero, and FreshBooks.

Step 2: Define invoicing policies

Defining invoicing policies and processes is critical to ensure everything runs smoothly during the invoicing automation.

The key to making this process efficient is to determine procedures for the delivery of purchase orders and invoices.

Make sure that the process for processing invoices is clearly defined. This way, you can better guide your current procedures and policies.

Step 3: Automate invoice tasks

The invoice process can be automated using various tools, but it is essential to always ensure that the tools you choose comply with the requirements, such as legal, data security, and privacy. Invoice management tools often use cloud-based technologies that enable your company to receive invoices, process them, and pay them no matter where you are located.

The key to successful invoice automation is to adopt a single, standardized process, no matter the number of ways you capture your invoices at the beginning.

People who use paper-based, manual processes for the accounts payable process are now facing problems in managing the growing customer bases and invoicing needs. As an option, your large customers may be able to receive electronic invoices on an incremental basis if you implement electronic invoices through your trading network or, if needed, with individual customers.

By using these methods, it is anticipated that you will be able to move invoices into automated invoice processing increasingly efficiently. You can use InvoiceOwl to automate your invoice generation while also creating estimates, generating e-signatures, and managing multi-company accounts.

Step 4: Integration of software

Your organization will likely suffer from business continuity problems in the future if your company does not automate its invoice processes yet. Software like InvoiceOwl will save thousands of dollars on your invoicing needs, enabling you to focus on the most critical aspects of your business rather than worrying about the invoicing process itself.

The best invoicing and estimation software on the market is InvoiceOwl, which is the perfect solution to ease the invoicing tasks in your organization.

If you're interested in trying this wonderful tool out, don't wait any longer before you do so. With the free trial offer, you will be able to realize that sending your invoices is now as simple as a few clicks instead of several hours.

Before integrating an invoicing tool into your payment process, ask yourself: Can you automate the entire invoice generation process? Can you do electronic/digital signatures? Can you manage multiple clients? Can you track invoices? Can you generate financial reports?

Benefits of Automated Invoice Processing

Some businesses still utilize manual processes for invoicing to process invoices, and they may consider switching to automated tools to improve their overall efficiency.

1. Minimize human error

Automated invoices ensure that there are minimum human errors. With manual entries, employees need to double-check their data every time, wasting valuable time and resources. However, with automated invoice processing software, you can automate the process of using it to record, file, and report invoices in a way that minimizes human error.

Therefore, the AP department can digitize invoices and upload them to the software if they haven't already done so. This way, employees can search the system to quickly retrieve information such as the vendor's name, price, and product order by using keywords.

2. Cost efficiency

Today's market is full of software options that are affordable even for small businesses, making it easier for them to take advantage of management systems.

Although the initial cost of the solution may be high, the total return on investment (ROI) from the solution outweighs the initial purchase cost. Automation tools are essential because they help companies avoid late fees by ensuring invoices are paid on time.

As a result, the business can maintain excellent credit standing with suppliers and maintain a good reputation with the government.

Vendors sometimes offer additional discounts to incentivize organizations relying on vendors to pay them on time.

3. Cut back on unnecessary spending

Automating repetitive tasks such as filing, retrieving records, and other clerical tasks can help companies save a considerable amount of time and money in terms of labor costs.

Using this software:

- Office supplies can be reduced

- Waste can be diminished

- Money spent on wasteful items can be saved

A study has shown that the cost of paper invoices can range between $12 and $30, whereas automated invoices can be as low as $3.50. While the business bears most of the expenses associated with paper and labor, it must also cover storage costs. There is a risk that the physical invoice will be lost, meaning that AP will have to repeat the whole process, incurring a double expense.

In addition to double-checking the data entry and automating the calculations, invoice software prevents costly mistakes.

Paper invoices cost $12-$30 per invoice vs. automated invoices at just $3.50 per invoice. For businesses processing 100 invoices monthly, that's potential savings of $850-$2,650 per month.

4. Integrate systems

A software solution for invoice processing that integrates with existing processes can provide employees with a universal interface to access all the information they need. For example, the AP team can integrate its invoice solution with its billing, inventory ordering, and accounting software. In this manner, employees do not have to spend time on manual data entry, saving them time and money.

5. Fraud prevention

Invoice fraud is a serious problem that affects many businesses, namely when someone possesses a supplier to receive funds from the business. Several large corporations, such as Google and Facebook, have suffered the consequences of invoice fraud, which cost them more than $100 million.

These organizations could survive these hits as they were stable enough to withstand them, but not every business can afford to lose such a crucial asset.

Invoice fraud has cost major companies like Google and Facebook over $100 million. Automated systems with built-in verification and approval workflows significantly reduce fraud risk by creating clear audit trails and validation checkpoints.

Management and Optimization Tips

The cash flow of small businesses is crucial for their survival since they need to preserve capital as much as possible. If invoices are not paid on time, budgeting and other financial planning can be negatively impacted.

An effective invoice process ensures timely, accurate payments, so companies must establish one as soon as possible.

1. Simplify billing processes

Several small businesses mistake automated billing solutions for billing systems of larger corporations when they are, in fact, much more affordable and easier to use. Paper invoices always have the risk of losing or making a mistake, and fraud may also occur. Moreover, traditional invoices are time-consuming to prepare, require several employees, and require tracking.

Billing software, on the other hand, ensures that invoices are received electronically and in a timely manner by storing and transferring them. Advanced solutions may even perform a double check on data in real time to ensure that there are no mistyped or error invoices.

2. Create invoice checklists

When businesses in the field use invoice software, they are prompted to enter critical information for invoice classification like

- Customer's name

- Invoice number

- Date

- Date of payment, incremental payments

- Representative of sales

- Order for a product

3. Set up a timeline for invoices

Generally, large projects are billed in increments rather than in full. The process can be carried out on a weekly, bimonthly, or quarterly basis to maintain cash flow. Managing payment plans when there are multiple projects on different schedules can present a challenge. So, to ensure payments are processed and supplier expectations are met, businesses should create a billing schedule.

4. Monitoring and evaluation

The Account Payable department must monitor the implementation of the invoicing process to ensure that bills are being recorded and filed properly. In an efficient system, invoices are automatically sent after a sale, approvals are triggered, and agreement terms are regularly reviewed.

Choosing the Best Software for Your Business

If you're automating the invoice process, you need to have the right set of tools that ease the work for you. The ultimate choice depends on various factors that we've listed below.

Before committing to an invoice automation platform, take advantage of free trials to test the software with your actual workflow. Look for tools that offer comprehensive customer support and regular updates to keep pace with evolving business needs.

Start Implementing Invoice Automation Software in Your Business

Keeping your vendor relationships strong requires that your accounts payable department ensures that your financial obligations are paid on time. Even so, manual invoice processing is inefficient and subject to error, and your company risks losing invoices, missing payments, or even being cheated.

With invoicing software, you can automate workflows integrated with your accounting software. With enterprise-grade software that has hardened security, digital signature support, audit trails, and more, you can take advantage of the latest technology at a reasonable price.

Ready to Automate Your Invoicing Process?

Join thousands of businesses using InvoiceOwl to streamline invoicing, reduce errors, and get paid faster.

Start Your Free TrialFrequently Asked Questions

Invoicing automation is the process by which you automate your invoice process in such a way that it will function automatically once it has been configured. By automating the invoice-processing process, businesses of all sizes can save time and improve productivity by eliminating the need for manual data entry.

The workflow of an invoice includes invoice submission, data capture, and matching with purchase orders. In addition, there are approval routing, approver review, payment processing, and archiving to help you with faster approvals and accurate records.

Identifying your business needs and defining your processes is essential to selecting the right platform. Besides reading product reviews, you can also try the products for free or schedule a demo. A good choice would be to start using InvoiceOwl, which offers transparent pricing policies, regular updates, and excellent customer service.

Studies show that paper invoices cost between $12-$30 each, while automated invoices cost as low as $3.50. For a business processing 100 invoices monthly, this translates to savings of $850-$2,650 per month, plus reduced labor costs and fewer errors.

Yes, invoice automation is particularly beneficial for small businesses. Modern solutions are affordable and easy to implement, helping small businesses save time, reduce errors, improve cash flow, and compete more effectively with larger competitors.