Can't spot the difference between an invoice and a statement?

Both documents serve distinct purposes that are easy to confuse, and thus, knowing them is essential for making your business more efficient.

You might make an accounting mistake that costs you money, time, and above all, your reputation as a business owner.

Therefore, we have compiled a statement vs invoice comparison to tell apart the main differences and similarities between the two.

So, without any further ado, let's get started.

Key Takeaways

- 01Invoices are payment requests issued for specific transactions, while statements summarize all account activity over a period

- 02Invoices are issued when payment is needed; statements are issued periodically or on demand

- 03Both documents are legally binding and sent by sellers to customers

- 04Invoices detail line items and payment terms; statements show transaction history and account balance

- 05Using invoicing software can automate both invoices and statements for accurate financial management

Defining Invoices and Statements

For business owners and freelancers operating across the U.S., it is important to maintain accurate financial records for varied reasons. In the sections below, we'll explore the key components and practical uses of both invoices and statements for efficient financial management.

What's an Invoice?

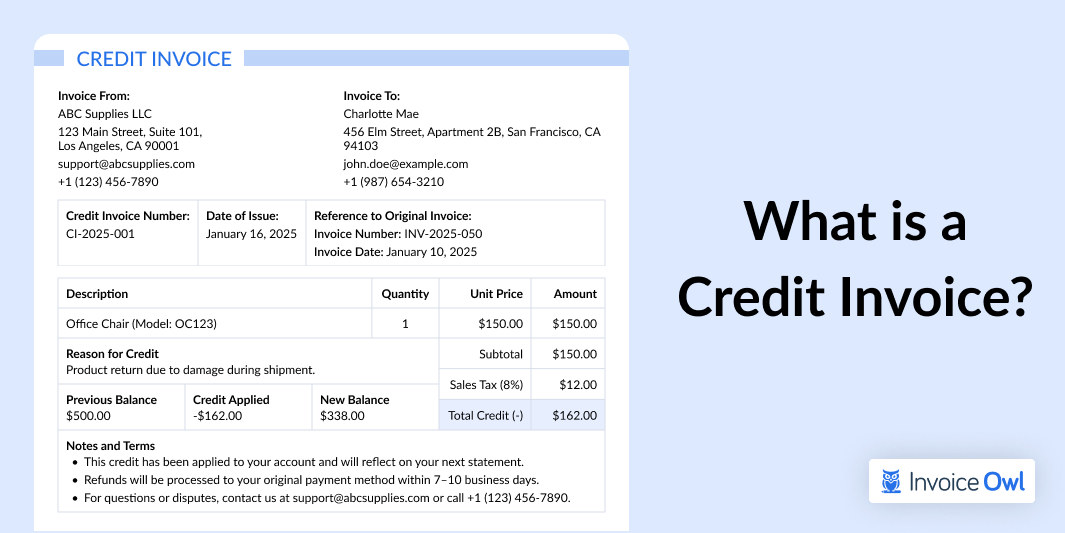

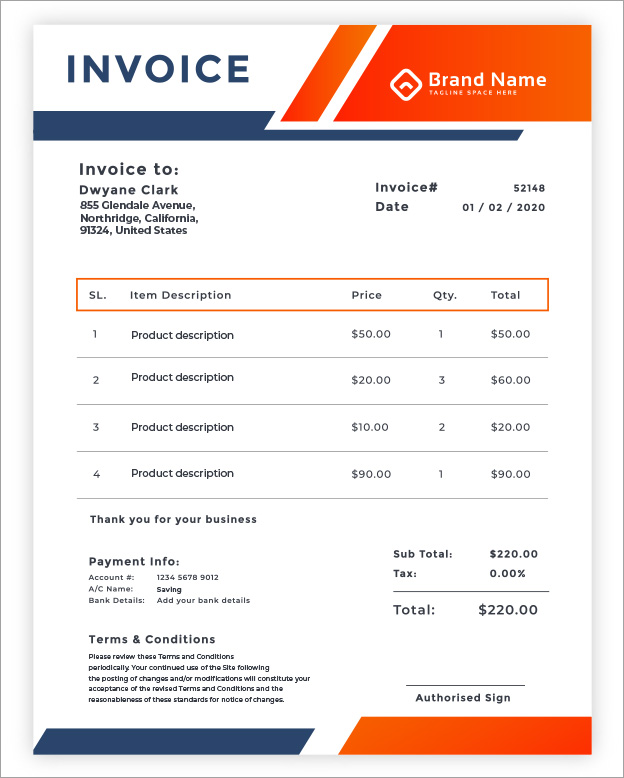

An invoice is a document to request payment. It is generated for every trade. It is generally issued at the end of the trade by the seller to the buyer.

The invoice serves the purpose of initiating the payments from the buyer.

A typical invoice includes the details of the goods or services provided in the specific transaction. This consists of detailed information about all the goods and services rendered, the date of the trade, the payment due date, and other essential payment instructions.

- When is it Issued?

Generally, it is said that an invoice is issued to the customer at the end of the business. Which is just an assumption and not correct in every case.

Since a sales invoice is a payment request, a business owner issues invoices whenever they need the payment.

Now this depends on business to business and on every business-customer contract too.

Whatever may be the case, the time of invoicing is priorly agreed upon in the contract at the time of closing the deal.

So, most businesses do invoice the customer at the end of the trade, but some businesses especially in the service sector, such as contractors, consulting agencies, and freelancers might issue invoices before the service period for collection of an advance, deposit, or partial payment.

- Key components of an invoice

From customer names to their contacts, an invoice has all the necessary details that will help you verify the invoice effortlessly.

Is that too much to remember?

Don't worry, we have a ready-made invoice template for you to just download and fill in.

Download FREE Invoice Template

What's a statement?

A statement establishes the credits and debits made by a customer in his/her account with the business in a particular period.

In simple words:

A statement is a record of all the individual sales transactions that occurred between the customer and the vendor.

When a customer has a long relationship with a business, instead of the sales tax receipt pile, they can save this document as proof of all the invoice payments made in a given period.

Moreover, the statement also records the funds that the customer owes and paybacks by the vendor to the customer.

For example, a bank account summary is nothing but a financial statement between the customer and the bank. The same goes for a credit card statement.

- When is it issued?

The statement is issued in three scenarios, which are:

- At previously set intervals

- When the customer demands it

- When the authorities want to audit the account

- Usage scenarios

Let's talk about these scenarios in a bit more detail.

At previously set intervals Generally, when a customer and the seller have a long-term trade relationship, the statements are generated at time intervals. These fixed interval statements include all the items refunded and paid amount, which occurred between the period of the last statement and the present date.

The time period for generating statements is called the statement period. This statement period is commonly a month.

However, it can be a week or a day based on the nature and number of transactions occurring regularly.

When the customer demands it A statement might also be issued at a given point in time for a given period when demanded by the customer.

The customer is right to demand a statement at any time to know the existing account status. Also, the statement will reflect the current amount in the customer's account and revise all the transactions.

When the authorities want to audit the account This is the rarest occasion and businesses would wish it never came. The IRS might ask you for the statement of a particular account.

This is most commonly in three cases:

- They suspected unlawful transactions

- Your account has been reported

- For random audits

- Key components of a statement

A statement is a summary of the paid and unpaid amounts in a given time. Therefore, it contains:

That's all!

We know it's easier said than done. Many small business owners, especially new beginners might find this complex. They have greater chances of making mistakes.

Thus, we have come up with a statement memo that you can edit easily. Just fill in your details here and you will be ready with a customized statement to share promptly.

Simplify your payments today and start invoicing!

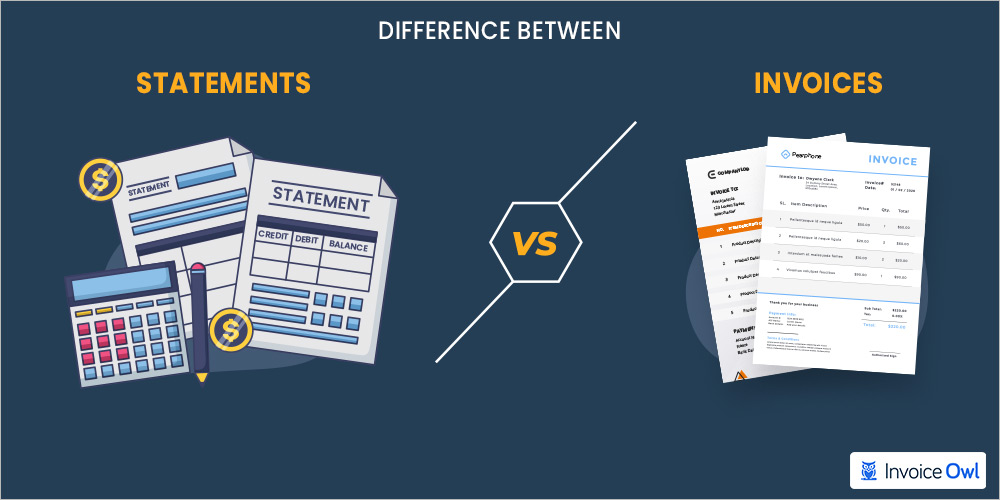

Comparing Statements and Invoices

We have described an invoice and a statement individually. That must have cleared a lot of smog for you.

Still, for better understanding, let's see invoices and statements side by side and compare them both to highlight the several key differences.

Shall we?

Key differences between invoices and statements

Statement vs Invoice: Key Differences

| Criteria for Differences | Statement | Invoice |

|---|---|---|

| What's the Purpose? | To show account balance and transactions | To put request payment from the buyer |

| What does it signify? | All transactions during a statement period | Trade between the seller and the buyer |

| What's its role? | Notifies the account holder | Obligates payment action |

| What's the intent? | To notify and update the account holder of all transactions | To collect payment for goods or services |

| What's the time of issuing? | Issued periodically to summarize activity over time | Issued when the seller needs payment for a specific order |

| What amounts does it show? | Shows amounts already paid | Shows the total amount due |

| What details does it have? | Statement number, transaction history, duration, and credit terms | Invoice number, description of purchase, amount due, payment terms, and billing period |

| What are the consequences? | May lead to unawareness or legal action for past due invoices | Can result in cash flow issues for the seller due to unpaid bills |

| How does it benefit? | Provides a transaction log, aids budgeting, and accounts tallying | Registers payment requests, ensures faster payments, and tracks revenue |

Alright!

Now that we have a clear idea about several key differences between invoices and statements, let's discuss how both documents are similar.

Similarities between a statement and invoice

Although the statements and invoices are both different documents, they have a few similarities too.

Knowing these similarities would make you less confused and understand more details of the concept.

So, are you eager to know?

Here we go.

Statement and Invoice Similarities

| Criteria for Similarities | How are they Similar? |

|---|---|

| What are they? | Legally binding documents |

| Who sends them? | Sellers send statements and invoices |

| What do they highlight the most? | due balance |

Other than these similarities, if an invoice is issued during a statement time of a statement, the statement shows the same transaction as the invoice as an entry.

Best Practices for Using Statements and Invoices

Managing statements and invoices effectively must be your ultimate goal to sustain your business. However, the right practice is necessary to incorporate. The significant actionable practices are defined further to streamline your billing and collections:

Ensuring timely payment

To keep a stable cash flow, send invoices promptly after delivering goods or services. Issue account statements regularly to remind customers of outstanding balances and payment history.

Utilizing software solutions

Use invoicing and accounting tools to automate the creation, sending, and tracking of invoices and statements. It saves time and ensures accuracy.

Invoicing software like InvoiceOwl can automatically generate both invoices and statements, reducing manual errors and saving valuable time.

Clear communication

Clearly outline payment terms, due dates, and accepted payment methods in both invoices and statements to avoid confusion and disputes.

Consistent follow-ups

Use statements to follow up on overdue invoices and provide a consolidated view of outstanding payments, encouraging customers to settle accounts efficiently.

Common Challenges and Solutions

Managing statements and invoices effectively is crucial for smooth business operations, but it often comes with challenges.

What are these challenges? Let's find out.

Late payments

Delayed payments often disrupt the cash flow. This is mostly observed for small businesses. To avoid this, you can set clear payment terms, offer multiple payment methods, and send timely reminders through invoicing tools.

Discrepancies in documentation

Errors in invoices or statements can confuse customers and delay payments. Ensure that you double-check all documentation for accuracy and use software tools to minimize manual errors.

Tracking outstanding balances

Manually managing accounts can be error-prone and even overwhelming. You can miss out on outstanding payments simply because of overlooking every invoice and statement. In this case, it is best to adopt digitization and track unpaid invoices and generate detailed account statements.

Customer miscommunication

In some instances, customers may misunderstand the purpose of invoices or statements. For invoices, ensure that you provide clear descriptions of the services and explanations of the documents to promptly address customer queries.

Ready to Streamline Your Invoicing?

Join 100,000+ contractors using InvoiceOwl to create professional invoices and statements with ease. Automate your billing process and get paid faster.

Try Free for 3 DaysFrequently Asked Questions

The invoice and statement are both distinct documents. You pay an invoice. The statement includes the statement amount just to notify you how much money you have as your balance.

A statement can not be used as an invoice as it does not state the payment terms and line items.

A statement is the transaction history in billing. It shows all the items debit or credit for a given interval. The best examples of a statement are bank, billing, and credit card statements.

There are some advanced tools and resources available for automating accounting and invoicing processes, such as InvoiceOwl, FreshBooks, QuickBooks, Zoho Invoices, and Xero. They are developed to meet the diverse needs of the business.

Conclusion

Invoices and statements are different documents but with a few similarities, most small businesses that are new to accounting get confused between the two. When customers receive an invoice means that the service provider has completed the work and expecting payment. Whereas, the statement will be available periodically showing the customer's overall transaction activities.

We hope as we have defined both documents in this blog separately and compared them in detail, this will help you differentiate them easily and use them correctly.

So, if you are looking to create professional invoices to get paid faster, all you have to do is start using InvoiceOwl which is a leading invoicing software. The software allows the creation of FREE invoices with a personalized touch. So, start your FREE Trial Today and start repaying its' benefits.