Key Takeaways

- 01A purchase invoice is a document sent by a supplier to a buyer detailing products/services and the amount owed

- 02Purchase invoices are essential for revenue tracking, cash flow management, and tax compliance

- 03Key elements include header information, buyer details, product/service descriptions, and clear payment terms

- 04Automating purchase invoicing with software reduces errors and improves efficiency

- 05Purchase invoices differ from purchase orders in timing and purpose - POs request goods, invoices request payment

As a business owner, you must have experienced the challenge of never-ending paperwork. Among the documents like estimates and expense reports, purchase invoices are generated frequently and can often feel like a tedious task. However, these invoices are important for keeping your finances organized. They help you track your spending, manage your budget, and avoid mistakes.

Curious to know more about how they can benefit your business? Let's explore the ins and outs of the purchase invoice in this blog.

Table of Content

- What is a Purchase Invoice?

- Purchase Order vs Purchase Invoice

- Why is Purchase Invoice Important for Businesses?

- What is Included in a Purchase Invoice?

- Purchase Invoice Template (Free)

- Things to Consider While Creating a Purchase Invoice

- How to Automate Purchase Invoicing

- Purchase Invoice: Our Final Take

- FAQs

What is a Purchase Invoice?

A purchase invoice is a document that is sent by a supplier or a vendor to a buyer mentioning the details of the products or services provided and the amount owed. It serves as an official record of the transaction, outlining the agreed-upon prices, quantities, and terms of payment.

Now that we know what a purchase invoice is, you might be confusing it with a similar term: Purchase order. Let's explore how they differ from each other.

Purchase Order vs Purchase Invoice

While they might sound similar, they serve different purposes in the buying process. Here's a detailed look at their differences:

Purchase Order vs Purchase Invoice Comparison

| Criteria | Purchase Order (PO) | Purchase Invoice |

|---|---|---|

| Purpose | To request goods or services from a seller | To request payment for goods or services provided |

| Created by | Buyer or contractor (e.g., Construction companies, field service businesses, retailers) | Seller (e.g., Wholesalers, manufacturing companies, distributors) |

| Timing | Issued at the beginning of the transaction | Issued after the goods or services have been delivered |

| Inclusions | Details of the products/services, quantities, prices, and terms | Details of the products/services delivered, total amount due, and payment terms |

| Function | Acts as a formal offer and agreement to purchase | Acts as a bill confirming the delivery and requesting payment |

| Legal Binding | Becomes legally binding once accepted by the seller | Legally binding document requesting payment for delivered goods/services |

| Helps in | Tracking orders, budgeting, and ensuring purchase terms are met | Recording financial transactions, and managing accounts payable |

| Document Type | Pre-transaction document | Post-transaction document |

For a more detailed comparison, check out our in-depth blog on Purchase order vs invoice.

Why is Purchase Invoice Important for Businesses?

Purchase invoices play a key role in ensuring smooth business operations and financial stability. Here's why purchase invoices are important for your business:

Revenue Tracking

Purchase invoices help you keep an accurate sales record, ensuring that all transactions are documented and accounted for. This is essential for tracking your revenue and understanding your business's financial health.

Cash Flow Management

Invoice creation helps you get timely payments from buyers, which is essential for maintaining a healthy cash flow. This enables you to manage your expenses, pay your suppliers, and invest in business growth.

Legal Documentation

Invoices serve as legally binding documents that you can use to enforce payment terms. They provide you with concrete evidence of the business transaction and can be crucial in resolving payment disputes or legal issues.

Tax Compliance

Detailed invoices are essential for tax reporting and compliance. They provide proof of income and can be used to calculate federal and state taxes owed, ensuring you meet all legal requirements and avoid penalties from the IRS.

Inventory Management

Purchase invoices help you monitor your inventory levels and manage stock effectively. With its insights, you can avoid overstocking or stockouts.

Now, you might be wondering what details to include when creating a purchase invoice. Let's take a quick look to clarify.

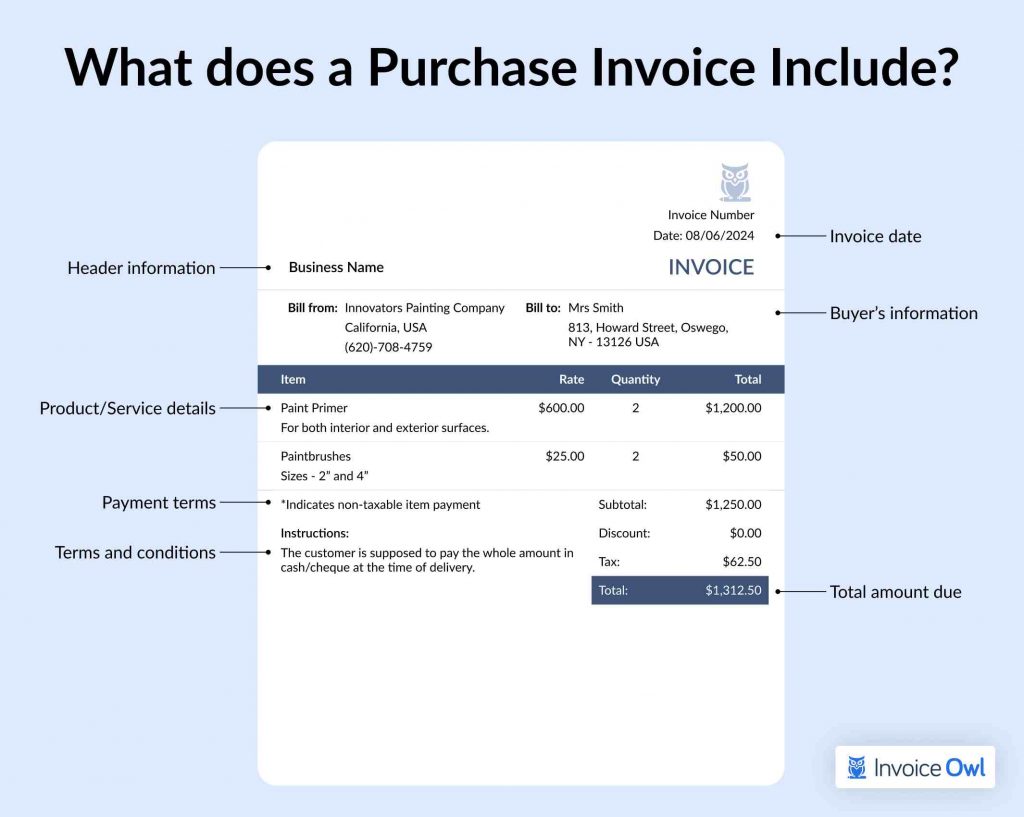

What is Included in a Purchase Invoice?

A well-structured purchase invoice includes several key elements to ensure clarity and accuracy. Here's what you should include:

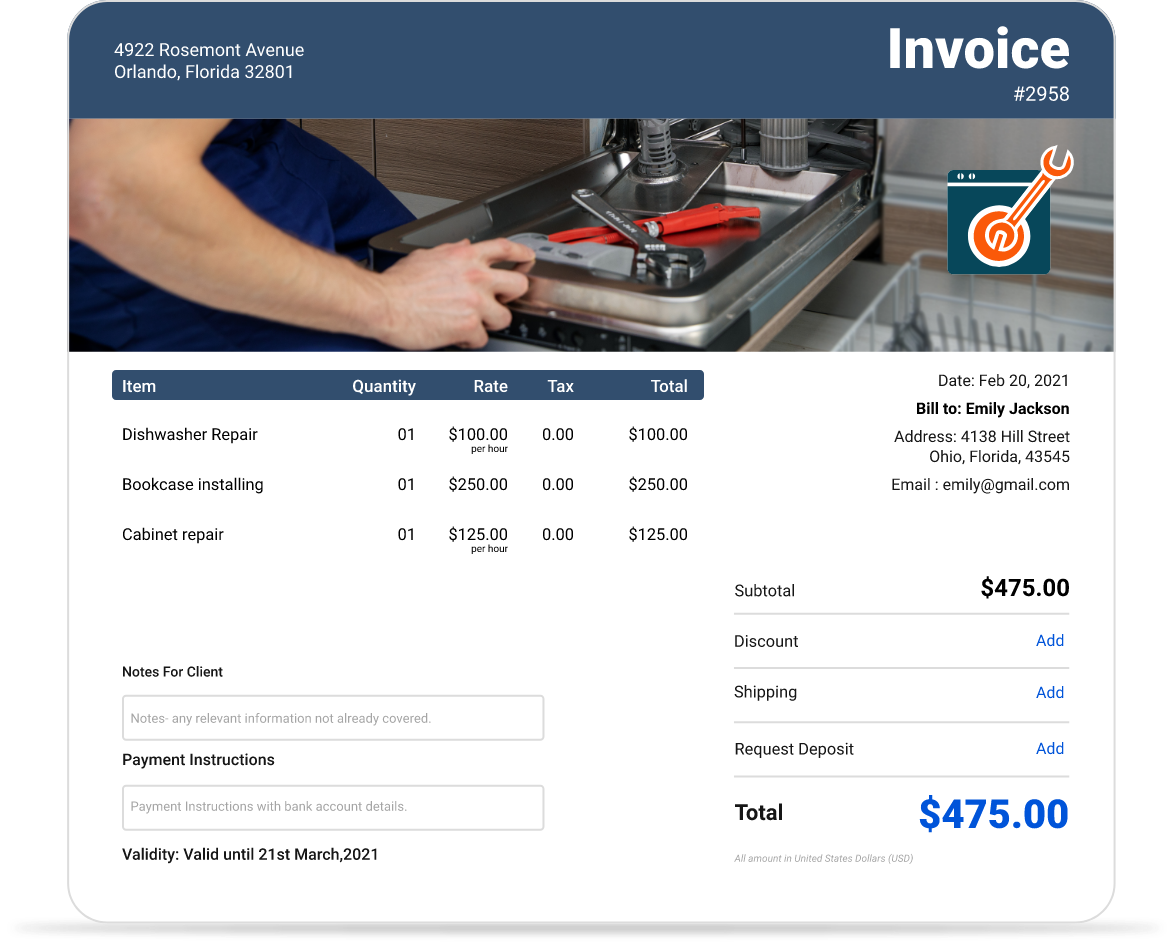

Purchase Invoice Template (Free)

To help you dodge the process and create purchase invoices instantly, we have given a free ready-to-use template. All you need to do is edit product or service details, add contact information, and customize it with your brand name and logo and it is ready to send to your clients.

Download FREE Purchase Invoice Template

Things to Consider While Creating a Purchase Invoice

Creating a purchase invoice requires attention to detail to ensure it is clear, accurate, and professional. Here are key things to consider:

- Complete and accurate details: Ensure all information on the invoice is complete and accurate. Double-check the buyer's details, product descriptions, quantities, prices, and any additional fees.

- Unique invoice number: Assign a unique invoice number to each invoice for easy tracking and reference. This helps maintain organized records and simplifies searching in invoicing software.

- Clear description of goods and services: Provide a detailed and clear description of the goods or services provided. Include specific product names, quantities, unit prices, and any applicable discounts.

- Important dates: Include important dates such as the invoice date, delivery date, and payment due date. These dates help track the transaction timeline and manage cash flow.

- Payment terms: Clearly state the payment terms, including the payment due date, accepted payment methods, and any penalties for late payments. This sets clear expectations for the buyer and helps in timely collections.

- Total amount due: Clearly indicate the total amount due, including a breakdown of any taxes, shipping charges, or additional fees. Ensure the calculation is accurate to avoid payment delays.

- E-signature options: Include options for electronic signatures to reduce the back-and-forth of transferring physical papers for signatures. This will speed up the approval process and make the transaction more efficient.

- Terms and conditions: Include any relevant terms and conditions, such as return policies, warranties, or service agreements. This provides clarity and protects both parties in case of disputes.

What If We Tell You That You Can Create Purchase Orders in a Tap?

Yes, InvoiceOwl is here to help you with creating purchase orders in real time.

How to Automate Purchase Invoicing

Automating purchase invoicing can save time, reduce errors, and improve efficiency. Here's how you can streamline the invoicing process:

- Try invoicing software: Use invoicing software that offers automated features, such as quick invoicing, automatic follow-ups, estimate generation, reporting, real-time notifications, and integration with payment gateways. These platforms streamline the entire invoicing process from creation to payment.

- Use accounting software: Implement accounting software that offers automated invoicing features. This software can generate invoices based on pre-set templates, track payments, and send reminders to clients.

- Integrate with purchase order systems: Connect your invoicing system with your purchase order system. This integration allows you to generate invoices automatically based on purchase orders. It will help you minimize manual data entry and billing errors.

- Set up recurring invoices: For regular transactions, set up recurring invoices in your invoicing software. This feature automatically generates and sends invoices at specified intervals to ensure timely billing for ongoing services or product deliveries.

- Customize invoice templates: Create and customize invoice templates that fit your business needs. These templates can help you create consistent, professional invoices.

- Automate payment reminders: Set up automated payment reminders to notify clients of upcoming or overdue payments. This reduces the need for manual follow-ups and helps ensure timely collections.

Purchase Invoice: Our Final Take

Creating and sending invoices might seem like a time-consuming task, but understanding its role and importance can significantly impact your business operations. By adopting automation and ensuring that every invoice is accurately made, you can streamline your processes, improve cash flow, and maintain healthy payment cycles with your clients.

Remember, well-managed invoicing software like InvoiceOwl is key to a smoothly running payment process. From invoice generation to payment reminders, it automates your workflow and helps you go 100% paperless. Creating and maintaining purchase invoices for your business can ensure your business runs more efficiently and effectively.

Automate Your Purchase Invoicing Today

Stop wasting time on manual invoicing. InvoiceOwl automates your entire workflow, from creation to payment tracking, helping you go 100% paperless.

Start Your FREE TrialFrequently Asked Questions about Purchase Invoice

Common mistakes in purchase invoices include incorrect buyer information, errors in item descriptions or quantities, missing or incorrect dates, and unclear payment terms. These errors can lead to delays in payment, legal disputes, and misunderstandings. Always double-check all details before sending an invoice to avoid these issues.

Purchase invoices are important for financial audits, as they verify transaction accuracy, ensure proper sales and expense recording, and provide evidence of transaction legitimacy. Well-maintained invoices support a smoother audit process with organized financial documentation.

The sender of the purchase invoice is the seller or service provider who has supplied the goods or services. They issue the invoice to request payment from the buyer. The receiver of the purchase invoice is the buyer or client who has received the goods or services. The buyer uses the invoice to verify the purchase details and process the payment.

A purchase invoice is issued by the seller to the buyer, detailing the goods or services provided and the amount due for payment. In contrast, a sales invoice is a document that the seller creates to bill the buyer for the goods or services sold. Essentially, the purchase invoices are viewed from the buyer's perspective, while the sales invoices are viewed from the seller's perspective. Both documents contain similar information but are used by different parties to track and manage transactions.

Businesses involved in buying and selling goods or services can use both purchase invoices and purchase orders. This includes freelancers, contractors, and service providers. Contractors among various use purchase orders to request materials and services from suppliers and then use purchase invoices to manage payments from their clients. Service providers use purchase orders to track client service requests and vendor services, and purchase invoices to bill clients and record expenses.