Keeping business documents up-to-date is the basic aspect of maintaining accurate accounting records.

But, this task can be confusing for most business owners. Sometimes they get confused between various legal documents, as understanding the fundamentals of invoice vs receipt is surely tricky.

Both documents play a major role in supporting the sales process of any business. An invoice and a receipt for the same transaction have many differences and similarities as they request and confirm the payment respectively.

Key Takeaways

- 01Invoices request payment before a transaction is complete, while receipts confirm payment after completion

- 02Both documents serve distinct legal and financial purposes in business operations

- 03Invoices track accounts receivable and outstanding payments, receipts provide proof of purchase

- 04Understanding when to use each document ensures compliance and smooth cash flow management

- 05Digital invoices and receipts enhance efficiency and reduce errors in modern businesses

Let us check out the main difference between an invoice and a receipt in detail.

Introduction to Invoices and Receipts

Ideally, both invoices and receipts are financial documents. They are used as exchangeable contexts but serve a different purpose. In simple terms, an invoice is a request for payment, issued by a seller to detail goods or services provided, along with payment terms. A receipt, on the other hand, is proof of payment, confirming the transaction is complete.

Defining Invoices and Receipts

There is no denying the fact that understanding their differences is crucial for accurate record-keeping and ensuring smooth financial operations. So let's break these down in detail.

What is an invoice?

An invoice is generated to ask the customer for the payment. When received by the customer, they call it a bill.

This legal document itemizes the product or service, and it calculates the prices, total cost, additional business expenses, and applicable taxes that the client owes you for the work, time, and materials. As a part of business, sometimes business owners also get the bills from the vendors.

Businesses issue invoices to the client, indicating the amount to be paid. Sometimes, the invoice is also sent for the request for payment of the outstanding invoices or the partial amount that has to be paid in advance.

An invoice can be created digitally or traditionally. However, most businesses nowadays prefer to use the modern way of the invoicing process and get instant payment.

Key characteristics of invoices

Examples of invoices in various businesses

Popular business chains such as those described below regularly require invoices:

- Retail: A clothing store issues an invoice for a bulk order.

- Freelancing: A graphic designer sends an invoice for completed projects.

- Construction: A contractor provides an invoice for materials and labor.

- Healthcare: A dentist issues an invoice for treatments performed.

What is the receipt?

A business owner issues a receipt once the client has paid their invoice as proof of payment.

Well, it is the most essential proof of purchase which a customer needs to have.

This can help both the client and the customer in avoiding a complicated situation. You can also use those receipts for future transactions with clients or businesses (if it's a business-to-business trade).

Payment receipts, whether created through traditional methods or by using the option to make a receipt online free, make it easy for a small business owner to calculate the payments that are already paid and will also help you calculate the tax to make sure you are not disobeying any taxation rules.

It can be only issued when the sale is completed and after the seller receives the payment. The receipt can be either sent digitally or in printed form through the mail.

Key characteristics of receipts

Examples of receipts in various transactions

Receipts are most popular among the following businesses:

- Retail: A customer receives a receipt for grocery purchases.

- Online shopping: An email receipt confirms an e-commerce order.

- Utilities: A receipt is provided for a monthly electricity bill payment.

- Travel: A cab service issues a receipt for the ride fare.

Try our free online invoice generator today! Designed for businesses in construction, consulting, and photography, to simplify and get paid faster.

Purpose and Usage Guide

Businesses issue different types of invoices and receipts that serve different purposes. Let's understand how they matter in this realm.

What is the purpose of an invoice?

Here are some of the main purposes of having an invoice for your customers:

- Invoices are used to request payment from the customers against the provided products or services.

- Invoice ensures a smooth cash flow that is essential for running a successful business.

- Invoicing is the best way to record the information about the transaction between a buyer and a seller and to get paid quickly.

- It notifies the client about the exact amount that the client needs to pay before the deadline.

- Invoices help keep track of the sales and estimate future revenues.

Now that we know the purposes of invoices, let's know when invoices are used.

Scenario-based examples

As discussed earlier, invoices serve different purposes. And to better understand the use of an invoice, let's know when an invoice is used.

- When the vendor wants to request a payment from the customer for the product(s) or service(s) sold.

- When the vendor wants to notify the customer about the amount payable.

- When the seller wants to inform the client about the positive balance.

- When the vendor wants to collect a deposit or advance payment.

What is the purpose of a receipt?

The purpose of a receipt is discussed further:

- A receipt is one of the documents that a vendor or seller issues to their customer to notify the payment received.

- Receipts are important for everyone that is doing small business or large business and selling goods or services. This is considered as a piece of document that helps businesses in tracking most of the sales and additional business expenses.

- It also serves as an important document to recover any lost invoice income or for a tax audit.

- Many businesses use receipts to file their financial reports and plan their budget for the next financial year.

- Not only this, but receipts are equally important for buyers as well, especially if they want to reclaim the VAT on a particular product purchase. It is also helpful if the buyers want to return or exchange any product, at that time the seller will ask for the receipt as per their return policy.

Scenario-based examples

Every business has to use receipts, but do you know when?

Let's quickly see when to use a receipt.

- When the vendor wants to confirm the payment

- When the customer wants to claim a refund

When to Use Invoices and Receipts

Both invoices and receipts complement each other with their distinguished characteristics. However, it's very important to understand how to use these two factors properly for managing the cash flow, managing records, and fostering trust with clients.

Best practices for using invoices

Best practices for using receipts

Compliance and legal requirements

Both invoices and receipts must meet compliance standards to ensure legal validity.

For invoices:

- Adhere to tax regulations, including GST or VAT if applicable.

- Include mandatory details such as business registration number and tax ID.

For receipts:

- Ensure receipts meet consumer protection laws.

- Maintain records of receipts for the duration specified by local tax authorities.

Differences and Similarities

Both invoices and receipts are considered commercial tools, which are widely used in the business transaction process. Both the documents have their own value and fulfill different purposes. Receipts and Invoices both have differences and similarities too. Let us see everything in detail.

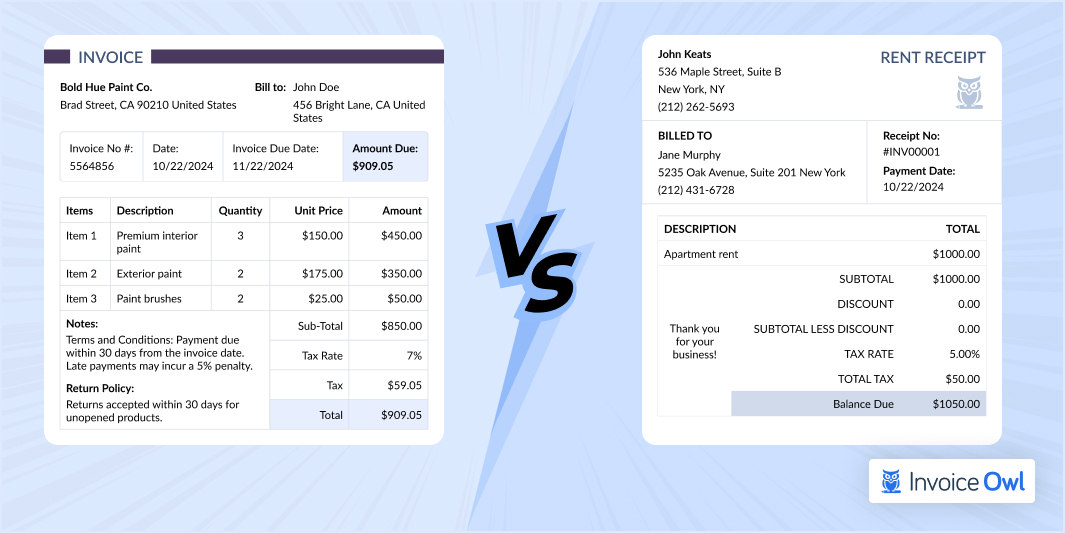

Key differences between invoices and receipts

Invoice vs Receipt Comparison

| Basis of Difference | Invoice | Receipt |

|---|---|---|

| Purpose | An invoice is generated to request payment. | A receipt is proof of received payment. |

| Time of issuing | An invoice is issued before the payment is paid. | A receipt is issued after the payment is paid. |

| What it states | The invoice includes the total amount that is due or needs to be paid. | The receipt includes how much amount has been paid and what was the mode of payment. |

| Use | Refunds can not be claimed based on the invoice. | Refund claims need a receipt of the payment made. |

| It tracks | The goods or services sold. | The goods or services bought. |

Commonalities in function

Despite their differences, invoices and receipts share the following common functions:

- Both are important for financial documentation and record-keeping.

- They ensure transparency in business transactions.

- Serve as tools for tax calculation and compliance.

- Used for building trust between businesses and customers.

Scenarios where both are used

- Retail transactions: A store issues an invoice for a bulk purchase and a receipt upon payment completion.

- Freelancing projects: A freelancer sends an invoice for services rendered and provides a receipt upon payment.

- Rent payments: A landlord issues an invoice for rent dues and a receipt once the rent is paid.

- Healthcare services: A clinic generates an invoice for treatments and issues a receipt after receiving payment.

Writing Effective Invoices and Receipts

As invoices and receipts serve different purposes, it is written differently. So let's quickly know the elements to mention in an invoice and a receipt.

This will make the difference even clear.

How to write an invoice

Here's a quick and simple guide to creating an invoice:

- Step 1: Include your business name, logo, and contact information.

- Step 2: Add the word "Invoice" prominently.

- Step 3: Assign a unique invoice number for tracking.

- Step 4: Mention the issue date and due date.

- Step 5: Add the client's name, company name, and contact details.

- Step 6: List each product/service with a description, quantity, unit price, and total cost.

- Step 7: Specify any applicable taxes or extra fees.

- Step 8: Highlight the total amount to be paid.

- Step 9: Provide details on acceptable payment methods and terms.

- Step 10: Include any specific terms, like late payment penalties or discounts.

How to write a receipt

Simply follow the steps outlined below to create a concise receipt:

- Step 1: Display your business name, logo, and contact details.

- Step 2: Carefully add the heading Receipt.

- Step 3: Assign a unique receipt number.

- Step 4: Mention the transaction date.

- Step 5: Add the customer's name and contact information (if applicable).

- Step 6: Detail each product/service with quantity, unit price, and total amount paid.

- Step 7: State the payment method (cash, card, online).

- Step 8: Include the last four digits of the card, if applicable.

- Step 9: Specify the amount of tax paid, if relevant.

- Step 10: Highlight the total amount received.

Additionally, it's also a good practice to include a "Thank You" note to improve customer satisfaction.

Real-World Applications

Here's how different businesses use invoices and receipts effectively in real-world scenarios:

Businesses using invoices and receipts effectively

Every successful business needs to have both an invoice and a receipt. From freelancers to startups, small to large businesses, designers to carpenters, everyone issues invoices and receipts. Every business that sells products or services needs to issue invoices and receipts.

Thanks to technology businesses can send invoices and receipts via email too. These legal documents are generally useful to sellers, merchants, traders, and vendors.

Industry-specific examples

1. Freelancers and Consultants

Freelancers, such as graphic designers or content writers, rely on professional invoices to clearly outline their services, rates, and payment terms. For example, Excalibur Designs, a graphic design solopreneur, uses customizable templates to include itemized project details and automatically calculate applicable taxes. This helps to send clear and professional invoices for timely payments.

Benefit: Well-structured invoices help Jane avoid misunderstandings, maintain a steady cash flow, and track her earnings for tax reporting.

2. E-commerce Businesses

E-commerce stores like ShopCraft Goods issue detailed receipts for every transaction. These receipts include product descriptions, quantities, prices, and shipping details. With automation, ShopCraft can instantly generate digital receipts and email them to customers, for a seamless shopping experience.

Benefit: These receipts act as proof of purchase, reducing disputes and improving customer satisfaction while enabling smooth returns or exchanges.

Ready to Streamline Your Invoicing?

Stay organized and keep your finances in check with InvoiceOwl's professional invoicing and receipt management tools.

Start Your FREE TrialFrequently Asked Questions

Digital invoices and receipts significantly enhance business efficiency by streamlining processes, reducing errors, and enabling users to make faster payment processes. Driven by the rapid adoption of digitalization across all sectors, companies are increasingly utilizing electronic invoices and receipts.

The legal implications of e-signatures on invoices are significant in many ways. It is observed especially for small businesses, including freelancers and contractors, the e-signature holds massive importance. As they completely rely on remote and online transactions. Presently, e-signatures are widely recognized as legal processes under laws such as the U.S. Electronic Signatures in Global and National Commerce (E-SIGN) Act and the Uniform Electronic Transactions Act (UETA).

Automated invoicing systems are designed to reduce any human errors. Thus, the process helps to achieve consistency and speed up the billing process. By streamlining invoice creation and management, these systems empower businesses to improve cash flow and enhance accuracy.

Conclusion

Invoice and receipt both are important parts of the purchasing process. The Invoice helps businesses to inform clients about the total pending amount, whereas a receipt is a way to identify whether the amount for the stock or goods and services has been received or not.

If you are looking for an all-in-one invoicing solution that helps create invoices quickly and send automated receipts right away, Download the InvoiceOwl app. And this will be the last solution you will need.