Are you tired of losing early payment discounts?

How long does it take to process an invoice for you? Is it more than a week?

What if we tell you, it can be cut to 3-4 days maximum?

As a small company, it must be tough for you to manage all the business tasks and keep up with invoice processing without a dedicated accounts payable department. And everyone wants to avail the early payment discounts, hence they avoid any late fees.

So, to save your business a lot of money and time, you should opt for an invoice processing software.

And today we are here to talk about the automated accounting system. We will cover all your questions starting from the basic introduction to benefits, cost, and time consumption of using invoice processing automation software.

What You'll Learn

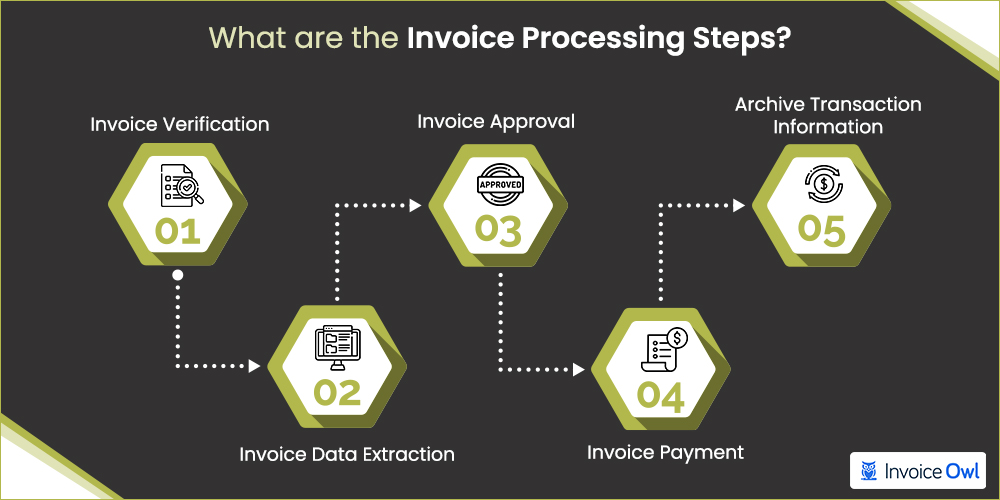

- 01The five critical steps of invoice processing from verification to archiving

- 02How manual processing can take 17 days vs. 3-4 days with automation

- 03Key benefits of using invoice processing automation software

- 04Direct and indirect costs associated with invoice processing

- 05How automation reduces errors and improves transparency

Table of Content

- Understanding Invoice Processing

- Detailed Invoice Processing Steps

- Estimating the Time for Invoice Processing

- What are the Benefits of Invoice Processing Using Automation Software?

- Maximizing Efficiency with Automation Software

- Evaluating the Costs of Invoice Processing

- Conclusion

Understanding Invoice Processing

Invoice processing is nothing but the handling of digital invoices right from receiving to paying the invoice. Every company has its own route and workflow to process the invoices.

So, for better understanding, let's discuss each invoice processing step with more details.

Detailed Invoice Processing Steps

Here's a breakdown of the process:

Step 1: Invoice verification

After receiving, invoice verification is the first step in invoice processing. It includes the basic cross-checking of the invoice date and the vendor. The purchaser verifies the suppliers invoices with the purchase orders and delivery receipts. With the help of various online tools, you can easily make a receipt online without any hassle.

Once the invoice document is verified, the accounts payable clerk sorts the invoice into different categories. For example, by invoice date, due date, vendor, type of transaction, or by the department.

The invoice management helps in sorting invoices and smoothening the invoice processing.

This process may take time as it is generally done manually.

Common verification methods

Ensure to verify invoices with cross-referencing against key documents, such as contracts, purchase orders, and delivery receipts. These methods comprise both manual checks and automated software.

Importance and challenges

With invoice verification, you can ensure data accuracy and also prevent fraud. This method is time-consuming, and also subjected to human error, such as miscalculation and improper data without proper tools.

Step 2: Invoice data extraction

Once the invoice document is verified and sorted, the invoice information is fed into the system either manually or by general ledger coding.

If done manually, the accounts payable clerk does invoice data entry, such as to write invoice date, vendor, invoice amount, and due date to the system. This method is slow and has room for human error.

Whereas, the alternative is the AP automation software. Using general ledger coding of an AP automation software, the accurate data is directly fetched by the system in less than a minute. All the accounts payable clerk has to do is scan the invoice and import it into the invoice processing software.

The AP automation software converts the scanned image into a researchable document. Once it is converted, it is programmed to find the necessary fields and fetch the information. You can manage and customize the fields that the software imports.

Make sure to include the following fields to fetch:

- Vendor

- PO number

- Customers

- Date of purchase

- Invoice date

- Due date

- Accounts payable

- Payment method

Manual vs. automated methods

Manual methods are all about adding important data whereas the automation method uses OCR or software for accurate speed and precision.

Key data points to extract

Always pay special attention to invoice numbers, the vendor's details, amount, and payment terms.

Step 3: Invoice approval

The invoice approval process is one of the most crucial steps in invoice processing. This is done to avoid fraudulent and duplicate payments.

After the invoice has been put into the system, it waits for the approval process to finish. The invoice is sent to the authorized person (generally the manager/the person who made the purchase order). The person approves the invoice and forwards it to the accounts department to make the payment.

This is easier than said. In the real-life scenario, it is quite common that invoices get misplaced, or just be another paper in the unprocessed document pile. And in many cases, the accounts payable department may even miss errors during the invoice management, which ends up being detrimental to the company finances.

Therefore, by making the entire process digitally, the AP automation software takes care of it effectively. The invoice processing software automates the cross-checking of data and makes sure not even the tiniest detail goes unnoticed. Moreover, as it works digitally, it is impossible to misplace an invoice.

Approval workflow tips

One of the best ways to streamline approval is to implement clear roles, escalation paths, and automation tools.

Common bottlenecks

Most of the time, delays occur due to complex processes or missing information. Resolving these issues surely speed up the entire workflow.

Step 4: Invoice payment

Once the authority has approved the invoice, it is sent to the accountant in order to prepare the invoice.

The accountant checks the invoice payment information, such as the accounts payable process, and payment terms and conditions. The accountant also checks the account balance of the vendor. If the purchasing company has already made a partial payment, deposit, or surplus amount in the previous bill processing. And pay the dues accordingly.

If done manually this makes the accountant go from one ledger to another. It would be a time-consuming job. To avoid such waste of resources, invoice processing automation systems are the best solution.

Payment terms and options

Make use of various payment methods, like ACH, checks, and wire transfers, for distributing payments. Additionally, always stick to the agreed payment terms.

Ensuring payment accuracy

Ensure to check all the invoice details and payment amount twice to avoid any errors or double payments.

Step 5: Archiving and documentation

The invoicing process does not end with the payment. Archiving the transaction information is a crucial step in the process. Archiving information like bank transfers, checks, and invoice receipts serves many purposes from generating financial statements, tracking expenses, or for reference during the tax season.

Now storing piles of paperwork demands storage space and maintenance. And no matter how well-organized your invoice storage is, it takes a lot of time and energy to take out an invoice from two years ago for reference and put it back.

Whereas, an accounts payable automation software archives unlimited invoices and brings out any of them in just a single click. Moreover, it sorts the invoices via multiple categories at the same time.

Best practices for record-keeping

It saves the records digitally with clear categorization and secured backup for quick data recovery.

Compliance and audit tips

Always ensure compliance of your documents with legal and audit standards to ensure proper access controls.

Estimating the Time for Invoice Processing

As discussed, invoice processing comprises five complex steps. Thus, the time to process an invoice depends on various factors, such as the invoice type, invoice amount, payment method, capacity of the AP department, and finally the work culture of the company.

Invoice Processing Time Comparison

| Processing Method | Average Time | Key Factors |

|---|---|---|

| Efficient AP Teams | 3-4 working days | Streamlined workflows, automation tools |

| Small to Medium Companies | Up to 17 days | Limited resources, manual processing |

| With InvoiceOwl Automation | Less than 2 days | Automated verification, approval, and payment |

However, efficiently working AP teams take 3-4 working days on average. On the other hand, it wouldn't be surprising if medium to small-scale companies with limited resources takes as long as 17 days.

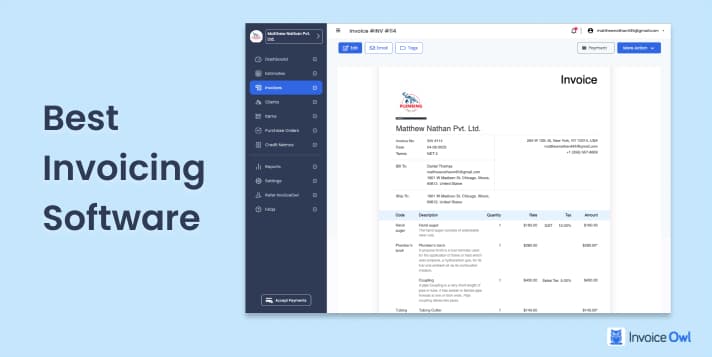

Having said that, every company, small or large, has the scope of improving its invoice processing time if they use invoicing software—InvoiceOwl.

Talking about InvoiceOwl, the software is being used by 10K+ businesses. It not only makes repetitive manual processes easier for you but automates most of the invoicing tasks so that you do not have to do them in the first place.

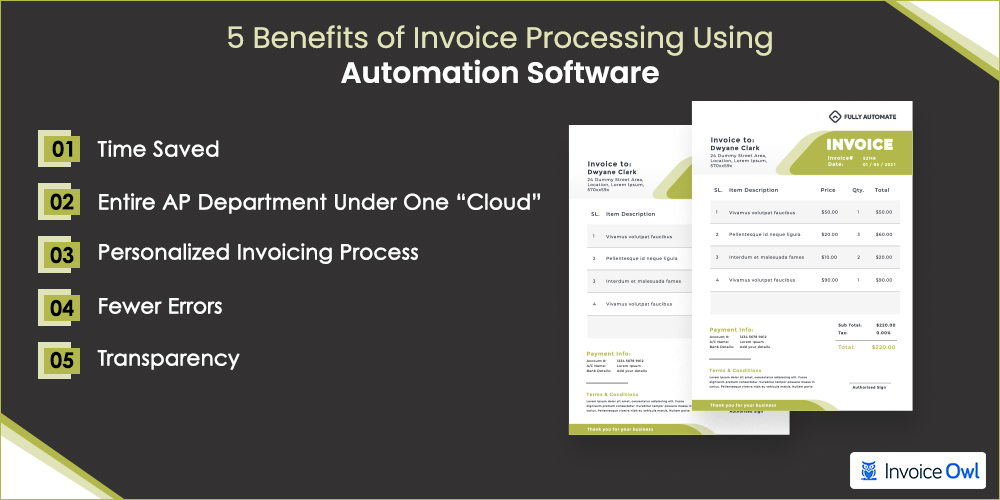

What are the Benefits of Invoice Processing Using Automation Software?

Invoice processing using automation software offers numerous benefits, including:

Time saved

Apart from everything, time-saving is the biggest benefit of invoice processing using automation software.

Ever heard "time is money"?

By automating the invoice processing, you get the job done in less than half of the time it would take manually.

If you use the AP system, you can save time and money in every stage of the process. It verifies the invoice within seconds and asks for approval. Moreover, automation shrinks the room for human errors and indirectly saves time to correct the mistakes.

Entire AP department under one "cloud"

This hassle-free software brings in all the AP members under one roof. The AP clerk, the AP manager, and other authorized personnel can work on the same platform without interrupting each other's workflow. It lets multiple authorities access the same invoice document simultaneously promoting workplace collaboration.

Furthermore, the accounts payable automation software stores all the essential information in a central database. It makes finding supporting documents and previous invoices easy. The company does not have to spend on logistics for keeping and maintaining all the paper stacks. Hence, it boosts efficiency tenfold.

Personalized invoicing process

The invoicing process slightly differs from company to company. It has tons of elements depending on company size and business niche.

The AP system lets you create bills as per your customized invoicing process. If you want supplier invoices to be approved by multiple approval steps or want to put a cap on invoicing authority of employees, the automation process routs the invoice accordingly.

Moreover, it lets you pick the fields to capture data from, similar to manual data entry. This streamlines the workflow and avoids unnecessary information from using up space.

Fewer errors

It is tough to keep track of all the paper and electronic invoices being sent to you from left and right. When dealing with all those invoices manually, some errors are bound to occur. If not anything,

Sometimes, even a "fat finger" error in invoice processing workflow costs you a fortune. Hence, accuracy is the benefit that lures many customers to use an automation system.

Since the latest AI trends in AP eliminate most of the human touchpoints in invoice processing, it reduces the chances of human errors. This is one of the benefits that most companies earn while processing invoices.

If you are spotting an error even after using the AP system, it must be from the vendor's side in most cases.

Transparency

Invoice processing is the process that needs to be transparent. Therefore, the AP automation system lets you keep track of the real-time invoice process status. This lets you keep track of all the paid and unpaid invoices too.

Moreover, as it archives all the processed invoices, you can refer to, monitor, or audit any invoice from the past. All you have to do is run a search word (for example vendor name) and you will find all the related invoices in the search results.

Maximizing Efficiency with Automation Software

Automation software for the invoicing process helps businesses to manage transaction and business operations with ease. This not only saves time, reduces errors, but also streamlines workflows.

Below, we explore key features and real-world examples of how automation can enhance your efficiency.

Major time-saving features

Automation software significantly reduces manual effort, and thus, mentioned below are two notable points that represent how businesses can do their best to minimize errors:

Automated capture and validation

The automation tools can extract important invoice details, reduce manual errors, and validate entries. This automation quickens invoice processing and lets you work on other important tasks.

Real-time notifications

With automation software, users can send reminders for upcoming due dates, payment confirmations, or discrepancies. This helps to keep your team informed without manual intervention.

Integration with cloud solutions

Integrating automation software with cloud systems ensures many advantages, and some are defined further:

Benefits across the organization

Cloud-based systems are known for centralizing invoice access, offering seamless updates in real-time, and improving cross-department collaboration.

Case study: typical setup

In a mid-sized business, integrating cloud solutions enables all teams to access the same invoice repository, reducing delays caused by siloed systems.

Personalized solutions for your business

Automation software offers flexibility with respect to unique business needs. Some important processes are mentioned below:

Customizable workflows

Automation software customizes your workflows to complement specific processes like unique approval hierarchies or ever-changing compliance requirements to ensure smooth operations.

Industry-specific features

You get industry-specific features to meet your specific business needs, like automated tax calculations or specialized templates.

Evaluating the Costs of Invoice Processing

Direct and indirect costs

Direct costs comprise the printing, labor, and postage whereas indirect costs include the administrative inefficiencies and errors during processing. Having a better understanding of both concepts comes in handy to identify areas of improvement.

Cost-benefit analysis of automation

The automation reduces manual labor, saving time and resources while minimizing errors. To know automation's benefits, you can assess the upfront costs of technology against the long-term financial savings.

ROI and long-term savings

Using automated invoicing software provides you with measurable ROI along with quick payments, streamlined workflows, and lesser processing costs.

Create Professional Invoices Online Easily and Keep On Top of Your Finances

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers, and contractors to create invoices on the go and get paid quicker!

Get Started for FREEConclusion

After understanding the various steps and challenges of Invoice Processing, we know it is a tricky, complex, and most of all a time-intensive process. Therefore, it is highly advisable to utilize AP and pay your dues precisely and punctually.

We hope this blog has helped you to learn a new thing about invoice processing. For more such knowledge-enhancing blogs about invoicing ideas, tips, and advice, keep in touch with the InvoiceOwl blog section.

Frequently Asked Questions

Invoice processing is used for transaction details. This process makes sure you pay all the accounts payable in due time avoiding fraudulent payments and double payments.

Invoice processing consists of five fundamental steps, which are: invoice verification, invoice data collection, invoice approval, invoice payment and archive transaction information.

An invoice processing software is a software that automates invoice payments. It helps you make invoice payments quicker by completing mundane repetitive tasks automatically and digitizing invoice databases.

Automated invoice processing is using software to take care of all the invoice processing steps. It narrows the scope of human errors and helps process an invoice as quickly as possible.

The automation feature eliminates human error by flagging inconsistencies like missing information, incorrect tax calculations, or vendor details. They also validate essential data in real-time and auto-fill fields to reduce manual inputs.

The ways of achieving transparency in invoicing is with the help of automated systems. You can offer detailed audit trails, track every change, and provide clear and accessible records for reviews or audits. This transparency leads to enhanced trust among customers and stakeholders.

![Construction Invoice Factoring [All-in-One Guide]](/images/2022/06/construction-invoice-factoring.jpg)