The vendor invoice is a document that lists the total amount suppliers own and is listed by the recipient. An invoice is always generated and issued to the organizations when they place orders for goods and services unpaid.

Key Takeaways

- 01Understanding what vendor invoices are and how they differ from regular invoices

- 02Common payment terms including Net 30, 2/10 Net 30, and line of credit arrangements

- 03Industry-specific invoicing standards for contractors, freelancers, and service providers

- 04Key benefits of automating vendor invoice processing for efficiency and cost savings

- 05How automation improves payment speed, reduces errors, and simplifies auditing

The necessary information included in a vendor invoice is the amount owed, delivery fee, applicable tax, accepted payment methods, and the date of payment. This will help out all the partners in doing appropriate vendor invoice management.

Upon receiving the vendor invoice, the client includes the vendor invoice into their company's financial records or into accounting software to schedule the payment. They also need to enter the amount at top of the "Total Due" field while billing. So, this section might have answered your question: what is a supplier invoice? Right?

Understanding Vendor Invoices

A vendor invoice is a document a business receives from a supplier. It outlines what exactly it owes for goods or services purchased. For example, a local coffee shop orders supplies like coffee beans, milk, and pastries from a distributor. The supplier then sends a vendor invoice to the coffee shop, listing all the items purchased, the cost per item, any added taxes or fees, and the total amount owed.

The vendor invoice also includes a due date, such as "pay within 30 days." This invoice is useful in terms of serving as a reminder and record for the business owner.

A local coffee shop orders supplies like coffee beans, milk, and pastries from a distributor. The supplier sends a vendor invoice listing all items purchased, costs per item, taxes, fees, and the total amount owed with a due date.

Invoice Terms and Conditions

Common payment terms

Terms of sales are the payment terms agreed upon by the vendor and client. The payment terms in the vendor invoice include delivery, the amount payable, due date, payment method, and cost into the empty field.

It is the agreed terms made between a vendor and the company. The terms of the vendor invoice give clarity to all requirements for the sales to go through smoothly.

For international trade, terms of sales are taken seriously because they cover information concerning the transportation of the goods and when they will be transported. They also include contacts that are responsible for taxes and international duties, as well as other established factors by international commerce regulations.

Payment in advance

Payment in advance refers to the amount paid ahead of time. Some business owners demand upfront payment before supplying their goods and services. The software automatically takes the order lines and line items from the purchase order to indicate that invoicing process is complete for the purchase order. This will also help owners in displaying the processing of invoices with the associated purchase order number and invoice number and invoice date.

Take a freelancer, for example, he or she can demand a 40 percent advance payment before starting on the job. Advance payments help to cover expenses during the jobs as well as helping vendors recover a part payment through vendor invoice.

Immediate payment

Immediate payment is also known as "Cash On Delivery" (COD). It signifies that payment has to be made at the time of delivering the goods. When a customer fails to make an immediate payment after being agreed upon by them and the vendor, maybe by credit card, bank transfer, wire transfer, online payment, or e-check, the vendor retains the full right of repossessing the goods. Immediate payment can also be called "Payable on Receipt."

Net 7, 10, 30, 60, 90

This term is known as the net payment due in any written number. The no. signifies the number of days after the vendor invoice date.

For instance, if a vendor invoice is issued and dated on September 5 and the vendor states in the terms "Net 30", the payment will be due 30 days after September 5 which is October 5.

Use clear terminology like "Due in 30 Days" instead of "Net 30" to avoid confusion with customers and your accounts payable team.

Sometimes this term confuses the customer and the company's accounts payable section. As a vendor, you are advised to use a clear term like "Days" instead of "Net."

2/10 Net 30

Since Net 30 means the customer has to pay on or before 30 days, some companies often give discounts to payments made early. The vendor may state in the description of terms that a 2 percent discount applies if payment is made within ten days.

These terms can change depending on how the vendor chooses to make changes. They may give a 5 percent discount if payment is made within a week.

Line of credit pay

This means the customer can pay their bill given some days. The days extend on a quarterly or monthly basis. Line of credit pay also means the customer can order goods or services no matter how much quantity on credit. This practice is often common among larger companies because small businesses cannot decrease cash flow like them.

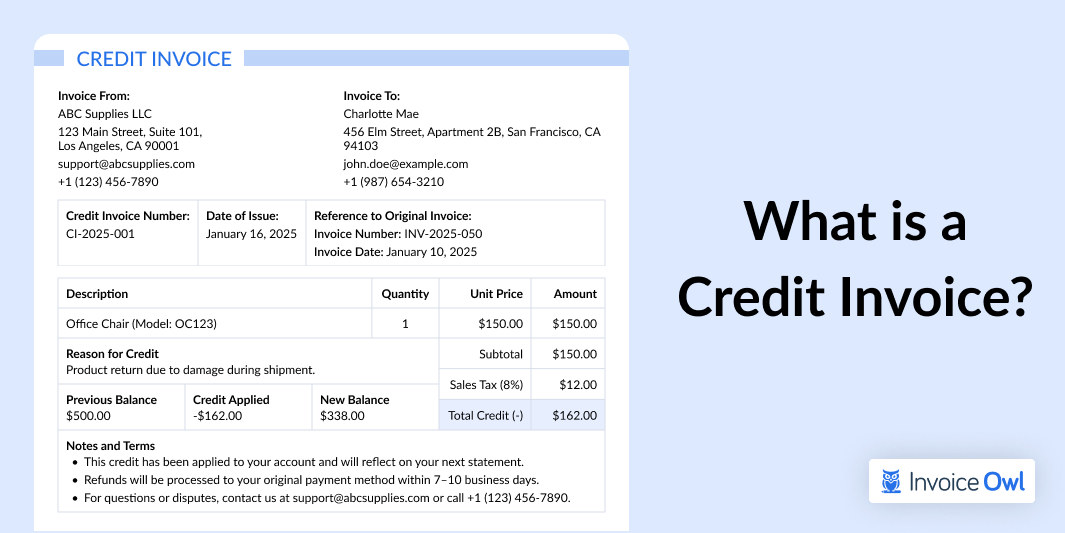

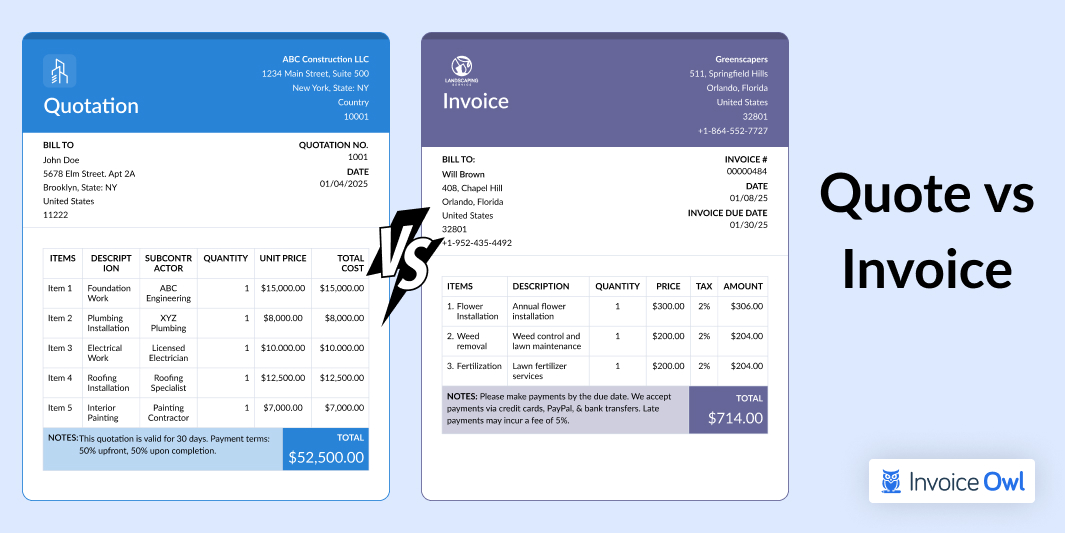

Quotes and estimates

Quotes and estimates mean a certain figure given to the customer by a vendor or company for the prices of their products and services. With it, clients can compare the prices stated in purchase orders with that of other competitors.

Quotes and estimates do not mean the total amounts the customer has to pay; They should be detailed just like the invoice.

You can convert quotes and estimates into an invoice when the sale has been made, and the prices have been agreed upon.

Industry standards

In the U.S., it has been observed that different industries have common invoicing practices to make billing simple and clear. In construction and contracting, payments are usually based on project stages. For example, contractors might ask for 50% of the payment at the start, 25% halfway through, and the final 25% when the project is done. This whole setup helps the sector to cover costs as the work progresses.

While for freelancers and consultants, the practice is different. The professionals charge by the hour or through monthly retainers. Invoices often list the project details and any limits on changes to avoid surprises.

Payment Terms by Industry

| Industry | Common Payment Structure | Typical Terms |

|---|---|---|

| Construction & Contracting | 50% upfront, 25% midway, 25% completion | Progress-based payments |

| Freelancers & Consultants | Hourly or monthly retainer | Net 15 or Net 30 |

| Retail & Service | Immediate or COD | Payment on delivery |

| B2B Services | Monthly billing cycles | Net 30 or Net 60 |

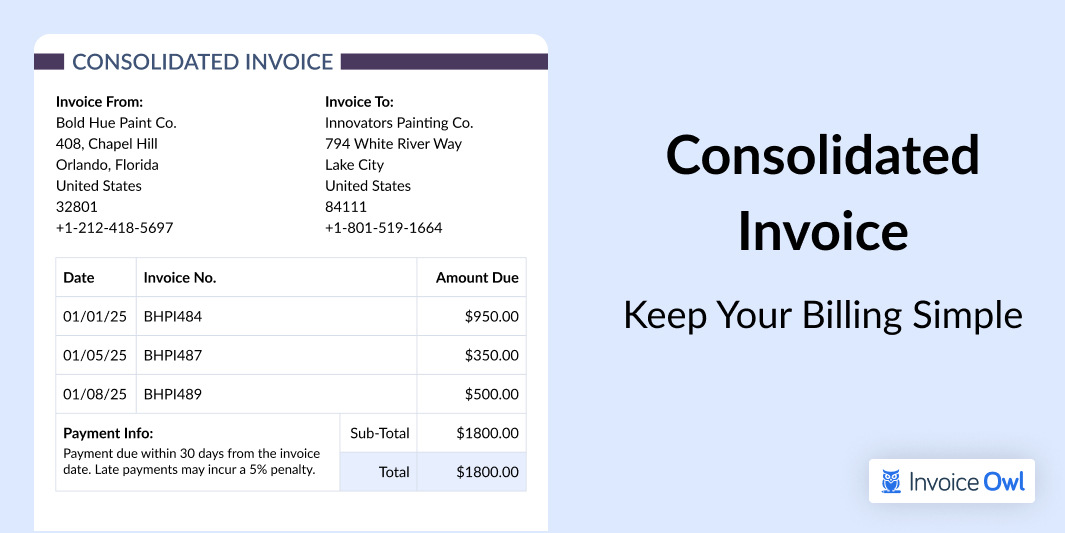

Recurring invoice

Hosting services and other technology functionality providers don't change the price every time, so they are specifically in need of recurring invoices.

Recurring invoices guarantee constant cash flow to the business and are void of disputes and the task of reminding clients for payment.

Interest invoice

Interest invoices affect those clients who make late payments. For these customers, interest or late fees are charged on late payments as the days increase on the payment due date.

Interest invoices also include the date when payment has to be made.

Invoice factoring

Invoice factoring is considered an option when the customer or construction company fails to make payment after it is overdue. During the period, you may need money in the business and have no option than to hand the invoice to an invoice factoring company. You'll get up to 90 percent of the total amounts in advance but will later get charged for their services.

Invoice factoring can help with cash flow during late payments, but you'll typically receive only up to 90% of the invoice value and will be charged service fees. Consider this option carefully against your immediate cash needs.

Reasons Why a Supplier Invoice/ Vendor Invoice Should Be Automated

The supplier invoice is a document of sale created and issued by the seller or vendor and received by the buyer. Supplier invoices or we can say vendor invoices are also called vendor invoices by customers. InvoiceOwl also has a collection of invoice templates in MS Word.

A supplier invoice lists down the full transaction details between the supplier and the customer. When the supplier gives goods to the buyer on credit, he issues them an invoice to payment along with a clear invoice header, name, address, description, items/products, preferred terms, and purchase order.

A supplier can as well choose to send a statement of accounts to their customers as an invoice since it shows buyers their outstanding amount for the line items. When a seller sends a statement of accounts to the buyers, they have to indicate in the document that they won't be sending an invoice for reporting.

Vendor Invoices were first reported on paper, and the practice has been to date where copies have to be created so the seller and buyer will have one to themselves. In this modern-day, invoicing solutions have made the task easy that the invoice can be generated digitally and sent. The digital invoice to pay can also be referenced and sourced easily.

One of the ways to achieve a quick turnaround on vendor invoices is to improve the accounts process. This will reduce extra your business spend on and boost visibility. An automated solution will do more to the business than manual invoicing. Here are some of the reasons why you should adopt an automation solution for accounts processing and vendor invoices processing:

Automation Benefits and Implementation

Efficiency improvements

Manual invoicing can sometimes be demanding, especially when you're dealing with a company or when you have a large project to work on. At some point, you become inefficient and tend to apply heavy risks while you access the vendor information and invoice information. Your invoice information may get misplaced, and this means you or a person dealing with your accounting may have to start afresh or trackback to where you continue from. Also, you're prone to making mistakes, which may result in neglect during the workflows.

Automated invoicing reduces stress and cost, as well as improves your efficiency. The workflow becomes easy to monitor and organize. The tasking part may be the accounts payable automation, which needs approval if management. There are solutions for accounts payable, too, that help you route vendor invoices and other documents for fast review and approval.

Fast payments

Every business owner is aware of how their business can be interrupted when they pursue clients for late-payments and penalties. Late payment affects transactions and sometimes disorganized amount schedules; this can cause the client to have a bad reputation and end-customer relationships.

With automated invoicing, you can track all your vendor invoices and control transactions, as well as follow up on every outstanding amount along with the best user experience.

Easy auditing

Adopting automated invoice processing and invoice approvals allows you to go through less stress when doing audits for line items. It enables you to source financial reports at any given time; the reports generated from the system help you get prepared for the audition by studying any variance beforehand. You can also access your accounts payable online while you're auditing to provide information quickly. Automated invoice processing reduces the case of a missing file that can make the audit staff think otherwise.

Cost savings

Going digital with your invoicing process helps you with unforeseen expenses that are attached to manual invoicing. Also, the cost of preparing vendor invoices will reduce drastically. In accounts payable, labor takes about 63% of the cost. There's also a lot to pay for, which includes ink, paper, delivery fee, and labor.

With automated invoice processing, you or staff won't have to waste time with data entry and checking status. The risk of making errors is also reduced and gives an accurate status of the invoice. So, do you have any queries related to vendor invoices? Share it with us and we can guide you further.

Manual vs Automated Invoice Processing

| Aspect | Manual Processing | Automated Processing |

|---|---|---|

| Processing Time | Hours per invoice | Minutes per invoice |

| Error Rate | High (human data entry) | Minimal (automated capture) |

| Cost per Invoice | $15-30 | $3-5 |

| Audit Preparation | Time-consuming search | Instant digital access |

| Payment Tracking | Manual follow-up needed | Automated reminders |

Ready to Streamline Your Vendor Invoice Processing?

Join 100,000+ contractors and small businesses using InvoiceOwl to create professional invoices, automate billing, and get paid faster.

Get Started for FreeFrequently Asked Questions

A vendor invoice is received by a business from a supplier for goods or services purchased, while a regular invoice is sent by a business to its customers. Both serve the same purpose of requesting payment but from opposite perspectives in the transaction.

Essential vendor invoice information includes the vendor's name and contact details, invoice number and date, itemized list of goods or services, quantities and prices, applicable taxes, total amount due, payment terms, and payment methods accepted.

Most businesses should retain vendor invoices for at least 7 years for tax and audit purposes. This timeline can vary by jurisdiction and industry, so consult with your accountant for specific requirements in your location.

Net 30 means payment is due 30 days after the invoice date. For example, if an invoice is dated September 5 with Net 30 terms, payment is due by October 5. This is one of the most common payment terms in B2B transactions.

Yes, invoice automation solutions are available for businesses of all sizes. Automated systems can capture invoice data, route for approvals, schedule payments, and maintain organized records, typically reducing processing costs by 60-80% compared to manual methods.

This term means the buyer can take a 2% discount if they pay within 10 days, otherwise the full amount is due within 30 days. For example, on a $1,000 invoice, paying within 10 days costs $980, while waiting the full 30 days requires the full $1,000.