Key Takeaways

- 01Phantom tax requires paying taxes on income you haven't received as cash

- 02Common sources include stock options, partnership income, real estate depreciation, and debt forgiveness

- 03Phantom tax can strain cash flow and create unexpected financial obligations

- 04Strategic tax planning and professional consultation can minimize phantom tax exposure

- 05Maintaining financial reserves and monitoring statements regularly helps manage phantom tax effectively

Phantom tax is when you're required to pay taxes on income you haven't received as cash.

Might sound strange for you, but it's real!

This financial phenomenon occurs when your accounting records show a profit, but your bank account doesn't reflect it – yet you're still needed to pay taxes on this "phantom" income.

Such situation is mostly observed in investments like partnerships, real estate, or mutual funds. You're taxed on income you haven't received. Even without the income, the tax must be paid.

In this blog, we will talk about what does phantom tax means, how it works, its impact, examples, and ways to tackle it.

Table of Content

- What is Phantom Tax?

- Why the Phantom Tax is Important for Businesses

- Impacts of Phantom Tax on Businesses

- How the Phantom Tax Works?

- What are the Differences Between Phantom Tax and Regular Tax?

- Top 5 Examples of Phantom Tax Scenarios

- How can Businesses Manage Phantom Tax Effectively?

- Navigating Phantom Tax for Financial Success

- Frequently Asked Questions on Phantom Tax

What is Phantom Tax?

Phantom tax is an intricate financial concept where an individual or business is required to pay taxes on income they haven't received in cash. This situation arises from different sources, such as stock options, deferred compensation, forgiven debts, or partnership income.

In such cases, income is reported before it has been received, which might lead to tax obligations without sufficient cash flow. Subsequently, individuals might come across taxes on income they have not yet realized, which could result in potential financial strain.

Phantom tax, also known as dry income, is different from regular income tax. It comprises non-cash transactions that require proper financial planning to manage related tax implications.

- Stock options

- Partnerships and LLCs

- Restricted stock units (RSUs)

- Depreciation in real estate

- Deferred compensation plans

- Unrealized gains in trusts

- Non-cash compensation (Bonus or Incentive)

- Debt forgiveness

- Trust and estate distributions

Now that we understand the phantom tax meaning, it's important to understand its pertinent role in businesses.

Why the Phantom Tax is Important for Businesses

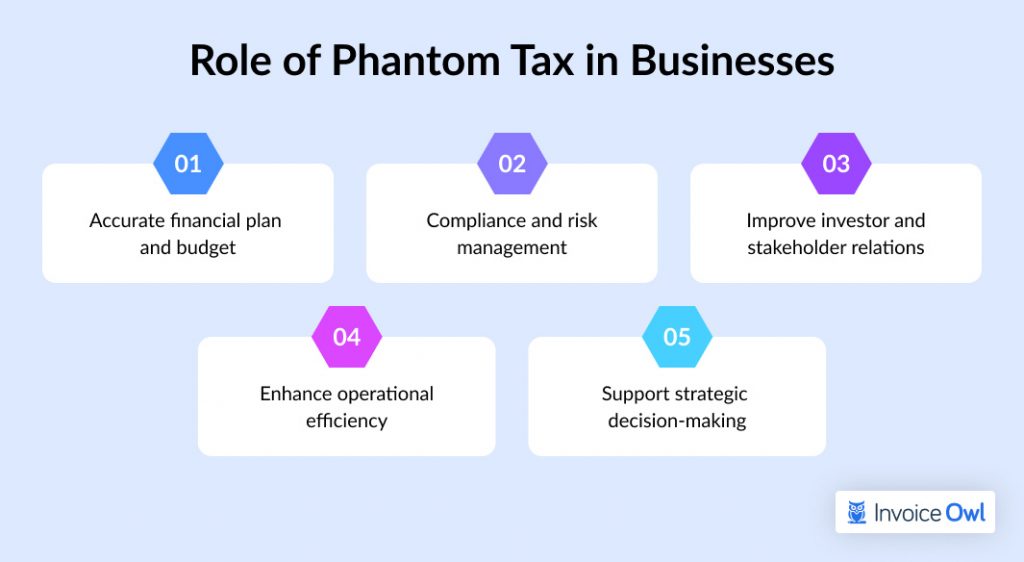

Phantom tax plays an essential role in businesses' financial planning and tax strategy. It impacts cash flow management, influences investment decisions, and the organization's tax liability.

Let's discuss the importance of phantom tax for businesses below in detail:

Accurate financial plan and budget concerns

Phantom tax significantly impacts an organization's financial statements and tax obligations. Businesses need to recognize the tax consequences of phantom income and create accurate financial budgets. This helps in better resource allocation and cash flow management.

Compliance and risk management

Failing to account for phantom tax leads to non-compliance with tax regulations, which results in penalties, interest, and legal issues. To avoid such a situation, businesses must perform record-keeping and stay informed about the current tax requirements.

Improve investor and stakeholder relations

The presence of phantom tax changes an organization's financial statements and its disclosures. This impacts the thinking of the investors and stakeholders regarding the organization's financial health. So, businesses must disclose their phantom income and its implications to convey their commitment to risk mitigation and robust financial management to investors.

Enhance operational efficiency

By considering Federal tax implications in operational planning and decision-making, organizations can save their resources from being wasted on unnecessary taxes. This strategic approach to managing leads to enhanced efficiency in business operations.

Support strategic decision-making

With proper knowledge of phantom tax, organizations can improve their strategic business decisions, such as investments, financing, mergers, or acquisitions. Organizations that understand phantom tax liabilities make informed choices that align with their long-term goals and financial health.

After understanding the role of phantom tax, let's see how it works.

Impacts of Phantom Tax on Businesses

Phantom tax can strain cash flow, and for businesses, it can lead to challenges in managing resources.

Here are some key impacts of the phantom tax that businesses must be aware of:

Tax obligations

Phantom taxes consist of taxable phantom income that is not transacted in cash. Individuals need to acknowledge and pay taxes on fictional income. This would further raise their taxable income and taxes without having any cash. It is important to plan for these taxes and ensure proper funding for such expenses.

Constraints in cash flow

This situation emerges from the accrual accounting method, which is related to non-cash income and therefore, affects cash flow. Subsequently, individuals might have to liquidate their assets, utilize personal savings, or take on debt to pay their taxes, putting additional pressure on cash flow.

Complications in tax planning

The complex rules around when income is recognized for tax purposes have a significant impact on tax planning. Taxpayers should look for situations that could create phantom income and account for them in their tax strategies. However, identifying all potential sources of phantom income can be difficult without guidance from tax professionals.

Challenges in retirement planning

The phantom tax also arises from specific retirement plans and structures that lead to changes in the tax system and plan structure. Individuals with such plans might come across unexpected tax bills on incomes that have been recognized for tax purposes but not yet received in cash. In such cases, they need flexible retirement plans that can accommodate these tax costs and help them overcome significant retirement planning challenges.

- Opt for cash distributions

- Defer income recognition

- Choose non-taxable benefits

- Leverage tax-advantaged accounts

- Plan equity vesting

How the Phantom Tax Works?

The Phantom tax works when tax laws consider income as received, even though you haven't actually gotten the cash yet. Let's look at how the mechanics of phantom tax perform:

Income acknowledgement

According to the doctrine of constructive receipt, a notable Federal tax law, some income must be accounted for as earned, not when the cash is received. This comprises various things like non-cash benefits, money owed to the company, or deferred revenues.

Establishment of tax liability

When this income is recognized, it is added to the total income of a taxpayer for that particular year. This leads to an increase in taxable income and generates a specific tax amount that needs to be paid in taxes.

Non-cash payment requirements

The taxpayer needs to have cash to cover taxes on the income, despite not having received any actual funds. Such instances create pressure on cash flow and require careful business financial management.

What are the Differences Between Phantom Tax and Regular Tax?

When it comes to taxation, understanding the distinction is crucial for effective financial planning and management.

Here is the detailed table comparing Phantom Tax and Regular Income Tax:

Phantom Tax vs Regular Income Tax Comparison

| Aspect | Phantom Tax | Regular Income Tax |

|---|---|---|

| Definition | Tax on income that has been accrued or allocated but not received in cash | Tax on actual cash income received |

| Cash flow | No cash received | Cash received |

| Income type | Non-cash income (paper gains, retained earnings) | Actual cash income received (wages, salaries, interest, and dividends) |

| Common scenarios | Partnerships/LLCs, stock options, and debt forgiveness | Employment, investments, and business income |

| Examples | Reinvested partnership profits, exercised but unsold stock options, and forgiven debt | Salaries, interest from bonds, and business profits |

| Tax liability basis | Based on accrued or allocated income | Based on cash income received |

| Timing of income recognition | Income is recognized for tax purposes before it is received in cash | Income is recognized for tax purposes when it is received in cash |

| Impact on financial planning | Can create unexpected tax liabilities requiring careful cash management and planning | More predictable and straightforward for budgeting and financial planning |

| Industries most affected | Real estate, technology startups, investment funds, professional services, agriculture, and healthcare | All industries where employees and businesses receive cash income |

| Examples of income sources | Retained earnings in partnerships, unexercised stock options, forgiven debt, and reinvested profits | Salaries, wages, interest, dividends, and business income |

| Mitigation strategies | Advance planning, setting aside reserves, and consulting with tax professionals | Standard tax planning and withholding strategies |

| Examples of tax codes/regulations | US: Subchapter K for partnerships; US: IRC 83 for stock options | Internal Revenue Code (IRC) Section 61; Internal Revenue Code (IRC) Section 1 |

| Regulatory compliance | Stricter compliance requirements for reporting non-cash income and ensuring accurate tax filings | Standard compliance for reporting received income |

After understanding the differences between phantom tax, also known as fanum tax, and regular income tax, let's move on to understanding phantom tax scenarios with various examples.

Top 5 Examples of Phantom Tax Scenarios

Here are 5 best examples of phantom tax scenarios:

1. Unrealized gains on stocks and other scenarios

Unrealized gains refer to a situation where the taxpayer possesses an asset that has appreciated but has not sold it. Suppose an investor has some share of appreciated stock. Here, the increased value is an unrealized gain until the shares are disposed of.

An investor buys shares in a tech company for $10,000. Over time, the value of these shares increases to $15,000. Although the investor now holds an asset worth $15,000, the $5,000 increase is considered an unrealized gain because the shares have not been sold. The gain remains unrealized, and no taxes are owed until the investor decides to sell the shares.

2. Real-estate depreciation

Real estate depreciation allows property owners to write off a portion of the property's cost over its expected useful life. Although it reduces taxable income, depreciation is a non-cash expense and does not reflect an actual cash outflow.

A property owner purchases a rental property for $500,000. Under the Internal Revenue Code (IRC), specifically using the guidelines for real estate depreciation, they can write off $18,182 annually over the property's expected useful life of 27.5 years. This depreciation reduces their taxable rental income each year, lowering their tax liability. However, this is a non-cash expense, that does not represent any actual cash outflow from their pocket.

3. Partnership and LLC income

Individuals in a partnership and members of an LLC get a certain share of the business's profit. Partnership members need to report this profit as income in their tax returns, even though the profits are retained by the business.

John and Sarah are partners in a marketing firm, with John owning 60% and Sarah 40%. In a fiscal year, the firm generates $200,000 in profit. Despite retaining all the profits within the business for future growth, John must report $120,000 and Sarah $80,000 as income on their tax returns. This means they both owe taxes on their respective profit shares, even though they received no cash distributions, potentially causing cash flow challenges.

4. Zero-coupon bonds

Zero-coupon bonds are issued lower than their face value and don't receive any interest payments. Here, the interest is compounded and paid while redeeming for its face value on the due date.

An investor buys a zero-coupon bond for $700, which will mature at its face value of $1,000 in 10 years. Although no interest payments are received annually, the bond's value appreciates each year. The IRS requires the investor to report the imputed interest as taxable income annually, despite not receiving any cash until the bond matures. This results in phantom tax, where the investor owes taxes on the accrued interest each year without any actual cash inflow.

5. Debt forgiveness

In a situation where a certain portion of mortgage debt is forgiven, the amount forgiven is considered a taxable income by the IRS. The borrowers have to pay taxes on the forgiven debt amount, even though no actual cash is received.

A homeowner owes $200,000 on their mortgage but negotiates with the lender to forgive $50,000 of the debt. Although the homeowner no longer has to repay the $50,000, the IRS considers this forgiven amount as taxable income. Consequently, the homeowner must pay taxes on the $50,000, even though no actual cash was received from the forgiveness.

How can Businesses Manage Phantom Tax Effectively?

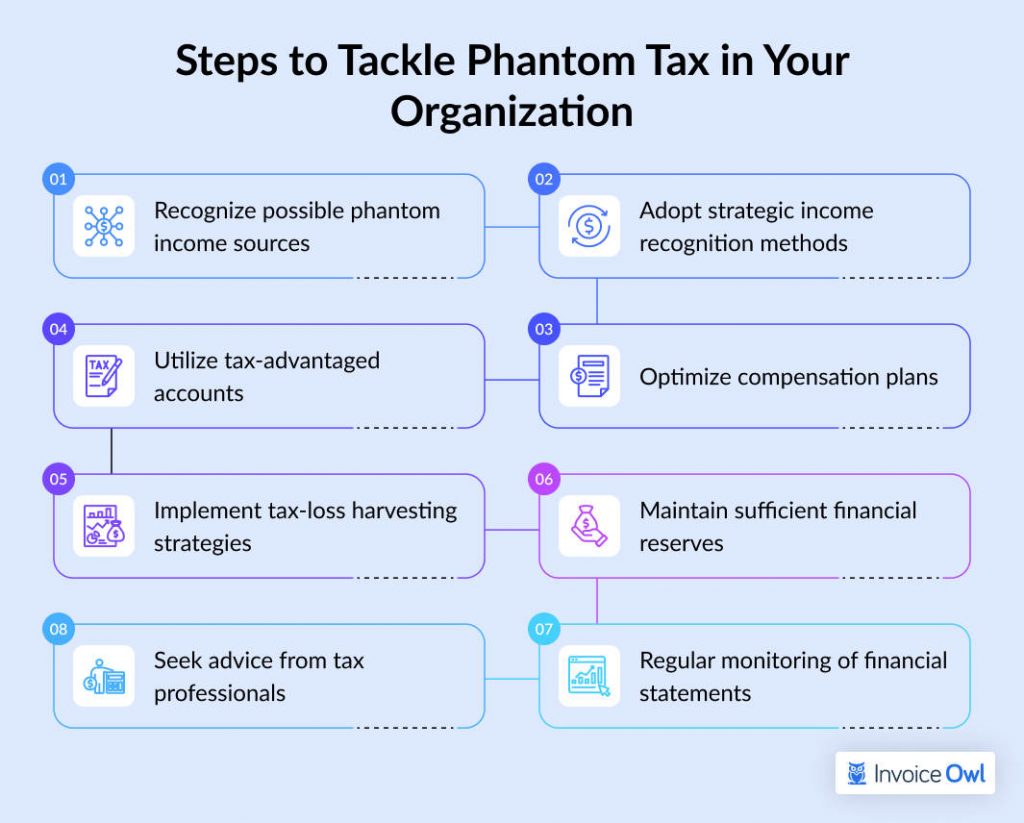

To manage phantom, businesses should implement strategic tax planning, like using deferred compensation plans, and tax-advantaged accounts.

Here are 8 effective steps organizations can take to manage phantom tax:

Take Control of Your Business Finances Today

Don't let phantom tax catch you off guard. InvoiceOwl helps you streamline invoicing and maintain clear financial records, making tax planning easier.

Start Your FREE TrialNavigating Phantom Tax for Financial Success

Phantom tax is one of the most complex and ignored aspects of investment taxation. It might seem strange to pay taxes on income that is yet to be received in cash, but that is how phantom income works.

Investors need to understand the workings of fanum tax and its various forms. Having considerable knowledge will help to make better decisions and manage potential tax bills effectively.

By taking a proactive approach and using the right strategies, investors can minimize the adverse impact of phantom tax. Averting phantom taxation helps investors stick to their investment plans and work toward their long-term financial goals more easily.

The best possible way to deal with the complexities of the Phantom tax is to have the right information and plan carefully.

Frequently Asked Questions on Phantom Tax

As per the tax rules, Avoiding phantom tax liabilities will perhaps result in interest accrual on unpaid taxes, penalties, and other financial pressure due to unanticipated tax demands. It is important to control these liabilities and plan properly for them.

Yes, targeted tax strategies like tax-sheltered investment plans, charitable contributions, and creative compensation strategies are some of the best ways to deal with phantom tax. Before choosing any strategy, always consult your tax advisors.

Tax laws affecting phantom income can change concerning when and how much tax is owed. To avert high taxation situations, individuals and organizations must stay updated on tax regulations and consult with experienced tax professionals.

Back in the 1980's, Phantom stock plans gained popularity as an alternative to traditional stock plan options. Organizations use these phantom stock plans to provide their valuable employees with long-term incentives related to the organization's success without giving them actual stock ownership.

The term "phantom capital" refers to investments that flow through empty corporate shells, known as Special Purpose Entities (SPEs). These shells lack genuine business activity and exist without generating any tangible economic value.

Phantom taxes cause significant challenges for small businesses like Real estate partnerships and REITs, construction companies, and retail. The adverse impacts comprise cash flow constraints, challenges in planning and budgeting, and debt forgiveness. Having a proper understanding of phantom tax effects can help manage financial strategies.

Phantom income is an income that is taken into consideration for tax purposes but is not received in cash. This results in potential tax liability without any cash inflow. On the other hand, Imputed income is a theoretical income amount that is designated for specific tax purposes. It is often used to value non-cash benefits, such as employer-provided health insurance.

The AMT is related to phantom tax because it can worsen issues, especially with Incentive Stock Options (ISOs). The moment an ISO is exercised, the difference between the exercise price and market value is incorporated into Alternative Minimum Tax (AMT) income. This income creates a tax liability even if the stock cannot be sold, leading to a phantom tax.

No, there isn't any specific tax form for phantom income. However, it is supposed to be reported on applicable tax forms. For instance, phantom income from partnerships is reported using Schedule K-1 (Form 1065).

Phantom tax can be avoided or minimized with strategic tax planning, such as using deferred compensation plans, tax-advantaged accounts like 401(k)s, IRAs, or HSAs, or aligning distributions with cash flow needs.

The phantom tax has a great impact on cash flow as it creates a tax obligation without any actual cash income, like depreciation recapture or partnership distributions. It means that the taxes have to be paid from other resources which might strain the finances.