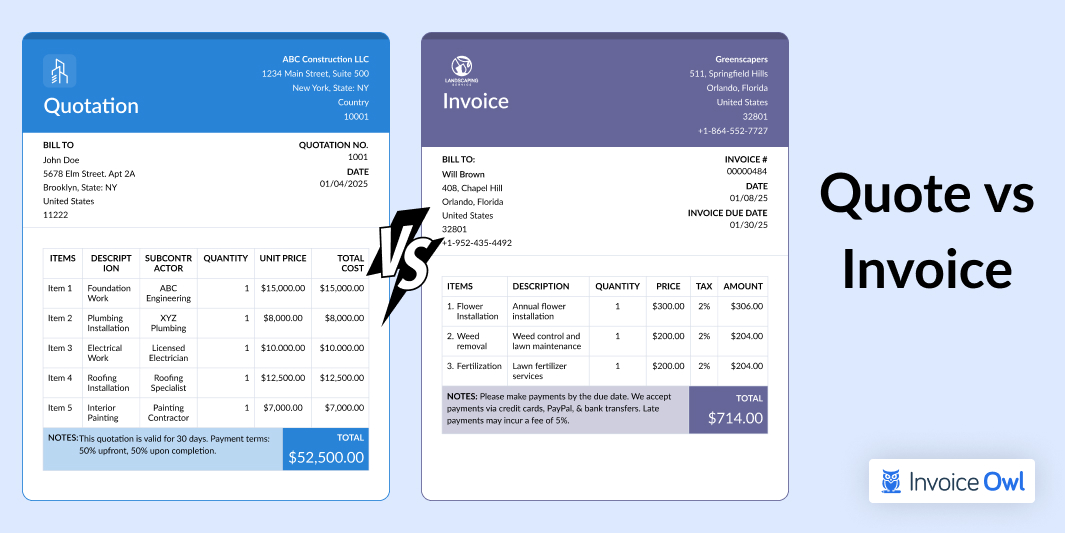

An original invoice is a notice for an outstanding payment issued to a customer by a vendor or company that explains details of the products/items or services acquired by the customer. In an invoice, payment terms and policies, methods of payment, and invoice due date are clarified.

When a company or vendor sends the consumer or buyer a bill for instance they send it for the products/items or services they have sold, but the client has not paid the bill as of the due dates, the statement is then counted as an outstanding invoice. So what is an outstanding invoice? It is the invoice is being neglected and not paid yet.

Let's find it out.

What You'll Learn

- 01The difference between outstanding invoices and past due invoices

- 02How unpaid invoices can impact your business reputation and cash flow

- 03Best practices for preventing late payments before they happen

- 04Step-by-step strategies for recovering outstanding payments

- 05Legal options and when to escalate unpaid invoice situations

- 06How digital solutions can automate invoice tracking and payment reminders

Understanding Outstanding Invoices: Definition and Importance

An outstanding invoice term is used when the buyer/purchaser of the goods or services has already received products or availed of the services but hasn't paid for the same.

You don't need to separately generate an outstanding invoice to notify your customers. Just an email would suffice.

Besides, the payment terms are cleared when creating a sales invoice, which means your customer has a specific time period to pay.

For instance, if a customer A buys goods from you stating 30 days as a payment window, then he/she is liable to pay within 30-calender days. Till that time, sales invoices that you've generated is counted as an outstanding invoice.

Post-due date, the sales invoice is called Past Due Invoice. Now what is this new term and how is it related to outstanding invoices? Let's figure it out.

What Is Past Due Invoice?

Most businesses have lots of accounts that are extensively unpaid even if the due date has passed. Such unpaid invoices sometimes make businesses lose thousands of dollars and leave them with extra hours of work by chasing payment for the unpaid bill. In this case, past due invoice reminders come to the rescue and help businesses get the payment. Basically, it works as a reminder invoice.

For instance, if a customer A buys goods on the 1st of January, keeping a 30-days window for payment, and fails to pay after the due date, the sales invoice automatically becomes a past-due invoice on the 1st of February.

So, are both outstanding and past-due invoices the same? Or is there any difference between both? Let's check it out.

Outstanding Invoice vs. Past Due Invoice

Many businesses get confused between what is an outstanding balance invoice and a past-due invoice. So let's know the comparison.

Outstanding Invoice vs Past Due Invoice Comparison

| Difference | Outstanding Invoice | Past-Due Invoice |

|---|---|---|

| Meaning | All unpaid invoices are considered outstanding invoices as per the accounting system terms and policy. | An unpaid invoice or overdue invoices that remain unsettled post due date is known as a past-due invoice. |

| Does it attract penalties? | If the customer pays before or on the due date, he/she is not liable to pay penalties. | If the customer fails to pay on or before the due date, late payers attract penalties. |

| What does it include? | Past-due invoices are included in outstanding invoices. | Outstanding invoices are not included in past-due invoices. |

| Impact | If received on time, these invoices positively impact the company. | Negatively impacts the company. |

| Payment Terms | The payment terms are clearly mentioned in the sales invoice. | This doesn't count since the customer has already failed to pay on the agreed payment terms. |

So these are the basic differences between outstanding and unpaid invoices. How will an outstanding invoice impact your business? Let's know what risks are involved.

Why It Is Risky To Have Outstanding Invoices?

The outstanding invoices can ruin your business credit in the market. Based on the overdue invoices, vendors can lower the company's credit limit or stop accepting orders from that client's account. In the worst scenario, pending invoices for a long time may eventually go to a collection agency. This results in a permanent bad credit mark against the company or business owner, depending on the business's legal policies. Seeing such marks on the list, other vendors may not do further transactions with the company that has many invoices due dates.

Outstanding invoices left unresolved can lead to permanent bad credit marks, limiting your ability to secure vendor credit and affecting future business relationships.

Now that you know how badly an outstanding invoice can impact your business reputation and goodwill, let's know the ways to get the payments on time and build a brand.

Managing Outstanding Invoices Effectively

When business owners need to send payment reminders for past bills, most of them get hesitant and find it difficult to chase the customers for the money they owe and make a loss. Here are a few tips to handle overdue invoices and help you prevent late payments.

Prevention strategies and best practices

Dealing with outstanding invoices

Outstanding invoices usually start by inconveniencing and interrupting cash flow and can shortly grow into affecting the operations of the small business. Interrupting cash flow may mean that the business owner is unable to pay their suppliers and employees.

With that, the business operation will be halted after some time. Late payments can also affect a business's reputation.

It is required of the business owner to have backup plans for tracking unpaid invoices as they are a major problem to the business operations.

Include late payment dues in your invoices

Charging an extra amount for late payments is one sure way to receive payments on time. You should include a late payment fee or penalties in your payment terms and policies at the initial stage of sales.

Also, clearly stating the mutually stated payment terms in your construction agreement is advisable before you start supplying the goods. In other words, they should be clear on the payment terms.

The late payment fee or penalties on your bill should be in bold prints so they can be spotted. You can as well quote a percentage and do the math for clarity's sake.

- Total fee by October 12: $400

- Total fee after October 12: $420

Before the due payment dates, you could call them to remind them of the extra charge, or when they enter late fees territory, you could offer a deduction from the extra charge if they pay immediately.

Clearly display late payment fees in bold on your invoices with specific amounts. For example, show both the on-time total and the late payment total to create urgency.

Send them an email or letter

Usually, the first thing to do when the customer fails to make a payment is to reach out to the customer. It can be done through email or letter. Your letter or email should be polite while you include the bill number and payment due date. Also, ask them when they're going to make the payment. Do not explain the details of the bill since the bill carries all the details; keep the content short and precise.

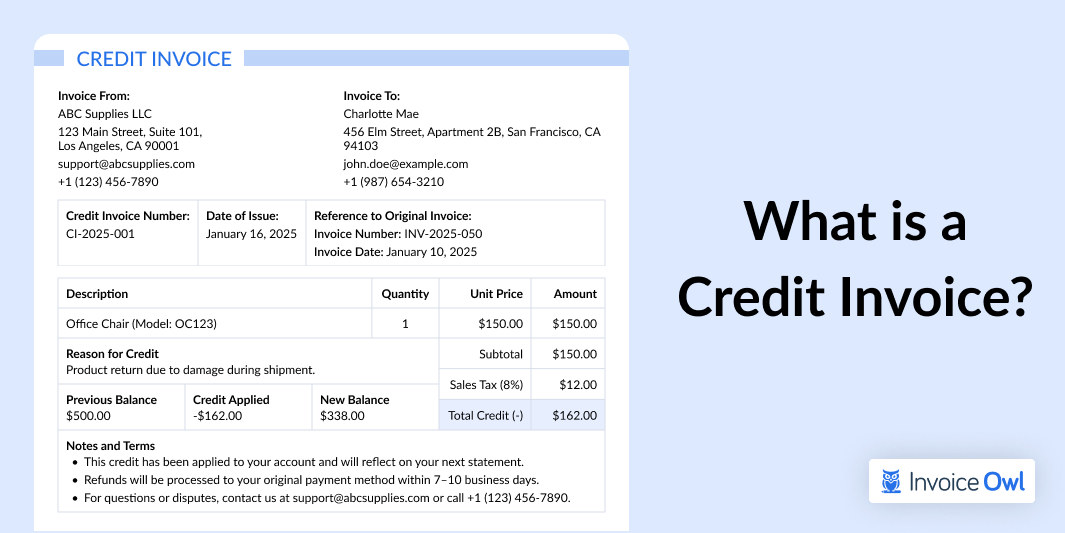

Send an invoice overdue

Another strategy to deal with an unpaid bill is by sending an overdue bill. If you're printing the bill, add an overdue stamp on it. If you send it through email, the original invoices should be sent with the payment request. You may choose to include an invoice overdue watermark.

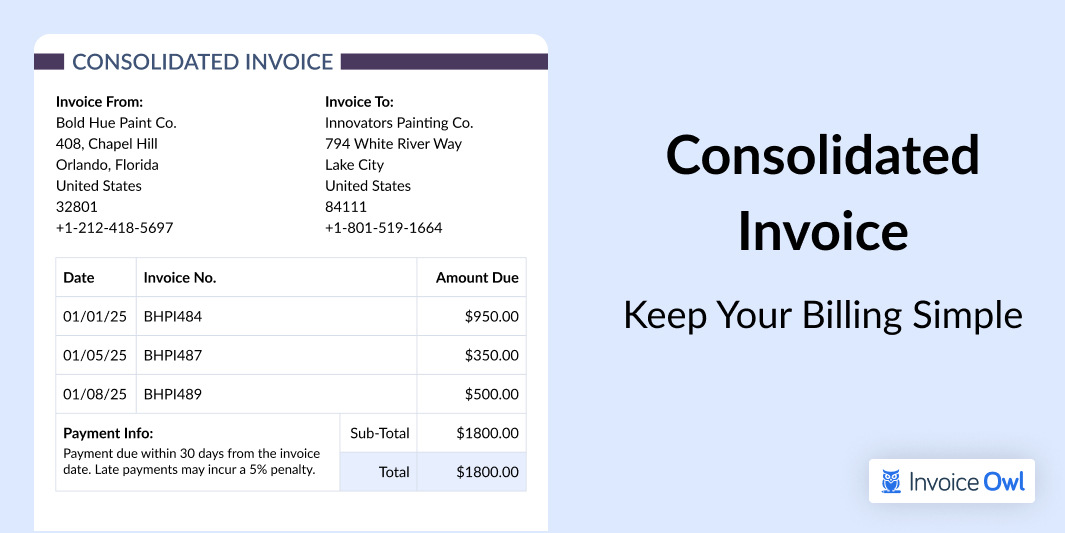

Send a statement of accounts

When an individual customer has more than one outstanding original invoice with you, you must send them a statement of account showing all their outstanding invoices in it. Summarize them for a customer who has more outstanding payments.

You can also generate a statement with your accounting software. After sending a customer the statement of accounts, call them immediately to arrange a payment plan.

Phone them

As a business owner, calling your customers from time to time will help you get the payment quickly. It is a usual practice in some companies always to call customers who have unpaid invoices. If a customer does not pick up the call, it is obvious they are ignoring you, but it will be hard to ignore a phone call.

When you are on the phone with a customer, be precise and politely inform them of their payment. You can also ask when to expect your payment. You should conclude how to get payment before ending the phone call.

Legal aspects and recovery options

If it's too late, there are some extra measures you can take into consideration.

Stop supply until you get paid

When you keep supplying customers with outstanding invoices, and you don't get paid, your business will become unsustainable at some point. Do not fulfill their orders until they pay their outstanding invoices, be professional in your approach, and make them understand what they have to do to keep getting your supplies if you're the go-to vendor. It could be tasking but effective.

Use a debt collector to get your outstanding payment

You can get debt collectors to obtain your outstanding payments from owing customers. Debt collectors can be professional in their approach when they go after outstanding invoices. In the process of hiring a debt collector, you may have to end any relationship you have with the customer. Consider the risk, but it takes about 25% of the total due to get their service.

Hire a lawyer

Involving a lawyer is the next best thing to do if a debt collector firm couldn't get it. You're taking legal action that depends on what organization you're doing business with. If you hire a specialist lawyer, the case may become a complex one; they'll have to deal directly with individual departments of both companies. If after you hire a debt authority collector where there are legal experts to help you get the right lawyer for the case.

When Should You Send Overdue Invoice Templates?

Sending reminders for unpaid invoices completely depends on your small business policies and your financial cash flow. You may send such invoices as soon as the payment due date has passed, or you may simply remind them about the payment to the client following the above-given steps and if they ignore your reminder then it is the right time to send a late payment bill. Generally, people send invoices after 30 days and then 60 days, so it completely depends on your preferences.

After sending invoices you need to chase the clients for the payments. Some people chase by calling a client for the payment request, some write emails, basically, everyone has their own ways as per their expertise and skill to chase the invoices for getting paid quickly. But, sending due invoices is known as one of the best options to chase a bill in a polite way.

Stop Chasing Payments Manually

InvoiceOwl automates payment reminders, tracks invoice status in real-time, and notifies you when clients view or pay invoices.

Try Free for 3 DaysDigital Solutions for Invoice Management

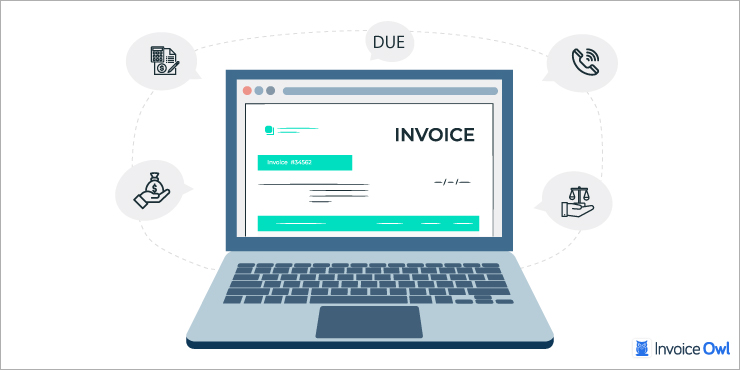

Keeping track of unpaid invoices is a must since it is a hole that can sink your ship not only financially but also industry-wise.

Since you have put all your blood sweat into your business, an extra resource would not be affordable.

But what if you get automated software that monitors all your unpaid sales invoices and gives you an in-depth idea about how much money is yet to receive.

With easy-to-use invoicing software, InvoiceOwl offers tracking feature that helps you know which invoice remains unpaid or are yet to get paid.

3 Outstanding Benefits to Expect with this InvoiceOwl tracking feature:

- Read Receipt: You receive notifications whenever your client opens or reads invoices. It eliminates the hassle of regularly taking follow-ups. Plus, it even rules out taking follow-ups via phone calls.

- In-build Payment Notification: Get notified via mobile + web-based app for the payment you receive.

- In-app Review: Get notified when your customer appreciates your product or services.

InvoiceOwl is integrated with intelligence tracking methods that make monitoring tasks a cakewalk.

Frequently Asked Questions

For collecting past due invoices, just follow 5-simple steps. Firstly, sort out those unpaid invoices that have crossed a 90-day payment mark. Start sending overdue invoice notice emails to those customers informing them about the payment they owe you. Post-sending emails set payment reminders and call your past-due accounts. You can even follow up with a past due balance email invoice.

Many small businesses charge around 1-1.5% as a penalty every month post-due date.

Writing past invoice letters is important since it notifies customers about the payment left to pay. Many customers miss out on meeting deadlines which is when the payment gets due. Always use polite language when writing a past invoice letter. Besides, you must also attach invoices and the actual date of payment.

When the customer buys goods or renders services from the seller/service provider and fails to pay on the agreed payment date, terms, and conditions, it becomes an outstanding payment.

Outstanding invoices can be categorized based on their payment status and duration. Current outstanding invoices are those within the agreed payment terms, while overdue invoices have surpassed their due date. Partial payments indicate incomplete settlements, and disputed invoices involve disagreements over charges or services. Categorizing outstanding invoices aids in efficient management and recovery processes.