How many times have your customers approached your accounts department to get a clear understanding of every charge on their bill? Whether it's about a specific service, product cost, fees, or taxes, it is essential to offer them transparent and detailed explanations.

Imagine your customers feeling relief after getting a clear understanding of every charge on their bill. No confusion, no frustration, just complete transparency. This is where an itemized bill comes into action.

In this blog, we will take a closer look at what an itemized bill is, and why it is important for building trust in your business transactions.

Key Takeaways

- 01Itemized bills provide detailed breakdowns of every charge, improving transparency and customer trust

- 02Healthcare providers, construction companies, and service businesses all benefit from itemized billing

- 03Automated billing software reduces errors and speeds up the itemization process

- 04Patients can request itemized bills from healthcare providers to verify charges and support insurance claims

- 05Clear itemized bills help prevent billing disputes and streamline payment collection

What is an Itemized Bill?

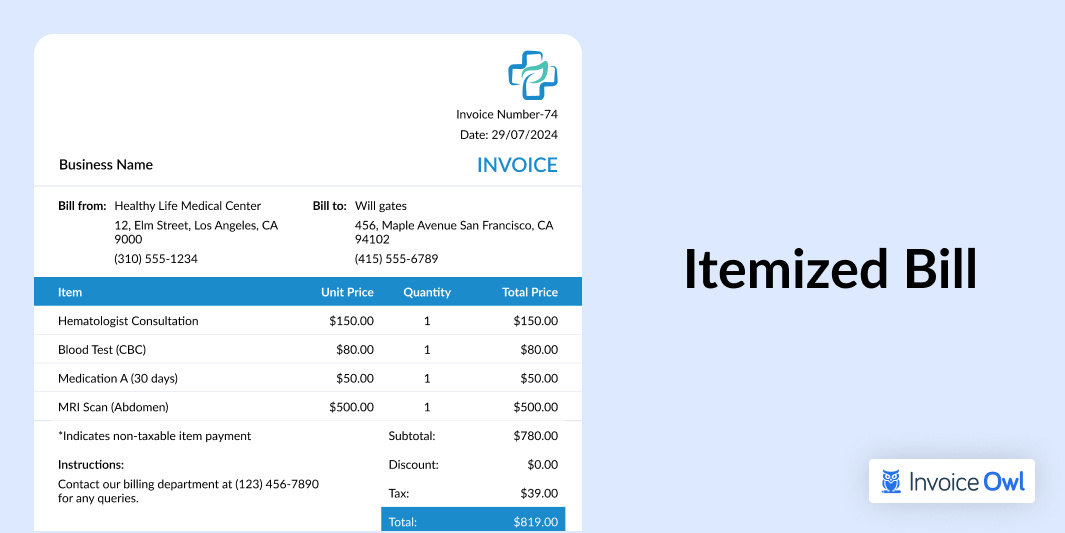

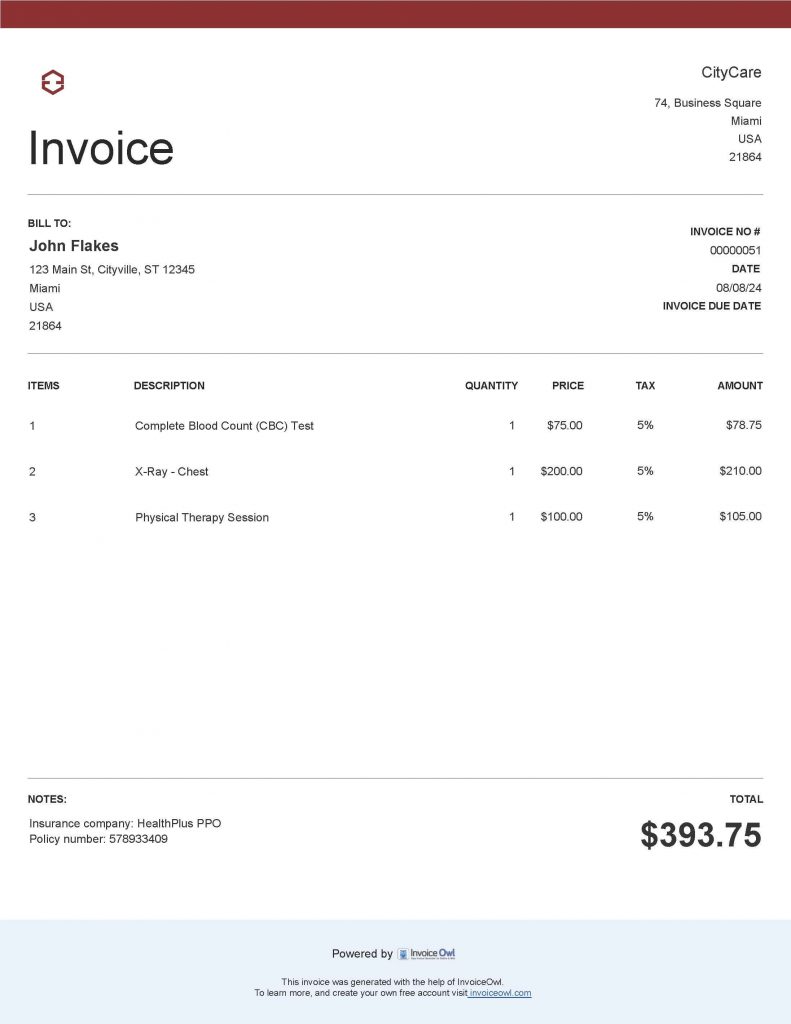

An itemized bill is a detailed document sent to the clients before payment for goods or services. When compared to traditional invoices that just offer the total prices, the itemized invoices comprise the prices for each item.

These invoices are extremely important for ensuring timely payment for all businesses. There are various factors that you must take into consideration while designing an efficient invoicing system. Having a proper understanding of these components is essential for getting payments quickly without any hassle.

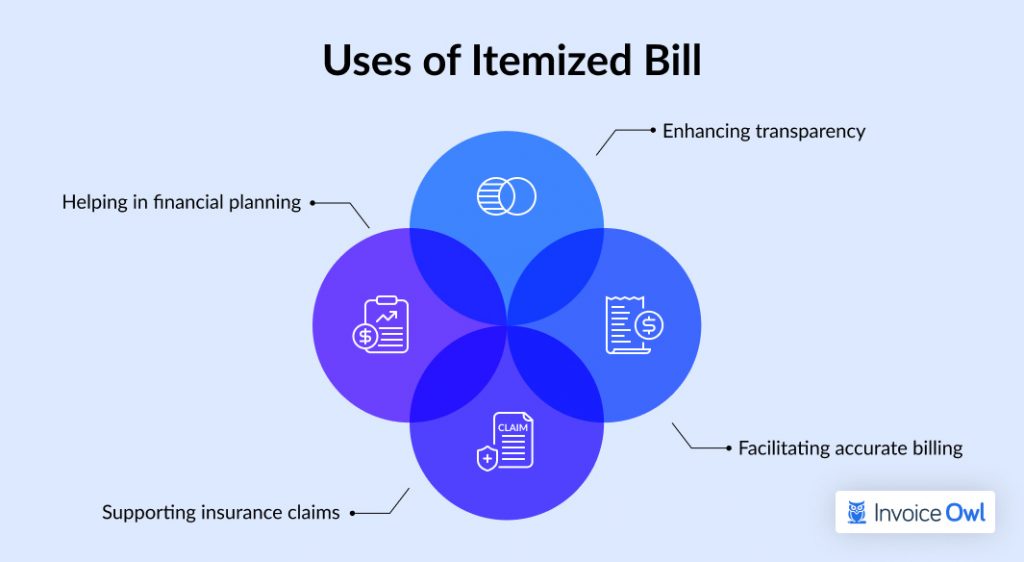

What is an Itemized Bill Used for?

An itemized bill plays an important role in the healthcare billing process by offering detailed insight into the medical expenses incurred during a patient's visit. Here's how it benefits both patients and healthcare providers:

Enhancing transparency:

- Provides a clear breakdown of every charge, including consultations, treatments, and medications.

- Helps patients understand exactly what they are paying for and reduces confusion and frustration.

Facilitating accurate billing:

- Ensures all services and costs are recorded in detail.

- Minimizes the risk of billing errors and omissions, making it easier for providers to review and manage their billing processes.

Supporting insurance claims:

- Insurance companies often require itemized bills to process claims.

- Detailed breakdown helps insurers verify charges and determine reimbursement amounts, speeding up the claim processing.

Helping in financial planning:

- Allows patients to see the specifics of their hospital bills for better budgeting and expense management.

- Helps them plan payments or seek financial assistance if necessary.

Health Savings Accounts (HSAs) and Flexible spending accounts (FSAs):

- Patients with health savings accounts or flexible spending accounts are dependent on receipts for receiving money for qualified medical costs.

- An accurate itemized invoice is handy for claim processing and acquiring payment for covered costs.

15 U.S. Code § 1666 mandates that credit billing errors must be addressed quickly. If you find a mistake on your credit bill, you can report it in writing to your creditor within 60 days. The creditor must acknowledge your complaint within 30 days and resolve it within 90 days. This involves correcting the bill or explaining why they believe the bill is correct.

Things to Include in an Itemized Bill

Itemized bills are of great importance in healthcare as hospital bills consist of a wide range of services like diagnostics, medications, and room charges.

Creating an itemized hospital bill involves listing several key components to ensure clarity and completeness.

Here's a list of inclusions your itemized bill should have:

Essential Components of an Itemized Bill

| Item | Description |

|---|---|

| Patient information | Name, address, and contact information of the patient |

| Provider information | Name, address, contact details, fax number, email address of the healthcare provider |

| Date of service/admission | The specific dates when services were provided or when the patient was admitted |

| Treatment description | Detailed descriptions of each service or treatment performed |

| Procedure codes | Relevant medical codes (e.g., CPT, ICD-10) for each service or treatment |

| Quantity | Number of units or times each service was provided |

| Unit price | The cost per unit or service |

| Total cost | The total amount charged for each service or treatment |

| Payment information | Details of any payments already made or adjustments applied |

| Insurance information | Details about insurance coverage, including policy number and provider |

| Balance due | The amount remaining is to be paid by the patient after insurance and other payments |

| Tax information | Applicable taxes, and information related to tax deductions |

| Notes or comments | Additional notes or explanations regarding the charges or medical procedures |

Itemized Bill Template (Free)

To help you with itemized billing and save you time, we have provided a free template. Simply download it, fill in the necessary details, and share it.

Download FREE Itemized Bill Template - Create your itemized invoice online instantly

How to Create an Itemized Bill?

Creating an itemized bill comprises detailed breakdown of all the charges related to a product or service.

Here is a step-by-step guide on how to create an itemized bill:

Step 1: Add the necessary components

When creating an itemized bill, ensure it includes the following necessary components for clarity and accuracy:

- Business information: Add your business name, address, contact information, and email address.

- Invoice number and date: Assign a unique invoice number and also add the date of issuance.

- Description of services: Initiate the process by collecting all the important information related to the specific transaction like products or services offered.

- List items and services: Make a detailed list of each product or service offered in the transaction. For every item, you must add a new line with a short description.

Step 2: Cost breakdown

- Add quantity and unit price: Specify the unit price and the quantity of each item. Doing so will ensure transparency and also help the customer understand the way the total cost is calculated.

- Calculate the total for each line item: Multiply the product quantity with the unit price for each line item and make the total. This will help you get the total cost of each product or service.

- Mention additional charges: Specify the quantities and specific prices. Ensure to add any additional charges related to the product or service like shipping costs, taxes, or service fees. All of these charges should be listed separately to avoid any potential confusion.

- Provide the final total: Now, it is time to calculate the total amount owed by the customer. Add all the line items, taxes, and the additional fees. Make sure to bold the final total amount on the bill.

Step 3: Include payment terms

- Add payment terms and contact information: Ensure to add the payment terms, due dates, and payment methods. Also, add your business contact information to make it easier for the customer for further clarification.

- Review for accuracy: Before sending out the itemized bill, ensure to check all the calculations and details to make sure the bill is accurate.

Following these steps will help you create an itemized bill that is easy to understand and reduces the chances of any potential disputes or confusion.

Common Challenges and Solutions in Itemized Billing

While creating hospital bills, you are likely to encounter several challenges, but understanding these issues and their solutions can help streamline the process:

1. In healthcare

- Challenge: Complex and time-consuming

Solution: Implement automated billing software that can generate detailed itemized bills quickly and accurately. Automation reduces the manual effort required and minimizes errors.

- Challenge: Inaccurate or Incomplete Information

Solution: Establish clear procedures for documenting services and charges at the point of care. Regularly training proper billing for staff on practices ensures all relevant information is collected correctly.

- Challenge: Patient confusion and disputes

Solution: Provide clear explanations and descriptions for each charge on the bill. Offer support through a dedicated billing department or customer service to address any patient queries or concerns.

- Challenge: Unclear terminologies or codes

Solution: Patients often get confused by complex healthcare terminologies, names, or codes. Having a knowledgeable person break these down into simple and understandable language can help patients understand what they are paying for.

For example: People might get confused between ICD (International Classification of Diseases) and CPT (Current Procedural Terminology) codes, two of the most common terms in medical bills. Your staff should be sympathetic and well-informed to explain their meanings and significance when asked.

2. In insurance

- Challenge: Insurance claim rejections

Solution: Ensure that itemized bills include all necessary details and comply with insurance company requirements. Regularly review and update billing practices to align with insurer guidelines.

- Challenge: Insurance claim delays

Solution: With the help of an advanced billing system, you can ensure compliance with industry-specific coding standards resulting in reduced claim denials. In an industry like automotive repair, you can use software that automatically generates itemized bills based on particular service details. This results in improved insurance claim approval rate and reduces delays too.

- Challenge: Manage large volumes of medical bills

Solution: Use billing management systems that can handle high volumes efficiently. These systems can track and organize medical bills, making it easier to manage and retrieve information as needed.

3. In dispute resolution

- Challenge: Payment disputes

Solution: Use itemized bills to minimize disputes. An itemized bill offers a detailed breakdown of services and costs. In construction, it helps to explain any adjustments due to project changes and ensures both parties understand their charges. Whereas in healthcare, it mentions the descriptions related to medical procedures.

How to Ask for an Itemized Bill

Getting a detailed bill from your doctor or health care provider is not a big deal. It is a simple process that can be achieved by following 5 steps listed below:

Step 1: Get in touch with the billing department

Contact the billing department or the healthcare provider's office to make your request. The contact details are available on their respective website, the hospital bill, or the medical records.

Step 2: Provide your information

Provide the necessary details like your name, date of birth, contact information, and identification number (if applicable). This information aids the billing department in finding your records and confirming your identity.

Step 3: Make the request

Reach out to the billing department representative and ask for an itemized bill for the medical services you received. Mention specific details you need related to the services, procedures, and materials used during your treatment.

Step 4: Specify the format

You can pick your choice of format to receive the itemized bill. Ensure to mention the specific format (email, mail, or fax) in the call itself. Also, provide your email address, mailing address, or fax number, as per the format you pick.

Step 5: Follow up

If you come across a situation where you haven't received your itemized bill within the specified timeframe, then you must follow up with the billing department. It will help you know the status of your request.

Following the steps mentioned above will help you ask for an itemized bill from your healthcare provider or doctor in a polite way.

Generally, healthcare providers offer itemized bills without any request, but there might be chances where you might have to ask for one. While asking for an itemized bill, be sure to initiate the process in a polite manner and with utmost patience.

What to do after You Receive an Itemized Bill?

If you know how to handle itemized bills once you receive them, the process becomes smoother and less confusing. Here's what you should do:

Create Itemized Invoices Instantly With InvoiceOwl

Invoicing usually takes way too long. That's why we're here. InvoiceOwl makes your invoicing faster and simpler so you can get paid promptly and without the hassle.

Start Your FREE TrialItemized Bill for Other Industries

While itemized bills are mostly used by healthcare businesses to provide their patients with detailed bills, they are also used by various industries to ensure transparency and accuracy in their billings.

Here is a table showcasing how different sectors use itemized bills:

Itemized Bills Across Industries

| Industry | Key Components of Itemized Bill |

|---|---|

| Healthcare | Medical treatments, medication, diagnostic tests, doctor fees, hospital stays, equipment charges, and taxes |

| Construction | Materials, labor hours, subcontractor fees, equipment rental, permits, site preparation, and cleanup charges |

| Retail | Product details, quantity purchased, unit price, discounts, taxes, and shipping fees |

| Hospitality | Room charges, dining, spa services, amenities, minibar usage, taxes, and service charges |

| Legal services | Hours of legal consultation, court filing fees, document preparation, travel expenses, and taxes |

| Freelance work | Hours worked, project milestones, materials used, software subscriptions, travel fees, and taxes |

| Automotive | Automotive parts, labor hours, diagnostic charges, equipment usage, additional service fees, and taxes |

| Education services | Tuition, course materials, lab fees, library usage, extracurricular activities, technology fees, and taxes |

What are the Best Practices for using Itemized Bills?

Here are some best practices for using itemized bills across industries:

1. Offer clarity and transparency

Ensure to provide a clear transaction breakdown. Start by listing each product and service offered to the customer. Make use of simple-to-understand language to describe each item.

2. Accurate and detailed descriptions

Make sure that every product or service is described accurately along with quantities, unit prices, and any applicable taxes or fees. Also, add brief descriptions wherever needed to clarify the purpose of the charges.

3. Categorize charges

In case of large bills like construction of legal services, make a group of charges as per their specific category (e.g., labor, materials, consulting fees). Ensure to highlight the additional charges in a separate line like taxes, shipping fees, or service charges.

4. Include payment terms

Ensure to specify the payment terms, deadlines, and the penalties chargeable for late payments. Add the payment accepted for easy transactions. ( (e.g., credit cards, PayPal, and bank transfers)

5. Use automated software

Use invoicing software for automating the generation of itemized bills, reducing the risk of human error. Always provide an electronic version of itemized bills to your client. It will enable them to review the charges at their convenience.

Building Trust Through Detailed Itemized Billing

Implementing itemized billing enables you to practice better healthcare management. By breaking down each charge and providing detailed explanations, you can build trust and improve the overall patient experience. Itemized billing helps you prevent billing disputes, streamline insurance claims, and ensure accurate reimbursement.

For your information, in many organizations, itemized bills are also referred to as "itemized invoices" or "itemized statements". Regardless of the name, their purpose remains the same: to help customers understand what they are paying for. Remember, clarity and transparency in billing are key to maintaining a positive relationship with your patients.

Frequently Asked Questions

You can request an itemized bill by contacting your healthcare provider's billing department representative directly. Many providers also offer online portals where you can request and view an itemized statement. It's a good practice to request an itemized bill for every visit to maintain transparency.

If you do not collect an itemized bill, you risk missing errors or overcharges, which leads to potentially higher costs. Without detailed information, it becomes difficult to verify the accuracy of charges or to dispute any discrepancies. Additionally, lacking an itemized bill can complicate insurance claims for an insurance provider.

Healthcare providers can enhance the itemized billing process by implementing automated billing systems, which significantly reduce manual errors and save time. These systems streamline the billing workflow, ensuring accuracy and efficiency. Automation can handle large volumes of data, generate detailed itemized bills quickly, get invoices paid faster, and integrate seamlessly with Electronic Health Records (EHRs) and insurance databases.