Getting paid as a solopreneur isn't always easy, especially when clients need clear guidance on payment expectations. Before payments roll in, it's essential to master how to send an invoice.

As invoice is more than just a billing document—it's a professional and organized form of payment request that communicates your expectations clearly.

Numerous invoice email templates are available, among which you can choose the one that fits the requirements of your company and clients as well. This will help you look professional and even get you paid on time as you will not be missing any essential information.

What You'll Learn

- 01How to create a professional invoice layout with proper formatting

- 02Essential elements to include in every invoice for clarity

- 03Proven tips for sending invoices that get paid faster

- 04Multiple channels and payment options to streamline collections

- 05Best practices for follow-ups and payment terms

How to Send an Invoice Professionally

When you have completed an order, whether it is for a product or a service, it's now time for you to prepare an invoice so that you can get paid as soon as possible. For small business owners, it is important to make an effective invoicing process to get quick payments.

Here is the complete process of creating a professional invoice.

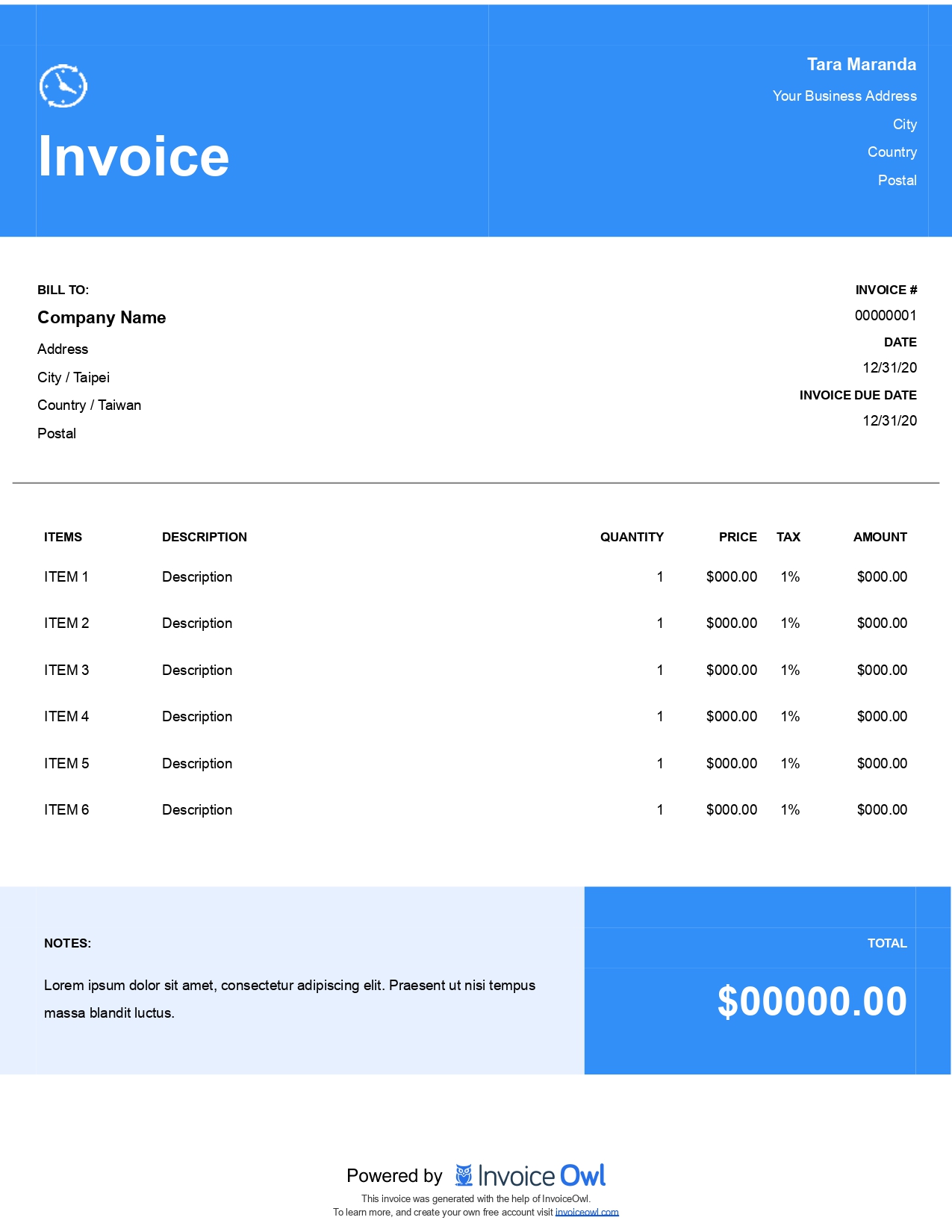

1. Start with a professional layout

A big font should be used for your business name and logo. Adding a business logo and your business type to your invoice increases your chances of getting paid three times!

There are a range of invoice templates available in Microsoft Word, Excel, and PDF invoice formats. If you want something more efficient than this, use the free invoice generator offered by InvoiceOwl, which will issue a pre-built invoice that is already formatted so you can start using it immediately.

2. Include company and customer information

The address, phone number, and e-mail for your business should be immediately below the name of your business.

When your customers have questions or concerns, they can easily reach out to you when they need assistance.

Ensure your online invoice reaches the right person by including the recipient's name, address, and contact information. If their service address is different from their mailing address, you should also include it on the bill.

3. Assign a unique number, a due date, and an issue date to your invoice

Numbers, invoice issue date, and due date are the three most important numbers on an online invoice.

Keeping your records organized is easier with an invoice number and issue date. In addition to tax filing, this is also important when getting recurring payments from the same client.

If your client hasn't paid an invoice for a long time, you'll want to know which invoice you're referring to when you contact them.

By stating the due date, you let your customers know when they need to pay you. A payment schedule might not be included in every business's workflow, but getting paid as quickly as possible is a good idea. For this, you can send reminders to your client so that there are no overdue and your business cycle can run smoothly.

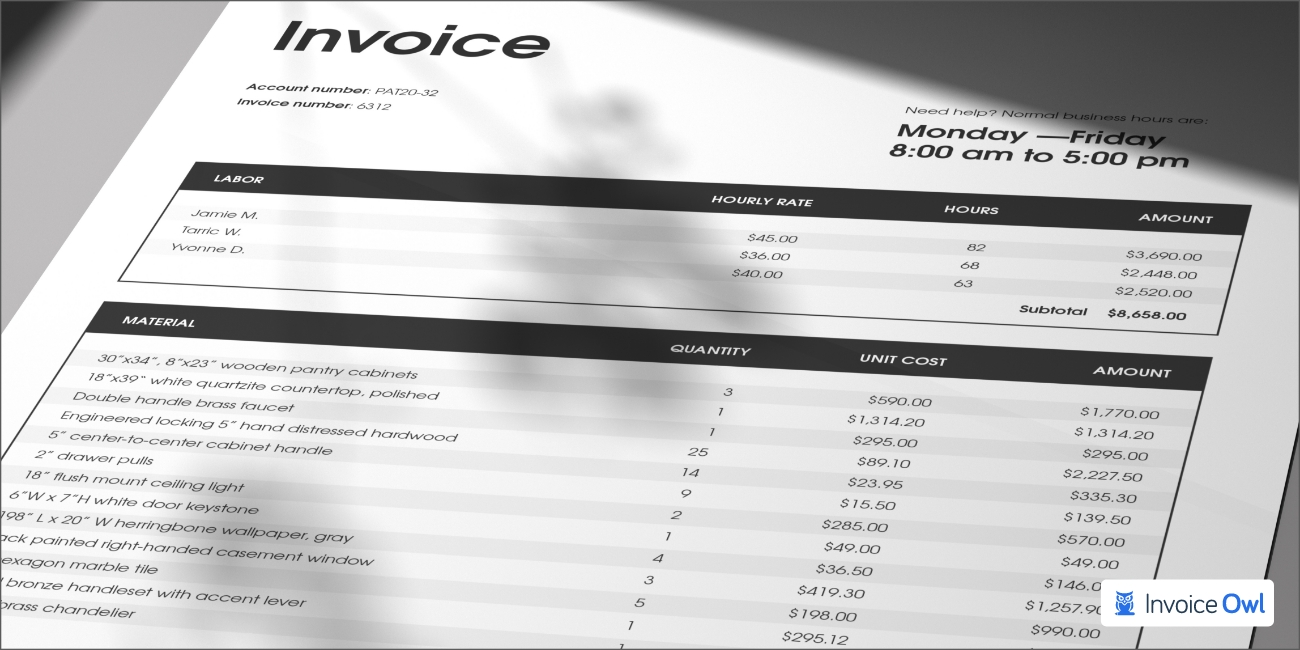

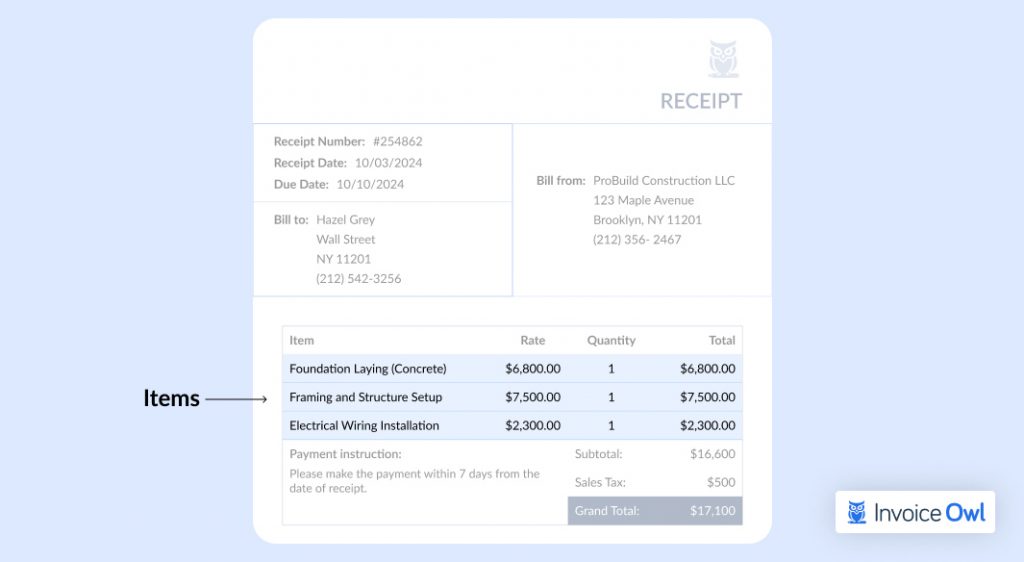

4. Description of the goods and services provided

During the invoice period, the invoice should include information about all goods and services provided by your company.

You must also include the purchase order number, quantity, rate per unit, and subtotal of each item sold. In the case of services, provide details about each service line item and the time spent on it.

Making your pricing transparent can make it easier for your clients to pay you on time, making your payment collection system robust.

Whenever your invoice for a fence you built includes the cost of all the boards and nails and how long it took,. Make sure you present these details separately so you and your clients are clear.

5. Total the line items for the total amount owed

You should add the subtotal to your invoice after you have priced each line item. If you use a good invoice template or invoicing software, you'll get these fields automatically calculated.

Divide your total amount owed by any taxes, fees, or discounts you've applied to the job. The number should be bolded or highlighted to stand out from the rest.

Looking to try InvoiceOwl? You can go for a free trial.

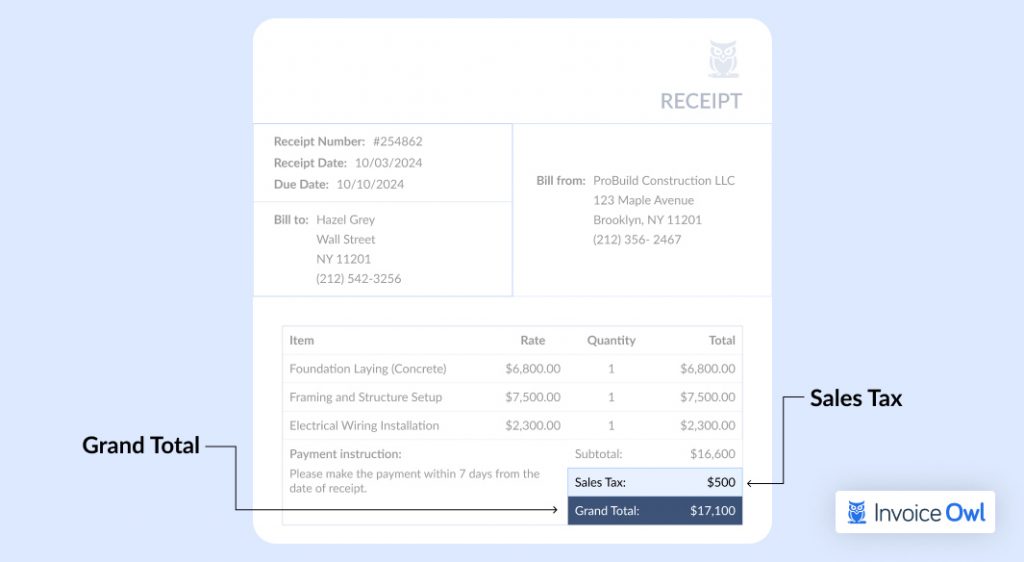

6. Include payment terms

The payment term is always essential to include in the invoice. Some details about the taxes applicable to the sale, which vary from country to country depending on their laws, local tax rate, type of business, and other factors, are necessary to add.

Calculating the total tax liability at the bottom of an invoice is typical when there are multiple line items.

It's easier to calculate the tax on each item instead of splitting it by the tax groups the billable items fall into.

Tally up the total and highlight the total owed by the customer once the tax and discounts are accounted for.

Don't forget to include payment processing fees, late fees, and penalties on overdue invoices.

Though there are lots of ways to create invoices, like PayPal invoices and square invoices, using InvoiceOwl, the leading invoice generator, gives you great features to keep your business finances organized.

How to Use the Invoice Templates: Download the Free Template

Download our free invoice templates in Word, Excel, PDF, and Google Docs formats. These professional invoice templates help you bill clients quickly and get paid faster.

Tips for Sending Invoices That Get Paid

A small business needs to create an invoice to receive payments from clients, but there are ways to send an invoice that will get you paid on time.

Clients will be motivated to make immediate payments when an invoice and its accompanying email communicate the right message.

The following tips will help you communicate with your clients about invoices:

1. Timing is everything

After you complete the work you're billing for, you should create and send your invoices.

In addition to getting paid sooner, you'll also be able to write invoices immediately following your work.

Having your invoices ready as quickly as possible will help you remember all the details and prevent mistakes, which can frustrate or anger clients.

2. Always be polite

Whenever you write an invoice or come across any business communication, be polite. Communicating politely helps you build stronger relationships with clients, making you more likely to get repeat business.

3. Always be concise

Whenever you write an invoice, be concise and straight to the point. Provide clients with all the essential business information they need to pay you by your terms: state the amount due and the date payment is due.

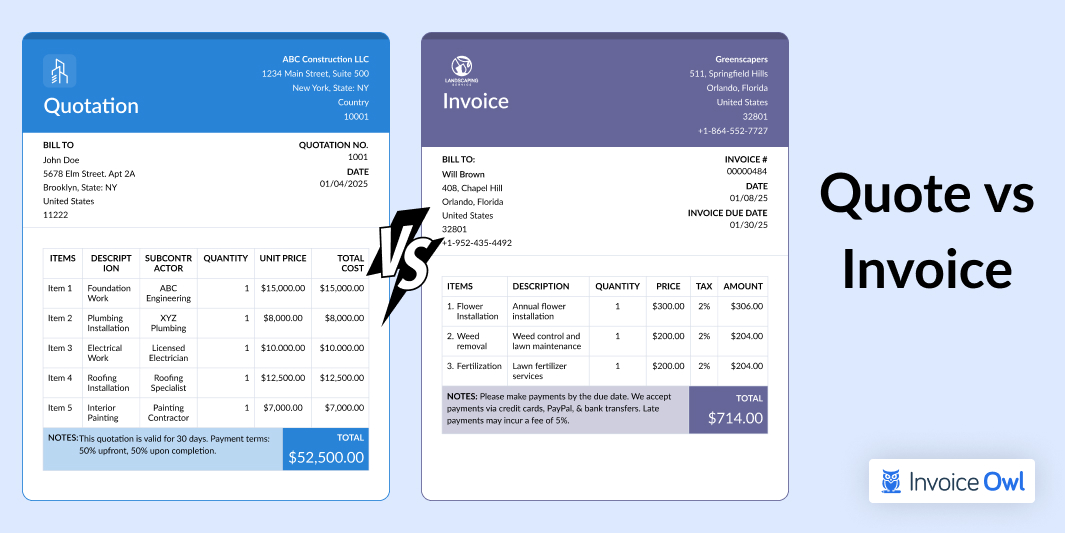

Clients may be confused by fancy terms used in invoices. To avoid confusion, understanding the distinction between invoice and receipt can be crucial. An invoice is a formal request for payment issued before the transaction is settled, while a receipt serves as proof of payment after the transaction is completed.

Rather than "payment due on receipt" on invoices, which is vague, specify the due date, such as "March 29, 2025."

4. Easy payment options

Invoice payments should be made accessible for your customers so that you can provide a better experience for them. You will be able to get paid sooner.

It is important to include clear language in your invoice so that your clients can understand what payment methods they can use to settle their invoices.

If you accept checks, ensure that you include wording that covers all the necessary details, such as "Please make checks payable to my small business and mail them to this address."

As a way of making sure that your customers can find your payment page easily, make sure that you provide them with a link to your online payment page at the bottom of your invoice.

5. Provide multiple payment options

If you want to get paid faster, make it easy for your customers to pay off their bills by offering multiple payment methods.

Only accepting cash and debit cards or credit cards can lead to a loss of sales and payment security.

6. How often to follow up

The frequency of follow-ups typically depends on your payment terms and client communication preferences. Moreover, consider your business needs and your customer's shopping habits when deciding which payment types to accept.

An example would be to use ACH payments. Payments made through ACH are cheaper than those made through credit cards, so your business will save money. Security is one of their most enormous benefits, and recurring payments can be set up easily.

SMS or Text2Pay payments, on the other hand, give customers one of the quickest and easiest ways to pay you.

From the examples discussed above, it is obvious that there are many ways in which large and small businesses can increase the speed at which they receive payments by accepting more payment options to increase their cash flow.

Channels to Send an Invoice

To make creating invoices easier in the future, you will probably want to create your own invoice template. When you're unsure where to start, it is recommended to try a relatable invoicing tool. It is invoicing software that offers simple and easy-to-use invoice creation software that enables you to generate professional invoices to send to clients and get paid immediately.

Invoice Delivery Methods Comparison

| Method | Speed | Best For | Considerations |

|---|---|---|---|

| Fast (instant) | Most businesses and clients | Quick, accurate, and trackable | |

| Physical Mail | Slow (3-7 days) | Clients without email | Less secure, harder to track |

| Invoicing Software | Fast (instant) | Modern businesses | Automated, centralized, with payment tracking |

Invoices can be sent to customers in a variety of ways:

- Email: The method of sending an invoice via email to the customers is quick and accurate in comparison to other channels. There are certain things to keep in mind before sending an email and to maintain accuracy.

- By physical mail (post): Customers without email addresses can receive mail at their postal address. This model has several downsides, such as its slowness and lack of security.

- Through invoicing software: Integrating an efficient and automated web-based tool like InvoiceOwl can do wonders for your ongoing invoicing processes. Be it creating professional invoices, sending them to clients, tracking payments, or generating receipts on the arrival of payments, everything is centralized.

Ready to Streamline Your Invoicing?

Join thousands of small businesses using InvoiceOwl to create professional invoices and get paid faster with automated reminders and payment tracking.

Start Your Free TrialWrapping It All Together

It is not as difficult as you might think to create a professional invoice. If the creation of an invoice is done right, it will leave a good impression on the clients.

Don't be in a hurry while creating invoices, as even a single mistake can lead to disputes, late payments, and a lack of professionalism.

These tips will help you write an invoice that improves customer relationships and makes collecting payments easier.

Frequently Asked Questions

There are legal requirements for business that are operating across the United States. Invoices should comply with basic legal standards by including accurate details of the transaction, but no specific format is mandated. For instance, in respect to the tax purposes, always ensure the details meet IRS requirements.

To send an invoice through email, you need to attach the invoice (preferably as a PDF) and use a clear subject line, such as "Invoice #12345 for ." It is useful to get professional templates and ensure the invoice includes all necessary details like your business info, client details, payment terms, and a breakdown of services. This ensures clarity and professionalism.

To make sure that your invoice gets paid always ensure few key points. First and foremost, send invoices promptly. To show that you are a true professional, always include clear payment terms (e.g., "Net 30"), and offer multiple payment methods like credit cards, ACH, or checks.

Yes, you can automate invoices. As a business owner or freelancer, try to get invoicing software to automate invoice creation and delivery, which saves a lot of your time and reduces errors.

To use invoicing software is always advisable. For most of the solopreneurs, invoicing is a tedious task. Often it is better to use an invoice generator as it streamlines the process, ensures professionalism, and offers features like automation and tracking.

Word

Word Excel

Excel PDF

PDF Docs

Docs