Key Takeaways

- 01Net credit sales = Gross credit sales minus returns, allowances, and discounts

- 02This metric is essential for calculating accounts receivable turnover ratio

- 03Net credit sales impact your balance sheet through accounts receivable and working capital

- 04Offering credit can boost sales but requires careful cash flow management

- 05Track net credit sales to forecast revenue and manage collection strategies

Not every sale results in immediate cash in hand. Several businesses dealing with long-term clients or large transactions offer credit to customers, allowing them to pay later.

This approach is a great one, as it aids in attracting more buyers and building a loyal customer base. However, careful financial tracking is required to ensure profitability. That's where net credit sales come in.

Shifting your focus to net credit sales rather than gross credit sales, helps businesses get a more accurate picture of their actual revenue and collectible earnings. Additionally, it helps businesses to forecast incoming payments, manage accounts receivable, and make informed financial decisions.

In this blog, we'll cover various topics like what are net credit sales, how to calculate net credit sales, and its impact on your balance sheet.

What are Net Credit Sales?

Net credit sales are the total income received from sales made in credit mode. This specific amount doesn't include any allowances, returns, or discounts offered to the customers. Contrary to cash sales where payment is done prior, net credit sales comprise deferred payments, which can harm an organization's cash flow and financial stability.

It is important to track net credit sales for businesses, as it comes in handy in assessing accounts receivable and financial health. Additionally, it plays a critical role in evaluating key financial metrics like accounts receivable turnover. The 'accounts receivable turnover' measures the efficiency of an organization to collect pending payments.

- Net credit sales showcase the accurate revenue from credit sales post accounting in returns, allowances, and discounts

- They directly impact accounts receivable, influencing both working capital and liquidity management

- The accounts receivable turnover ratio uses net credit sales to highlight collection efficiency

How to Calculate Net Credit Sales

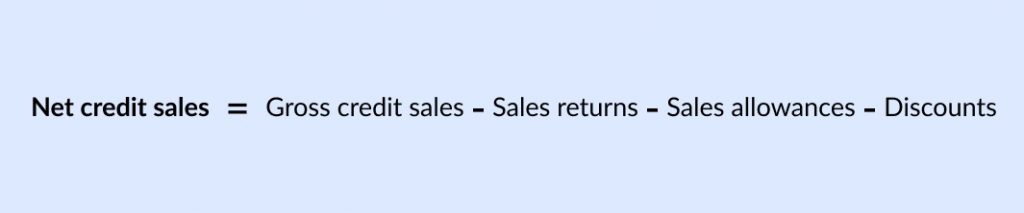

One must calculate the net credit sales to analyze income from credit transactions and evaluate your organization's financial health with cash flow monitoring.

Net credit sales are the total revenue of credit sales after deducting:

- Gross credit sales: This amount showcases the total sales done on credit in a specific period without any deductions. It also comprises all the credit transactions meant for discounts and returns.

- Sales returns: Sales returns refer to the amount of money businesses will have to refund to their customers in case they return your product or service.

- Sales allowances: If a customer finds any defects, damage, or dissatisfaction, then you'll have to reduce the selling price.

- Sales discounts: It is about lowering the price upfront to encourage customers to pay beforehand or opt for a promotional period.

Suppose a company has the following sales and deductions:

- Total credit sales – $200,000

- Returns – $7,000

- Allowances – $5,000

- Discounts – $2,000

Calculation: $200,000 − ($7,000 + $5,000 + $2,000) = $186,000

Net credit sales = $186,000

Major Difference Between Gross Credit Sales and Net Credit Sales

The major difference between gross credit sales and net credit sales lies in the adjustments made to the total revenue figure. In fact, there are other pointers too to know, and here's a breakdown:

Gross vs Net Credit Sales Comparison

| Aspect | Gross Credit Sales | Net Credit Sales |

|---|---|---|

| Definition | The total value of all credit sales made by a business, including any returns or allowances. | The total value of credit sales after deducting returns, allowances, and discounts. |

| Returns & allowances | Does not account for returns, allowances, or discounts. | Accounts for sales returns, allowances, and discounts. |

| Financial impact | Shows the full value of credit sales before adjustments. | Reflects the actual sales that are expected to be collected after adjustments. |

| Calculation | Gross Credit Sales = Total Credit Sales (before adjustments). | Net Credit Sales = Gross Credit Sales – Sales Returns & Allowances. |

| Use in financial analysis | Less useful for assessing the actual sales performance for not reflecting the true value of credit sales. | Provides a more accurate measure of credit sales that will likely be received by the business. |

| Representation on financial statements | Listed as total sales on the income statement, but can be misleading. | Listed as net sales, giving a more realistic picture of revenue generation. |

What are the Advantages and Disadvantages of Net Credit Sales?

Have you ever given much thought about how offering net credit sales could impact your business? In American business, extending credit terms is a common practice.

Mostly it has been observed in industries like retail, manufacturing, and services. It surely does boost sales and customer loyalty but requires careful management. Let's know more in detail about the advantages and disadvantages with respect to U.S. businesses.

Advantages of net credit sales

Improved Customer Relationships

Credit sales improve customer satisfaction by providing flexibility in payments. By providing 30-day credit terms, you can build long-term relationships with your customers and win over competitors.

Increased Sales Revenue

Offering credit purchases helps your business attract more customers who might not have enough cash at hand. This results in improved sales volume along with greater profitability.

Clear Financial Break-up

Net credit sales provide a clear difference between sales returns and sales allowances. This helps you understand the amount of money lost due to product issues.

Enhanced Financial Insight

Net credit sales tracking helps businesses analyze their credit policies, manage accounts receivables, and get insights into financial health and customer behavior.

Disadvantages of net credit sales

- Cash flow challenges: Offering credit sales causes delayed cash inflows and liquidity issues, especially for small businesses with limited working capital

- Increased administrative costs: Effective credit sales management requires monitoring receivables and sending payment reminders, increasing operational expenses

- Dependency on credit terms: Customer reliance on extended payment periods could harm the business if terms need to be tightened in the future

How Does Net Credit Sales Look on the Balance Sheet?

Net credit sales are not listed on the balance sheet but have an important role to play in calculating key financial metrics. Rather, it impacts the main two areas of the balance sheet accounts receivable and revenue.

Accounts receivable

When businesses make sales on credit, this specific amount must be accounted for as accounts receivable on the balance sheet. It showcases the money owed by customers to the company for products or services delivered but not yet paid for. As the credit sale accumulates, the account receivables amount increases reflecting outstanding payments due from customers.

Revenue

Net credit sales add up to the total revenue reported on the income statement which as a result impacts the balance sheet. This income is realized at the point of sale, even in cases where cash is not received immediately.

Bad debt allowance

Every credit sale doesn't result in full collection, which might lead to allowance for bad debts. This showcases an estimated amount of credit sales that the organization thinks will not be collected. With bad debt allowance, you lessen the value of accounts receivable on the balance sheet, which offers a more realistic view of the company's expected cash inflows.

Impact on working capital

Net credit sales have a great influence on working capital, the only difference between an organization's current assets and current liabilities. Accounts receivables are directed by net credit sales which are part of current assets, higher receivables increase working capital. But, if the credit sales are not collected quickly, they can strain the cash flow reducing the company's liquidity. You need to perform effective credit collection to maintain a healthy working capital balance.

Cash flow considerations

Net credit sales generate revenue but don't have any immediate impact on cash flow until collecting the receivables. Hence, an organization might come across an increase in net credit sales in the income statement. The balance sheet will showcase the increase in account receivables, but not cash. Suppose the receivables are not collected on time, then it might lead to cashflow challenges focusing on the requirements of converting credit sales into cash to support operational activities.

Role of Net Credit Sales on Financial Statements & Ratios

Net credit sales are critical when it comes to financial statements and key financial ratios. They offer detailed insights into the company's revenue and liquidity. Talking about the income statement, net credit sales appear as a part of total revenue, showcasing the actual sales revenue earned on credit after deducting returns, allowances, and discounts.

Moving on to the balance sheet, the net credit sales have a direct impact on accounts receivable. Keeping an eye on this metric helps businesses to calculate cash flow and manage credit risks effortlessly.

Accounts Receivable Turnover = Net Annual Credit Sales / Average Accounts Receivable

This ratio measures an organization's efficacy in collecting timely payments from customers. The day's sales outstanding (DSO) ratio calculates the average number of days it takes to receive payments.

4 Essential Tips to Make Best Use of Net Credit Sales for Your Business

Did you know that managing net credit sales effectively not only improves cash flow but also enhances customer loyalty and increases profitability?

Here are 4 proven tips to maximize their potential for your business:

Optimizing Net Credit Sales for Business Growth

Businesses offering credit to customers must have a detailed understanding of net credit sales. This specific metric plays an essential role in managing cash flow, accounts receivable, and overall financial health.

Calculating accurate net credit sales helps businesses assess their credit policies, identify potential risks, and improve collection strategies to maintain a steady cash inflow. Monitoring net credit sales along with key financial ratios like accounts receivable turnover ratio. This ensures that an organization can effectively manage outstanding payments and avoid liquidity issues. Moreover, integrating an automated invoice platform like InvoiceOwl streamlines the invoicing process and tracks payments in real-time.

By regular tracking and optimization of net credit sales, businesses can strengthen their financial position, build better customer relationships, and sustain long-term profitability.

Never Lose Track of Your Credit Sales Again

Late payments and poor credit sales tracking can hurt your business. InvoiceOwl streamlines invoicing, ensuring you get paid on time.

Start Your FREE TrialFrequently Asked Questions on Net Credit Sales

Credit sales are not involved in generating immediate cash, but high net credit sales might lead to cash flow issues in case customers delay payments. Businesses must manage receivables efficiently.

The difference between gross sales and net credit sales is that the term gross sales comprises all sales (both cash and credit). Net credit sales refer to credit-based transactions after returns, allowances, and discounts.

Yes, organizations can improve their net credit sales collection by putting out clear credit terms, conducting credit checks, and using automated invoicing and accounting software.

The industries that are highly dependent on net credit sales are wholesale, manufacturing, B2B services, and retail. These industries use net credit sales to maintain customer relationships and manage large transactions.

Yes, keeping track of net credit sales aids small businesses in managing cash flow, predicting revenue, and ensuring not being reliable on unpaid invoices.

The term net sales refers to the company's gross sales less returns, allowances, and discounts. It showcases the amount of revenue earned from the goods and services sold and offers a clear understanding as compared to gross sales.

![How to Get More Plumbing Leads [10 Proven Ways]](/images/2022/09/how-to-get-more-plumbing-leads.jpg)