Let's face it—getting paid for long-term projects is challenging. Opt for progress invoice to save your business from a financial crunch.

Think of it as splitting payments for long term projects into smaller and more manageable parts based on milestones. Also known as progress billing, it keeps your cash flow steady and ensures clear communication at every stage of the project.

Progress invoicing surely makes large expenses more manageable for any small to medium-sized businesses across the construction, contracting, or service industries with lengthy timelines.

Curious how it works and why it's a must-have strategic move for your company?

Stick around—we'll provide you with the necessary details (mechanics, key components, and best practices), which can transform your business for the better.

What You'll Learn

- 01What progress invoicing is and how it differs from traditional billing methods

- 02Step-by-step breakdown of how progress invoicing works for long-term projects

- 03Essential components to include in every progress invoice for clarity and compliance

- 04When and which industries benefit most from progress billing

- 05How progress invoicing improves cash flow and reduces financial risk for businesses

- 06Best practices for managing progress invoices with modern invoicing software

What is Progress Invoicing?

A progress invoice is an approach that involves billing clients incrementally for the project until completion. This process offers business owners a pay-as-you-go setup and thus, ensures a steady revenue stream by keeping clients informed and aligned with the ongoing project.

Progress invoicing is an alternative choice to up-front billing, where you can invoice customers for partial payments instead of lump sum amounts. As solopreneurs, you don't have to wait until the entire project is finished. It is a widely used progress payment phenomenon in industries like construction, SaaS, and manufacturing, where such progress billing aligns with project milestones.

How Does Progress Invoicing Work?

Progress invoicing is not just about sending bills—it's about managing and improving cash flow.

Understanding how progress invoicing works is key for U.S. business owners who are handling long-term projects. Here's a step-by-step breakdown to see why it's a smart decision to make.

Step 1: Establish the contract

At the beginning of the project, both parties must discuss and agree on the total cost, payment terms, and a breakdown of milestones. Thus, for partial payments, the said contract includes:

- The total project value

- The schedule of values (SOV), which itemizes costs for each phase

- A timeline for each milestone

- Payment percentages for each phase

Step 2: Break down the milestones

Dividing the project into clear, manageable phases is important to prepare for multiple partial payments. The given examples show how such an arrangement can add value to the project in various United States' small business settings.

For example:

- Construction: Phases like demolition, framing, plumbing, and finishing.

- Landscaping services: Stages like site preparation, planting, and final detailing.

Step 3: Calculate work completed

As the project progress, you need to calculate the percentage of work completed. After that, issue an invoice based on that percentage. For instance, if 25% of the project is complete and the total value is $100,000, the client is billed $25,000. Thus, you as well as your client, are aware of the remaining balance.

Step 4: Issue invoices

While issuing the invoice, keep update on the important pointers, depending on the project agreement for progress billing. Each upfront billing includes details such as:

- The total project cost

- The percentage completed

- The amount being billed

- The remaining balance

Step 5: Track payments and progress

Both parties monitor invoicing bills and project timelines to ensure the project stays on track.

What to Include in Progress Invoicing?

To create progress invoices, keep a few pertinent things clear, get a flexible billing and invoicing software for seamless project management, especially if you are one of the U.S. businesses, which are juggling long-term projects.

Let's be clear now—progress invoicing isn't your average bill.

Here's what you need to include:

- Project summary: Briefly outline the project or task. For example, "Website Design for Greenfield Tech Solutions" with invoice date.

- Phase or milestone details: Identify the specific portion of the work covered. For instance, "Phase 1: Initial Design Concepts."

- Work completion percentage: State the portion of the total project completed. For example, "40% of project completed" for a custom furniture order billed incrementally.

- Amount payable for this phase: Clearly specify the amount due for the current stage, such as "$7,500 for Phase 1 completion."

- Prior payments made: List payments already received, helping customers track what's been paid. Example: "Previously paid: $10,000."

- Outstanding Balance: Show the remaining amount after the current invoice is paid, for example, "Balance due: $20,000."

- Payment terms and deadlines: Include payment expectations, such as "Due within 15 days of invoice issuance."

- Issuer and recipient contact info: Provide full and accurate contact details for both the business and clients.

- Additional notes/ instructions/ conditions: Add details like "Work on Phase 2 will begin upon payment" or "Final delivery scheduled for March 2025" for more specific deliverable milestones.

Turn estimates into progress invoices in just a few clicks. InvoiceOwl offers detailed, accurate invoices on time and informs your clients about project costs with ease.

When Would You Use Progress Invoicing?

Already, we have explored how industries like construction and landscaping use progress invoicing to manage payments efficiently. However, this billing method is just as crucial for other small businesses managing long-term projects.

The table below highlights various small business sectors and freelancers where progress invoicing plays an important role.

Industries Using Progress Invoicing

| Industry | Example Milestones | Timeline |

|---|---|---|

| Custom furniture making | Design approval → Material procurement → Assembly → Finishing | 1–6 months |

| Home renovation | Demolition → Structural work → Installations → Final walkthrough | 2–8 months |

| Freelance digital marketing | Strategy development → Content creation → Campaign launch → Reporting | 3–9 months |

| HVAC installation | System design → Installation → Testing → Final handover | 1–6 months |

| Software development | Initial design → Coding → Testing → Deployment | 3–18 months |

| Photography services | Pre-shoot planning → Shoot → Editing → Final delivery | 1 week–3 months |

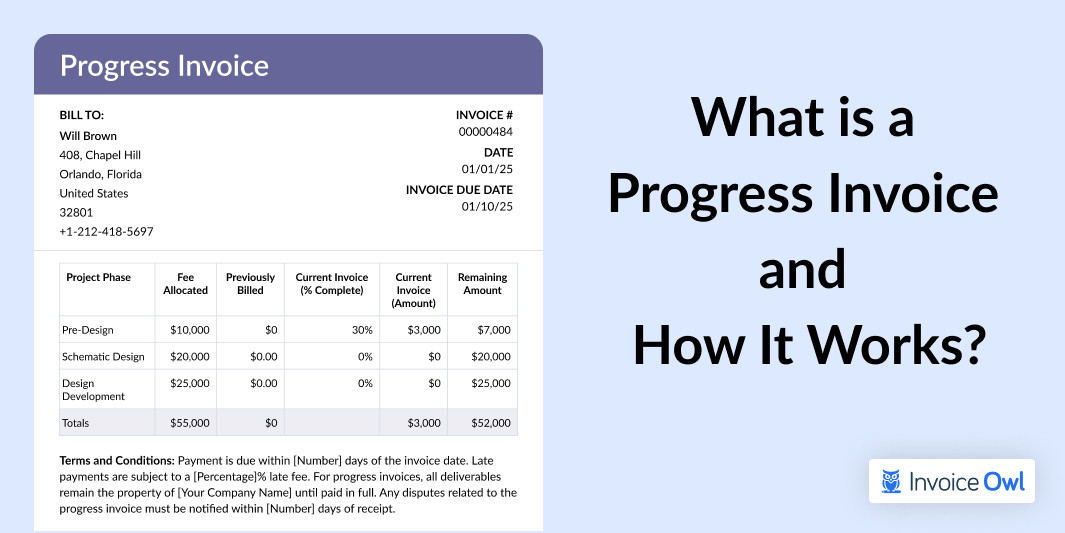

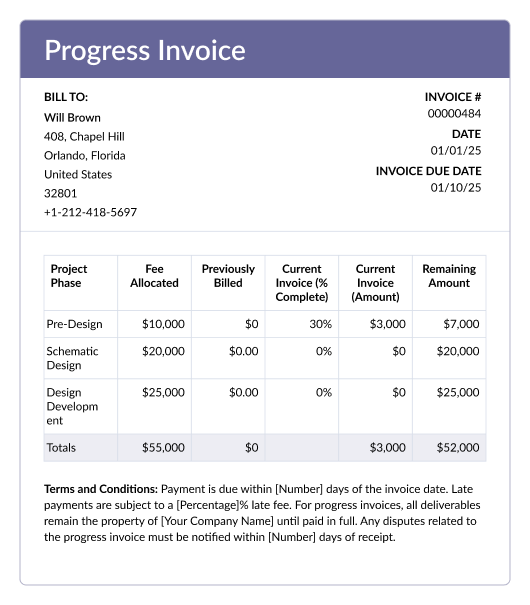

Progress invoice example

The above image is just an example to show how a progress invoice looks, complete with terms and conditions, milestones, and other key elements that ensure clarity.

Now, let's take a landscaping project with multiple tasks, as a instance to understand how progress invoicing works. Suppose you're transforming a backyard with a total project cost of $50,000. Payments are divided into milestones, each tied to a significant operation cost of the project.

Here's how it could look:

Landscaping Project Payment Breakdown

| Payment Breakout | Milestone | Invoice Amount |

|---|---|---|

| 10% first payment | Deposit | $5,000 |

| 20% second payment | Design approval | $10,000 |

| 20% third payment | Hardscaping (patio and walkways) | $10,000 |

| 20% fourth payment | Irrigation system installed | $10,000 |

| 20% fifth payment | Planting (trees and shrubs) | $10,000 |

| 10% sixth payment | Final cleanup & walkthrough | $5,000 |

| 100% | – | $50,000 |

Why use progress invoicing?

According to the National Federation of Independent Businesses and a study by U.S. Bank, 82% of small businesses fail due to cash flow challenges, including inconsistent or delayed payments. Therefore, by invoicing in different stages tied to project milestones, businesses can mitigate these financial risks and maintain steady operations.

But why should you care about the benefits for both businesses and clients? Simple—when everyone's happy, projects run like a dream. That's why understanding the benefits of progress invoicing is essential for businesses and clients alike.

How Does Progress Invoicing Benefit Your Company?

Progress billing offers significant advantages for both the company offering service and customers. Of course, when business supports its customers, automatically other benefits follow. In fact, advantages are coming as direct and immediate, but some are meant to add value directly to your growth.

The following 7 benefits are categorized based on business and client perspectives, for the readers to learn why they hold such importance:

For businesses

- Improved cash flow: Regular payments help cover ongoing costs, such as labor, materials, and subcontractors. This helps the company or the contractor to receive fund-in-house to manage operations and upcoming project stages.

- Reduced financial risk: Billing incrementally minimizes the risk of non-payment by clients. Thus, both the provider, partners, and subcontractors feel motivated to work, thereby keeping the projects on schedule.

- Better project management: Tying payments to milestones ensures projects stay on schedule. In addition, progress billing keeps the regular communication between both parties. Where SOVs are involved, several project stakeholders analyze the percentage completion of each dedicated task.

- Professionalism: Detailed progress invoices demonstrate build trust with clients. It also acts as a customer retention strategy through transparent invoicing. Documentation of each deliverable offers clarity; hence, the customer or clients know what they are supposed to pay, accordingly.

For clients

- Flexible payments: Clients don't have to pay the full project cost upfront. The budget-friendly option for the client's long term project is more financially manageable and prevents clients from hefty lump-sum amounts of the total contract price to pay during project completion.

- Transparency: Clients can see exactly when you create a progress invoice, and what they're paying for at each stage of the project. The project scope and clarity for a clear breakdown of costs at each stage of the project are indispensable.

- Increased confidence: This invoicing approach perfectly aligns with the needs of U.S. businesses and individuals who value clarity, efficiency, and control. The progress invoicing supports operations and helps professionals like web developers with high value projects.

Manage Progress Invoicing With Invoicing Software

Progress invoicing is undoubtedly a powerful tool for organizations handling long-term projects, enabling efficient billing and steady cash flow. By dispersing large estimates into smaller invoices, it becomes easy to ensure clients pay for completed work in stages. This billing frequency results in reduced financial strain and enhances project transparency.

Whether you're a contractor, freelancer, or service provider, opting for process invoicing streamlines your billing process and maintains financial stability. By choosing the best practices and using an automated invoice maker tool like InvoiceOwl, optimize your invoicing system, achieve clarity for progress invoicing bills, and satisfy clients throughout the project lifecycle.

Professional, stress-free progress invoicing starts here

With InvoiceOwl, you can effortlessly manage your progress invoicing along with a steady cash flow. Try it free for 3 days.

Start Your FREE TrialFrequently Asked Questions

Yes, progress invoices help with tax reporting in the U.S. It provides users with a clear financial trail and cash collection, which is helpful during tax season. They show incremental income received, which can be reported accurately to the IRS. This helps businesses comply with U.S. tax laws and avoid audits.

Using invoicing software like InvoiceOwl can help you with tracking payments for progress invoices and full payment. The software can automatically calculate the percentage of work completed, generate invoices, and track outstanding balances, ensuring accurate records and compliance with tax regulations in the U.S.

A progress invoice differs from a final invoice when it is issued during the course of the project to cover the costs of ongoing work. On the other hand, a final invoice is issued once the project is fully completed. The final invoice often includes a summary of all progress payments made and the remaining balance due, if any.

Yes, progress invoices can include charges for approved change orders. In the U.S., it's standard practice to document change orders separately and include them in the next progress invoice to ensure transparency and agreement with the client.

Yes, it is necessary to include retainage in the progress billing. The initial estimate is important for the construction industry to survive the competition. Start progress invoicing to get future revenue benefits for timely completion. The lengthy projects can't survive single lump sum payment for massive operating cost.

Yes, negotiating progress invoice bills' terms and conditions with the clients is pertinent. This discussion must take place at the very beginning. While you create progress invoices, always make sure to notify the client or customers at the start. In the U.S., having these terms clearly outlined project payments in a contract protects both parties from disputes.

Progress invoices help business organizations maintain steady cash flow. This upfront billing process provides continuous cash flow, thus, helping businesses to stay afloat. With sufficient funds to meet current obligations, such as costs of materials, labor, and overhead, businesses do not feel the risks of financial strain, especially in sectors such as construction and manufacturing in the U.S.