Whenever a seller issues a tax invoice, it means they have supplied goods and services to the buyer. On the other hand, if the seller is not registered, then the buyer should approach a registered dealer or get a payment voucher.

So, when a dealer makes a taxable sale, they have to issue a valid tax invoice to the buyer. Thereafter, the buyer can avail tax credit on their purchased product if the seller has to resell the goods.

Here, we will throw more light to understand what is a tax invoice and how to generate it? So, if you are a registered purchaser or registered dealer who wants to learn about the tax invoice or retail invoice, give a full read.

Table of Content

- What Is A Tax Invoice?

- Differences Between Tax Invoices and Receipts

- Step-by-Step Guide to Generating Tax Invoices

- The Importance of Tax Invoice

- Conclusion

- FAQ

What Is A Tax Invoice?

Tax invoices are critical for maintaining financial and legal compliance. As a seller, issuing proper tax invoices ensures that your business adheres to tax regulations and offers transparency to your clients.

Definition and purpose

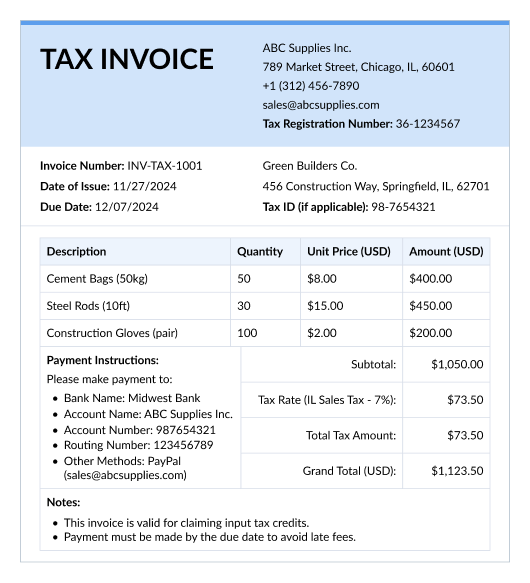

A tax invoice is a legal document issued by a certified seller to the buyer of their goods, showing payable tax. Usually, a tax invoice includes product name and description, invoice date, invoice number, tax amount, and services rendered.

These tax invoices can be of original copy or duplicate copy as per the requirement. Since there is no such limit, the supply of products can be varied as per registered supplier availability. Basically, it is just a summary invoice that consists of goods sold, the tax charged at the time of service provided, and other services tax.

Hence, it is primary evidence which states that one registered vendor delivered goods and services to the GST registered customers who want to avail input tax credit.

Key components of a tax invoice

A tax invoice is inclusive of the following elements:

Mandatory information

- Supplier and receiver information

- Unique invoice number and invoice date

- A detailed description of the goods or services

- The quantity and value of the goods or services

- The applicable tax rates and amounts

- Total amount payable

Optional details

You can include the following information to ensure clarity and professionalism:

- The payment terms

- Applicable discounts or rebates

- Thank you note or promotional details

- Terms for delivery

Examples and formats

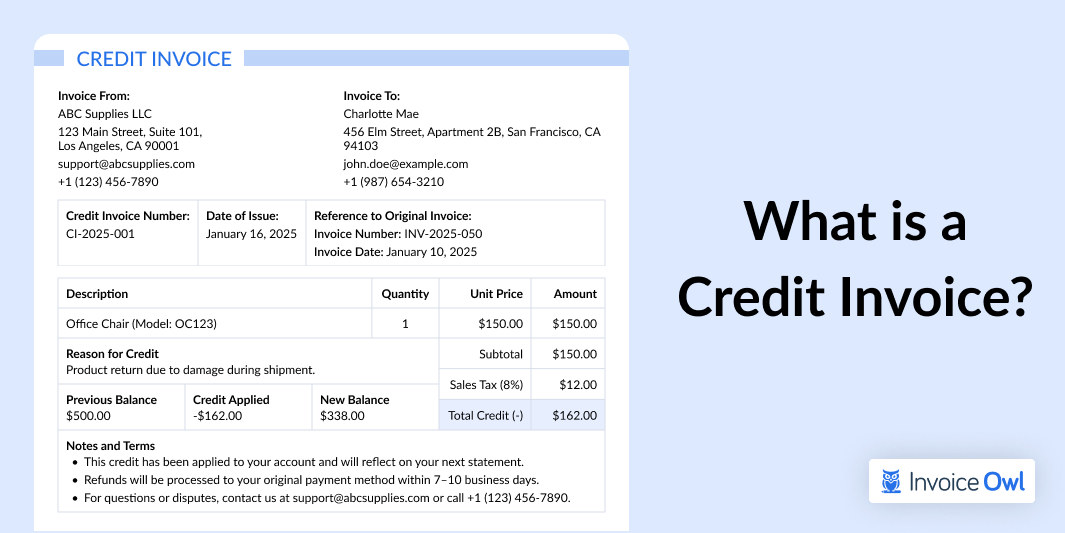

Example of a tax invoice

For example, ABC Supplies Inc., a Chicago-based construction supplier, sells 50 bags of cement and 30 steel rods to Green Builders Co.. The total sale amount is $1,050, with an additional Illinois sales tax of 7%, bringing the total payable to $1,123.50. The tax invoice issued includes a clear breakdown of the items, quantities, unit prices, and the tax applied, along with both companies’ tax IDs and contact details.

This is the perfect example of invoices that ensure compliance with tax laws and provide transparency. Here, Green Builders Co. properly records expenses and claims tax credits during their tax filings. For sellers like ABC Supplies Inc., it demonstrates adherence to state tax regulations in order to maintain a professional and trustworthy relationship.

Tax invoice format

You can create tax invoices in various formats such as PDFs, Excel, Word, Google Sheets, and Google Docs, and using automated invoice generation tools.

Differences Between Tax Invoices and Receipts

Receipts and invoices are created by sellers before issuing them to the buyer. Even though both documents may contain somewhat similar information, a tax invoice is not the same as a receipt.

Critical distinctions

Aspects

Tax Invoices

Receipts

Time of sending

An invoice is sent to the buyer or company before payment is made and is used to request payment.

A receipt is issued once the payment is done.

Components

It contains prices, discounts, the amount of tax payable, and details of both the buyer and the seller.

The products and services rendered, are listed in the invoice with discounts, taxes, payment methods, prices, and the amount paid.

Objective

Request payment

Proof that certain products and services have been paid for.

When to use each document

Tax invoice: Tax invoices are issued during or before the payment from a customer. For example, say a business selling bulk office supplies to another company will issue a tax invoice to outline the charges of the supplies and the tax associated with the same.

Receipt: A receipt is issued after the payment has been made. For example, after receiving the payment for the office supplies, the seller issues a receipt to confirm the amount paid and finalize the transaction.

Step-by-Step Guide to Generating Tax Invoices

Generating accurate tax invoices doesn’t have to be difficult or complex. Check out the step-by-step guide to generating tax invoices.

Preparation essentials

- Step 1: Create a new document: Open the MS Word and choose a new document. The page will appear blank where you need to type “Tax Invoice” as the header.

- Step 2: Add your business details: Type your business Information like business name, logo, address, phone number, and email on the right-hand side of the header.

- Step 3: Input customer information: Following details of your business, type your customer name, and contact information as the seller’s identity.

- Step 4: Include invoice details: Add the invoice date, the invoice number, and the GST registered number before you put the payment due date and the quantity purchased.

- Step 5: List the items and descriptions: Type every description of services provided in their right quantities and standard-rated purchases.

- Step 6: Calculate taxes and fees: In this process, you should not forget to input tax charges and shipment fees in the total amount. The total amount should be boldly typed.

- Step 7: Specify payment terms: Lastly, add payment terms and accepted payment methods.

Software and tools for tax invoicing

The process of preparing tax invoices is easy with invoicing software. Check out some of the tools that you can use to quickly create and send invoices:

- InvoiceOwl

- QuickBooks

- Invoice2go

- Invoice Ninja

- Zoho Invoice

- FreshBooks

- Invoicera

The Importance of Tax Invoice

Tax invoices are useful for different reasons other than accounting purposes. Below are the reasons why tax invoices are necessary:

1. Facilitates tax credit claims

Tax invoices allow tax-registered customers to claim tax credits easily. Business organizations across the United States must ensure accurate reporting and compliance with IRS guidelines.

2. Identifies payment due dates

Tax invoices indicate the payment dueTax invoices indicate the payment due dates based on when the invoice was received. It is crucial for businesses to adhere to "Net 30" or "Due Upon Receipt," which are common in the U.S.

3. Track transactions and tax IDs

Offers clear transactions and also ensures every sale is linked to the appropriate tax identification system. This is particularly vital for businesses dealing with state and federal tax compliance.

4. Legal compliance

Invoices act as legal proof for claiming input tax credits or deductions. For companies or entrepreneurs operating in the U.S, these are important for necessary documentation for audits or IRS inquiries.

Additionally, they also help businesses avoid issues like phantom income, where unreported income is showcased on financial statements, potentially leading to tax penalties.

5. Prevents tax evasion

Tax invoices create transparency by documenting sales and purchases. Thus, it assists government authorities in preventing tax evasion. Overall, businesses do benefit from maintaining ethical and lawful practices.

6. Financial documentation

Tax invoices help calculate taxes accurately for quarterly and annual filings, and thus, facilitate tax relief claims. They also simplify claiming deductions, which is especially important during the tax season.

Create Professional Invoices Online Easily and Keep On Top of Your Finances

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers and contractors to create invoices on-the-go and get paid quicker!

Conclusion

Tax invoices are prepared by the seller who expects payment from their client. It is helpful for the buyers if they want to claim tax credits. We understood the meaning and use of the tax invoices before finding the difference between an invoice and a receipt. Also, we discussed the steps to generate tax invoices using a word document. On the ending note, we hope now you will find it easier to send or collect the tax invoices.

Are you taking more time to generate an invoice? If yes, then use the invoice generator at InvoiceOwl. Start your free trial now.

Frequently Asked Questions

- Is Tax Invoice a Bill?

Sellers issue invoices on time for services provided along with the applicable taxes. If a seller is transporting goods, they need to issue an invoice when they delivered them to the buyer. A tax invoice is different from the general bill as it requests payment from the buyer. The general bill helps customers in knowing the products purchased and the prices.

- What are the necessary points to be included in a Tax Invoice?

Following are details that you need to mention at the time of generating the tax invoice.

- Invoice date

- Invoice number

- Customer’s name and contact details

- Shipping address

- Product description

- Amount of tax payable

- Vendor’s signature

- Will invoices help me to submit a tax return?

A tax invoice can only help you complete the payment as it is a legal document requesting payment from your side. However, you need to save the payment receipts which will aid you during the submission of the tax return. Also, you can show the receipt if you have tax-related inquiries.