What prompted you to look for the Invoice2go alternative? Is it

- a high price against the number of invoices available

- difficulty in navigating the website or mobile app

- negative user ratings from verified users

- not able to find what you are looking for

- incomplete billing solutions

The list doesn't end here; other major flaws contribute to decision-making factors. For instance, poor customer care services due to which contractors look for alternatives to invoice2go. Or because of hidden terms and conditions related to the number of invoices available in the freemium version. Considering these major flaws that unnecessarily burn a hole in the pocket, we have curated a list of the most affordable and widely acceptable invoicing and estimating software. Now that you know how invoice2go falls short in certain essential factors, let us introduce you to the updated alternatives.

What You'll Learn

- 01Why contractors are seeking Invoice2go alternatives

- 02Side-by-side comparison of 10 invoicing software solutions

- 03Pricing breakdown for budget-friendly options

- 04Key features to look for when switching software

- 05Which tools offer unlimited invoicing capabilities

Quick Comparison of Invoice2go Alternatives

At-a-Glance Comparison

| # | Software | Price | Rating | Best For |

|---|---|---|---|---|

| 1 | InvoiceOwl | $28.99/mo | 5.0 | Contractors & small businesses |

| 2 | Wave | Free | 4.4 | Basic accounting needs |

| 3 | Freshbooks | $6/mo | 4.5 | Freelancers & consultants |

| 4 | Zoho Books | $12/mo | 4.3 | Multi-currency businesses |

| 5 | QuickBooks | $7.50/mo | 4.5 | Full accounting solution |

| 6 | Odoo | $20/mo | 4.1 | Integrated business apps |

| 7 | Chargebee | $299/mo | 4.3 | SaaS subscription billing |

| 8 | Square Invoices | $20/mo | 4.7 | Retail & service businesses |

| 9 | Sage | $10/mo | 4.1 | Project management |

| 10 | Xero | $22/mo | 4.5 | Bank reconciliation |

Jump to Software

Top Alternatives to Switch From Invoice2go

InvoiceOwl

InvoiceOwl

Best Estimating and Invoicing Software

Learning from other's mistakes and adding value to contractors/small businesses is what InvoiceOwl focuses on. InvoiceOwl keeps an eye on contractors'/small businesses' needs and delivers accurate solutions. No matter if you are into plumbing, construction, HVAC, or shipping, InvoiceOwl caters to every industry.

Apart from this, the biggest advantage, unlike other accounting software, is you can create unlimited estimates and invoices. We will make it easy for you; to get the touch and feel of invoicing software solutions. The software is not only limited to estimates and invoices, it even lets you create purchase orders and credit memos.

InvoiceOwl vs Invoice2go Comparison

InvoiceOwl vs Invoice2go

| Difference | InvoiceOwl | Invoice2go | Winner |

|---|---|---|---|

| Paid Plans | 1 | Three | Invoice2go |

| Pricing | $28.99 - Monthly | $5.99, $9.99, 39.99 - Monthly | InvoiceOwl |

| 1-Click to Get Started | ✅ | ❌ | InvoiceOwl |

| Invoices | 50 and Unlimited | 2, 5, and Unlimited - Monthly | InvoiceOwl |

| Free Version | Available | 30-Days | Invoice2go |

As you can see, the comparison table states that 3 out of 5 times InvoiceOwl is the clear winner. Now that you know how it adds value and thrives your business, let's look at some extra-ordinary features:

- Monitor your invoices and estimates

- Get access to customer reviews

- Generate sales reports at a single click

- Save clients and items

Want to know each feature in detail, get it through a single click. So, no more sleepless nights working hard to streamline the business process, InvoiceOwl takes the reins.

InvoiceOwl makes waiting for payments, generating reports, and difficulty in accessing software a thing of the past.

I love the agile customer service. Most users have customer service complaints with invoice2go, but that's not the case with InvoiceOwl.

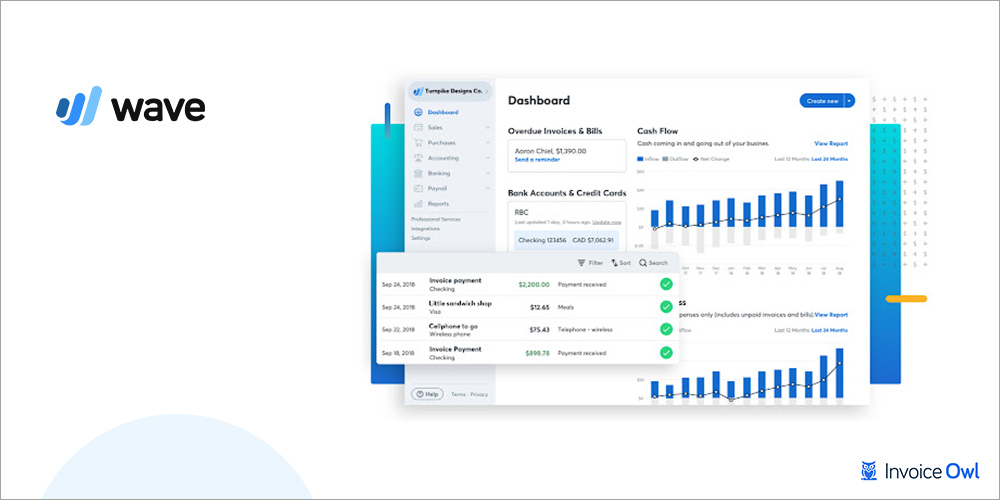

Wave

Wave

Free Accounting and Invoicing Software

If generating financial statements, tracking income & expenses, calculating sales tax, and generating various accounting reports are your daily hassle, then wait no more. Wave is a great mobile + web-based accounting software that lets you freely do all the accounts-related tasks. And when we say it's free, it not only means peace of mind but also without spending a penny.

Besides, you don't even need to sign up, meaning no wasting time filling up or integrating your already existing accounts (Google or Facebook). Signing up comes into the picture when you want to access payroll services. Another major area when you would be paying money to Wave is when you want to get paid faster from your vendors/clients.

Wave collects payment on your behalf and processes it to your bank account. Wave charges $2.9 + 30 cents for most credit cards, $3.4 + 30 cents for American Express, and 1% for bank payments. Additionally, Wave charges $15 for dispute fees and $5 for insufficient funds.

- Offers a free accounting system

- Makes life easier for accountants

- Allows to run multiple businesses through one account

- Charges dispute and insufficient funds fee

- No PayPal integration

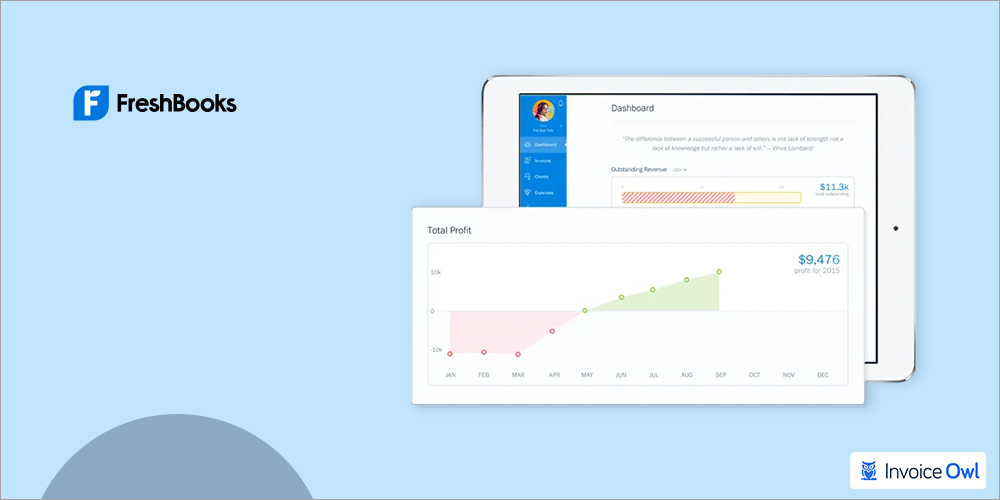

Freshbooks

Freshbooks

Invoicing and Expense Tracking for Freelancers

Though Freshbooks started its journey in the pre-internet era, it still manages to adapt to the influence of the Internet. By creating mobile + web applications, Freshbooks marked its presence in the digital space as well. Freshbooks makes self-employed professionals, freelancers, and small business owners' life easier by providing everything in one place. It helps you with expense tracking and invoicing. Moreover, it even ensures that whatever you do use Freshbooks software, it does it in half the time.

The starting price of Freshbooks is $6 per month. The only hassle is the pricing policy of Freshbooks since it demands too much for too few things. Besides, there is a custom pricing policy but that could also turn out to be expensive since they would be charging money for every single feature added.

- Good customer care service

- Good for small business

- Make estimates and invoices faster

- High pricing policy

- No notification for exceeding the limit

If you are looking for a simpler solution, check out alternatives to Freshbooks!

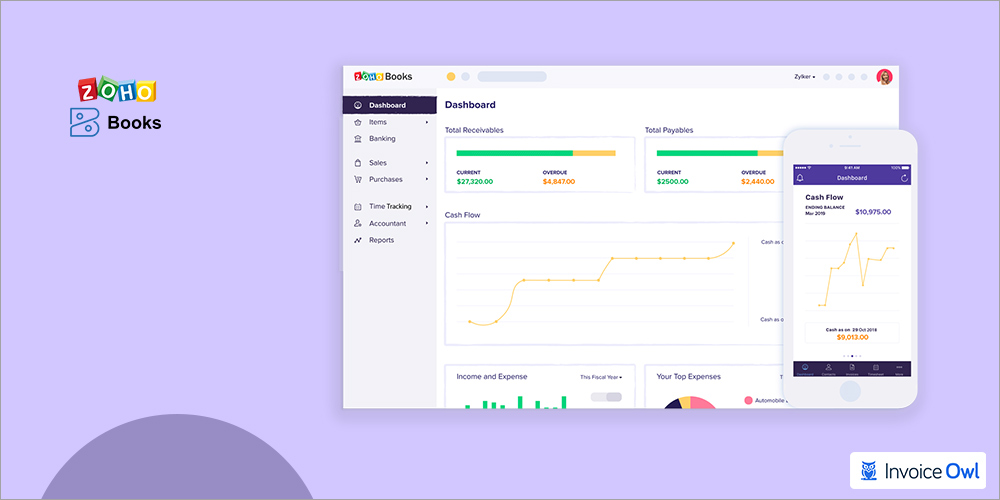

Zoho Books

Zoho Books

Comprehensive Accounting Software Solution

Zoho offers multiple solutions to all industries, which is why it has big names under its clientele. Talking about how Zoho can contribute to small contractors' and business owners' lives, it offers Zoho Books accounting software. This software caters to all business-related transactions, which includes:

- Payment processing

- Hourly billing

- Online invoicing

- Accounts receivable

- Time tracking

- Stripe billing

- Keeping track of expenses and income

- Sales tax management

Other than this, Zoho even offers multi-currency management. With this, you can create invoices in any language and make payment processing a cakewalk. Another benefit Zoho brings to the table is you don't need to involve yourself in reminding your client about payment processing - Zoho does it on behalf of you.

Besides, you get access to revenue management software, which is a helping hand when you are generating income from several sources. It creates income statements and balance sheets for all the different businesses you handle. Lastly, get customized reporting right on your dashboard. What else can you expect is scheduling reports so that they can be visible to you at your scheduled time.

- Access to ample features

- Budget-friendly subscription plans

- Too confusing learning curve

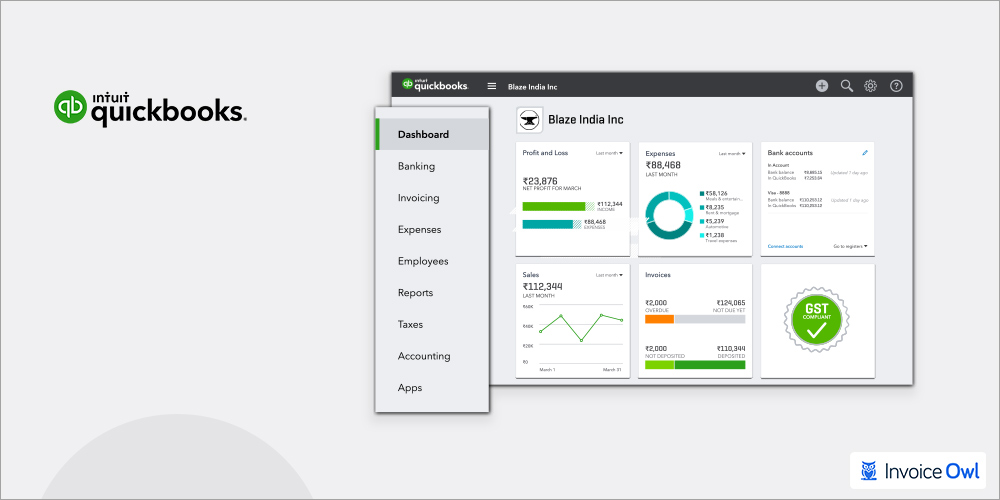

Intuit Quickbooks

Intuit Quickbooks

America's #1 Small Business Solution

Intuit Quickbooks is America's #1 small business solution that makes businesses profitable. With Intuit Quickbooks paid plan, you get access to:

- Cloud Accounting

- Online Invoicing

- Online Banking

- Cash Flow Management

- Time Tracking

- Accounting Reports

- Multiple Users

- Free Unlimited Customer Support

Just because the software is integrated with cloud accounting, you can access your financial reports or invoice history from anywhere anytime. Besides, you can create customizable invoices, which is another benefit it brings to the table. You don't need to waste time searching for elements required for creating invoices.

Moreover, you can schedule your payments so that you don't forget them and save both time and reputation. The software is also integrated with a time tracking feature, which is helpful for businesses having employees working for them. With this feature, you can monitor employees doing what or where they are employed. Lastly, Intuit Quickbooks offer unlimited customer care support, so solve your queries at your fingertips. If we compare Invoice to go vs QuickBooks, then the latter wins the battle.

- Send and track invoices

- Complete billing solution

- Best for small business

- Allows online and payments

- Helps with time tracking

- Lengthy signing process

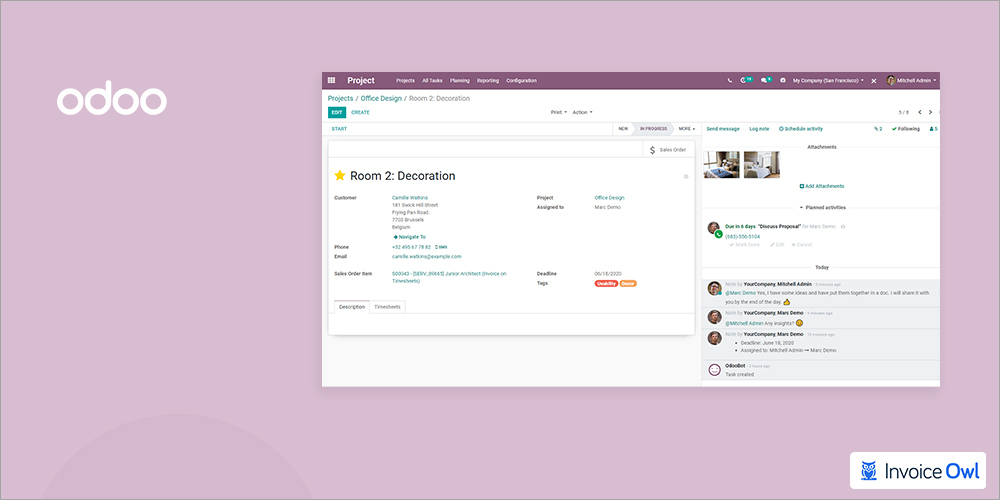

Odoo Invoicing

Odoo Invoicing

Open-Source Business Management Suite

Odoo is an open-source software that has a comprehensive list of applications, each one catering to different business needs. But when we closely look at the invoicing software solution of Odoo, its quite easy-to-use and understandable. It includes all your business at one place, such as inventory management, project management, and accounting. Odoo has 7 Million users subscribed and growing. The software records all invoices and monitors all payments. Besides, it even allows easy selection of invoicing and automatically obtain supplier's vital information.

- Works for small & medium business

- Integrate all your services

- Make business operations smooth

- Adds value to your business

- Saves a lot of time

- Does not offer customer support

- Multiple software for different requirements

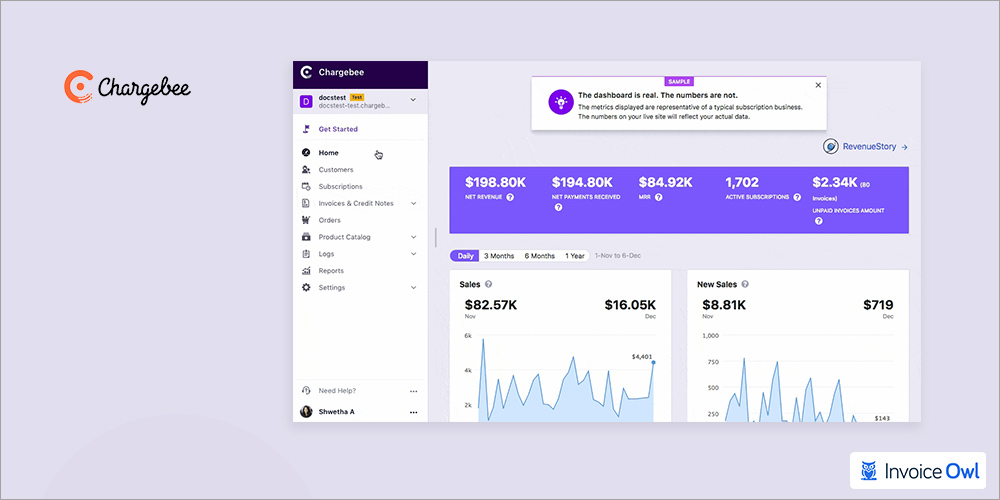

Chargebee

Chargebee

Subscription Billing Software for SaaS

It is a subscription billing software that ensures to smoothen SaaS and other similar businesses' operations. It offers various payment gateways, such as Stripe, PayPal, and Braintree. Besides, it even manages:

- Online invoicing

- Tax calculator

- Dunning management

- Mobile payments

- Subscription management

- Inventory management

What else you can expect is enterprise-level security, revenue intelligence, and an extensible platform. Since it targets bigger businesses, it has designed pricing plans accordingly. The plan starts at around $299/month. Besides, Chargebee is only supported on SaaS-based platforms, and not on Mac, Windows, iPad, Android, and Linux.

Chargebee is designed for enterprise-level businesses with pricing starting at $299/month. It doesn't include contingency billing and project billing features.

- Offer free version

- Works well for all businesses

- Fast payment

- Subscription billing

- Fully integrated software

- Pricey software

- Steep learning curve

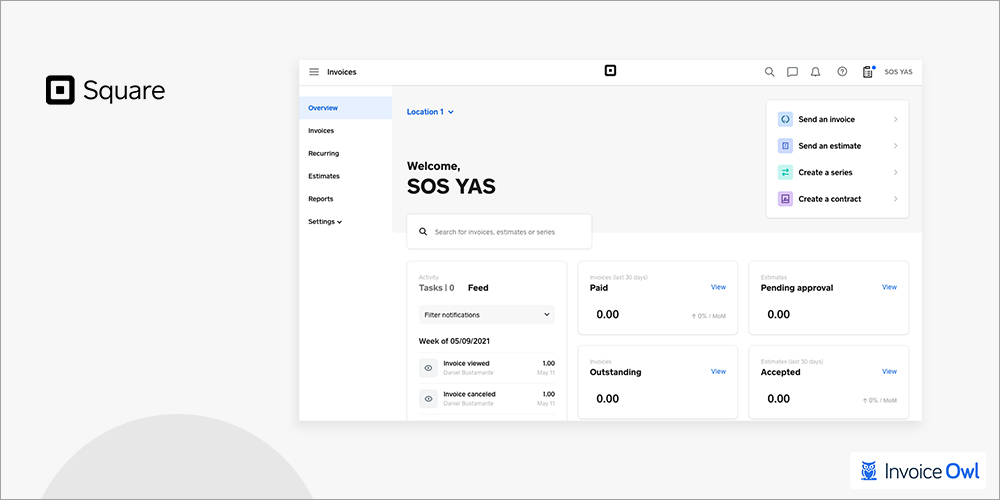

Square Invoices

Square Invoices

Fast Estimate and Invoice Creation

As the name indicates, this software ensures you prepare estimates and invoices in a fraction of seconds. In short, this software can become a helping hand for you. Not only creating, but it can even send invoices. Besides, you can even track paid and invoices not paid, automatically send invoices and accept online payments, and integrate bank accounts.

Square invoices claim that 75% of their invoices are paid within a day. You can access Square invoices anywhere, anytime from your mobile devices or systems. This invoice2go alternative comes with a feature that notifies your outstanding balance when there is a part payment. It even notifies your debtor about the same. Moreover, it helps generate historical reports, tax reports, and balance dues with just a few clicks. The User-Interface is quite cool and anyone can easily access it.

- Quick at creating estimates and invoices

- Save time and streamline payments

- Let you send beautiful invoices

- Packed with powerful features

- Great for startups

- No option to choose between pricing options

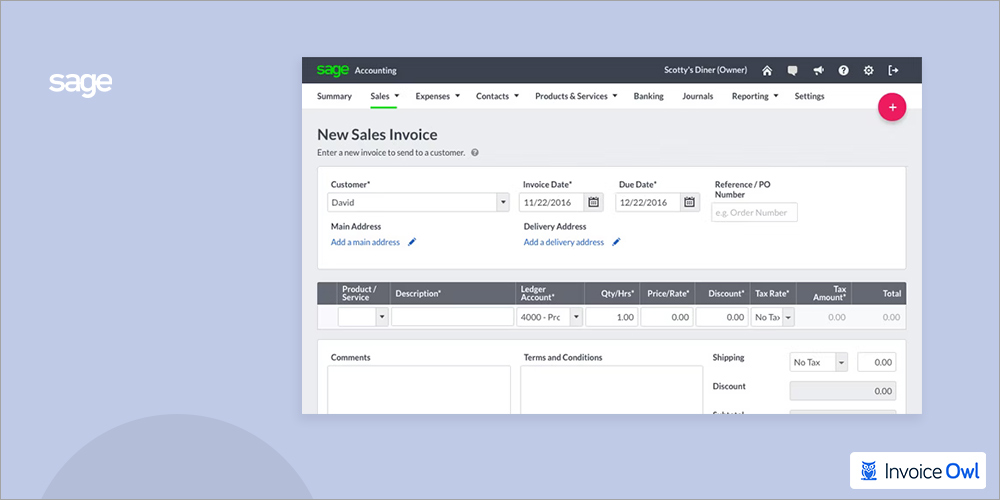

Sage Business Cloud Accounting

Sage Business Cloud Accounting

Accounting Software for Small Businesses

Sage business cloud is accounting software designed specifically for small businesses. Having this software means saving time and getting time to focus on other vital business tasks. So how does it save your time?

- Streamlines your workflows

- Monitor invoices

- Access anywhere, anytime

Sage business cloud is also a great invoicetogo alternative since it consists of simple sets of software integration that are easy to access. Plus, they are quick at responding to queries, questions, and try to resolve doubts.

- Create customizable invoices

- Manage invoices

- Generate invoices

- Works great for small and medium business

- Not for large enterprises

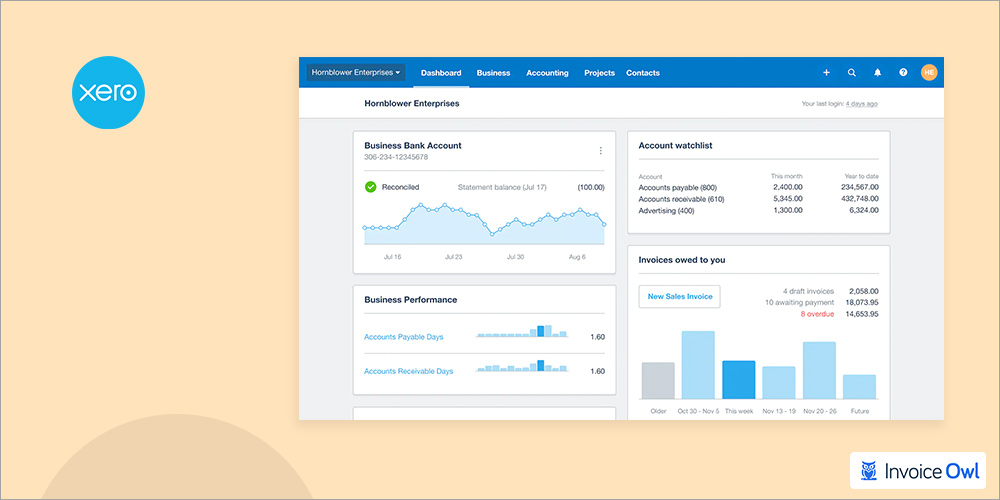

Xero

Xero

Automated Accounting and Bank Reconciliation

Xero is another accounting system that does most of the tasks on your behalf. The software includes a variety of features to make the business operation efficiently smooth. Plus, it ensures all your transactions are handled smoothly. Besides, Xero even offers bank reconciliation services, which means it matches your bank accounts with cash books, so no chance for discrepancies.

Moreover, it even automatically updates cash flow statements and business finances, anytime you want, you get the updated one. Doing so would benefit you with expense tracking and business transactions.

The target audience Xero targets are:

- Freelancers

- Small-Scale Businesses/Entrepreneurs

- Medium Businesses

The software is web-based and available on both Android & iOS platforms. Xero offers three different pricing plans to its users: $11, $32, and $62 per month.

- Makes expense tracking easier

- Manages accounts receivables

- Automatic billing

- Applicable for small and medium businesses

- Affordable starting price

- Requires to buy a half-yearly package for availing pricing benefit

How to Choose the Right Invoice2go Alternative

Consider these factors when making your decision:

By Business Type

- Contractors: Look for mobile-first options with unlimited estimates (InvoiceOwl, Square Invoices)

- Freelancers: Consider tools with time tracking (Freshbooks, Harvest)

- SaaS Companies: Subscription billing is essential (Chargebee)

- Small Businesses: All-in-one solutions work well (QuickBooks, Zoho Books)

By Budget

- Free options: Wave (with payment fees)

- Budget-friendly: Freshbooks ($6/mo), QuickBooks ($7.50/mo), Sage ($10/mo)

- Mid-range: Zoho Books ($12/mo), Odoo ($20/mo), Square ($20/mo), Xero ($22/mo)

- Premium: InvoiceOwl ($28.99/mo with unlimited invoicing), Chargebee ($299/mo)

Must-Have Features

- Unlimited invoice creation for growing businesses

- Mobile app access for on-the-go invoicing

- Payment tracking and automated reminders

- Multi-currency for international clients

- Integration with accounting software

Ready to Switch to Better Invoicing?

Join thousands of contractors using InvoiceOwl to create unlimited estimates and invoices without restrictions.

Try Free for 3 DaysFrequently Asked Questions

InvoiceOwl is one of the best alternatives to Invoice2go since it is easy to use, displays the number of estimates and invoices it offers and is quick at answering customers' requests. Unlike Invoice2go's limited invoice counts, InvoiceOwl offers unlimited invoicing capabilities.

Frequent spending in the invoice2go app has become one of the major flaws, which prompts users to look for alternatives. Another disadvantage is the pricing model; though it looks affordable, it becomes quite expensive when offering services. For instance, you get to send only 2 invoices per month at $5.99, while there are alternatives that charge double but offer 5x more than invoice2go.

Though InvoiceOwl asks for almost double what invoice2go charges for a beginner's pack, it still is worth registering with InvoiceOwl. The reason is InvoiceOwl actually adds value to money by offering unlimited estimates and 5x of invoices. Plus, InvoiceOwl clearly states what they are offering in the freemium version against which invoice2go is unclear with numbers.

Yes, several Invoice2go alternatives offer unlimited invoicing. InvoiceOwl provides unlimited estimates and invoices, while Wave and Square Invoices also offer unlimited invoice creation. This is a significant advantage over Invoice2go's invoice limits on lower-tier plans.

Most Invoice2go alternatives provide mobile apps for both iOS and Android. InvoiceOwl, Freshbooks, QuickBooks, Zoho Books, Wave, and Square Invoices all have robust mobile applications that allow you to create and send invoices on the go.

InvoiceOwl is specifically designed for contractors and small businesses, offering unlimited estimates, easy estimate-to-invoice conversion, and mobile access. Square Invoices and QuickBooks are also popular choices among contractors for their ease of use and payment processing features.

Conclusion

Streamlining your business activities should be an utmost priority. And what's better than opting for a mobile + web application. But what if the investment you made turns out to be recurring expenses. It's time to look for an alternative.

You have just read the 10 best alternatives to invoice2go, out of which, InvoiceOwl has been a clear winner of the race. It is not only accepted by a large number of small businesses but also has a high customer retention ratio. It means contractors have to not look behind once they are a subscriber of InvoiceOwl.

The best Invoice2go alternative depends on your specific business needs:

- For contractors and trades: InvoiceOwl offers unlimited invoicing with mobile-first design

- For budget-conscious businesses: Wave's free tier handles basic invoicing well

- For freelancers: Freshbooks balances simplicity with useful time-tracking features

- For full accounting needs: QuickBooks or Zoho Books provide comprehensive financial management

- For SaaS businesses: Chargebee excels at subscription billing

Most platforms offer free trials, so test a few options with your actual workflow before committing. Pay attention to invoice limits, pricing transparency, and customer support quality when making your decision.