Are you tired of waiting for weeks or even months to receive payments for your contracting services? If so, then it's time to take a closer look at your invoicing process.

Invoicing is a crucial aspect of any business, big or small. As per the reports, almost 82% of small businesses face cash flow issues in their businesses. Late payments and continuous overdue payments are some challenging reasons for hampering business growth and sustainability.

But have you ever tried to know why it happens? What's the reason behind it, or is there any solution to improvise?

In this blog, we'll cover the essential elements to answer your query on what to include on an invoice to streamline the payment process.

What You'll Learn

- 01Essential components every invoice must include for legal compliance

- 02How to structure pricing and payment terms for faster payments

- 03Different types of invoices and when to use them

- 04Best practices for writing clear, professional invoices

- 05Common mistakes to avoid when creating invoices

Understanding Invoices

Invoices are an essential component of financial transactions. It serves both practical and legal purposes. In the following sections, we'll explore the definition and purpose of invoices, their role in business operations, and the various types, just tailored for your different transaction needs.

Definition and purpose

Invoices are formal records issued by businesses to request payments for goods or services offered to a client. Every invoice comprises important information like the organization's contact information, a breakdown of the products or services offered, associated costs, and payment terms like penalties for delays.

The main purpose of invoices is to streamline cash flow management and serve as a legal document. It helps businesses maintain accurate financial records, support tax filing, and address disputes.

Business need and legal implications

Invoices play a dual role by maintaining the cash flow and also acting as legal evidence for financial transactions. Businesses can depend on invoices for accurate bookkeeping, managing disputes, tax compliance, and ensuring transparency in operations.

Variations of invoices

Types suited for different transactions

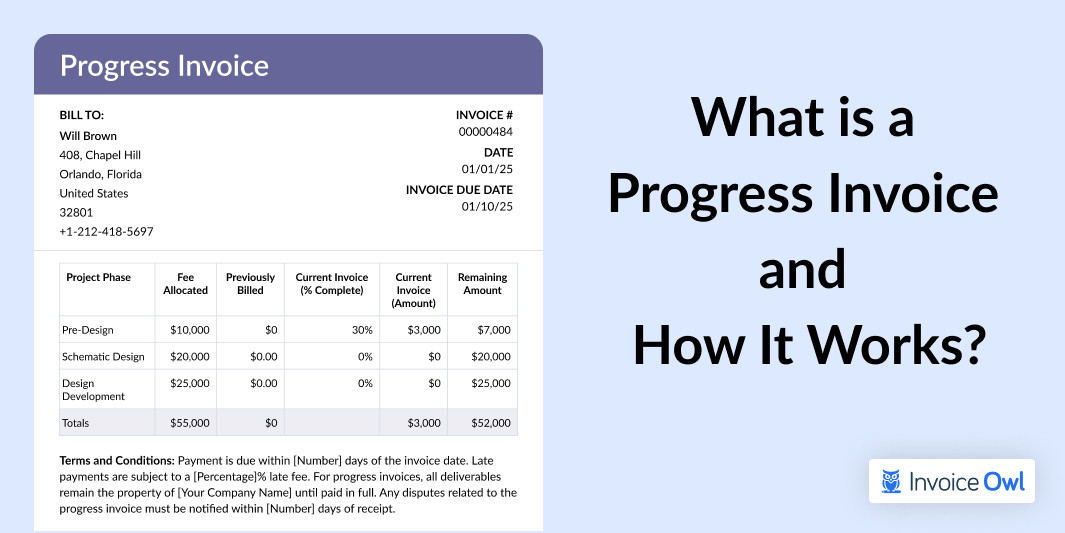

Every transaction needs different invoice types to meet specific business requirements.

Comparative analysis of invoice vs. bill

Invoice vs. Bill Comparison

| Aspect | Invoice | Bill |

|---|---|---|

| Purpose | Requests payment for goods or services delivered, often used for delayed payment terms | Reflects immediate payment needs for goods or services provided upfront |

| Details | Specifies detailed terms of the transaction, including payment due date and itemized breakdown | Provides a quick summary for payment without extensive transaction details |

| Industries | Found in industries like wholesale, manufacturing, and professional services | Found in industries like restaurants, hotels, and retail stores |

Core Elements of an Invoice

Creating a professional invoice requires attention to detail and the inclusion of essential elements. Below, we break down the key components that make an invoice clear, effective, and compliant, ensuring smooth communication and timely payments.

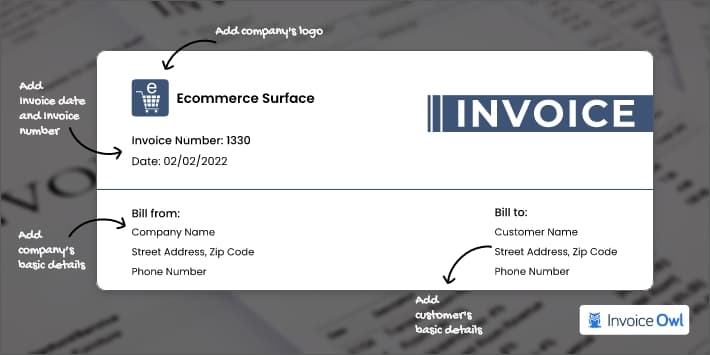

1. Company details

To establish credibility and ensure easy communication, start by mentioning your business's full name, contact information, and registration number.

- Full name and contact information

Add your organization's name, an official email address, contact information, and physical address. Adding this information ensures that the client can easily reach out for inquiries or clarifications.

- Business registration number (if applicable)

Adding your business registration number and tax identification details offers credibility and ensures compliance with local regulations. These details are important for audits or formal records.

2. Invoice details

Ensure to add a unique invoice number, issue date, and due date to ensure clear identification and easy tracking for both parties.

- Unique invoice numbering systems

Just as a person's name is essential to identify them, similarly, an invoice number is essential to identify an invoice. It is a unique identifier that helps businesses and clients keep track of their invoices and payment history or even for reconciling purposes.

- Invoice creation and due dates

The invoice date indicates when the invoice was prepared and when the payment is due. Mentioning the invoice date as well as the payment due date helps businesses avoid any delayed payments. Also, it helps clients understand how long they have until the payment becomes overdue.

3. Client information

Add the client's important details to personalize the invoice and streamline communication for payment or queries.

- Name and contact of recipient

Entering the client's name, address, and contact information as it provides a clear reference of who the invoice is being sent. This information is proof that the invoice is delivered to the correct person or organization, which can help resolve invoice disputes, discrepancies, or errors in the future.

4. Description of services/products

Offer a description of services or products to maintain transparency and avoid any potential disputes.

- Importance of detailed descriptions

Offering detailed descriptions ensures clarity and avoids any potential disputes. Additionally, it also helps to build trust with clients and make them understand the services they are being billed for.

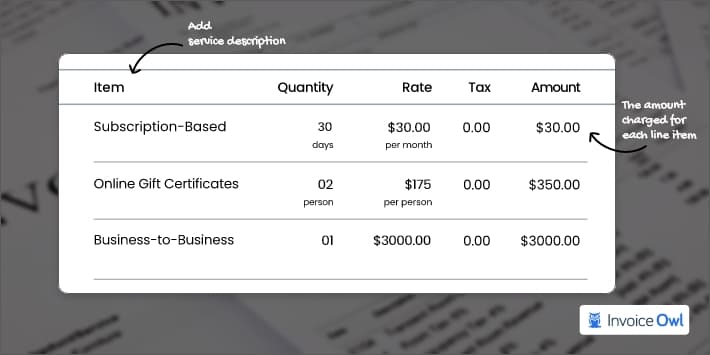

- Categories and itemized breakdown

Ensure to organize your products and services into categories for clear understanding. Offer an itemized bill with all the important quantities, rates, and final amount. Using this format simplifies the process of tracking for both the client and the businesses.

5. Pricing structure

Make sure to break down the cost of each item and service to ensure clarity on the final amount owed by the client.

- Individual and total costs

To accurately track the prices of the services rendered, it is essential to include the amount charged for each line item. Additionally, it enables clients to understand the entire cost of the invoice.

- Applicable taxes and discounts

Ensure to include any applicable taxes or duties (if any). Also, when the rates of services sold are mentioned, businesses will get paid faster.

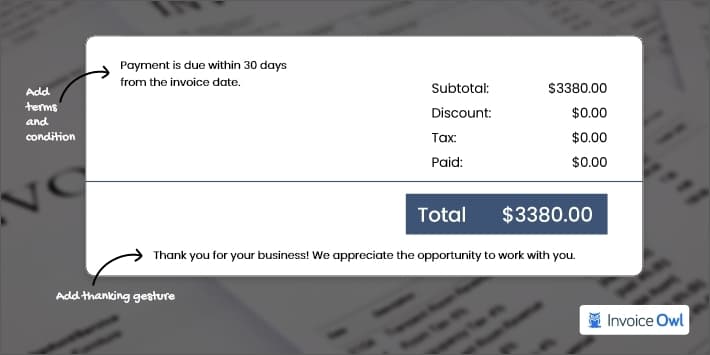

6. Invoice payment terms and payment methods

It is crucial to include all the payment details, terms, and conditions as well as acceptable payment methods. Clearly define

- The accepted payment methods (Cash, Online, Offline, Checks, Credit cards or Debit Cards)

- Payment instructions to the client (to whom payment is made, where they can go and make an online payment, on whose name cheque is to be drawn, etc).

- Late payment fees (if applicable).

- Any money-back guarantee or service warranty disclaimers.

- Payment due dates to avoid undue or unnecessary payment delays.

- Any terms or conditions that are required to be included regarding the advance payment, immediate payment, or return/replacement policy.

Clients can then better understand when and how to make payments for their invoices. Additionally, it establishes clear guidelines for the payment procedure, which may promote quick payment and minimize late fees or penalties.

Clear payment terms reduce confusion and help you get paid faster. Always specify the due date and accepted payment methods prominently on your invoice.

7. Thanking gesture

Lastly, it's a good practice to include a thanking gesture, such as a thank you note, to show appreciation to the client for their business. This can help build a positive relationship with the client and increase the chances of repeat business.

Effective Invoice Writing Techniques

Crafting an invoice isn't just about listing charges—it's about presenting information clearly and professionally. Below, we outline the best techniques to apply:

Best practices (Do's)

The best practices are:

- Use of professional tone

The first impression is always the last one. So, use a professional and polite tone in your invoice. It will help you create a good impression among your clients and also help build trust.

- Clear layout for visibility

A well-prepared debit note is one with all the important information that is easy to locate and understand. It is also required to ensure to use of separate sections for transaction details, invoice references, transaction details, and final amount to avoid any confusion.

Common pitfalls (Don't's)

Some of the notable pitfalls to avoid are:

- Ambiguous language or terms

Avoid using complex words or terms in your invoices as they lead to a potential dispute or confusion. Ensure that all the important details like payment deadlines, service descriptions, and pricing are accurate and easy to understand.

- Overloading with information

Adding unnecessary information can overwhelm your client and also overshadow the important information. So, always focus on important information like costs, service breakdown, and payment terms while creating your invoices.

Overloading invoices with unnecessary details can confuse clients and delay payments. Keep it simple and focused on essential information.

Read this detailed blog to know the detailed invoicing tips to get paid faster.

Ready to Streamline Your Invoicing?

Create professional-looking invoices in a few seconds by mentioning each and every invoice-related detail with InvoiceOwl.

Start Your FREE TrialFrequently Asked Questions

There are a few types of invoices which are listed here: Pro-forma invoices, Recurring Invoices, Interim invoices, Commercial invoices, and Self-billing invoices. These invoices are either manually created, or they are electronic invoices generated via leading estimating and invoicing software like InvoiceOwl.

An invoice that is issued by an individual who operates as a self-employed person and is personally liable for the debts of their business is a sole trader invoice. On the contrary, a limited liability invoice is issued by a company that is a separate legal entity from its owners and limits the liability of the owners to the amount of their investment in the company.

Yes, you can include multiple payment options, such as credit cards, bank transfers, PayPal, or digital wallets. All of these can enhance convenience for clients, and improve the timely payments.

Yes, there are legal requirements for invoices, but these get vary by region. Typically, invoices must include your business name, tax ID, client details, and payment terms. In addition, always check local regulations to ensure compliance, especially for tax purposes.

No, invoices for international clients may require some important adjustments. First, always ensure your account for currency conversions, language preferences, and international tax regulations like VAT or GST. This is majorly depends on the country. Thus, a tailored format helps maintain clarity and compliance.

Conclusion

Delivering clear, concise, and crisp invoice information help you get prompt payments. You can actually start implementing this saying in your business as you are now well-trained enough after reading this blog post on what to include on an invoice.

So, hurry up, revolutionize your invoicing process, create professional invoices in minutes, build some credibility, and get paid faster with well-crafted invoices.

"Invoicing may seem to be a smaller part of the business, but getting it the right way can actually make a huge difference."