![What is an Invoice Number? [Complete Guide with Examples]](/images/2021/10/what-is-the-invoice-number.jpg)

Just like the page numbers of a book helps you keep track of them, invoice numbers simplify your payment tracking process and help you stay organized. In short, your business needs a well-organized invoice management system.

But you might be wondering how. So in this guide, you will learn what is an invoice number and the best methods with examples for assigning the first invoice number in your invoice.

What You'll Learn

- 01What invoice numbers are and why they're essential for business organization

- 02Key components that make up an effective invoice number

- 036 proven methods for creating invoice numbering systems

- 04How invoice numbers help track payments and prevent duplicate billing

- 05Best practices for maintaining consistency in your invoicing process

Table of Content

- What is an Invoice Number?

- What Should an Invoice Include?

- 6 Ways to Create an Effective Invoice Numbering System

- The Importance of Invoice Numbers

- Conclusion

- FAQs

What is an Invoice Number?

An invoice number is a unique identifier that is assigned to invoices and is usually a combination of numbers, letters, and symbols. The invoice number enables small businesses to keep track of their invoice sequence and payments.

Moreover, an invoice number (also known as an invoice reference number) is assigned sequentially to each invoice to track and identify the transactions easily. It is also assigned to your invoice to help you avoid duplicate payments.

Generally, a unique invoice ID appears on the top of the invoice, making it easy to manage for both - the recipient of the invoice and the business providing it.

What Should an Invoice Include?

An invoice number is composed of the following components:

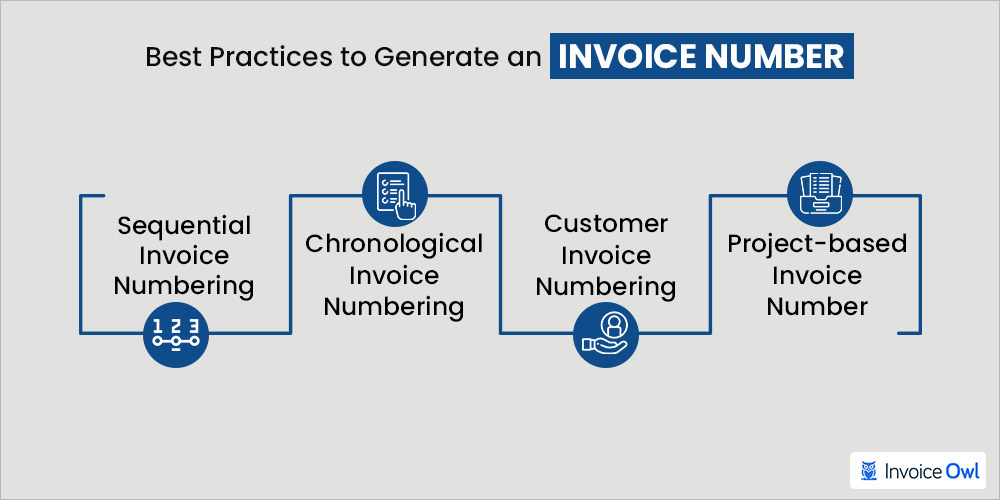

6 Ways to Create an Effective Invoice Numbering System

Before we start understanding the steps to generate an invoice number, note that it's not mandatory to just stick to the methods described here. Instead, it entirely depends on you and how you want to keep your invoice numbers.

Pick a suitable methods

- Sequential numbering: Consecutive number invoices like 001, 002, and 003.

- Chronological numbering: Add the dates in invoice number, 250320-001 for a first invoice dated 20 March 2025).

- Customer/project-specific numbering: Add the customer or project details in the invoice number. (XYZ- 001 for the client XYZ)

- Hybrid methods: Add important elements of different formats to create a unique system that meets your specific business needs.

- Prefixes: Add specific prefixes like "INV" (for invoice) or "25" (for the year 2025) to showcase it's an invoice along with the year it was issued.

- Suffixes: Add suffixes like s "-P" for pro forma invoices or "-C" for credit notes to showcase types of invoices.

Choose a starting point

Don't consider starting with 001, instead start with a higher number like 1,000. Doing so will make your business look like an established one and help avoid confusion related to the present invoices from other systems.

Make it unique

Ensure that every invoice number is unique to avoid any potential errors in payment processing and recordkeeping. Most of the invoicing and accounting software generate unique invoice numbers automatically without any risk of duplication.

Most invoicing and accounting software automatically generate unique invoice numbers, eliminating the risk of duplication and saving you time.

Consistency is the key

Irrespective of the different formats, make sure your invoices are easy to understand and follow consistent formatting.

Log your information

Ensure to note the invoice numbering system and share it with your important teammates. Create a record of all the issued invoice numbers to track and reference them.

Adaptable

With a growing business, you might need to adjust your invoice numbering system. If your existing system isn't capable of it, you can make necessary changes and meet your specific requirements.

Make use of the invoicing system

Most of the invoicing and accounting systems make it easier to generate a unique invoice number yourself. With these tools, you can pick your preferred numbering format and assign new numbers to the invoices automatically.

The Importance of Invoice Numbers

A unique invoice number helps you in many ways, such as:

Easily track payments

Invoice numbers help you keep track of paid and unpaid jobs for your new and old customers. Once your customer pays the total amount due, you must document the invoice numbers as paid. So, it becomes easy for you to track payments. Otherwise, tracking it down can become a real headache and time-consuming for both the buyer and seller.

Avoid duplicate payments

If you bill your clients twice or let's say 'incorrectly', there are chances of you facing big losses in your business in terms of reputation, time, and money. However, an invoice number keeps track of your original invoices and helps you avoid duplication.

Provide transparency and professionalism

Invoice numbers ensure transparency with the detailed invoices that help build trust with the customers. Creating properly formatted invoices with itemized services or products, payment terms, and due dates reflects business credibility.

Properly document income for taxes

Assigning invoice numbers helps tax officers review invoices against the business expenses and sales easily. This is especially useful, to your accountant or when you are using accounting software, for taxes and accounting tracking purposes. You will know exactly how many jobs you did and how much they were for. Thus, it is essential for payment tracking purposes.

Manage your invoices smoothly

With the help of efficient tools, you can track payments, send reminders, and streamline your invoicing process. Automated systems or templates can help in managing invoices save time and maintain accurate records.

Looking for a simple way to manage invoice numbers?

InvoiceOwl makes it easy to create professional invoices with automatically generated, sequential invoice numbers.

Start Your FREE TrialConclusion

The primary purpose of invoice numbers is to help differentiate and track payments.

For small business owners, generating numbered invoices is very simple, as you can opt for any of the methods like sequential, chronological, customer number, and project-based.

However, you also need to overcome many invoice sequencing errors, as they may lead to payment duplication.

The best option to avoid such complications is to adopt online invoicing software like InvoiceOwl and use reliable accounting software. It allows you to create invoices using a free invoice template and send invoices to your clients easily. You just have to mention your client's company details and let our software handle it. The software itself will automatically create an invoice number.

Sign up to InvoiceOwl NOW and know how it helps your business in different ways.

Frequently Asked Questions

No. It is up to you how you number your invoices. But you need to make sure that each of your invoice numbers is unique to your business. Thus, go for assigning them sequentially, which is the easiest way to do it.

The major difference between an invoice and a receipt is that an invoice is requesting payment mentioning the goods or services offered, payment terms, and amount due. Whereas a receipt refers to the document that confirms the transaction has been completed.

Yes, you can add the invoice number to a proforma invoice, as it helps with record-keeping and consistency. Nevertheless, the final invoice replaces the proforma with a definitive number upon agreement.

An invoice number is meant to identify a particular transaction that helps businesses maintain accurate records and streamline payment tracking by resolving discrepancies.

No, invoice numbers are not similar to the account number. The invoice number tracks the individual transactions whereas the account number identifies the client in the business records.

Mostly invoice numbers use the sequential or coded format for clarity. The chronological one looks like INV2025-001 whereas the alphanumeric is AB12345. Organizations have the choice to customize formats as per their specific needs.

The invoice ID invoice number refers to a unique identifier for each invoice. It helps organizations track their transactions, organize records, and ensure accurate bookkeeping. Generally, this comprises the combination of both numbers and alphanumeric codes customized to the business's system.

The invoice number added on the receipt is the distinctive identity from the original invoice linked to the payment. This number helps reconcile payments with the invoice and maintains clarity regarding the transactions between both parties.

Invoices include an invoice number as it is legally binding, helps audit taxations, and organizes invoices for your organization.

The invoice numbering comprises assigning unique and sequential identifiers to every invoice for record-keeping and professionalism. You can make use of a simple numerical format like 001 or a structured format like INV-2025-001 for better understanding.

To manage invoice numbers effectively, use a consistent format like "INV-YYYY-XXXX," where "YYYY" is the year and "XXXX" is a sequential number. This prevents missing or duplicate invoices, simplifying audits.

The common mistakes users need to avoid when assigning invoice numbers include starting with random or inconsistent numbers. This can lead to confusion and make record-keeping difficult, especially during audits.