Not securing advance payment before delivering major goods or services is challenging. What if a client delays payment? Or worse, what if they back out entirely?

These are difficult scenarios many businesses face, especially when significant upfront costs are involved.

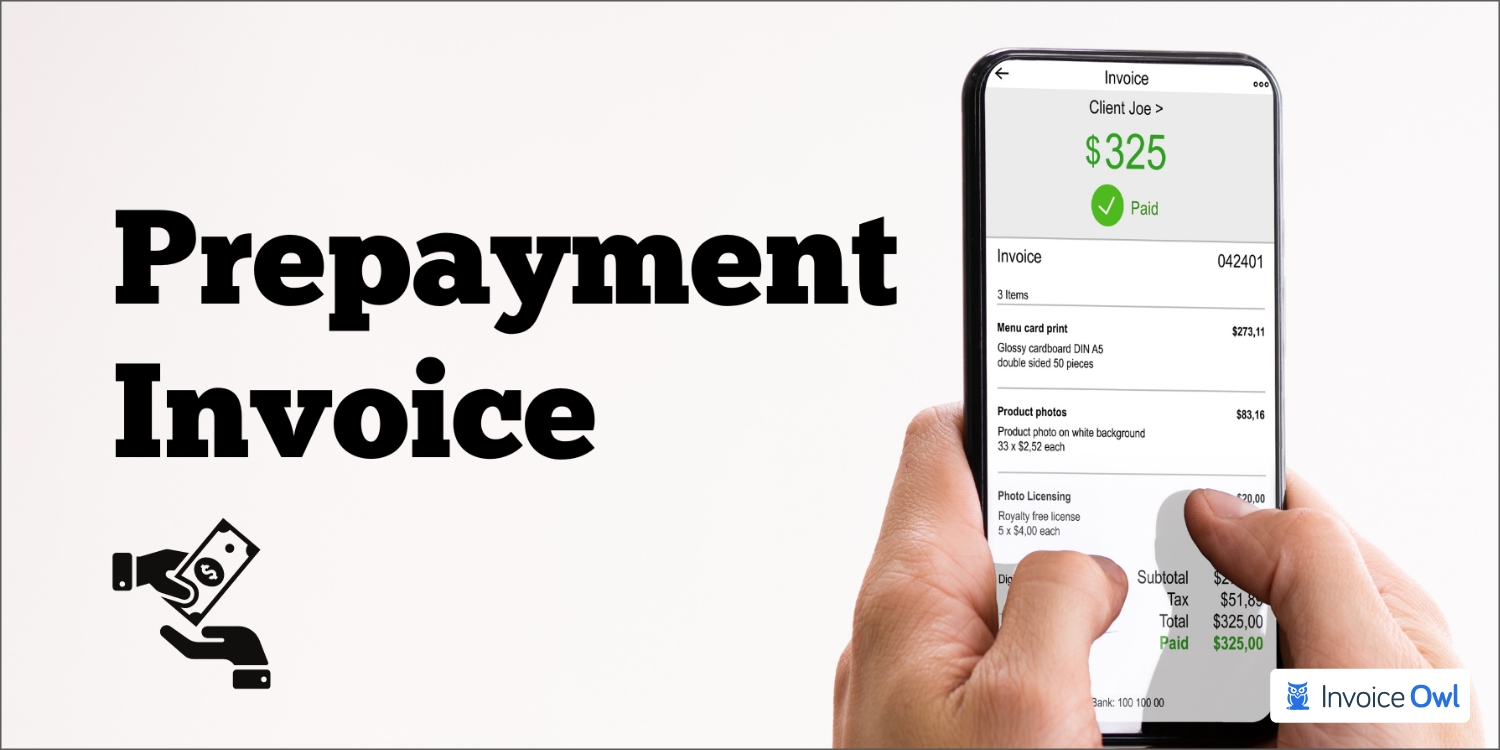

That's where prepayment invoices come in—helping you secure payments in advance, protect your financial interests, and build trust with clients.

Prepayment refers to the transaction wherein a customer pays for your goods or services in advance, either partially or fully. It helps you steer away from major losses.

Thus, it is pertinent for a business owner to build a functional accrual accounting system. In this guide, we'll discuss everything related to prepayment invoices, right from their purpose to tips for effective use.

What You'll Learn

- 01What prepayment invoices are and how they differ from advance payments

- 02Key benefits including improved cash flow and reduced payment risks

- 03Industry-specific applications from construction to freelancing

- 04Step-by-step guide to creating prepayment invoices with automation tools

- 05Common mistakes to avoid when sending prepayment invoices

Understanding Prepayment Invoices

Before learning how and when to use prepayment invoices, let's understand in detail what prepayment invoices mean.

Definition and overview

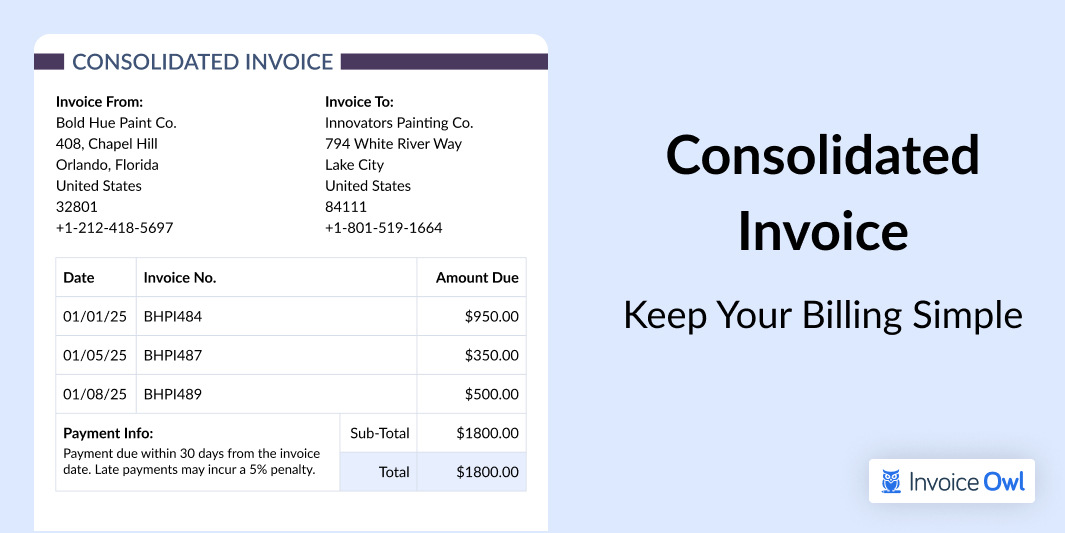

Prepayment refers to the transaction wherein a customer pays for your goods or services in advance, either partially or fully. A prepayment invoice works both ways; you can issue it to your customer and vendor. It can be to denote that you have sent a prepayment amount to your vendor or to seek prepayment amounts from your customer.

You can decide the prepayment amount by either fixing a prepayment percentage of the total amount or setting a fixed amount.

If there is a discrepancy in the number of requested items or services, you can issue additional prepayment invoices. By establishing default prepayment percentages, you can simplify the payment process manifold. It helps in realizing your payments before the settlement date, usually partially.

Thus, if established precisely, this system can have a major positive impact on your organization.

Moreover, establishing the prepayment process can be simple if you use invoicing software like InvoiceOwl.

Key characteristics of prepayment invoices

Prepayment vs. advance payment: Key differences

While prepayment sounds very similar to advance payment, they are slightly different. Let's check how.

Prepayment vs. Advance Payment

| Aspects | Prepayment | Advance Payment |

|---|---|---|

| Definition | Payment made before the delivery of goods and services, based on a prepayment invoice | Payment made in advance, not necessarily tied to a specific invoice |

| Purpose | Ensures financial security for a specific transaction | Can be used as a deposit for any of the future orders |

| Applicability | Common in certain industries like manufacturing where upfront costs are crucial | Used in varied contexts, including partial payments or securing services |

Use invoicing software like InvoiceOwl to automate prepayment invoices and track payments effortlessly. This ensures accuracy and saves time while managing upfront payments.

Benefits of Prepayment Invoices

Prepayment invoices is greatly assistive in setting up an accrual accounting framework, maintaining your company account, keeping a tab on the profit margins, and in many ways. The below given sections are provided with key benefits in two essential areas: securing your finances and enhancing operational efficiency.

Securing your finances

Prepayment invoices strengthen financial health. It always ensures upfront revenue and reduces payment risks.

Cash flow and risk mitigation

- Steady cash flow: Prepayment invoices guarantee upfront payment, allowing businesses to cover operating expenses, manage inventory, and invest in growth opportunities without financial strain.

Example: A graphic design agency collects full payment before starting a project, ensuring they can allocate resources confidently.

- Reduced risk of payment defaults: Requiring prepayments helps to minimize the risk of unpaid invoices. This is especially involved for high-value or custom orders.

Example: An event management company secures prepayment for venue bookings, eliminating financial losses from last-minute cancelation.

Budgeting advantages

- Better financial planning: Prepayments are developed to make future revenue predictable. Thus, it enables businesses to plan budgets effectively and avoid cash flow gaps.

Example: A subscription-based SaaS company collects annual prepayments, allowing them to allocate funds toward product development and customer support.

- Avoiding overcommitment: Businesses must follow to accept only prepaid projects. This prevents resource overextension or unmanageable workloads.

Example: A custom furniture maker takes prepayments to ensure they can source materials and allocate production time efficiently.

Enhancing operational efficiency

Prepayment invoices help businesses improve workflows, prioritize projects, and ensure timely payment collection.

Streamlined processes

- Faster payment collection and clear payment expectations: Prepayment invoices establish payment terms upfront, reducing delays and disputes. With automation tools, businesses can streamline invoice creation and reminders for quick client payments.

Better resource allocation

- Efficient resource planning: Prepayments allow businesses to allocate funds for materials, staff, or logistics well in advance.

Example: A bakery specializing in custom wedding cakes requires a prepayment. As the purchase of the premium ingredients and schedule additional staff is important to ensure everything is ready for the event.

- Improved project execution: Securing payments beforehand ensures smoother operations. Thus, it offers timely delivery of products or services.

Example: A landscaping company collects a 50% prepayment before starting a garden makeover project. This helps them to prepare before hand with the pre-order plants, rent specialized equipment, and assign staff to complete the project.

Now that we've check the benefits of prepayment invoices, let's check out their practical use cases.

Practical Use Cases for Prepayment Invoices

You can use repayment invoices can be used on several occasions, including defining a prepayment amount on your purchase order before issuing the final invoice, paying a vendor or an employee in advance, recording the prepayment amount, and more.

If yours is a cash accounting framework, you record prepayments only once the cash is received. However, in an accrual accounting structure, prepayments are recorded as soon as the financial event occurs.

Industry-specific applications

Prepayment is more common in some industries than others. Some industry-specific uses of prepayment invoices include:

- Construction: For securing upfront payment on large projects before purchasing materials.

- Retail: To confirm orders and secure payments before shipping goods.

- Event management: To secure venue booking and upfront service costs.

- Freelancing: To secure payment commitments for projects.

Case study: Prepayment in the retail sector

Prepayment strategies can transform cash flow management in the retail sector. This ensures that the businesses stay ahead of the financial challenges.

Let's take a look at how a retail company implemented a prepayment system to improve its operations.

Background

A mid-sized retail business that specializes in high-demand seasonal products. It was faced with increasing pressure to manage inventory effectively while maintaining a steady cash flow. The sales cycles also fluctuated and there was an ongoing struggle to ensure timely payments from customers, leading to operational delays.

Challenge

The company frequently dealt with delayed payments. This disrupted inventory restocking, causing missed sales opportunities. The issue accelerated during the peak seasons when the demand outpaced supply, leading to customer dissatisfaction and revenue loss.

Solution

The retailer adopted a prepayment system, offering customers incentives such as discounts or priority access to new collections for paying in advance. They used InvoiceOwl to implement this strategy, making it simple to create and send invoices while tracking payments efficiently.

Results

The prepayment system boosted cash flow stability, enabling the retailer to restock inventory promptly. The retail company reported a 25% improvement in customer payment timelines and a 15% increase in seasonal sales. Customer loyalty improved too due to the exclusive benefits offered through prepayment.

Next, let's learn the steps for creating prepayment invoices.

Step-by-Step Guide to Creating Prepayment Invoices

If you want to create any receipt or an invoice, opting for invoicing and estimating software can help you greatly.

InvoiceOwl helps you create an accurate receipt and invoice, and it also helps you generate a professional prepayment credit memo, purchase order, sales order, and more.

Here is how you can create prepayment invoices using automated software:

Step 1: Create a new account or log in to your existing account

Enter the required details, such as business name, address, contact details, country of origin, business type, etc., to create an account with InvoiceOwl.

Fill out further information, such as whether sales tax applies to your goods or services or not and if it is inclusive or exclusive.

If you already have an InvoiceOwl account, log in by entering your credentials.

Step 2: Go to the 'Invoices' section from the drop-down menu

In the next step, you are required to select the 'Invoices' option from the drop-down menu, visible on the left corner of the page.

The next page has two segments (active and paid) to track your invoices and an option to create a 'New Invoice.'

Step 3: Create an invoice in minutes

This segment allows you to enter all the pertinent details required to create a professional prepayment invoice. You can mention the following details to generate an accurate invoice:

- Invoice number

- Date of issuing the invoice

- The settlement date

- Payment terms

- Line items to mention every item/service sold

- Quantity, rate, tax, and amount

- Note for the customer

- Payment instructions, if any

- Attachments for adding supporting documents

- Contract

- Payment options

Step 4: Save and send

Once you select the 'Save' button, you will be directed to the next page. This page has the options of 'Edit' and 'Email' on the left corner. You can directly send the created prepayment invoice to your client using the 'Email' option.

Even though the steps mentioned above are for creating a new prepayment invoice, you can customize an invoice template per your preferences and requirements.

What are the tools and software for automation?

There are numerous tools you can use to send prepayment invoices. These include:

- Invoicing software

- Accounting platforms

- Payment gateways

- Workflow automation tools

Check out the top invoice automation tools and their key features and pricing:

Top Invoice Automation Tools Comparison

| Software | Key Features | Pricing | Best For |

|---|---|---|---|

| InvoiceOwl | Customizable templates, Automated reminders, Easy payment tracking, Multiple currencies | Free trial, custom pricing | Small businesses & freelancers |

| QuickBooks | Expense tracking, Invoice automation, Recurring payments, Mobile-friendly app | Starts at $30/month | Businesses needing full accounting solutions |

| Zoho Invoice | Time tracking, Multilingual invoicing, Automated workflows, Integrations with Zoho ecosystem | Free & custom pricing | Freelancers and growing businesses |

| FreshBooks | Recurring invoices, Time tracking, Expense management, Client communication | Starts at $17/month | Service-based businesses and solopreneurs |

| Square Invoices | Customizable invoices, Real-time payment tracking, Free templates, POS integration | Free, pricing starts at $20/month | Businesses using Square POS for payments |

What are the common mistakes to avoid while sending prepayment invoices?

Prepayment invoices are great for getting advance payments for risky projects. However, there are some common mistakes that companies make before sending prepayment invoices. Check out these errors and ways to avoid them.

Incorrect client details: Errors in client details such as misspelled names and wrong addresses can delay payment processes and create confusion. Always provide your contact details to make it easy for clients to reach out to you in case of any questions or concerns.

- Unclear payment terms: Clients may not prioritize payment if terms like "Payable Upon Receipt" are vague or undefined. To avoid this, review the final amount along with taxes, and discounts, to avoid disputes or delays in payment.

- Missing tax information: Excluding necessary tax details such as applicable tax rates can make the invoice non-compliant with local regulations. This can even lead to penalties or disputes with clients. Hence, ensure that you include accurate tax information to comply with the laws.

- Sending without confirmation: Always verify the client's agreement to prepayment terms before issuing the invoice to maintain professionalism. This just enhances your brand value and fosters the client's trust.

Ready to Streamline Your Invoicing?

Join thousands of businesses using InvoiceOwl to create professional prepayment invoices and get paid faster.

Start Your Free TrialFrequently Asked Questions

A prepayment invoice is a document a business issues to its clients before fulfilling the order. It requires customers to pay a fixed amount to the business in advance.

Yes, prepayments are useful as they prevent businesses from incurring losses and lift the burden off the client's shoulders by allowing them to pay in parts.

No, prepayment and advance payment are not the same. Prepayment refers to paying for goods or services before their due date. It is often a part of a contract or billing cycle. Advance payment, however, is made before goods or services are provided, typically as a deposit or initial payment. While both involve paying upfront, their purposes and contexts differ.

Yes, a prepayment is treated as a receivable. If a business makes a prepayment for goods or services, it records it as a prepaid expense (an asset) until the supplier fulfills the obligation. For the recipient, the prepayment is considered a liability until the goods or services are delivered.

Conclusion: Key Takeaways

If implemented correctly, the prepayment framework facilitates a win-win situation for all the parties involved. A prepayment invoice plays a major role in successfully establishing a prepayment structure.

Therefore, generating professional and accurate invoices is the need of the hour. Using an automated tool like InvoiceOwl to generate accurate invoices, bills, receipts, sales orders, and purchase orders provides your business with great assistance! Sign up to generate seamless invoices.