Key Takeaways

- 01Purchase order financing is a cash advance for small business owners to receive on their purchase orders

- 02With purchase order financing, a vendor can pay third-party suppliers up to 100% of the cost that is required to deliver and produce goods

- 03Purchase order financing process can be done in 8 steps with the help of a purchase order financing company

- 04This type of financing helps small business owners to receive more sales and orders

- 05The interest rates you obtain for purchase order financing will vary depending on criteria such as the quantity of the purchase order

According to Semrush, the most challenging roadblock for small businesses is financial flow.

Are you a small business owner thinking about purchase order financing for your business?

OR

Are you just trying to better understand purchase order financing while exploring various options for acquiring additional funding for your small business?

If so, you've landed in the right place!

We have created a comprehensive guide to help you understand purchase order financing in detail.

Read on!

Table of Content

What is Purchase Order Financing?

A purchase order (PO), also known as purchase order financing, is an agreement in which a third party agrees to pay supplier costs with sufficient funds to finance a client's purchase order.

In certain circumstances, purchase order funding will cover the entire order, while in others, only a percentage of it will be covered.

The purchase order financing company takes money directly from the client when the seller is ready to ship the order. After deducting their fees, the company sends the remaining amount of the invoice to your company.

Sellers would most likely prefer to not stress over financing large purchase orders. Admittedly, that isn't always the case. However, the good news is that by employing purchase order funding to finance purchase orders, sellers can meet the requirements of their clients while focusing on their business growth.

Earlier, small business owners used to expect conventional financial institutions to cover all of their financial requirements. But in the aftermath of the 2007–2008 financial meltdown, financial institutions are lending fewer and fewer amounts.

This is not to imply that financial institutions no longer finance small businesses. They are just selective, preferring to lend to qualified businesses with near-perfect credit scores that have been in the industry for a long period.

On the contrary, purchase order financing companies are willing to fund sellers with less-than-perfect credit scores.

These financiers are more concerned with the creditworthiness of clients who place purchase orders. Furthermore, securing business loans from a traditional financial institution can take a long time. Whereas securing purchase order loans is considerably easier.

This facility is incredibly beneficial for small businesses that are new in the industry and could be struck by a huge purchase order when they are not prepared for it.

If you're a small business owner concerned about whether your company will have enough money to fund the next big purchase order that arrives, purchase order financing is the way to go.

How Does Purchase Order Financing Work?

There are only two main parties involved in traditional small business loans: you and the lender who provides the financing. However, if you enter into a purchase order financing arrangement, you will generally collaborate with the following parties throughout the process:

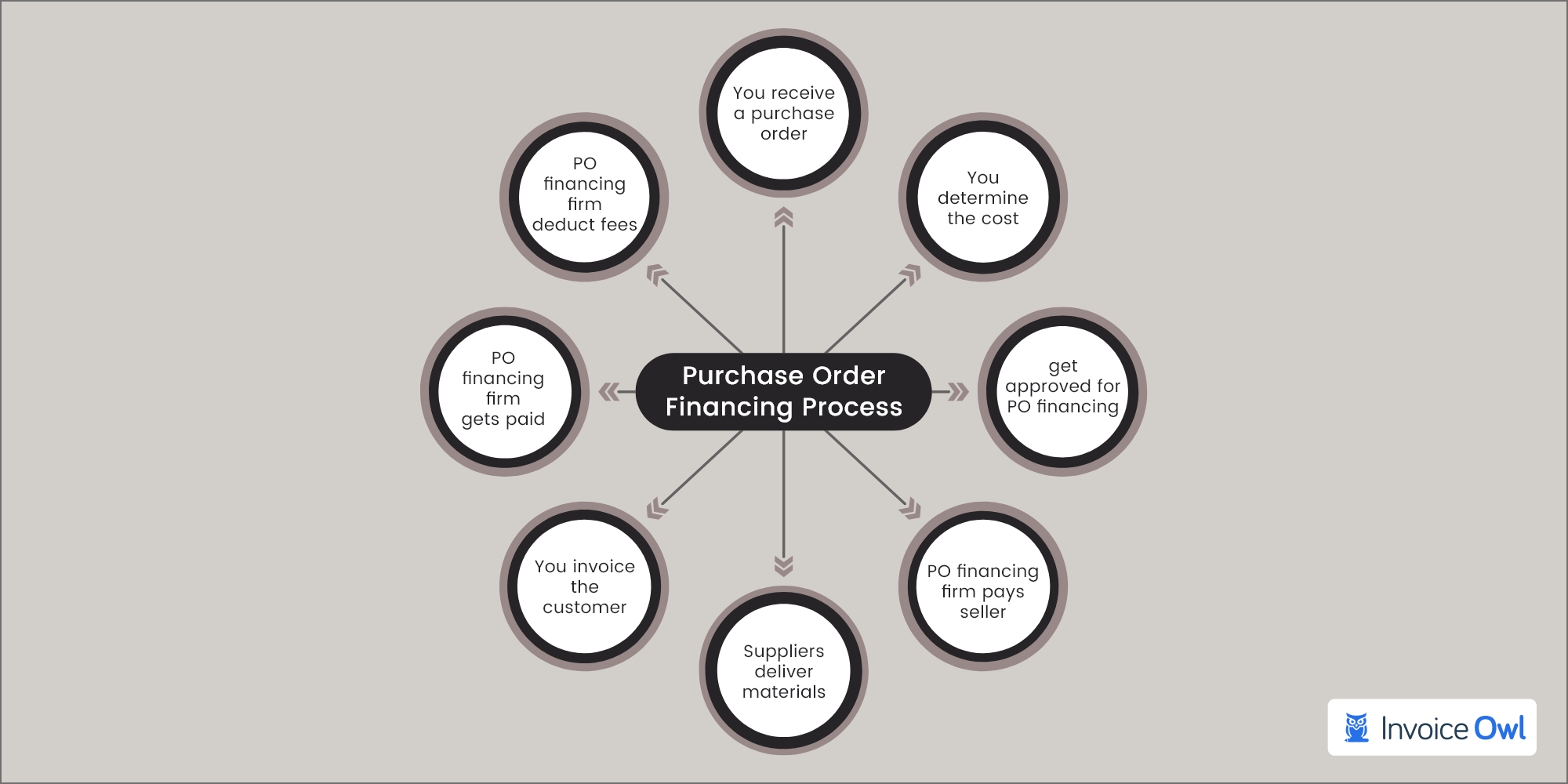

Purchase Order Financing Process in 8 Steps

1. You receive a purchase order

Your customer sends you a purchase order that details the type and quantity of goods they want to buy. Based on this info, you should be able to assess whether you'll need to obtain financing to complete the order. If you do, you can initiate the purchase order financing procedure to mitigate your cash flow problems.

2. You determine the cost

You contact your supplier or seller to find out how much it will cost to fulfill the customer's purchase order. You can determine whether you'll need to request for funding to fulfill the order based on the financial assessment provided by your seller.

3. You apply and get approved for purchase order financing

After determining that you require purchase order financing, you'll want to choose the best purchase order financing company for your business, fill out an application, and, preferably, seek approval.

As part of your application, provide the purchase order and the supplier's cost estimate. Depending on your organization's credentials, the supplier's track record and reputation, and the customer's creditworthiness, the finance company may approve you for up to 100 percent of the supplier's expenditures.

If the purchase order financing company only allows you for a portion of the funds, say, 90% of the supplier's charges, you will be responsible for paying the remaining 10% amount on your own.

4. The purchase order financing company pays the seller

Following approval, the supplier receives payment from the purchase order finance company to manufacture and deliver the products required to fulfill the customer's purchase order.

Generally, a letter of credit is used by several finance companies to pay suppliers (an official bank statement that payment will be made once specific terms and conditions are met). In this instance, once the goods have been dispatched and documentation of shipment has been submitted, the purchase order financing company pays the seller.

5. Suppliers deliver materials to the customer

The supplier delivers the products directly to the customer. The order process gets completed after the customer receives the items.

6. You invoice the customer

The supplier will notify you once the product is delivered to the customer. It's now time to invoice the client for the goods.

If the client intends to pay over time, the lender may acquire the invoice at a bargain from you. This is referred to as invoice factoring or factor lending. This often offers lesser fees but allows you to access your funds faster.

7. The customer pays the PO financing company

When the customer pays their invoice, they will pay the PO financing company directly instead of you. Your involvement will not be required once more for this stage of purchase order financing.

The sooner your customer pays back the lender, the faster you'll receive your cut of the earnings.

8. Purchase order financing company pays after deducting fees

After your customer pays, the purchase order financing company receives money. They then deduct their purchase order financing cost and send you the remaining balance of the purchase order earnings. In essence, the purchase order financing fees will function similarly to interest on your loan.

Advantages and Disadvantages of Purchasing Order Financing

If you are struggling with cash flow issues and are unable to fulfill an order, then using purchase order financing is just the solution for you. But just like any other financing, PO finance isn't for everyone.

To be clear, it has both pros and cons. Let's learn about some purchase order financing advantages first:

Advantages of Purchase Order Financing

1. No guarantee required

A personal guarantee is often required when taking out a normal business loan. This means that if the company is unable to repay the loan, the lender or financial institution can confiscate your personal assets in order to recover their investment.

PO financing is almost always non-recourse. This means that if your client cannot pay for the products, the lender bears the risk. In most circumstances, you will not be held accountable.

Whether the client cancels the shipment of goods, is unhappy with the product, goes bankrupt after the shipment is delivered, or fails to pay for any other reason, the lender loses money. However, you should consult with the lender about their procedures if the customer fails to pay beforehand.

2. Easier to qualify for finance

Purchase order financing is an excellent option for business owners who are having difficulty securing a loan or have a poor credit history.

PO loans have fewer and less stringent approval standards than regular bank loans. In this case, the purchase order serves as security for your loan.

In essence, purchase order financing companies are more concerned with your clients' payment history and credit score than with yours. Because your client pays the lender directly after the items are delivered, the lender wants to ensure that your client has a record of making payments on time. They usually do a background or credit check on your customers.

3. No weekly or monthly budgeting is required for loan repayment

Even if you are seeking funding, purchase order financing is not strictly a loan. When your cash flow is inadequate, you might fund yourself by trading in pending purchase orders.

Furthermore, you can finance up to 100% of your expenditures in one single amount without needing to worry about repaying the loan in installments.

PO financing is considerably more fluid and transaction-focused than, for instance, an SBA loan or bank loan, where you make a long-term agreement to repay in periodic installments over several years.

Let's go through some of the disadvantages of seeking financing for purchase orders:

Disadvantages of Purchasing Order Financing

1. Expensive

Purchase order financing is not the least expensive method of business financing. It's less expensive than, say, merchant cash advances or short-term loans.

However, the costs of PO financing can pile up over time. Every month, providers charge between 1.8 and 6 percent. When converted to an APR (annual percentage rate), PO financing might range between 20% and 75%. This is far more expensive than a bank or SBA loan.

2. Not flexible

The company you collaborate with oversees a substantial portion of the process with PO financing, including paying your supplier and receiving payments from your client. Your supplier also delivers goods directly to your client, so you're not involved in that step either.

Although this could save your company time, it could also mean that operations are not executed in the way you desire, potentially affecting your relationships with suppliers and clients.

3. Not for businesses that sell services

You must have physical goods or products that the seller can manufacture and deliver to your clients in order to qualify for PO financing. Purchase order financing is not accessible for companies that sell services to their clients.

Therefore, if you provide services and invoice your clients for them, invoice financing could be a better alternative for you, in that case.

Ready to Streamline Your Purchase Order Process?

Create professional purchase orders in minutes and track them with ease. Join thousands of businesses using InvoiceOwl.

Start Your Free TrialFrequently Asked Questions

Purchase order financing or PO financing is a financial loan on purchase orders that small business owners can obtain. A purchase order financing company will pay your third-party supplier costs of up to 100 percent of the expenditures through purchase order financing.

Purchase order financing and invoice factoring are two types of financing that could aid small businesses that are experiencing cash flow problems. The difference between these two financing facilities is that by using purchase order financing you receive payment or cash advance to complete a client order when you do not already have the working capital.

In contrast, with invoice factoring, you've already finished and invoiced a client for their purchase and are obtaining a capital advance to cover cash flow concerns while you wait for the client to pay their invoice.

Although some PO financing companies might offer a flat rate model, a tiered interest rate model is also prevalent with purchase order financing. The actual interest rates you obtain for purchase order financing will vary depending on criteria such as the quantity of the purchase order.

Use InvoiceOwl to Streamline Your PO Processes!

Now that you know how the process of purchase order financing works, let's come to the part where you have to create purchase orders.

This is a very important step, and it requires you to create purchase orders error-free. But you cannot achieve that if you use manual processes.

Here comes InvoiceOwl, an excellent estimate and invoicing software for contractors

With InvoiceOwl, you can create professional and customized purchase orders anywhere and anytime with ease.

You can also track the status of all your POs after you create them and save them in one place for easy access.

Start your FREE trial and learn about all the other benefits and features we offer to our clients.