Key Takeaways

- 01Credit memos reduce the amount owed by buyers, correcting billing errors or handling product returns

- 0261% of late payments stem from incorrect invoices and administrative problems

- 03Essential components include date, customer info, original invoice reference, items adjusted, and total amount credited

- 04Timely issuance and clear communication are critical for maintaining customer trust

- 05Credit memos can be applied as future credit or cash refunds, depending on customer needs

Have you ever issued a bill that turned out to be incorrect? Perhaps the cost was higher than expected, or a product was charged for which wasn't received.

Unfortunately for businesses, these errors are quite common, which could hurt customer relationships and revenue management.

According to Forbes, 61% of late payments are due to compliance or administrative problems, such as incorrect invoices. This is where a credit memo comes in handy.

Sellers issue credit memos to reduce the amount owed, ensuring accurate billing and preventing overcharges. Therefore, a credit memo acts as a financial correction tool that helps maintain customer trust and transaction accuracy.

Interested to understand how it works and what it contains?

In this article, we are going to focus on what a credit memo, its purpose, key components, and its importance in business transactions.

Let's start.

Table of Content

- What is a Credit Memo?

- Purpose, Use Cases and When do Businesses Issue Credit Memos

- What are the Essential Components of a Credit Memo?

- 5 Best Practices for Managing Credit Memos

- What are the Errors to Avoid When Issuing a Credit Memo?

- How to Settle Credit Memos and Enhance Financial Accuracy

- Role of Credit Memos in Strengthening Customer Trust

- Frequently Asked Questions on Credit Memos

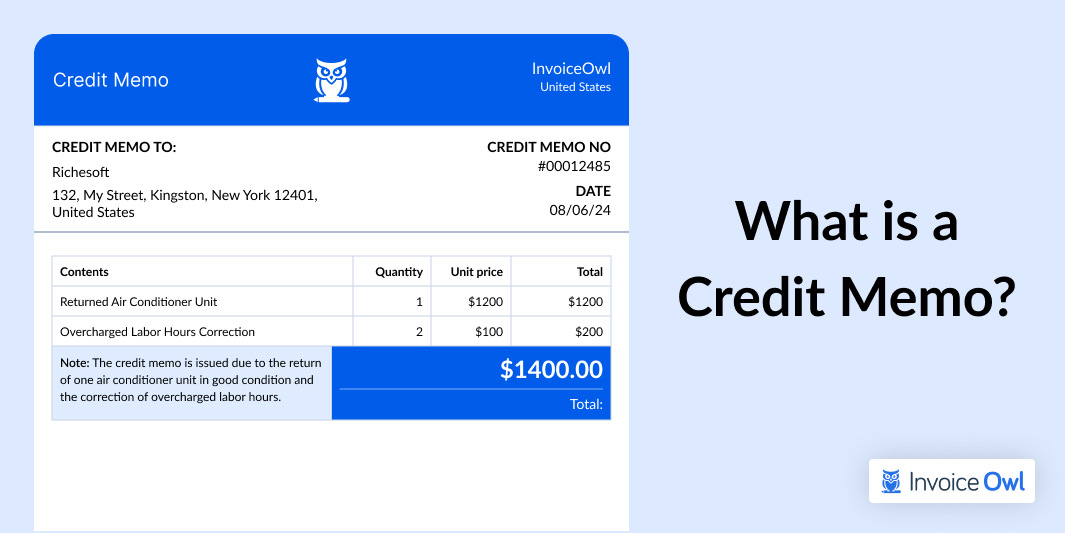

What is a Credit Memo?

A credit memo is a document a seller sends to a buyer to lower the amount the buyer owes on an invoice. It's a formal acknowledgement that confirms a customer is due a refund.

It is generally used to,

- Rectify billing errors

- Account for returned goods

- Offer a discount on future purchases

Credit memos are different from refunds. They apply credit to a buyer's account for future use rather than returning cash. While sometimes issued alongside refunds, credit memos alone don't guarantee cash back. Instead, they adjust the account balance, reducing future payments.

There are two main kinds of credit memos: internal and external. The internal credit memos are meant for account management purposes, and the buyer is not notified that they have a credit. In contrast, external credit memos are sent to the buyer, informing them that they have a credit on their account.

Jane Corporation purchased office supplies from a vendor for their small business. They received an invoice for $500, but upon reviewing it, noticed that they were mistakenly charged for 10 units of an item instead of the 5 they ordered.

After contacting the vendor, they accepted the error and issued a credit memo for the overcharged amount. The credit memo states that a $250 credit has been applied to Jane Corporation's account, reducing the amount they owe to $250.

Now that we understand what a credit memo is, it's important to understand the purpose of using them.

Purpose, Use Cases and When do Businesses Issue Credit Memos

Purpose and use cases of credit memos

Credit memos have many uses as they play an important role in maintaining customer relationships and financial accuracy. Here are the key purposes of a credit memo:

- Maintaining customer relationships: Business owners create a credit memo to address a customer's issues as a goodwill gesture. It shows that the seller acknowledges the error and is committed to fixing it. Several industries, such as retail and hospitality, use credit memos to rectify billing errors and ensure customer satisfaction.

- Performing inventory adjustment: During a product return, credit memos help with inventory adjustments. They help in monitoring returned items which allows small business owner to adjust inventory levels accurately and prevent discrepancies in stock levels and financial reporting.

- Improving compliance and recordkeeping: Credit memos are an important part of compliance and auditing in terms of accounting. They provide credible documents to auditors and tax authorities for accurate books of records or financial reporting maintaining the standards and norms set by regulatory bodies.

When do businesses issue credit memos?

Here are some primary reasons that prompt businesses to issue credit memos for future invoices and purchases.

Rectifying Billing Errors

When businesses make an error in an invoice, such as a pricing mistake or a clerical error in quantity, a credit memo is issued. It acknowledges the error, adjusts the charges, and corrects them promptly. Doing so will keep your accounting records accurate and also show your customers that you believe in fair billing practices.

Handling Product Returns

When customers return products due to defects or mismatches with their orders, businesses issue a credit note to adjust the invoiced amount. This reduces the client's payable balance or provides credits for future purchase orders, facilitating transparent return processes.

Offering Promotional Discounts

Businesses might issue credit memos to apply promotional discounts, such as loyalty discounts, not initially included in the invoice. Credit memos act as a tool for honoring promotional offers and maintaining customer satisfaction.

Solving Service Discrepancies

A credit memo can be a valuable tool when a service falls short of a customer's expectations or doesn't meet agreed-upon Service Level Agreement (SLA) terms. It allows for an adjustment to the billed amount, effectively correcting the invoice. This practice not only fixes the billing issue but also demonstrates the commitment to client satisfaction.

Performing Post-Purchase Price Adjustments

Businesses often encounter scenarios that need post-sale price adjustments. These may include the introduction of new discount offers or special considerations for loyal customers. In such cases, a credit memo acts as a useful tool for applying these changes. By issuing a credit memo, you ensure that your clients are billed accurately, reflecting the most recent pricing decisions.

Making Adjustments to Goodwill

Sometimes, businesses decide to offer a discount or adjust as a gesture of goodwill. In such cases, issuing a credit note would act as a formal acknowledgment of this adjustment.

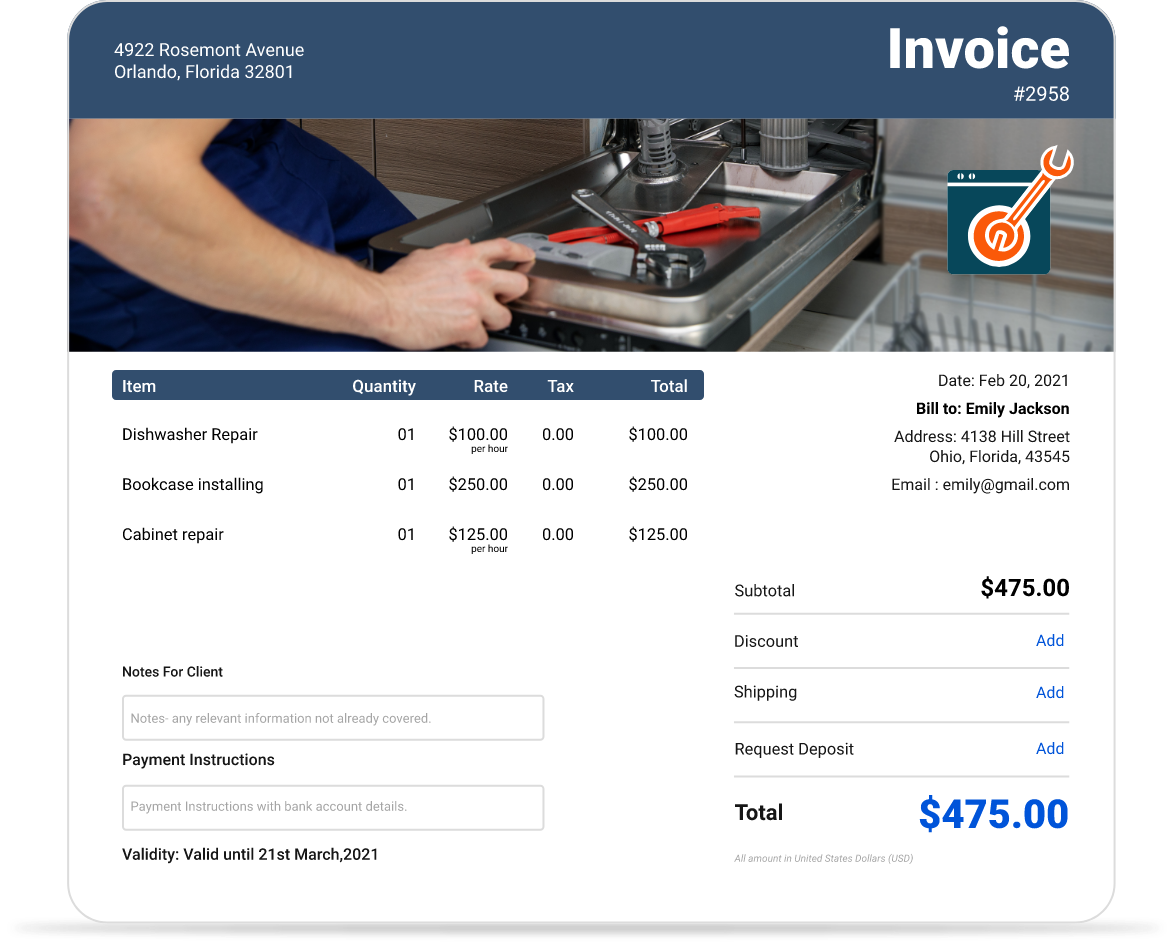

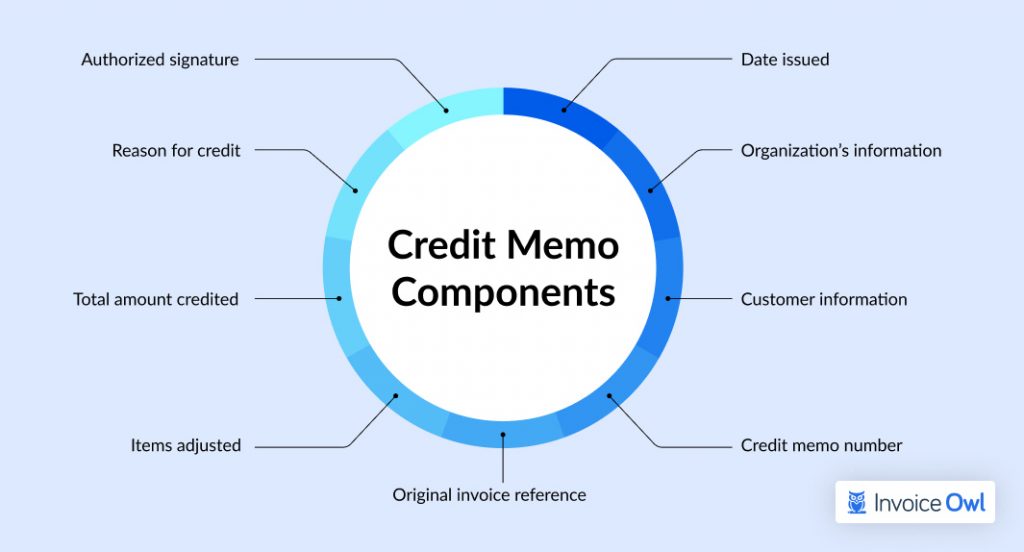

What are the Essential Components of a Credit Memo?

A credit memo must include specific details to ensure clarity and accuracy in financial adjustments. Here are the essential components of a credit memo:

- Date issued: Indicate the date this credit memo was issued or created.

- Organization's information: Include your company name, address, and phone number.

- Customer information: Provide the customer's name, shipping address, and account number.

- Credit memo number: A unique number that identifies this particular credit memo. (Mostly, this number is linked to the invoice number enabling easy search and management of credit notes within your system).

- Original invoice reference: In case, the credit memo number is not linked to the invoice number, then add the invoice number or reference number of the transaction being amended.

- Items adjusted: A list of specific products or services that the credit memo covers, including their description, quantities, price per unit, and the amount credited for each item.

- Total amount credited: Show the total amount credited to the customer's account.

- Reason for credit: State the reason for issuing the credit memo, such as product return or incorrect pricing.

- Authorized signature (Optional): An authorized person might need a signature to approve this. Why? - Both parties need to sign the credit memo to make it valid and legally binding.

Now that we know the essential components of a credit memo, it's important to understand the best practices for managing credit memos.

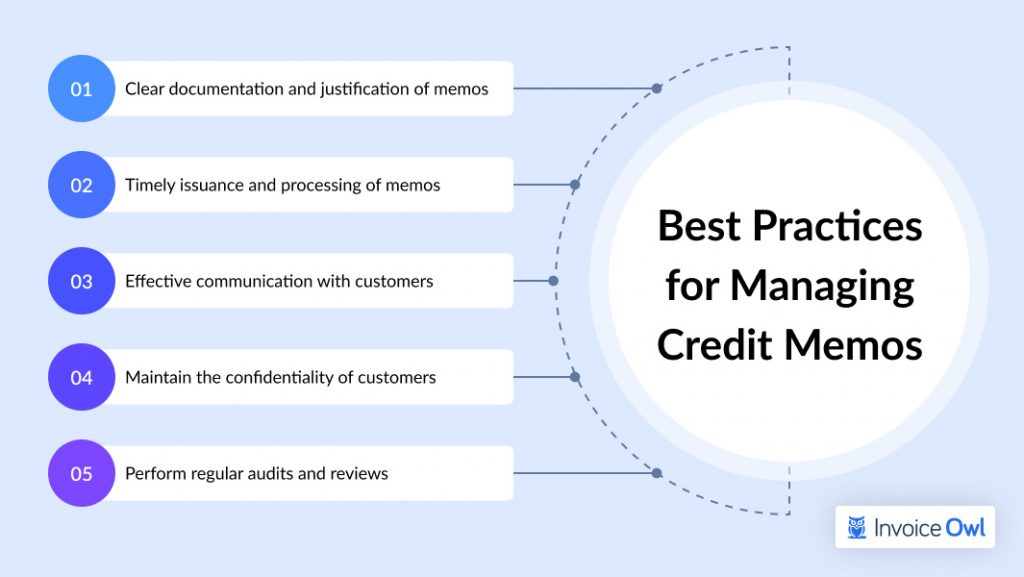

5 Best Practices for Managing Credit Memos

Managing credit memos effectively helps maintain accurate financial records and healthy customer relationships.

Clear documentation and justification of memos

Each credit memo should be supported by proper documentation. Ensure detailed information is maintained, such as original transaction records, invoice numbers, the reason for the adjustment, and any communications with the customer. This clear justification will help maintain transparency and make it easier to reference in case of disputes or audits.

Timely issuance and processing of memos

Once the discrepancies are identified, issue and process the memos promptly. Any delay in issuing a credit memo would create confusion and might affect financial reporting. Issuing credit memos quickly helps maintain cordial customer relations.

Effective communication with customers

Ensure that you explain the specific reason for issuing the credit memo, its impact on the customer's account, and any actions they need to take. Such clear and effective communication avoids misunderstandings and fosters trust.

Maintain the confidentiality of customers

Securely handle credit memos and their information to protect your business and your customers. Confidentiality is important when handling sensitive customer information.

Perform regular audits and reviews

Review credit memo transactions regularly to identify underlying errors and understand customer concerns. Credit memos must adhere to tax regulations set by the Internal Revenue Service (IRS).

Use automated invoice-generating software to standardize your credit memo format. This reduces common mistakes, streamlines auditing, and ensures consistency across all your financial documents.

While following best practices is crucial, being aware of common pitfalls is equally important. Let's now look at errors to avoid when issuing credit memos.

What are the Errors to Avoid When Issuing a Credit Memo?

Here are the 5 errors to avoid when issuing a credit memo:

1. Mismatch in the credit memo and invoice details

Ensure that a credit memo's details match the original invoice. Here are some points that you must check:

- Invoice number

- Customer account details

- Goods or services listed

- Incorrect amount

2. Lack of standardization

Using a standardized credit memo format avoids confusion and decreases the chances of common mistakes leading to streamlined auditing. You can use automated invoice-generating software for all your credit memos and invoicing templates.

3. Avoid adding an incorrect amount

Even the slightest mistake in your invoice amount can impact your accounts. It is commonly seen in complex adjustments like partial returns or discounts, so you must always verify before issuing a credit memo.

4. Delays in issuing credit memos

Customers never appreciate delays in receiving credit where it is due. So, make sure to issue credit memos timely to avoid any financial reporting disruption and ensure customer satisfaction.

5. Approving unauthorized credit memos

Restrict the credit memo access to authorized team members only. Implement a verification process and require signatures for each memo to prevent unauthorized adjustments.

How to Settle Credit Memos and Enhance Financial Accuracy

If the buyer has paid the full invoice amount, they have two options to settle the discrepancies:

- Future credit application: The buyers or customers can use the credit memorandum for future purchases or invoices from the seller. This option favors individuals who expect to make further transactions with the same seller.

- Cash refund: The buyers or customers can also request a cash refund for the specific amount owed due to discrepancies. This method is preferable when the buyer has no further plans to purchase from that seller or needs immediate liquidity.

This method is preferable when the customer does not plan to make further purchases from the seller or needs immediate liquidity.

If the buyer has not yet paid the seller, then they can use the credit memo as a partial offset to the outstanding invoice. However, the buyer is still responsible for paying the remaining amount after the credit adjustment specified in the memorandum.

When recording a credit memorandum, both parties make corresponding adjustments:

- The buyer reduces their accounts payable balance, reflecting a decrease in what they owe.

- The seller records a reduction in their accounts receivable, indicating a decrease in expected incoming payments.

Role of Credit Memos in Strengthening Customer Trust

Credit memos are essential to maintain financial records and customer relationship management. They ease making necessary adjustments and rectifying mistakes, which helps build transparency and trust between businesses and their customers. Proper implementation and management of credit notes leads to easy handling of returns and adjustments without impacting the financial integrity.

Moreover, credit memos streamline accounting processes, making it easier to manage accounts receivable. Using a credit memo template will lead to smoother operations, enhanced customer satisfaction, and more precise financial reporting. Understanding and utilizing credit memos effectively is essential for any business aiming to maintain accurate financial records and foster customer trust.

Create Professional Credit Memos in Minutes

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers, and contractors to create credit memorandums and notes on the go and get paid quicker!

Start Your FREE TrialFrequently Asked Questions on Credit Memos

A credit memo is often issued to reduce or write off the amount a buyer or customer owns due to product returns or any billing errors. An invoice is a bill sent to the buyer or customer for goods and services purchased by them, indicating the amount owed.

Yes, businesses can issue a credit memo for partial amounts. It comes in handy for rectifying overcharges, handling partial returns, or making other adjustments without canceling the entire invoice. Such flexibility helps maintain accurate financial records.

No, there is no such strict time limit, but it is advisable to issue credit memos promptly to ensure accurate accounting and customer satisfaction.

In such a situation, the credit memo amount is deducted from the total amount due on the invoice which effectively reduces the balance the customer needs to pay. This adjustment is reflected in both the seller's accounts receivable and the buyer's accounts payable.